“9 Series” SUV Battle Results: Who Reigns Supreme?

![]() 06/16 2025

06/16 2025

![]() 512

512

Introduction

The battle in the “9 Series” segment is not merely a contest for market share and profits; it is a comprehensive examination of whether Chinese automakers can genuinely achieve a transformation towards “premium” status.

In 2025, the automotive market’s battlefield shifts to a new dimension. Following the fierce competition in the “7 Series” segment, the “9 Series” battle has commenced.

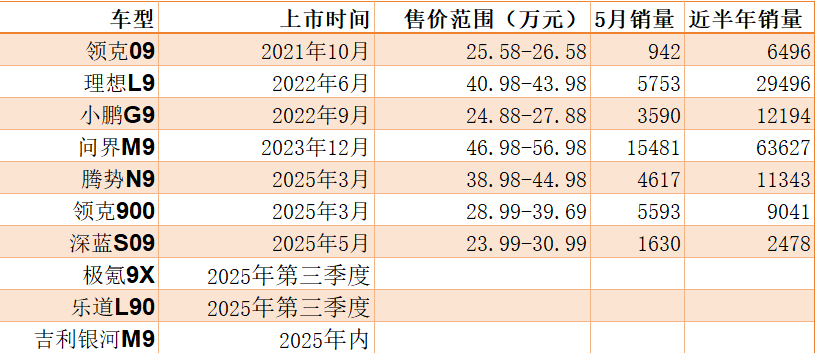

With early entrants such as Lingke 09, emphasizing luxury cost-effectiveness; Lixiang L9, targeting family scenarios; and Wenjie M9, leveraging Huawei’s technology as its core selling point, the “9 Series” mid-to-high-end SUV market is teeming with stars. Upcoming players include Lingke 900 with SPA Evo architecture and rear-wheel steering technology, Denza N9 backed by BYD, Deep Blue S09 equipped with HarmonyOS, and the forthcoming Geely Galaxy M9 and Ledao L90.

Chinese brands collectively advancing into the mid-to-high-end SUV market represents a strategic offensive aimed at the lucrative high-profit ground of the luxury market. In the fuel era, this profitable pie was monopolized by traditional luxury brands. Now, independent brands have pierced through the barriers of the old era with the sharp tools of electrification and intelligence, securing a seat at the table.

01 Highly Dynamic “9 Series” Market

Despite over a dozen models targeting the “9 Series” high-end SUV segment, data feedback indicates that this market has not yet fully solidified and remains highly dynamic.

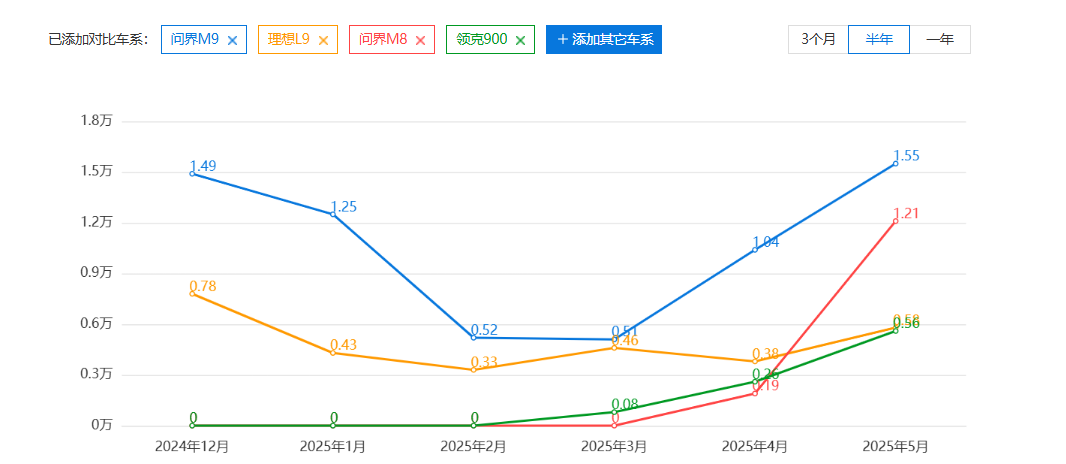

According to recent May data, Wenjie M9 leads the market with sales of 15,000 units. Notably, Wenjie M9’s price range spans from 469,800 to 569,800 yuan, placing it at the absolute high end of the “9 Series.” The recently launched Wenjie M8, despite being categorized as the “8 Series,” overlaps to some extent with other brands’ “9 Series” vehicles in terms of its price range of 359,800-449,800 yuan, specifications, and configurations.

Including Wenjie M8’s May sales of 12,000 units, the combined sales of Wenjie’s two high-end models far exceed the sum of sales of other “9 Series” vehicles in the table. Moreover, Wenjie M8, having been on the market for a short time, has received over 80,000 orders within 34 days of its launch, with a large backlog of orders yet to be fulfilled.

According to official sources from HarmonyOS Auto, Wenjie M8’s delivery target for June is 20,000-30,000 units. According to data from Qiyan Datong, in the first week of June, despite sales of most brands declining due to end-of-month incentives and the Dragon Boat Festival holiday, Wenjie M8 still sold 4,290 units, demonstrating its formidable strength.

Lixiang L9, which once kept pace with Wenjie M9, has begun to lag behind under the combined pressure from Wenjie M8 and M9. In May, amidst a major refresh of the entire Lixiang lineup, Lixiang L9’s sales not only halted a slight downward trend but also rebounded significantly to 5,753 units.

Despite this recovery, Lixiang L9 faces pressure not only from Wenjie but also from newly launched competitors like Denza N9, Lingke 900, and Deep Blue S09, which are eyeing the pie originally belonging to Lixiang L9. In May, Lingke 900’s sales also surpassed the 5,000 mark, closing in on Lixiang L9.

The trend chart reveals that Lingke 900 is in a stage of momentum growth, while Lixiang L9 is caught between two fronts. Apart from Lingke 900, Denza N9 and Deep Blue S09 are also formidable dark horses. In May, Denza N9 sold nearly 5,000 units, and Deep Blue S09’s growth curve also shows great potential.

This indicates that while Wenjie M9 and M8 have secured a significant market share, latecomers still have room to compete. Moreover, pricing in the “9 Series” market is mostly concentrated in the 300,000-400,000 yuan range, which undoubtedly offers more profits than low-end models. The launch of high-end vehicles also helps elevate brand image and create greater premium space for brands.

With both incremental growth and profits, it is not surprising that automakers are flocking to launch “9 Series” vehicles. In the second half of this year alone, competitors with both strength and unique features such as Zeekr 9X, Ledao L90, and Geely Galaxy M9 will enter this market. In this context, how to stand out in the shifting blue ocean has become an urgent task for automakers.

02 Collective Push by Independent Brands

“It’s not that we are cheap; it’s that they are too expensive.” On May 22, at the launch event of Deep Blue S09, Deep Blue Automobile CEO Deng Chenghao said this.

With a length of 5.2 meters, a wheelbase of 3.1 meters, a million-yuan-level chassis architecture, Huawei Kunlun Intelligent Driving ADS, HarmonyOS cabin Harmony Space 5, and the Yuanli Intelligent Range Extension 2.0 system, the Deep Blue S09’s subsidized price starts at 204,900 yuan and tops out at 274,900 yuan for the high-end four-wheel-drive Ultra+ custom version, far lower than the 400,000-yuan price range of Lixiang L9 and Wenjie M9.

This strategy of undercutting higher-priced competitors, which has proven effective in the mid-to-low-end market, has also borne fruit in the high-end SUV market. As of May 23, Deep Blue S09 had received over 20,000 confirmed orders.

On the same day as the launch of Deep Blue S09, in Milan, Italy, Geely Galaxy’s first large six-seater flagship SUV made its debut. The naming of M9 easily evokes associations with Wenjie M9. Considering Geely Galaxy’s positioning and pricing strategy, the Galaxy M9’s price is also likely to be in the 200,000-yuan range, equivalent to half the price of Wenjie M9.

In terms of configuration, the Galaxy M9 interior features the same strip-type liquid crystal instrument panel and large central display as the Lingke 900, with the Flyme auto infotainment system integrating all-scenario AI-empowered experiences. It also comes with second-row screens, zero-gravity seats, a car refrigerator, and more, making it suitable for both executive and family use scenarios. Powered by Geely’s Leishen Super Hybrid EM-P system with three electric motors, it offers both performance and fuel economy with a fuel consumption of 4.8L per 100 km under low battery conditions. Technologies such as the 11-in-1 intelligent electric drive, AI digital chassis, and Shendun gold brick battery will also be featured. It is understood that Geely has high hopes for this vehicle, aiming to make it a hit among its peers.

However, relying solely on extreme cost-effectiveness may not be enough to gain a foothold in the large six-seater flagship SUV market. The success of top “9 Series” models is the result of a deep integration of technology, brand, and user needs.

Despite its high price, consumers are willing to pay for Wenjie vehicles thanks to Huawei’s intelligence and brand bonus. Previously, an owner of a Zunjie S800 said that Huawei was the main reason for their purchase: "If Huawei’s brand and technology were not a factor, I wouldn’t even accept this car for free. Not just me, but at least one of my friends who bought a Maybach feels the same way. Huawei is the biggest reason."

For Lixiang L9, despite facing competition from all sides, as one of the earliest entrants into the “9 Series” market, its focus on family users has become deeply ingrained in the minds of consumers. With strong product capabilities, although its position is challenging, it will not be difficult for Lixiang L9 to maintain its leading position. The benefits of the refresh have not yet been fully realized, and Lixiang L9 has the confidence to continue growing in June.

As independent brands differentiate internally through intelligent breakthroughs and scenario segmentation in the “9 Series” market, external competitive pressure is accelerating from traditional luxury brands. The fierce competition in the “9 Series” arena is about more than just the success or failure of a few popular models or a single segment.

Diving into this profitable blue ocean is also a collective offensive by independent brands aiming at the core territory of the high-end luxury SUV market, which is the deepest and most profitable stronghold of traditional luxury brands. This is an unprecedented attempt by the Chinese automotive industry to collectively climb higher, a concentrated outpouring of technological confidence and brand ambition.

Riding the wave of electrification and intelligence, independent brands have successfully torn through the old paradigm and planted their flags on once unattainable high ground. Wenjie’s HarmonyOS intelligent driving, Lixiang’s scenario definition, and the extreme cost-effectiveness strategies of Deep Blue and Geely all demonstrate their strong competitiveness in specific areas. However, true “premium” status is not just about dazzling technological configurations or attractive price concessions; it requires excellence and refinement in all aspects.

Currently, independent brands are already ahead or have even set benchmarks in terms of intelligent experience, electrification technology, and user operations. However, compared to traditional luxury giants, there are still gaps to bridge in areas such as the profound skills of chassis tuning, the ultimate reliability of passive safety systems, the exquisite craftsmanship of vehicle manufacturing, and the intangible value brought by brand history and heritage.

Therefore, the battle in the “9 Series” arena is not just about market share and profits; it is also a comprehensive test of whether Chinese automobiles can truly achieve a “premium” transformation. It requires independent brands not only to be satisfied with their dazzling “long boards” but also to shore up their weaknesses, achieving all-dimensional technological investment and refinement from core battery-electric-drive systems, intelligent technology, to chassis architecture, safety performance, and quality craftsmanship. Only in this way can this “offensive” be transformed into a lasting “occupation,” truly etching the nameplate of Chinese automobiles into the strongest fortress of luxury brands.

This journey to climb higher is far from over, but every solid step forward is reshaping the power map of the global automotive industry.

Editor-in-Charge: Yang Jing

Editor: Wang Yue