Li Shufu and Huang Renxun: A Harmonious Sync in Innovation

![]() 06/16 2025

06/16 2025

![]() 698

698

The profitability challenge in selling new energy vehicles stems largely from automakers adhering to Tesla's outdated business model.

Following in the footsteps of Ideal Motor and Tesla, Geely is striving to become the third automaker to monetize AI effectively.

"There might not be another Tesla. Continuing with the existing model will lead to significant issues," a research analyst confided, discussing recent upheavals and advancements in the automotive industry.

Examining major events since May, including Nezha Auto's reorganization, NIO's substantial internal reforms, XPeng and Xiaomi announcing fourth-quarter profitability, over 20 automakers pledging 60-day supplier payments, and numerous automakers criticizing low-quality internal competition, the details behind these events vary, yet they converge on a single point.

As AI fails to complete the business loop as anticipated, monetization becomes problematic, necessitating an end to the expansion phase and the commencement of a period of stable operation. Thus, continuing Tesla's previous path of funding-research and development-breaking the circle is no longer viable. Musk's business empire encompasses more than just cars, with ventures like Starlink and SpaceX's manned spaceflight programs.

While the automotive industry has discussed AI for years, only Huawei and Ideal have truly monetized it, prompting Geely to alter its approach.

There is only one Tesla and one Huawei AI.

Currently, only partial commercial loops have been established, not a global one. This conclusion aligns with industry consensus and compares the current AI model with the internet and mobile internet models of the past 20 years.

Industry consensus highlights that OpenAI, the world's leading AI company, abandoned its six-year-old plan for a profitable subsidiary in May 2025, transforming into a non-profit organization. This non-profit will continue to control the public welfare company and serve as its largest shareholder.

Models like Deepseek, although popular, focus more on replacing traditional search engines for profit. Therefore, compared to previous internet and mobile internet models, today's AI, despite its popularity, still thrives in a narrow niche market.

NVIDIA, another global leader, indirectly addressed related issues. Huang Renxun's keynote speech at GTC at VivaTech Paris 2025 was enlightening, comprising five key messages: three about introducing new products and two about future AI expectations.

The core expectation, widely quoted, is Huang Renxun's belief that quantum computing has reached an inflection point. Thanks to algorithmic stack accelerations, with more efficient quantum computing, artificial intelligence has entered the Agent era, as Li Xiang mentioned when introducing the second-generation VLA driver model.

Huang Renxun's work essentially lays the groundwork for computing-related tasks, allowing various industries to form business relationships after analysis and judgment.

Ultimately, numerous attempts have been made, yet a breakthrough into the consumer market (to C) remains elusive, and AI has failed to monetize in most cases. For instance, selling computers to ordinary people was straightforward in the internet era, but AI is not yet sufficient today.

Automakers have also attempted numerous methods. Specifically, in recent years, AI in the automotive market has focused on autonomous driving and humanoid robots, alongside increasingly popular low-altitude transportation and flying cars. However, in reality, only Huawei and Tesla have directly achieved this, both being isolated cases difficult to replicate.

In the Chinese automotive market, Huawei's Hongmeng Intelligent Driving sells intelligent driving assistance systems for up to RMB 10,000. Qiankun Intelligent Driving is divided into two versions: ADS and ADS SE. The former has a guide price of RMB 36,000 but often comes with a RMB 26,000 purchase benefit when new cars are launched, resulting in an actual purchase price of RMB 10,000. The latter, the basic version not supporting urban NOA assistance, is mostly given away for free or included in the car price.

Another example is Tesla's FSD, priced at USD 8,000. However, as the world's earliest AI system of this kind, consumer enthusiasm for it has waned. In 2023, outside estimates showed its global purchase rate had fallen to 11%, while Huawei's ADS data looked promising, with an estimated purchase rate of 80% in 2024.

The overarching trend is that in fierce market competition, the sales prices of such technologies continue to decrease. Ideal has used bundled sales and giveaways since its inception. XPeng has shifted from optional extras to free giveaways. After examining strategies, only Huawei has successfully monetized AI. Even Xiaomi, which currently gives away its AI systems.

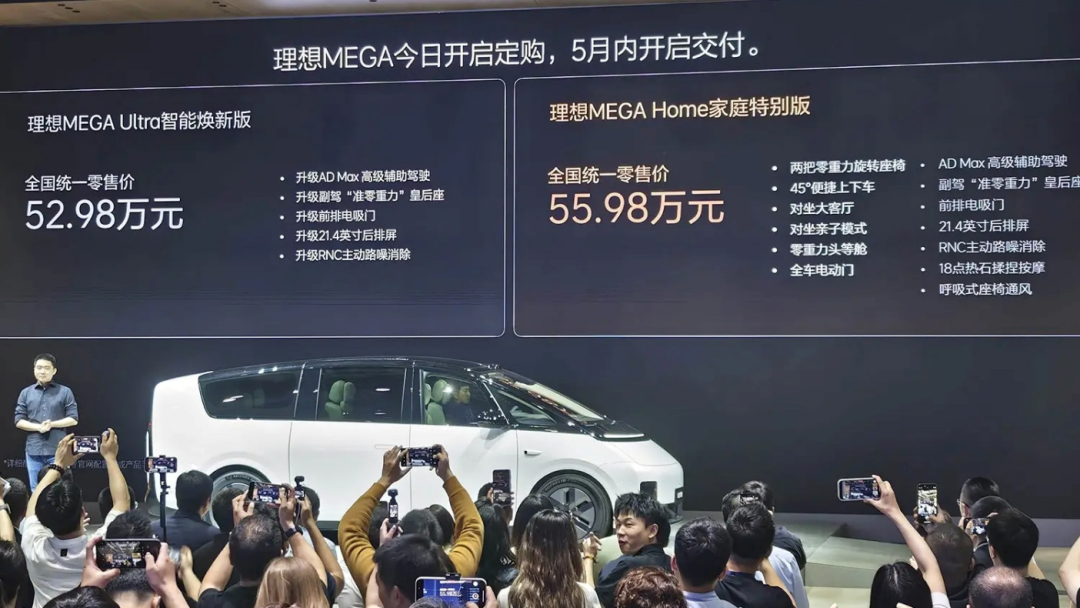

Li Xiang has a clear vision: AI can be used as an auxiliary tool to create selling points and premiums. This strategy has been recognized by the consumer market, making Ideal the first new force to turn a profit and now occupying a significant share of the traditional luxury fuel vehicle market. Geely is now following this approach.

Will the plug-in hybrid enter a watershed period, leading to a new round of reshuffling?

Geely's latest plug-in hybrid release has made a significant impact, with the main focus being the comprehensive implementation of AI.

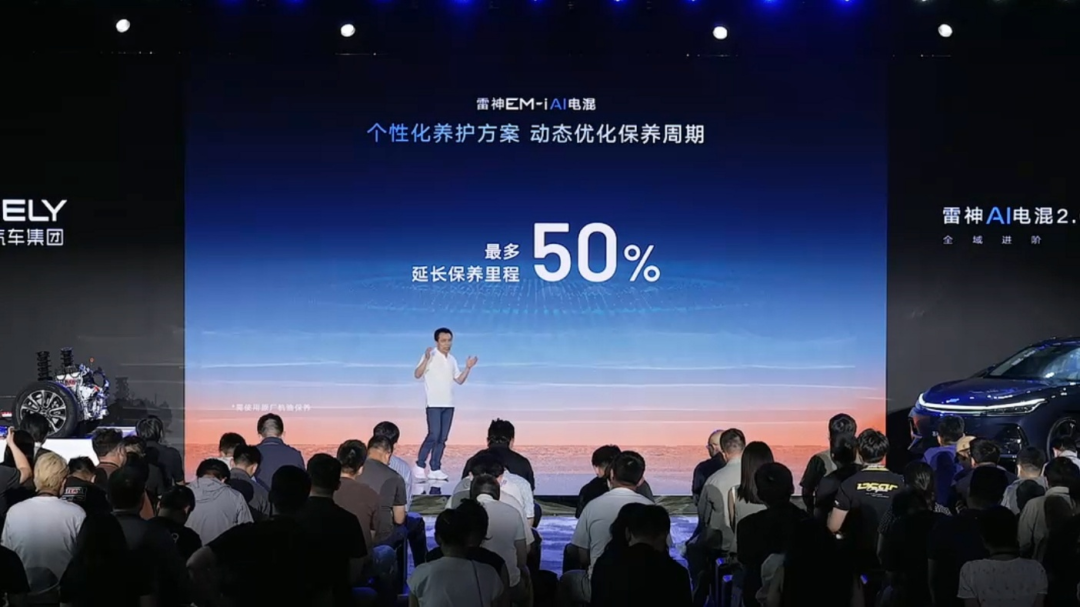

In summary, there are three major highlights: First, in research and development, it can swiftly identify the optimal combustion model and cylinder structure from vast amounts of data. Second, it optimizes battery, fuel, and power generation to maximize energy efficiency during driving. Third, it achieves highly accurate vehicle usage monitoring. A prime example is Li Chuanhai's statement at the press conference that it can increase the vehicle's maintenance cycle by up to 50%.

Explaining the above points, the first is a common practice in the industry, using AI to accelerate vehicle or technology development. The challenge lies in the similar analyses faced by various engineering teams.

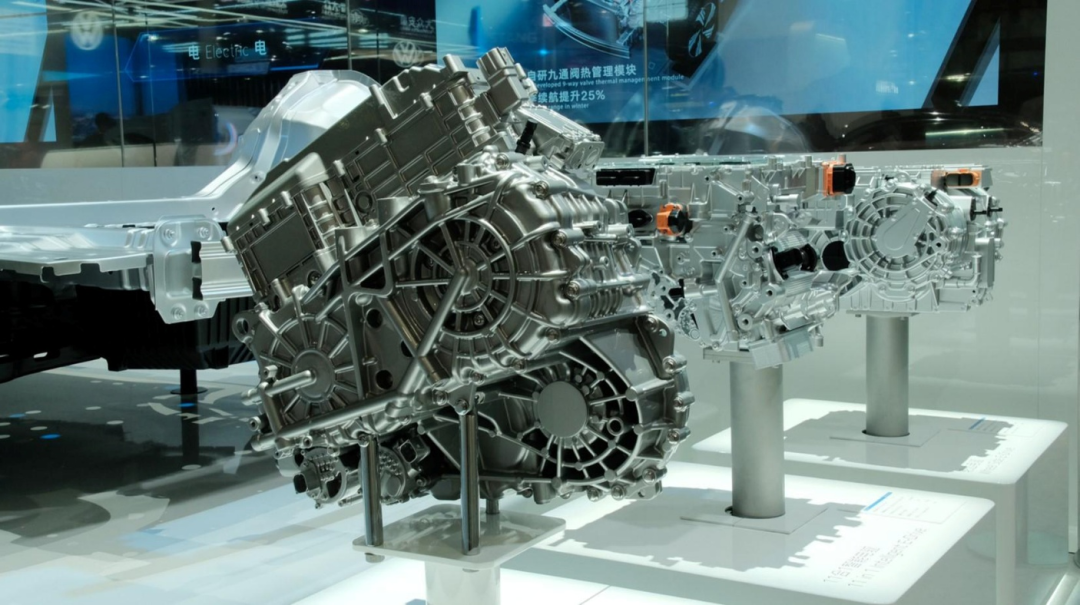

However, different automakers have varying resources, experience, and manufacturing capabilities. For instance, it's unrealistic for new players to rapidly develop technologies involving engines, such as extended-range and plug-in hybrids. To break the deadlock, one must look to companies like Volkswagen, Toyota, Honda, Mercedes-Benz, BMW, Geely, Chery, and Great Wall, which have prior engine reserves.

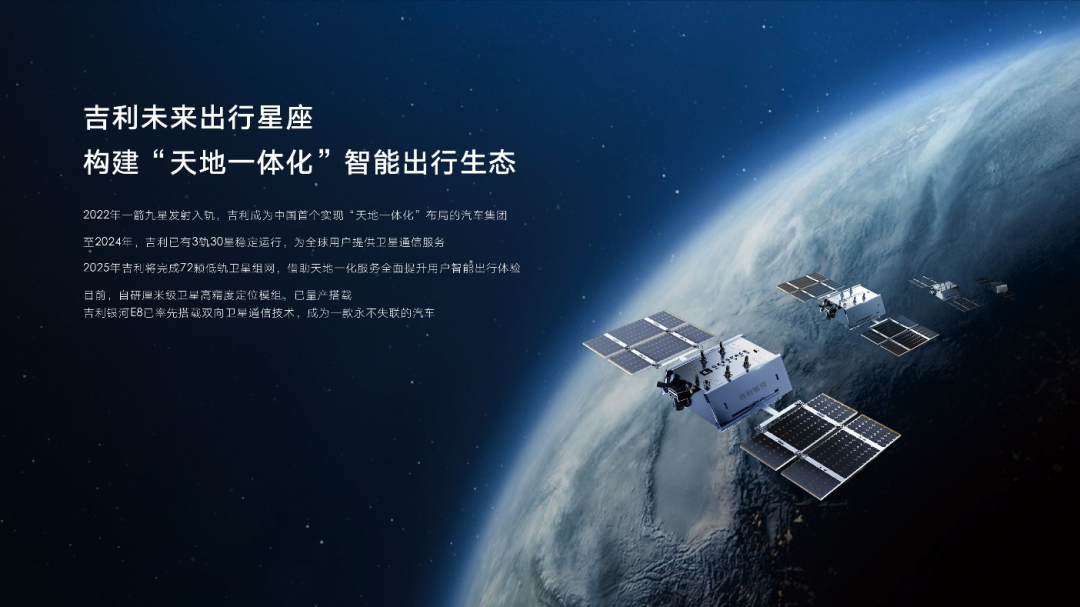

The second point is crucial for boosting sales and enhancing user reputation. Geely's model utilizes its recently established space-ground integrated system, which has launched 30 low-orbit satellites, to constantly monitor vehicle locations and estimate road conditions based on vehicle posture and traffic information. It combines learning the driver's habits with making the most precise possible control of the vehicle's limited slip, cornering, etc.

In simple terms, after understanding the driver's habits and style, it minimizes electricity use and maximizes efficient power generation and recovery. The actual test results presented at the press conference showed a fuel consumption of 2.49L per 100 kilometers under all operating conditions. The data tested under the Ministry of Industry and Information Technology's CLTC conditions was 2.67L/100km, with a comprehensive driving range exceeding 2,100km.

Admittedly, this may raise questions among consumers, given the abundance of plug-in hybrid technologies with 2L or 3L-level promotional information in the industry. Next, we will see if Geely can narrow the gap between promotional data and actual use, but from a technical theoretical perspective, it is indeed the most comprehensive and forward-looking in the industry.

The third point is not just about the 50% increase in maintenance cycles mentioned at the press conference, as everything is calculated by AI. AI calculations are black box models, and the final execution plan is based on suggestions given to users. The biggest variable is that previous users can also receive related OTA updates, leading to good secondary dissemination. Although there may be hardware differences between new and old plug-in hybrids, for car owners, any reduction in fuel consumption is a clear benefit.

So, will there be a new round of technological reshuffling in plug-in hybrids? The answer is likely yes, as the development path of intelligent driving assistance, also due to the addition of AI, has already proven many things.

Initially, intelligent driving assistance involved continuously writing rules to enable vehicles to travel from point A to point B. However, human-written rules cannot cover all real-world traffic scenarios. Therefore, after activating the system, it either frequently reminds the driver to take over or directly degrades to LCC or exits the system.

Early users of intelligent driving have encountered such scenarios. For instance, under the rule-based model, if there is an illegally parked vehicle ahead, the system may not be able to continue. To solve these issues, AI has evolved into the era of large models, leading to new technologies like VLM, VLA, and world models.

PHEV should follow this logic. Today, AI's most direct benefit is quickly finding the optimal solution through local or cloud computing, subject to various rules and restrictions.

In other words, flexible thinking triumphs over rigid rule-based thinking.

Written at the end

There are two key pieces of information currently at play. First, if Geely's new technology swiftly achieves market success, numerous similar technologies will soon emerge, from Chery, Great Wall, to Volkswagen, etc. It is expected that they will also provide relevant statements on AI.

Geely's killer move extends beyond low fuel consumption. The rumored price of the Geely Yinhe A7 may be in the 90,000 yuan range. Based on Yinhe's latest pricing strategy, the Xingyao 8 has directly reduced the original similar price by about 40,000 yuan, suggesting that the Yinhe A7 will likely set a new low for intermediate vehicle prices, possibly even starting with the number 8.

The other piece of information is that, based on existing regulations and emission standards, technological and parameter ceilings have more or less emerged. After dropping below 2.5L/100km, further reductions will become increasingly difficult. Therefore, a watershed will appear, or has already appeared. However, the deep integration of AI into auto manufacturing logic will have the greatest impact on cost control, achieving the ultimate goal of maximizing output with minimal input.