BYD's Global Expansion Blueprint - Aiming for 800,000 Overseas Sales by 2025 and 50% Overseas Market Share by 2030

![]() 05/19 2025

05/19 2025

![]() 592

592

BYD shares the same ambitious aspirations as its parent company, striving to break into the top three and eventually claim the top spot in global auto sales. Looking at the leading automakers worldwide, such as Toyota and Volkswagen, their significant overseas sales figures serve as a benchmark. Recently, BYD executives announced that the company intends to double its overseas sales to exceed 800,000 units by 2025 and address tariff hurdles by assembling cars locally. In the medium to long term, BYD aims to sell half of its vehicles overseas by 2030.

So, how will BYD achieve this grand vision? This article delves into BYD's global expansion strategy by exploring its global factory planning and layout. From the cradle of the Southeast Asian automotive industry, spanning the "One Belt and Road" Initiative, to the final frontiers of Europe, Africa, and Latin America, and to the often-overlooked largest single market for Chinese cars overseas – Russia.

Southeast Asia along the "One Belt and Road" coastal corridor has long been a pivotal geopolitical powerhouse. Post the Russia-Ukraine conflict, this trade route has become even more crucial for China. The war disrupted many continental trade routes and caused delays or scaling back of some "Belt and Road" projects. This trade axis stretches from the Malacca Strait to the Western Mediterranean, traversing Indonesia, Thailand, India, Pakistan, and reaching the Middle East, North Africa, and the European Union. It covers nearly half of the global population and is poised to occupy a significant share of the electric vehicle market.

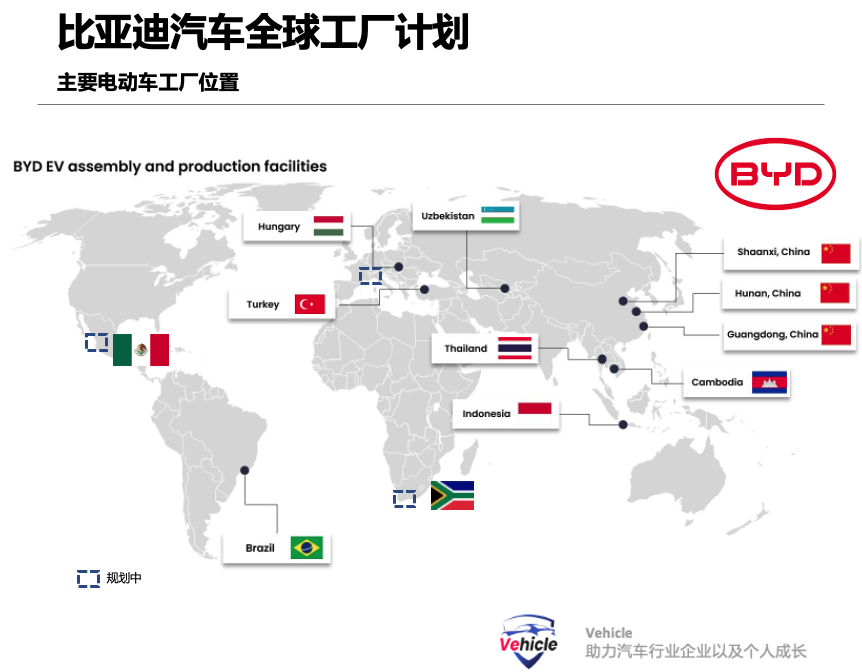

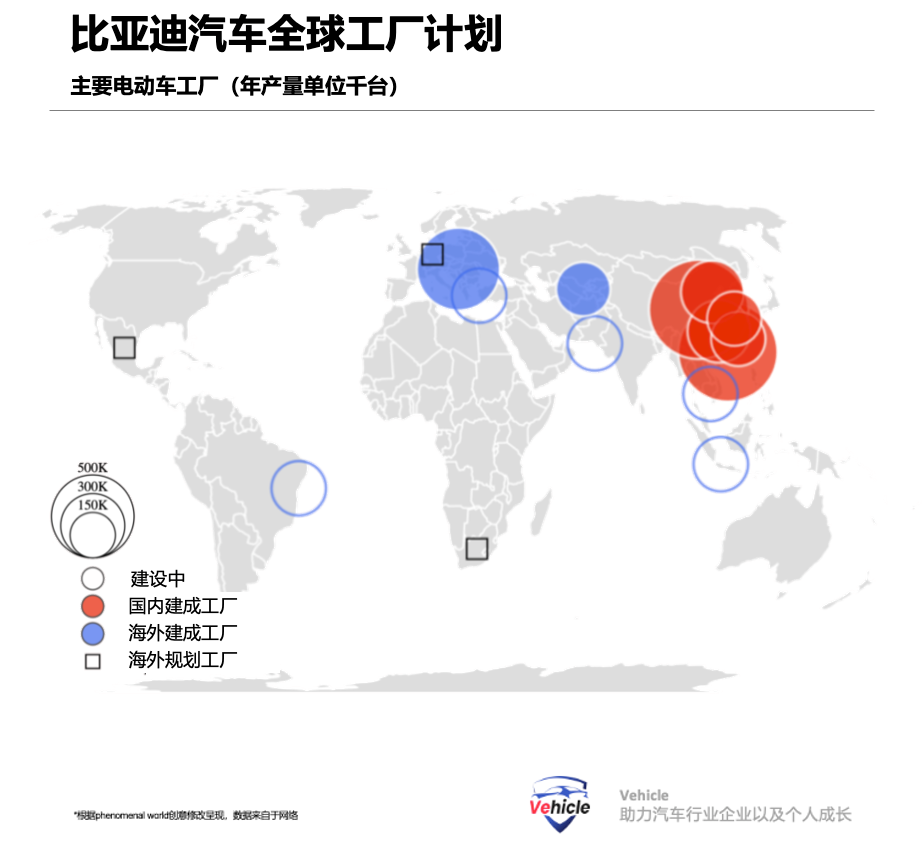

Unsurprisingly, some of the most important Chinese electric vehicle factories are being constructed along this corridor, where key ports controlled by Chinese companies like COSCO are strategically located. On China's southern border, BYD is expanding its operations in Cambodia, competing with the likes of Ford, Hyundai, and Toyota. It has invested in a factory within the Sihanoukville Special Economic Zone, primarily producing new energy vehicles. This factory, covering 120,000 square meters with an annual production capacity of 10,000 units, is scheduled to commence operations by the end of this year. In Vietnam, BYD is building a $250 million factory in the Phu Ha Industrial Park, expected to produce 150,000 vehicles annually, with plans for a second factory to leverage Vietnam's low labor costs. In neighboring Thailand, the second-largest automotive market in Southeast Asia, BYD is investing $500 million in a factory in the Eastern Economic Corridor of Rayong, anticipating an annual production capacity of 150,000 vehicles.

Across the Java Sea in Indonesia, BYD has invested $1 billion to establish a new factory in Subang, West Java. Scheduled to commence production in 2026 with an annual target of 150,000 units, this factory primarily targets Indonesia's vast domestic market. By 2030, Indonesia is expected to have 285 million consumers purchasing 2 million electric vehicles annually. Beyond assembling plants, BYD and other Chinese automakers venturing overseas are also investing in supply chains and logistics. Meanwhile, the Chinese government is boosting investments in regional infrastructure to foster economic cooperation and advance cultural diplomacy.

These actions underscore the Chinese government's keen awareness of the strategic importance of this region on China's "southern fringe" and its aspiration to establish it as a reliable hub for "friendly shores" and long-term partnerships. India presents a contrasting scenario. Currently, India imports substantial Chinese products and aims to bolster its technological capabilities, including in the electric vehicle industry. To this end, India has started restricting Chinese investments, resulting in BYD having only one factory in the entire country. Located in Tamil Nadu, this factory produces just 10,000 vehicles annually. To mitigate risks in China and India, Chinese automakers like BYD are turning to Pakistan, which is actively welcoming Chinese electric vehicle investments with the goal of becoming a global electric vehicle export hub. BYD plans to construct a factory in Karachi in collaboration with Pakistani company Mega Motors.

The factory is already under construction and is expected to commence production in 2026, initially producing 50,000 vehicles annually for the Pakistani market. By 2030, it is anticipated that 50% of car sales in Pakistan will be electric vehicles, and factory capacity may soon expand. In Pakistan, BYD is already selling three models – the Atto 3, Seal, and Sealion. Furthermore, BYD has partnered with HubCo, India's largest private utility company, to establish a network of fast-charging stations, embodying BYD's long-term infrastructure vision, unlike Western competitors who often focus on shorter timeframes.

The Birthplace of the Automotive Industry – Europe: If Chinese electric vehicle companies are eyeing the expanding Southeast and South Asian markets, then the affluent European automotive market will be the ultimate goal.

Europe (including the European Union and the United Kingdom) is the third-largest automotive market globally and the second-largest electric vehicle market after China. In 2024, electric vehicle registrations in Europe will reach 1.5 million (a slight decline from the previous year, partly due to the termination of subsidies in Germany). Chinese automakers venturing overseas aim to boost sales in Europe while fostering closer ties with the region, seen as a potential partner in building a multipolar order. However, the European Union's tariffs on Chinese electric vehicles complicate this task. As discussed in our previous article, "EU to Impose Tariffs of Up to 38.1% on Electric Vehicles Exported from China," the EU increased tariffs on Chinese electric vehicles at the end of 2023. BYD faces a 17% tariff, excluding the original 10% standard import tariff; other Chinese companies face even higher tariffs: Geely at 18.8% and SAIC at 35%.

The EU attributes this to unfair government aid or subsidies. These protectionist policies, though unintended, significantly incentivize Chinese electric vehicle companies to establish factories in Europe to circumvent tariffs. A common strategy adopted by automotive companies is shipping "knocked-down kits" (KDKs) to a country for assembly and domestic sales. KDKs, classified as components and parts, usually attract lower tariffs than finished products. From a supply chain perspective, this approach is also more efficient as disassembled cars are easier to transport. However, local governments may view this as a circumvention tactic and may require vehicles to have higher added value and local content to obtain localization certification.

To address these challenges, BYD and other Chinese electric vehicle companies have developed strategies for participation and long-term investment, establishing R&D centers on the European continent and forging long-term partnerships with suppliers. Additionally, BYD is leveraging soft power by sponsoring events and launching promotional activities to endear itself to European citizens. To date, BYD's most significant investment in Europe is in Hungary, renowned for its robust automotive supply chain and close ties with China.

Up to 44% of all Chinese foreign direct investment in the European Union flows to Hungary. BYD is about to complete a large factory in Szeged (near the Serbian and Romanian borders). This $1 billion investment is expected to produce (not just assemble) 150,000 to 200,000 vehicles annually, commencing production in mid-2025. Additionally, in the past two days, BYD announced the establishment of its European regional headquarters and R&D center in Hungary. To ensure the security of the local value chain, BYD has forged a partnership with Forvia, the world's seventh-largest automotive technology supplier based in France, to supply components for the Szeged factory.

However, the factory is currently under investigation by the European Union for unfair state aid, which may compel BYD to reduce production capacity or sell some assets. Even if these investigations reveal vulnerabilities in BYD's current global expansion strategy, they will not deter its ambitious plans. BYD has already commenced construction on a second factory to increase its production in Europe. The new factory in Manisa, near Izmir, Turkey, is scheduled to commence production in mid-2026 with an annual production capacity of 150,000 units.

Turkey's strategic geographical location on the edge of Europe is crucial. Although not part of the EU single market, Turkey is a vital component of the EU customs area. This means that cars assembled in Turkey can be exempted from high tariffs. The "strategic cooperation" between Turkey and China is evident in Turkey's recent participation in the "Belt and Road" Initiative, making it a natural choice for BYD's European expansion. The location of BYD's third European factory is also under debate.

There were rumors that Italy was a potential site, as the Italian government aims to diversify production to compensate for the decline in Stellantis production. However, preliminary talks with BYD did not yield results, although reports indicate Chery's interest in investing in Italy. Recent reports suggest that Germany may be the site for the third European factory. Volkswagen and other soon-to-be-closed German auto factories are likely to be attractive investment locations for Chinese companies. Access to Germany's production infrastructure and its central position in the European market would be a significant boon for any Chinese company seeking expansion.

BYD's ambitions extend beyond building a few factories in Europe. The company aims to position itself as a trusted European partner. BYD executives often emphasize the company's desire to "integrate into Europe." This practically translates to investing in integrated production (not just assembly), establishing R&D centers (such as the planned one in the UK), and fostering a robust local supply chain in Europe. Early in 2025, BYD representatives held talks with 300 Italian auto parts manufacturers in Turin, showcasing BYD's interaction with local economic participants and portraying itself as a reliable partner with long-term investment intentions.

The Final Frontiers: Africa and Latin America: Africa and Latin America may not be the primary focus of BYD's expansion, but they remain notable growth regions. Chinese investment in Africa and Latin America is on the rise, particularly in ports, logistics infrastructure, and the extractive industries. The electric vehicle wave provides China with an opportunity to further expand existing economic and diplomatic relations and establish a vast industrial and logistical influence, potentially having significant geopolitical implications, bringing these regions closer to China's sphere of influence and farther from that of the United States.

Plans are still in their nascent stages. So far, the only large manufacturing plant BYD is considering in Africa is located in South Africa, but it is still in the negotiation phase. BYD has also held exploratory discussions on establishing factories in Egypt and Morocco. The challenges in promoting electric vehicles in Africa include limited existing charging and maintenance infrastructure, along with the absence of a supportive regulatory framework and government incentives for electric vehicles. However, the situation is gradually changing. The middle class in African countries such as Rwanda and Nigeria has begun to show interest in electric vehicles, while Ethiopia has banned the import of gas-powered vehicles. New car factories are anticipated to open in the next decade.

BYD's plans in the Americas are more advanced. Opting to avoid the US and Canadian markets, which already impose 100% tariffs, BYD and other Chinese electric vehicle companies are gaining a foothold in Central and South America. In Brazil, BYD acquired a former Ford factory in Camacari, Bahia, and invested $1 billion to transform it into a state-of-the-art electric vehicle factory. Construction of the factory was halted due to an investigation into workers' living conditions. The latest information indicates that construction should resume, with assembly support by the end of 2025 and full operation by the end of 2026.

Great Wall Motors and Chery Automobile are expanding their footprints in Brazil, a hub for automotive production and distribution in South America. Meanwhile, BYD is actively discussing the construction of a new factory in Mexico. Unsurprisingly, this move has sparked concerns in the United States, which has voiced warnings that Mexico could fall prey to Chinese technological dominance. With a factory in Mexico, Chinese manufacturers eyeing the U.S. market can circumvent steep tariffs on Chinese goods and instead benefit from the more favorable 25% tariff rate applicable to Mexican vehicles, thereby bolstering their competitiveness. However, Chinese firms are also wary of potential technology leaks to American competitors, leading to reports that some Chinese electric vehicle companies are contemplating postponing their investment plans in Latin America. This underscores the fact that, similar to other regions, the automotive industry in Latin America has emerged as a critical arena in the geopolitical tug-of-war between global powers.

An Overlooked Giant: Russia, the largest single export market for Chinese cars. Many might ask, what about Russia? Recall from our previous article, Understanding China's Auto Export Market Data with One Chart, that in 2024, China exported over one million cars to Russia, making it the largest single market. However, when it comes to BYD, it doesn't rank at the top of sales lists in the Russian market. Despite entering the Russian market as early as 2005, BYD has now completely exited this easily accessible export market due to its global strategic goals. Some attribute this to factors like BYD's new energy vehicles being unsuitable for cold climates and Russia's abundant cheap oil. Yet, the fundamental reason lies in politics. With its focus on Europe, BYD cannot maintain a presence in both Russia and Europe.

Moreover, within the Central Asia region, a part of the land-based "Silk Road" initiative under the "Belt and Road" framework, BYD has had a long-standing presence. In 2024, BYD's Uzbekistan factory, with an initial annual capacity of 50,000 units, commenced operations. Final Thoughts: BYD's global expansion strategy is driven not only by local consumer demand but also by geopolitical considerations. Will BYD manage to double its overseas sales to 800,000 units by 2025? And will it achieve a 1:1 ratio of overseas to domestic sales by 2030? Share your thoughts and join the conversation.

Reference Articles and Images

*Reproduction and excerpts are strictly prohibited without permission. - Access to Reference Materials: Join our Knowledge Planet to download a plethora of reference materials, including the ones mentioned above, from our public account.