Thailand Auto Market Watch: March Sales Slightly Down, Chinese Brands Dominate New Energy Sector

![]() 05/08 2025

05/08 2025

![]() 606

606

In March 2025, Thailand's overall auto sales amounted to 55,798 units, marking a modest 0.5% year-on-year decline, continuing the downward trend from the previous quarter. For the first quarter, cumulative sales reached 153,193 units, with the year-on-year decrease widening to 6.5%.

In terms of manufacturer brands, Toyota maintained its lead with sales of 21,575 units, accounting for nearly 40% of the market. Honda (7,909 units) and Isuzu (7,320 units) followed in second and third positions, respectively, but both experienced year-on-year declines of 3.8% and 17.4%.

On the other hand, BYD recorded robust growth, selling 3,204 units in March, an impressive 183% year-on-year increase, making it the most notable newcomer this month.

01

Brand Sales Trend Analysis:

Stable Traditional Giants with Concerns, Rapid Rise of Chinese Brands

Overall, the Thai auto market continues to grapple with pressures, as weak growth in fuel vehicles and commercial vehicles barely sustain the overall situation.

Passenger vehicle sales dipped 5.8% year-on-year to 21,054 units in March, while commercial vehicle sales saw a slight 2.9% increase to 34,744 units. However, the core pickup truck segment fell 6.6% year-on-year.

● From a brand perspective:

- ◎ Toyota remains robust, with the Hilux, Yaris ATIV, and Yaris Cross models collectively contributing nearly 15,000 sales, accounting for over 70% of its total sales, highlighting the stability of its product portfolio.

- ◎ Honda holds a mid-tier position, with the Civic performing steadily, while the Accord and HR-V show average performance, suggesting a somewhat conservative overall brand competitiveness.

- ◎ Isuzu has been directly impacted by the decline in the pickup truck market. Although the D-Max sold 4,968 units, it experienced a significant year-on-year decrease, becoming a key drag on overall sales.

- ◎ BYD's explosive growth has garnered industry attention. Its EV products are rapidly penetrating the Thai market, with sales surging over 180% year-on-year, reshaping the local EV landscape.

- ◎ Mitsubishi has performed averagely and has yet to establish new growth points, necessitating a repositioning of its brand strategy.

● In terms of trends, the Thai market stands on the cusp of structural change:

- ◎ Traditional Japanese brands dominate but face challenges due to slowing growth and reliance on outdated pickup truck models.

- ◎ Chinese new energy brands, led by BYD, are entering the market with a richer product line and more cost-effective models, paving a new path forward.

02

TOP 10 Best-Selling Models and Summary of Premium BEV Best-Sellers:

Market Structure Undergoing Reconstruction

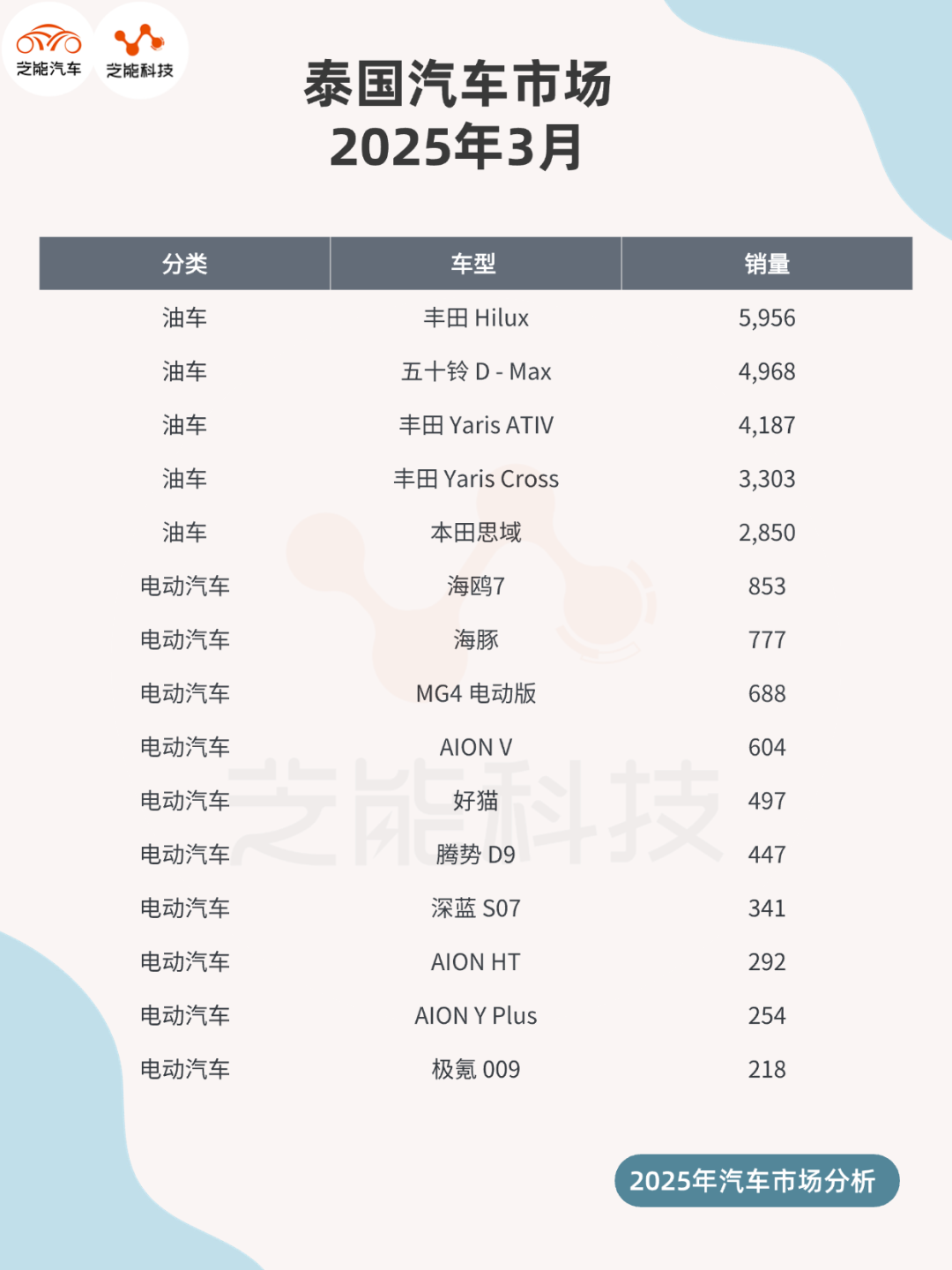

● Sales of the top 10 best-selling models in Thailand in March are as follows:

- ◎ Toyota Hilux: 5,956 units

- ◎ Isuzu D-Max: 4,968 units

- ◎ Toyota Yaris ATIV: 4,187 units

- ◎ Toyota Yaris Cross: 3,303 units

- ◎ Honda Civic: 2,850 units

- ◎ Mitsubishi Triton: approximately 2,000 units

- ◎ Toyota Corolla Cross: approximately 1,900 units

- ◎ Honda City: approximately 1,800 units

- ◎ Ford Ranger: approximately 1,600 units

- ◎ Isuzu MU-X: approximately 1,500 units

The best-seller list is still dominated by pickup trucks and Japanese sedans, but new energy models are gradually gaining traction among consumers.

● Highlights of Thailand's pure electric vehicle market sales in March:

- ◎ Registrations of pure electric vehicles reached 7,570 units, a year-on-year increase of 51.4%, setting a new monthly record. Chinese brands' dominance is increasingly evident, occupying 9 of the top 10 brands.

- ◎ BYD once again topped the list with 1,959 units, with its two models ranking first and second in BEV sales: Seagull 7 (853 units) and Dolphin (777 units).

- ◎ AION V, MG4 Electric, and ORA Good Cat all made it into the top five, demonstrating the advantage of diversified supply.

- ◎ DENZA D9, with sales of 447 units, emerged as a representative of high-end electric MPVs, while ZEEKR 009 also sold 218 units, indicating that the Thai market has the initial foundation to embrace high-end domestic pure electric vehicles.

● Sales of the top 10 pure electric vehicle models (units):

- ◎ BYD Seagull 7: 853

- ◎ BYD Dolphin: 777

- ◎ MG 4 Electric: 688

- ◎ AION V: 604

- ◎ ORA Good Cat: 497

- ◎ DENZA D9: 447

- ◎ Deepal S07: 341

- ◎ AION HT: 292

- ◎ AION Y PLUS: 254

- ◎ ZEEKR 009: 218

Summary

In the first quarter of 2025, Thailand's overall auto market remained sluggish, with cumulative sales down 6.5%. However, electrification emerged as the sole growth bright spot. Driven by government subsidies and consumption upgrades, the performance of the pure electric vehicle market far exceeded expectations. Chinese brands, epitomized by BYD, not only witnessed rapid sales growth but also achieved significant breakthroughs in brand recognition and product acceptance. Almost all of the top 10 pure electric vehicle models are from China, signifying that Chinese self-owned brands have made a substantial leap in their new energy competitiveness in Thailand.