Hyundai and Kia's Absence from Shanghai Auto Show: A Sign of Retreat or Strategic Realignment?

![]() 05/08 2025

05/08 2025

![]() 511

511

Transforming Chinese factories into export hubs, genuine localization emerges as the key to unlocking new growth potential.

Text

Hyundai and Kia's conspicuous absence from the 2025 Shanghai Auto Show marks the first time the South Korean automotive giants have skipped the event since their entry into the Chinese market. This unprecedented move has sparked widespread concern within the industry, raising questions about the future trajectory of Korean cars in China.

Industry analysts suggest that this absence underscores the accelerated decline of Korean joint ventures in China, compounded by strategic contraction and a sluggish transition to new energy vehicles.

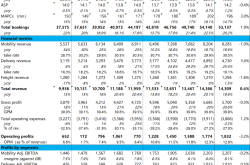

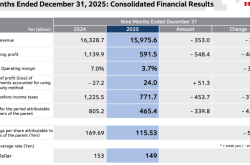

Despite selling 7.23 million vehicles globally in 2024, ranking third worldwide, Hyundai and Kia's sales in China plummeted to 402,000 units, a nearly 80% drop from their 2016 peak. This "global hit, Chinese flop" phenomenon has become an embarrassing footnote for the two brands.

Global Success vs. Chinese Struggles

Of the 7.23 million vehicles sold globally by Hyundai and Kia in 2024, the US market contributed 1.7 million units, with a growth rate exceeding 10%. Emerging markets such as India and Southeast Asia also served as growth engines. However, the US imposed a 25% tax on all imported cars on April 3, 2025, with additional tariffs on auto parts to follow by May 3. This poses a significant challenge for Hyundai Motor Group, as automobiles are Korea's largest export to the US, and the group accounts for a substantial portion of Korea's auto exports to the US.

To counteract tariff pressures, Hyundai Motor Group plans to invest $21 billion in the US over the next few years to establish factories and develop technology. While diversifying its investment portfolio, the group raised $3.3 billion through India's second-largest IPO last year and intends to invest $1.1 billion in Brazil to solidify its position as a market leader.

In stark contrast to its aggressive global expansion, Hyundai and Kia are experiencing a retreat in China. In 2024, Chinese brand passenger cars captured 65.2% of the market share, while Korean cars' share dwindled to just 1.6%.

This downward trend persisted in the first quarter of 2025. While Beijing Hyundai reported sales exceeding 50,000 units, indicating year-on-year and month-on-month rebounds, these figures remain low compared to historical data. Yueda Kia saw a 13% sales growth through exports but failed to achieve significant domestic improvement. The once popular Elantra also witnessed a sales decline, selling only 6,790 units in March 2025.

Dealership closures further exacerbate Beijing Hyundai's market challenges. The number of dealerships has shrunk from 1,018 in 2019 to just 11 in Beijing and 5 in Shanghai, the core markets.

With sales falling short of expectations, Beijing Hyundai has drastically reduced its production capacity. Of its original five production bases, the Beijing First Plant ceased production in 2019 and was sold to Li Auto for 6 billion yuan two years later. The Beijing Second Plant is also rumored to be up for sale, while the Chongqing Plant was sold for 1.62 billion yuan in 2024, and the Cangzhou Plant ceased production in 2023. The remaining Beijing Third Plant's annual production capacity has plummeted from 1.65 million to 450,000 units, with a capacity utilization rate of less than 40%.

On the other hand, Yueda Kia has transformed its Yancheng plant into a global export base, exporting 170,000 complete vehicles and over 300,000 engines in 2024.

Beyond sales declines, a more alarming issue is the erosion of reputation due to quality control problems. Beijing Hyundai has faced multiple complaints from car owners regarding issues such as abnormal vehicle noises and transmission failures, prompting two recalls within six months.

On April 18, 2025, the State Administration for Market Regulation issued a recall announcement for 121 units of the 2024 Sonata and 231 units of the 2025 Tucson L due to manufacturing defects in the high-pressure fuel pipe ports, which may cause gasoline leakage, posing safety and emission risks. In December 2024, another recall was issued for 139,000 units of the 2013 Santa Fe and 420,300 units of the 2010-2013 ix35 due to potential short circuits in the braking system's hydraulic electronic control unit, which could lead to engine compartment fires in extreme cases.

Caught between the ambition to rank third globally and the disappointment of defeat in China, Hyundai and Kia face a crucial juncture. The Chinese market is no longer a passive recipient of outdated capacity but a fiercely competitive arena demanding genuine innovation and localization efforts.

The Cost of Rapid Expansion

Hyundai's journey in China can be characterized as "succeeding due to rapid expansion and failing due to the same". Established in 2002, Beijing Hyundai capitalized on the strategic vacuum in the 100,000-250,000 yuan price range, swiftly launching globally synchronized models with Korean high-specification, low-price strategies.

The Sonata captured a 10% share of the B-segment market in its inaugural year, and the ix35 sold over 20,000 units per month during its peak. However, this rapid success concealed structural crises. Between 2010 and 2016, less than 30% of the 23 models launched by Hyundai in China involved localized improvements. As a result, Hyundai's product competitiveness in China waned, and the ix35 was mocked as an "industrial archaeological sample" due to its outdated technology platform.

In summary, Hyundai's development in China relied heavily on a lack of in-depth localized R&D, independent technical standards, and adaptation to consumption upgrades, leading to the failure to establish brand recognition and premium pricing.

Ironically, Hyundai possesses substantial electric technology reserves. The IONIQ 5, equipped with an 800V ultra-fast charging platform overseas since 2016, outperformed competitors. However, misjudging the pace of China's new energy market development, Hyundai postponed the introduction of this technology until 2021, missing the 2018-2021 new energy explosion window.

The collapse in the Chinese market is compelling Hyundai Motor Group to shift strategies. At an investor conference in June 2023, Hyundai decided to contract its business in China, significantly reduce expenditures, and focus on high-return core businesses to enhance brand image and profitability. Consequently, Hyundai streamlined its product line in China from 13 models to 8.

Conversely, the "Hyundai Way" strategy for global electric vehicle sales targets of 36% by 2030 out of 5.55 million units is progressing vigorously.

Five months ago, at the 2024 Guangzhou Auto Show, Beijing Hyundai showcased its flagship models, signaling new breakthroughs in intelligence and electrification. In December 2024, Beijing Automotive announced a joint injection of $1.095 billion into Beijing Hyundai by BAIC Investment and Hyundai Motor. More recently, Beijing Hyundai unveiled the "In China, For China, To The World" strategy.

Despite ceasing new energy vehicle sales in 2024, Beijing Hyundai has not abandoned its transformation efforts. However, under the group's overall strategic adjustment to withdraw from China, it will be challenging for Beijing Hyundai and Yueda Kia to reverse their retreat from the Shanghai Auto Show and regain a prominent position in the Chinese auto industry.

Conclusion

Hyundai Motor Group's 23-year experience in the Chinese market, from rapid success to marginalization, serves as a cautionary tale for global automakers. When a development model focused on speed encounters technological upgrades, shifting consumer demands, and intensified market competition, the lack of localization investment becomes glaringly apparent.

Hyundai Motor Group's rise and fall in China underscore three iron laws of the automotive industry: continuous technology updates, constant brand upgrading, and prioritizing localization in globalization efforts. It is hoped that the pitfalls encountered by Hyundai and Kia can provide valuable insights for the development of Chinese automakers.