Asian Auto Market | India vs. Pakistan: April Market Data Highlights Divergent Growth Paths

![]() 05/19 2025

05/19 2025

![]() 682

682

In April 2025, the auto markets of India and Pakistan continued to diverge markedly in their performance.

India's auto market logged 353,400 units, maintaining its growth trajectory with a 4.9% year-on-year increase in passenger vehicle wholesale sales, setting a new monthly record for the third consecutive year.

In contrast, Pakistan's market sold only 16,000 units, characterized by a low base and significant fluctuations, reflecting a distinct market structure from India's.

This article delves into the key automakers, sales structures, and market dynamics of both countries, exploring their respective competitive landscapes and future trends.

01

Indian Market:

Navigating Internal Competition

Emerging Brands Make Strong Gains

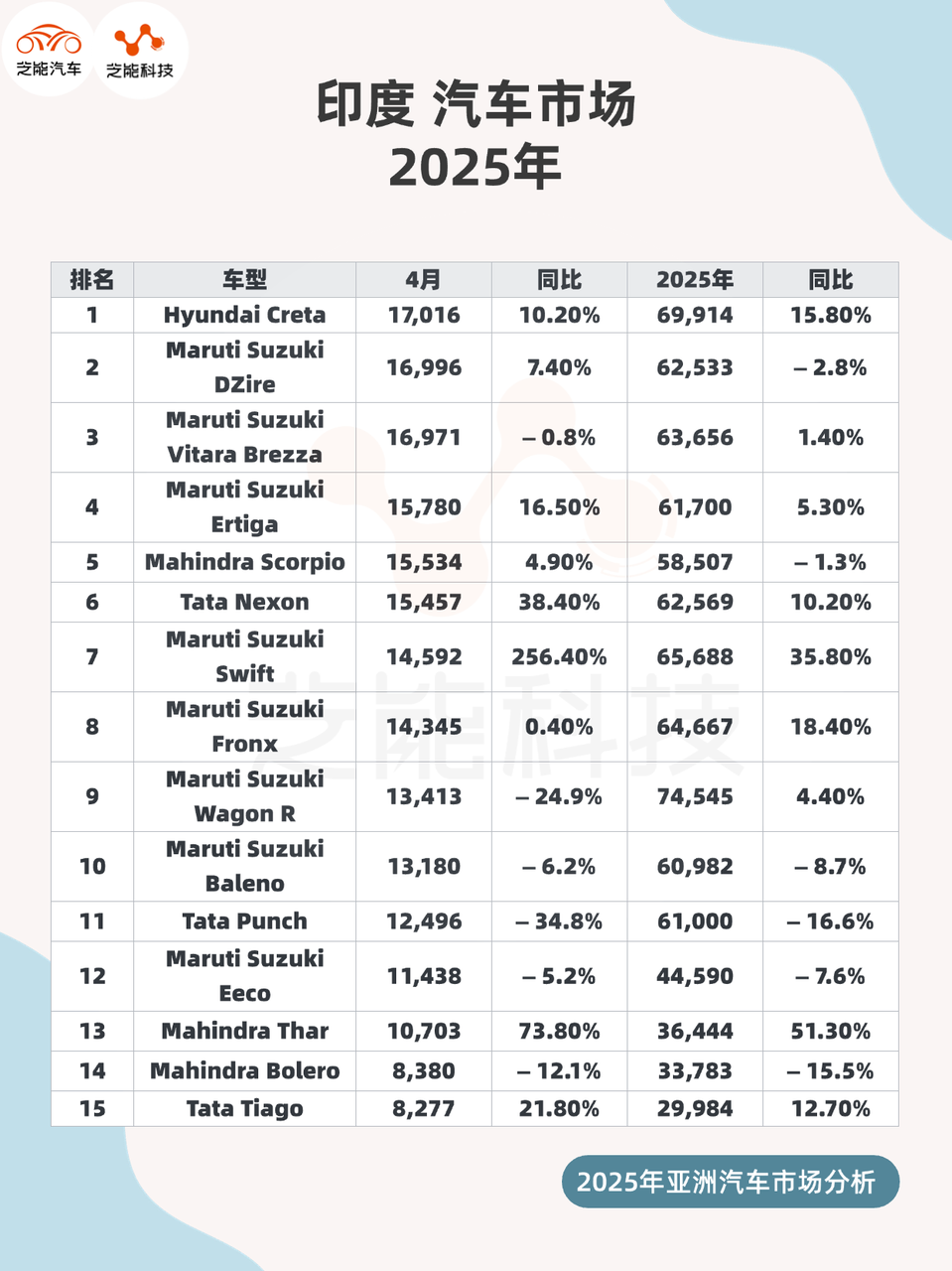

In April 2025, India's passenger vehicle wholesale market recorded 353,449 units, up 4.9% year-on-year, not only surpassing the same period last year but also breaking the April record for the third year in a row.

Cumulative sales for the year so far have reached 1,521,520 units, a 3.4% increase from the previous year.

This underscores the resilience of India's auto market and further confirms the continuous strengthening of its consumption capacity and industrial chain stability.

◎ The established giant Maruti Suzuki retained its top spot with a 39.2% market share in April, marking a modest 0.5% year-on-year growth but significant given its large volume. However, Mahindra, ranked second, deserves closer attention. In April, Mahindra's sales surged 27.6% year-on-year, reaching a record-high monthly sales of 52,330 units and securing second place in the monthly rankings for the first time, even surpassing Tata Motors in cumulative sales. Mahindra's robust performance is primarily attributed to its strong presence in the SUV segment, with the Scorpio model ranking fifth with 15,534 units, setting a new record, second only to last October's historical peak.

◎ Conversely, both Tata and Hyundai experienced declines. Tata fell 5.6% year-on-year, while Hyundai saw a steeper drop of 11.6%. Despite relying on the Creta to maintain its top position, accounting for 38% of brand sales, Hyundai's overall performance has been sluggish, with its brand structure yet to adapt to the current SUV-dominated market. Tata's Punch, on the other hand, witnessed a sharp decline in sales, down 34.8% year-on-year, falling from first place in the same period last year to eleventh, highlighting shortcomings in its product line amidst fierce competition.

◎ Skoda's performance is noteworthy. Thanks to its new Kushaq model, Skoda's sales surged 183.1% year-on-year in April, capturing a 2.1% market share, a record high, and propelling the brand to seventh place. The Kushaq also successfully entered the top 25 sales list, becoming a pivotal factor in Skoda's brand image and sales turnaround.

◎ Similarly, MG and Toyota recorded strong growth of over 30%, with Toyota leading the way with a 32.8% year-on-year increase, fueled by models such as Hilux, Innova, and Hyryder.

The Indian market is currently witnessing a phase of "rising secondary brands and intensified competition among top brands." Brands like Mahindra, Skoda, and MG have accurately targeted the SUV segment and launched products tailored to local demand, resulting in significant growth opportunities. Traditional Japanese and Korean automakers still hold certain advantages but appear relatively sluggish in a rapidly evolving market.

02

Pakistani Market:

Fragile Recovery Amid Policy Uncertainty

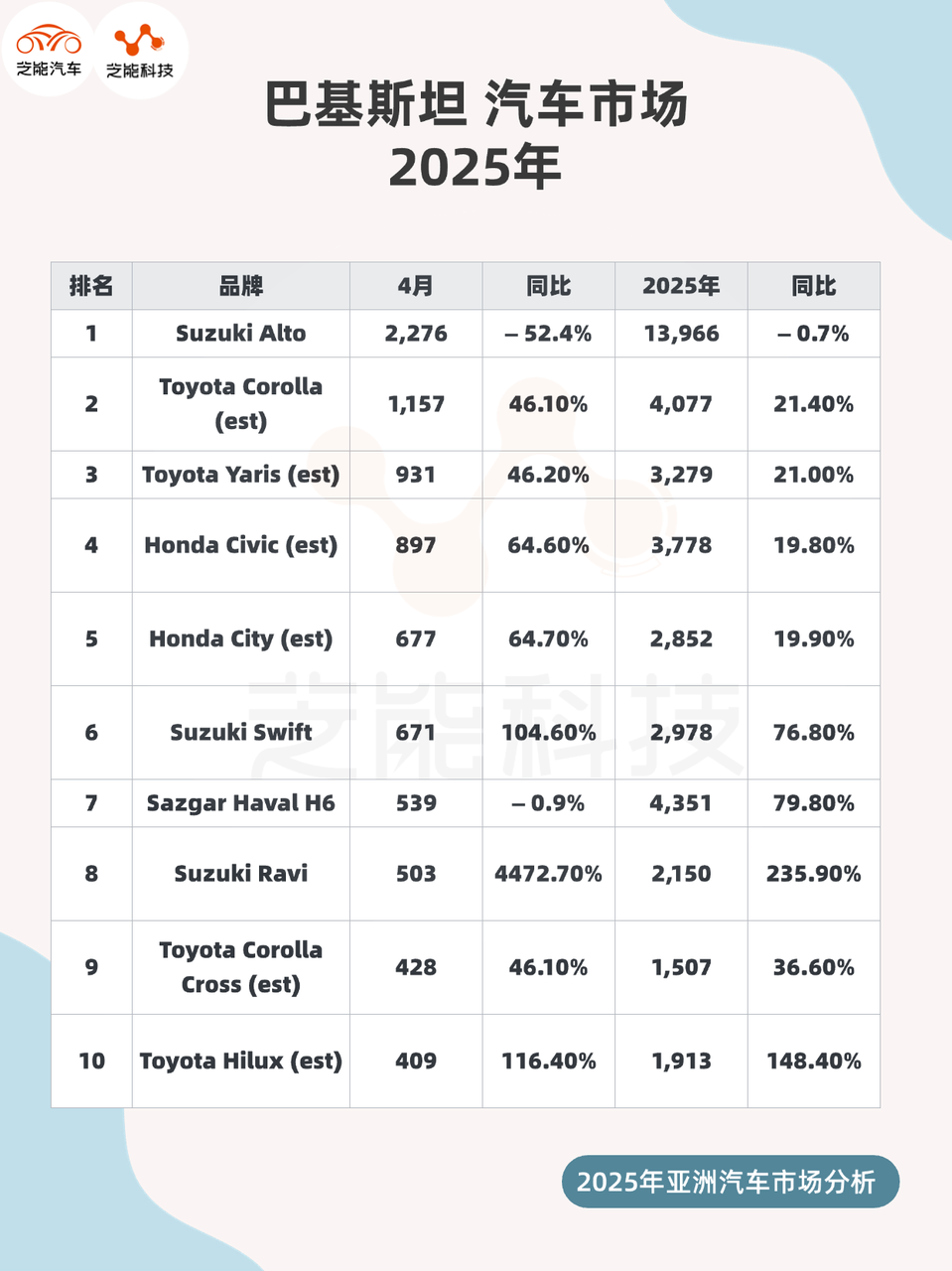

In contrast to India's steady growth, Pakistan's auto market exhibits significant uncertainty. Total sales in April amounted to only 10,596 units, indicating a slight year-on-year recovery but with severe structural issues persisting.

◎ Suzuki remains the market leader, accounting for 37.8% of the market share with 4,003 units sold in April, but experiencing a steep decline of 33.3% year-on-year. This sharp drop is primarily due to the sluggish sales of its core model, Alto.

As a perennial entry-level model, Alto sold only 2,276 units in April, a year-on-year plunge of 52.4%. With consumers' purchasing power still low and financing channels constrained, even economy cars struggle to stabilize market demand.

◎ In contrast, Toyota and Honda have seen strong rebounds. Toyota increased by 57.8% year-on-year, ranking second with 3,259 units sold, with its main models Corolla and Yaris both growing by over 40% year-on-year. Honda witnessed an even steeper growth of 70.2%, becoming the fastest-growing mainstream brand this month.

Behind their robust performances lies the stabilization of exchange rates, slight improvements in import clearance, and a recovery in the spending power of mid-to-high-end consumer groups.

◎ Korean automaker Hyundai, though not a significant player in Pakistan, recorded a stable growth of 31.2% year-on-year.

◎ Sazgar Haval, though still in the niche market, has seen a cumulative growth of nearly 80% throughout the year, indicating that Chinese brands' strategy of entering the middle-class consumer segment through local assembly and SUV products is gradually yielding results.

◎ Another Chinese brand, JAC, grew by 132.4% year-on-year from a very low base, also showing a weak but noteworthy growth signal.

Overall, the core issues facing the Pakistani market remain policy and macroeconomic uncertainties.

◎ External factors such as foreign exchange shortages, import quota restrictions, and tax fluctuations have significantly suppressed the market's development potential. While mid-to-high-end models are showing signs of recovery, the mass market remains sluggish.

◎ The significant decline of Alto reflects that car purchasing power has not yet recovered to pre-pandemic levels, while niche brands like Dewan Kia and BAIC can only maintain single-digit sales, contributing to a highly concentrated market structure.

Summary

Although both India and Pakistan are part of South Asia, India's auto market, driven by robust domestic demand, policy support, and a well-developed industrial chain, continues to strengthen, with a diversifying competitive landscape. The fierce competition among brands is sparking a new round of market restructuring, during which local brands like Mahindra have successfully capitalized on the SUV trend for a resurgence. In contrast, Pakistan's market remains constrained by policy uncertainties and economic fragility. Market demand has not fully recovered, consumer confidence remains low, and the brand landscape is highly concentrated. The dominant trio of Suzuki, Toyota, and Honda is unlikely to be shaken in the short term, while Chinese brands are entering the market through local assembly and price advantages.