Leapmotor: Navigating the Path to 'Half-Price Li Auto' and Closing in on its Ideal

![]() 06/16 2025

06/16 2025

![]() 688

688

Recently, a blogger unveiled a series of camouflaged spy shots of Leapmotor's upcoming "D Series" vehicles on social media. Judging from the images, the exposed model is an SUV from the new "D Series".

This model is notably larger in size and is anticipated to adopt a three-row seating layout. It features a charging port at the rear, with its overall design adhering to Leapmotor's classic family language, characterized by a rounded and full visual effect.

Rumor has it that this new SUV will exceed 5 meters in length, be equipped with CTC battery chassis integration technology, and may offer both pure electric and extended-range variants.

During the 2025 Shanghai Auto Show, Cao Li, Senior Vice President of Leapmotor, announced that the brand would launch the new "D Series" of high-end luxury models this year, coinciding with its 10th anniversary. He further stated that these models would offer configurations akin to those found in competitor vehicles priced above 500,000 yuan but at a more affordable price range of 250,000-300,000 yuan.

In March of this year, Zhu Jiangming, CEO of Leapmotor, also disclosed plans for the new "D Series". Among them, an MPV model codenamed D21 is scheduled for launch in June 2026, targeting "super luxury configurations" and an "affordable pricing of 200,000-300,000 yuan" for both family and business scenarios. Another MPV model is expected to be unveiled within the year, with the launch date to be determined, and is anticipated to attract young customers with its differentiated design.

Public opinion suggests that Leapmotor's introduction of the new "D Series" models aims to elevate its brand image through a high-end product matrix and optimize its product structure with a pricing strategy of 250,000-300,000 yuan, thereby increasing the average single-vehicle price and gross profit.

Data reveals that in the first quarter of this year, Leapmotor delivered a total of 87,552 vehicles, marking a year-on-year increase of 162.1%. Among these, C Series models sold a cumulative 67,812 units, accounting for 77.5% of total sales, up 5.7% year-on-year. Compared to the same period last year, the proportion of low-end models in Leapmotor's sales structure has declined, while the proportion of high-end models is on the rise.

From January to March 2025, Leapmotor's revenue reached 10.02 billion yuan, a year-on-year increase of 187.1%; its gross profit margin surpassed double digits for the first time, improving from -1.4% in the same period last year to 14.9%; and single-vehicle revenue increased by 4.9% year-on-year.

On the surface, Leapmotor appears to have found the right path with a promising future. However, a closer inspection reveals that the growth in Leapmotor's single-vehicle revenue lags significantly behind the explosive growth in sales and revenue. Behind this, the "high configuration, low price" strategy is the direct cause of the slow growth in single-vehicle revenue.

CEO Zhu Jiangming has clearly stated that Leapmotor aims to become the "Uniqlo of the automotive industry", winning the market with high-quality products at affordable prices. This has resulted in Leapmotor's average single-vehicle price failing to keep pace with its peers.

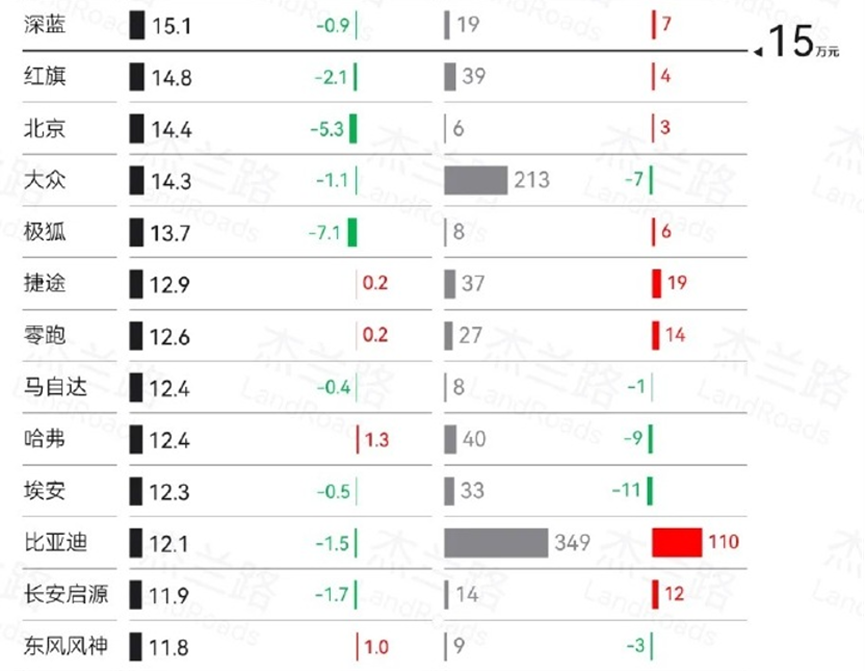

Leapmotor stated in its prospectus that it "primarily focuses on the mid-to-high-end mainstream new energy vehicle market with prices ranging from 150,000 to 300,000 yuan." However, according to data on the average single-vehicle transaction price of Chinese passenger car brands in 2024 released by professional consulting firm JLR, AITO's average transaction price was as high as 402,000 yuan in 2024; those of NIO and Li Auto both exceeded 300,000 yuan; XPeng's average transaction price was slightly lower at 178,000 yuan; while Leapmotor's average single-vehicle transaction price was only 126,000 yuan, slightly higher than BYD's.

Furthermore, Leapmotor's single-vehicle gross profit is also not high. Data from third-party platforms indicates that in 2024, Li Auto's single-vehicle gross profit reached 59,000 yuan; NIO's single-vehicle gross profit was 32,300 yuan; XPeng's single-vehicle gross profit was slightly lower but still amounted to 16,000 yuan. In contrast, Leapmotor's single-vehicle gross profit was only 9,200 yuan, representing a noticeable gap compared to "NIO, XPeng, and Li Auto".

It's also worth noting that the prevalence of price wars in the automotive market is gradually eroding Leapmotor's "cost-effective" advantage. Currently, both traditional domestic automakers, new energy vehicle makers, and joint venture automakers are engaged in intense price wars to expand their market share, leading to the emergence of numerous new models with "high quality and low prices". For Leapmotor, it's becoming increasingly challenging to sell cars solely relying on a high-cost-performance strategy.

Recently, Leapmotor, which was already highly cost-effective, introduced a limited-time fixed-price policy for the Leapmotor C16 Extended Range 200 Smart Edition and the Leapmotor C11 Extended Range 200 Smart Edition, with a maximum price reduction of 45,000 yuan. Some netizens exclaimed, "This is not just half-price Li Auto; it's one-third price Li Auto."

Leapmotor has consistently adhered to a self-research model for its components. Zhu Jiangming revealed that Leapmotor's self-researched and self-manufactured core components account for over 65% of the total vehicle cost. Simultaneously, in supply chain management, Leapmotor bypasses traditional tier-one suppliers, reducing profit sharing in intermediate links. Moreover, Leapmotor has been stringent in controlling its operating expenses. In 2024, Leapmotor's operating expense ratio dropped to 19.22%, which is on the lower end of the industry.

With this combination of strategies, Leapmotor achieved quarterly profitability for the first time in the fourth quarter of last year, becoming the second new energy vehicle maker to attain single-quarter profitability. In the first quarter of this year, Leapmotor's gross profit margin increased to 14.9% from the previous quarter, setting a new record high. However, costs cannot be endlessly reduced. Some analysts point out that Leapmotor has less and less room to compress costs, and rapid scale expansion is crucial to maintain its pricing competitiveness.

However, with market competition intensifying, it's difficult to average out costs by expanding sales volume alone. Therefore, while striving for scale, Leapmotor is also aiming for high-end products, increasing the sales proportion of high-value models, and raising the average single-vehicle price and gross profit, thereby driving overall profit growth.

Of course, considering Leapmotor's long-standing image as "half-price Li Auto", launching high-end models may pose certain challenges. As for the effectiveness of this strategy, time will tell.

(Images sourced from the internet. Please remove if infringing.)