Chinese Auto Brands Rush to Expand Overseas, Keeping Chairmen Busy

![]() 05/19 2025

05/19 2025

![]() 725

725

Introduction

Gui Shengyue ponders over overseas expansion challenges, Wei Jianjun forges new connections, Wang Chuanfu heads to Hungary, and Zhu Huarong receives accolades from the Thai Prime Minister.

In April, self-owned brands encountered obstacles in their overseas expansion endeavors; by May, several chairmen grew so concerned that they personally sought cooperation with prime ministers and presidents.

According to April's automotive manufacturer export figures, among the top eight, only BYD and SAIC-GM-Wuling saw export increases, while Chery, SAIC, Great Wall, Tesla China, and Geely experienced declines. Notably, Geely and Changan transitioned from year-on-year growth in the first quarter to declines, both exceeding 20%.

Consequently, these automakers could not afford to remain passive.

At Geely's first-quarter earnings conference this week, despite a 263.6% year-on-year surge in net profit attributable to shareholders of the parent company and a modest 2% rise in total exports, Geely Automobile CEO Gui Shengyue spoke candidly, reflecting deeply on the company's lackluster export growth.

One reason is Geely's relatively sluggish response to the overseas market. While overseas consumers have lower demands for vehicle configurations compared to Chinese consumers, Geely failed to adjust in a timely manner, maintaining configurations in line with the domestic market. In contrast, competitors reduced configurations, lowered costs, and priced competitively based on actual overseas conditions. Furthermore, insufficient resource investment hindered Geely Automobile's overseas expansion.

In contrast, Changan Automobile Chairman Zhu Huarong seems even more eager. On Thursday, Zhu personally led a delegation to Thailand to meet with Thai Prime Minister Prayut Chan-o-cha. On the occasion of the 50th anniversary of diplomatic relations between China and Thailand, Changan Automobile's first overseas new energy vehicle factory—the Rayong Factory in Thailand—commenced production on May 16 with an annual capacity of 100,000 vehicles, scalable to 200,000 in the future. This marks the first step in Changan's five overseas plans for 2025, signifying the official launch of Changan's global strategy into phase 2.0.

Data from the China Passenger Car Association (CPCA) reveals that in the first quarter of this year, Chinese self-owned automakers sold 27,000 vehicles in Thailand, a 15% year-on-year increase. A regular visitor to Thailand, Changan Automobile has successively launched seven new products there, including the S07, E07, and Avatar 11. In 2024, the Deep Blue S7 topped the sales chart for pure electric SUVs in Thailand.

Interestingly, this week's automaker leaders were notably silent. In addition to Zhu Huarong, Great Wall Motors Chairman Wei Jianjun and BYD Chairman Wang Chuanfu also visited the heads of state of two countries: Brazilian President Lula and Hungarian Prime Minister Orban. However, the two companies' situations regarding auto exports this year differ vastly: Great Wall Motors' overseas sales have continued to decline year-on-year, whereas BYD has surged ahead, with exports reaching 200,000 vehicles in the first quarter, a 105% year-on-year increase.

Despite their contrasting circumstances, expanding into overseas markets and achieving cooperation is undoubtedly gratifying. Judging by the frequency and content of Wei Jianjun's Weibo posts, this visit was not only enjoyable but also fruitful. The May 12 Weibo post began on a light note: "Today, I met a new friend, Brazilian President Lula." The accompanying photo shows Wei Jianjun and Lula holding up a Great Wall Motors car model and giving a thumbs-up.

After the meeting, Lula, accompanied by Wei Jianjun, showed keen interest in personally test-driving Great Wall Motors' new model, the GAO SHAN, occupying both the driver's and rear passenger seats. Following the experience, Lula not only affirmed Great Wall Motors' product quality and technological research and development but also expressed the hope that the company's new models would be introduced to Brazil as soon as possible.

As the third-largest overseas market after Russia and the United Kingdom, sales of Chinese self-owned automakers in Brazil reached 41,000 vehicles in the first quarter of this year, a 27% year-on-year increase, indicating substantial market potential. Additionally, as a leader in the Latin American market, Brazil boasts a well-established automotive industry foundation. In early 2022, Great Wall Motors officially took over the Iracemapolis factory in Brazil. After undergoing intelligent and digital transformation and upgrading, the Great Wall Motors factory in Brazil is expected to commence production in July this year, serving the entire Latin American region.

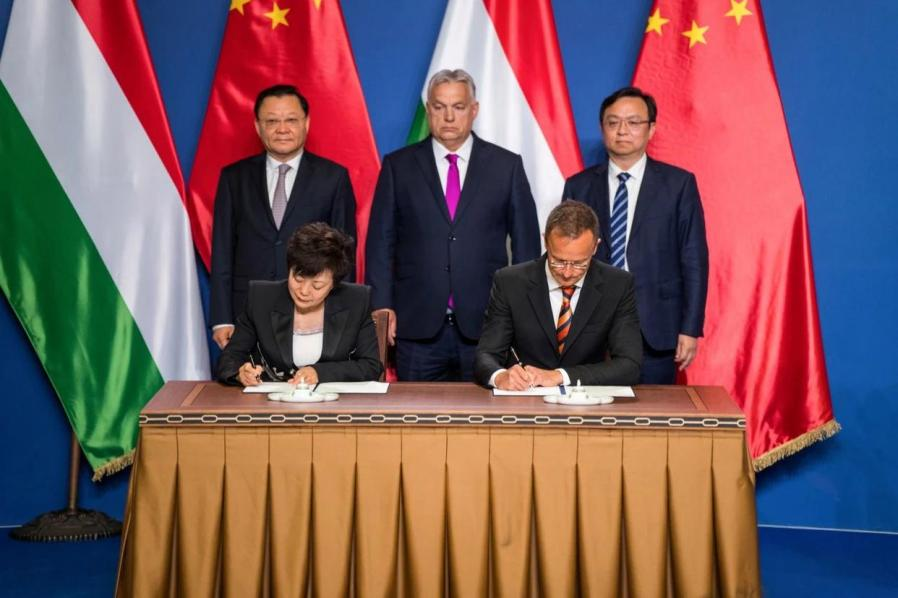

For Wang Chuanfu, whose overseas market sales doubled in the first quarter, this trip to Hungary was undoubtedly sweet. While the Changan Automobile team was visiting the Thai Prime Minister, 8,000 kilometers away, BYD held an official announcement ceremony for its European headquarters in Budapest, Hungary.

Nestled in the heart of Europe, Hungary has emerged as a springboard for BYD to expand its presence throughout the continent. As early as 2016, BYD established the Macrom Electric Bus Factory here. In 2023, the cooperation between the two sides deepened further, with BYD announcing the construction of its first European new energy passenger vehicle production base in Hungary.

Thanks to this, in April, BYD sold 11,000 vehicles across 14 European countries, surpassing Tesla and leading in core markets such as Germany, the United Kingdom, France, Italy, and Spain, making significant inroads into Tesla's stronghold.

BYD's European headquarters in Hungary will enable the company to further solidify its roots in Europe, continue to make breakthroughs in important European markets like the United Kingdom and Italy, and fly the flag of Chinese self-owned brands even higher.

Also on May 15, with a similar focus on Europe, SAIC Motor's Anji Logistics announced that the world's largest roll-on/roll-off ship, the "Anji Ansheng," with a capacity of 9,500 cars, carried nearly 5,000 SAIC self-owned models and vehicles from other automakers to Europe, setting a new record previously held by BYD's "Shenzhen" ship.

Continuous breakthroughs in overseas business are a key driver behind SAIC Motor's large-scale "shipbuilding and overseas expansion." In 2024, SAIC Motor's total overseas market terminal deliveries reached 1.082 million vehicles. In the first quarter of 2025, SAIC Motor's overseas sales reached 219,000 vehicles, accounting for 23.2% of the company's overall sales. With this maritime "megalodon" officially joining the fleet, SAIC Anji Logistics' auto fleet has expanded to 35 ships, maintaining China's first and the world's leading scale of self-operated vehicle fleet for finished vehicle logistics transportation.

The accelerated overseas expansion of automakers in Southeast Asia, Latin America, and Europe may also be linked to the significant decline in sales in Russia, currently China's largest overseas market. CPCA data shows that from January to March 2025, China exported 123,000 vehicles to Russia, a 39% year-on-year decrease. Previously, data from the General Administration of Customs also indicated that China's total exports of complete vehicles (including new and used vehicles as well as CKD kits) in the first quarter declined by 44% year-on-year in Russia.

Following the tightening of the Russian market, Chinese automakers urgently need to explore other overseas markets to mitigate the impact of the Russian market. As one of the most globalized industries, the future of the automotive industry extends beyond the domestic market, and accelerating overseas expansion is undoubtedly another potential growth point for boosting sales to the next level.

Whether it's Gui Shengyue reflecting on Geely's overseas expansion challenges, Wei Jianjun forging new connections, Wang Chuanfu heading to Hungary, Zhu Huarong receiving accolades from the Thai Prime Minister, or SAIC's largest roll-on/roll-off ship setting sail, the coinciding actions of these chairmen this week send a clear signal: with the dual engines of intellectualization and localization activated, the globalization narrative of Chinese auto brands is shifting from "borrowing ships to sail out to sea" to "building ships to voyage far."

The robust rise of China's self-owned brands has already been achieved, and the pace of their global conquest is unstoppable.

Gathering automotive news of the week and reviewing major and minor automotive events, anecdotes, and stories about cars can all be found in [Weekly Car Talk]. See you next week!

Editor-in-Chief: Du Yuxin, Editor: Wang Yue