Geely's Bold Move: Privatizing Zeekr Amidst Industry Transformation

![]() 05/08 2025

05/08 2025

![]() 569

569

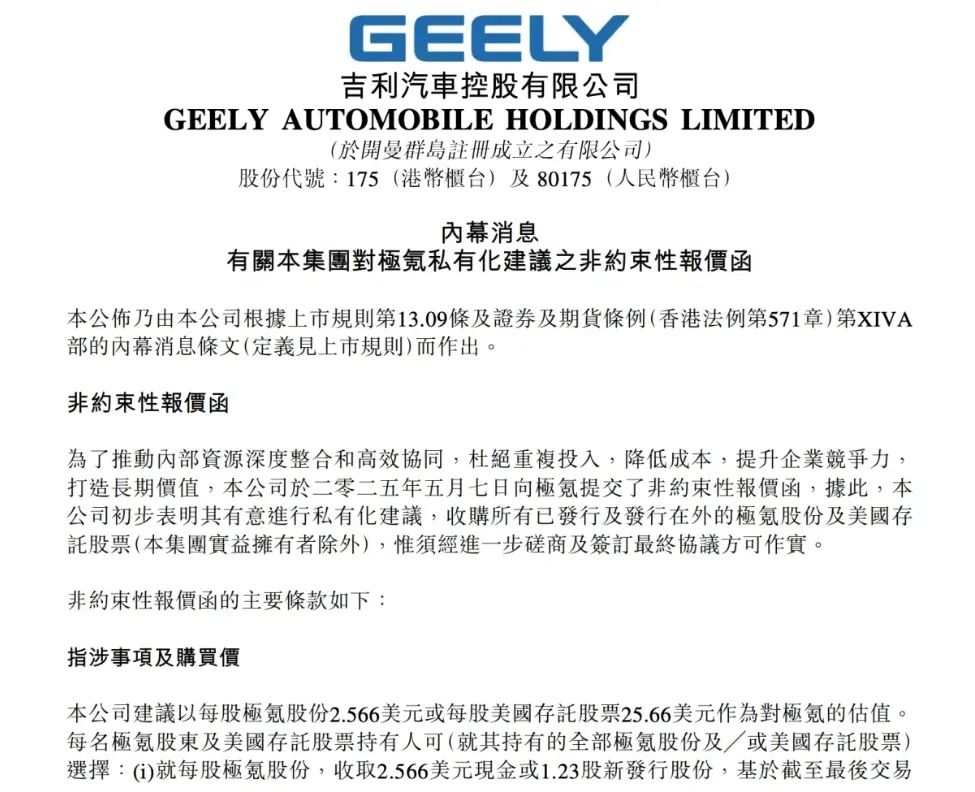

On May 7, Geely Automobile made a significant strategic move by submitting a non-binding offer to privatize its high-end new energy brand, Zeekr. The offer, which aimed to acquire the remaining 34.3% stake at US$25.66 per share, would propel Zeekr off the New York Stock Exchange. This decision, coming just one year after Zeekr's debut as the "fastest IPO auto newcomer," underscores the profound strategic shifts in China's auto industry amidst a capital winter and industrial transformation.

As a cornerstone of Geely Holding Group's "Taizhou Declaration," the privatization of Zeekr transcends mere capital operations. It embodies the resource integration logic and risk hedging strategy of Chinese automakers in the global competitive landscape.

Addressing Valuation Challenges and Synergy Bottlenecks

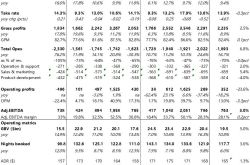

Zeekr's decision to privatize and delist reflects multiple strategic considerations. Despite raising US$5.2 billion in its IPO, its capital market performance has been out of sync with its operational fundamentals. In 2024, Zeekr reported a net loss of US$893 million and an asset-liability ratio of 131%, while Geely Automobile's return on net assets stood at 19.17%. The privatization offer, at US$25.66 per ADS, represents a 13.6% premium over Zeekr's last closing price but is nearly 50% lower than the IPO price. This move not only shields Geely from Zeekr's fluctuating performance but also provides flexibility for technological breakthroughs and long-term investments.

Strategically, the integration of Zeekr and Geely Automobile's resources has been long overdue. While they collaborate on the SEA architecture and electric technologies, independent brand operations have led to duplicated R&D investments and fragmented supply chain bargaining power. Initial integration between Zeekr and Lynk & Co. in Q1 2025 reduced unit costs by over 20% and boosted sales by 21% YoY, confirming the benefits of resource consolidation. Post-privatization, Geely plans to share core technologies like the SEA architecture and intelligent driving across brands, expecting a 30% increase in R&D efficiency and 50% expansion in user charging network coverage.

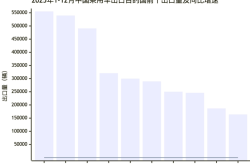

Geopolitical risks also factored into this decision. With Sino-US tariff frictions escalating, Zeekr, as the "first Chinese concept stock to return," carries symbolic significance. Statements by U.S. Treasury Secretary Janet Yellen about excluding Chinese companies from U.S. markets, coupled with the Holding Foreign Companies Accountable Act, pose a risk of mandatory delisting for Zeekr. Geely's choice to voluntarily delist Zeekr aligns with China's policy of supporting the return of high-quality Chinese concept stocks and paves the way for future capital operations at the group level.

Geely Accelerates Resource Aggregation and Ecological Reconstruction

Geely's ability to aggregate resources, demonstrated through the Zeekr privatization, is transforming into systematic competitive advantages. With an operating cash flow of US$3.85 billion in 2024 and a market value of HK$168.7 billion, Geely can fund the privatization without diluting its controlling stake. Post-privatization, Geely will concentrate resources previously spread across two listed entities, fostering strategic synergy. For instance, four out of five new Zeekr models planned for 2025 are hybrids, aligning with Geely's "Blue Star Initiative," ensuring full coverage of the new energy product matrix from pure electric to hybrid vehicles.

Technologically, privatization enables Geely to form a closed loop across seven key areas, including electronic and electrical architecture, intelligent cabins, and electric drive systems. By unifying intelligent driving solutions under the "Qianli Haohan" system, Geely achieves data interoperability between Zeekr's ZAD and Lynk & Co.'s LYNK E-Motive technology, shortening Zeekr's autonomous driving R&D cycle by 20% and reducing supplier dependency costs by 30%.

Brand matrix differentiation is another aspect of Geely's resource aggregation. Privatizing Zeekr clarifies the brand hierarchy of "Zeekr - Lynk & Co. - Geely Galaxy," with Zeekr targeting global luxury, Lynk & Co. focusing on high-end new energy, and Geely Galaxy covering mainstream consumers. This layered positioning ensures complementary product planning, with Zeekr launching flagship SUV 9X and super electric hybrids, while Lynk & Co. introduces the large six-seater SUV 900. This synergy avoids internal competition and enables Geely to lead the new energy market with a three-pronged strategy of "high-end leadership, mid-range breakthrough, and mass popularization."

Challenges Ahead: Integration Pains and Capital Tests

While Geely's current cash flow is robust, the funds required for the Zeekr privatization could strain its financial structure. With Zeekr valued at approximately US$6 billion, acquiring a 34.3% stake would cost around US$2.06 billion. A 50% debt financing plan could significantly increase Geely's asset-liability ratio.

Moreover, Zeekr's current unprofitability requires Geely to balance capital efficiency with overall profitability goals. Management integration may also pose challenges due to differences in operating models between Zeekr and Geely Automobile. Zeekr's "user co-creation" model clashes with Geely's traditional manufacturing system, as evidenced by recent integration challenges between Lynk & Co. and Zeekr. Coordinating decision-making under different corporate cultures will be a key governance issue.

Post-privatization, Zeekr will lose direct U.S. stock market financing channels, potentially relying on Geely Group's internal capital or seeking a secondary Hong Kong listing. Although Geely Chairman Li Shufu emphasizes maintaining U.S. capital market cooperation, geopolitical uncertainties may increase Zeekr's international financing costs. This shift in financing channels requires long-term strategic preparations to manage potential market volatility.

Conclusion

Zeekr's privatization and delisting mark Geely's bold move in the intelligent electric vehicle era. By restructuring its capital, Geely addresses valuation issues and gains strategic initiative in technology synergy and brand matrix optimization. Success hinges on converting resource integration into product competitiveness. As giants like Tesla and Volkswagen streamline their strategies, Geely's "reverse operation" is a daring bet – using capital to buy time and integration to boost efficiency, ultimately forging a "technology-cost-brand" moat in global competition.

The challenge lies in transitioning from "scale expansion" to "value creation" while managing financial leverage. The outcome will determine whether Chinese automakers can secure a central role in the global auto industry's restructuring.