European Auto Market | Russia May 2025: Market Decline Amidst Chinese Brands' Rise

![]() 06/16 2025

06/16 2025

![]() 646

646

In May 2025, the Russian passenger car market faced persistent pressure, recording a year-on-year decline of over 28%.

Despite the overall subdued demand, Chinese brands have consistently increased their market penetration in Russia, with some companies even setting new records for market share. Notably, the Sino-Belarusian joint venture brand performed robustly, Chery's multi-brand strategy maintained its growth trajectory, and JETOUR achieved growth amidst the market's weakening, showcasing the escalating competitiveness of Chinese brands in the Russian market.

01

Overview of the Russian Passenger Car Market:

Local Brands Falter

Collective Strength of Chinese Brands

In May 2025, the Russian light vehicle market extended its downward trend, with monthly sales of 91,218 units, marking a year-on-year decrease of 28.3%.

Cumulative sales for the first five months of the year totaled 440,259 units, down 26% year-on-year. This reflects the general weak consumer confidence in the Russian market and highlights the growing differentiation among brands.

Local brand Lada remained the market leader, but sales plummeted to 25,552 units, a year-on-year drop of 36.2%, and its market share shrank from nearly 30% in the same period last year to 28%.

Although its Granta and Vesta models retained the top spots in sales, the decline was substantial, particularly for Vesta, which witnessed a year-on-year fall of over 50%.

The veteran model Niva Legend bucked the trend, rising to fifth place and achieving its best ranking in the past year, indicating that with limited new car supply, some consumers are reverting to classic, easy-to-maintain products.

Chinese brands performed well overall.

◎ Haval ranked second with sales of 10,623 units, accounting for 11.6% of the market. Chery closely followed with sales of 9,780 units and a market share of 10.7%. Although both companies experienced double-digit declines year-on-year, their declines were significantly lower than the market average, demonstrating strong brand power and extensive channel coverage.

◎ Geely and Changan, although still ranking among the top five, saw larger declines, falling by 38.7% and 43.5%, respectively. Notably, Changan, which made a strong breakthrough in 2024 with models like the CS55 Plus, is now gradually stabilizing amidst intensified competition.

◎ The Belarusian locally assembled joint venture brand Belgee achieved growth against the trend with a slight increase of 0.4%, reaching a market share of 4%, a record high. Another dark horse, JETOUR, achieved a year-on-year increase of 8.3%, breaking through a 3.7% share for the first time and setting a new record for the brand in the Russian market. The rise of these two brands has effectively filled the void left by the withdrawal of European and Japanese-Korean brands.

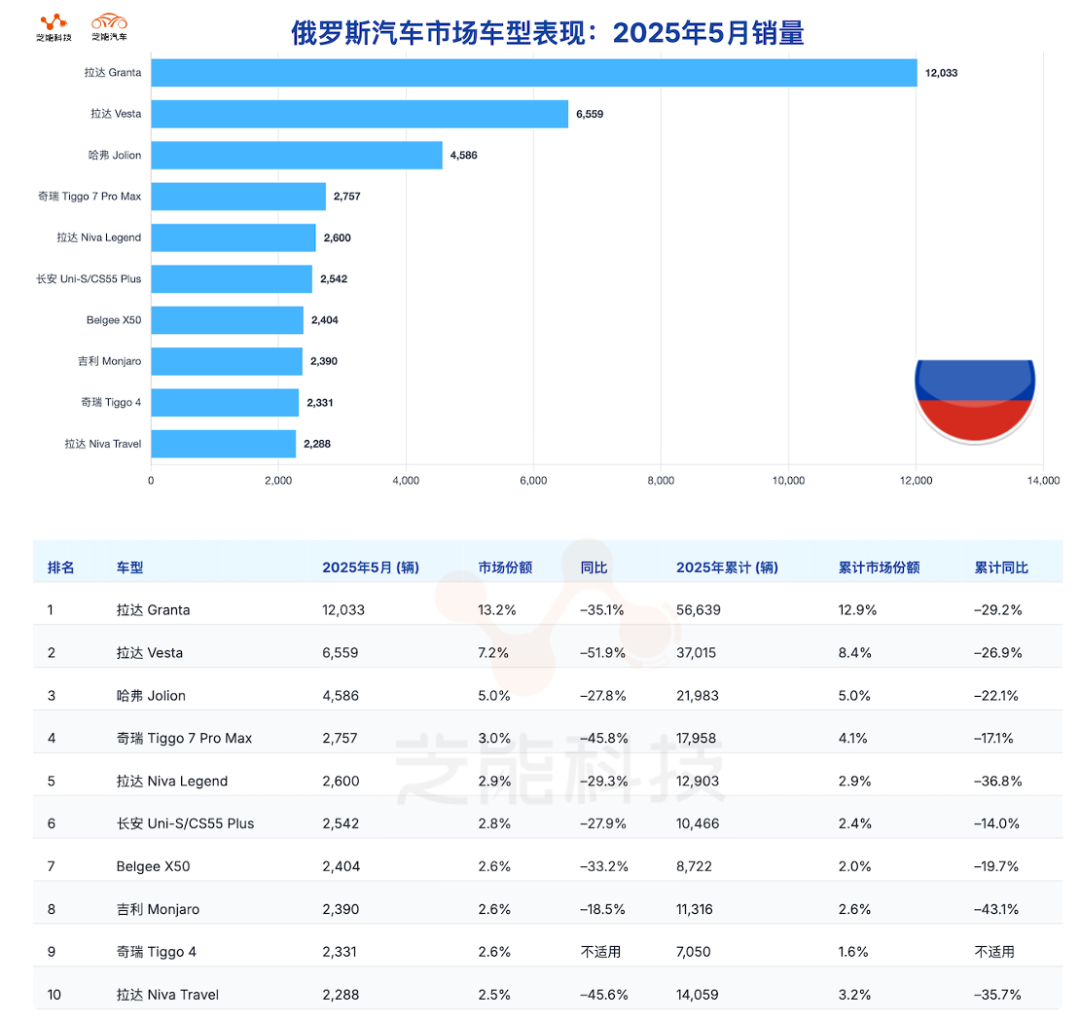

In terms of models, besides Lada products firmly occupying the top spot, Haval Jolion, Chery Tiggo 7 Pro Max, Changan UNI-S, Geely Monjaro, etc., all ranked among the top ten, showcasing the extensive coverage of Chinese automakers across multiple market segments. JETOUR and Belgee successfully broke through with the X70 series and X50, respectively, further illustrating that non-first-tier Chinese brands also possess the potential to compete in the Russian market.

02

Chinese Brands

Sustained Growth Momentum in Russia

Initial Structural Differentiation

Against the backdrop of the overall contraction of the Russian passenger car market, Chinese brands have demonstrated robust resilience as a collective.

According to May 2025 data, six of the top ten brands are Chinese, with a combined market share exceeding 40%. Among them, Haval, Chery, Geely, and Changan form the mainstay, while Belgee and JETOUR have achieved breakthrough growth due to their regional assembly advantages and differentiated positioning.

From a Sales Perspective:

◎ Haval Jolion maintained its leading position with monthly sales exceeding 4,500 units, ranking third and almost matching the average market decline.

◎ Chery Tiggo 7 Pro Max, despite a notable decline, still held onto the fourth position.

◎ The newcomer Tiggo 4 entered the top ten for the first time, indicating its growing appeal to price-sensitive consumers.

◎ Belgee, as Geely's joint venture in Belarus, benefits from localized production, which helps it avoid import restrictions and tariffs. The X50 model has been in the mainstream category for several consecutive months, with sales in May reaching 2,404 units, ranking seventh, further solidifying the brand's influence in the small and medium SUV market.

◎ The rise of JETOUR was one of the month's biggest highlights. With a market share of 3.7% and a year-on-year increase of 8.3%, it is the only Chinese independent brand to achieve year-on-year growth, indicating that its product philosophy centered on large space, robust configuration, and affordable pricing is being recognized by Russian consumers. This also validates the possibility for Chinese automakers to carve out niches in overseas markets through precise positioning.

◎ On Changan's side, despite a significant year-on-year decline, the UNI-S series re-entered the top ten, indicating that its high-appeal and high-configuration products still attract specific consumer groups.

◎ Although Geely's overall brand has declined significantly, its higher-end mid-size SUV still contributes steadily to sales.

◎ Chery employs a multi-brand parallel strategy in the Russian market. In addition to the main brand, it also deploys sub-brands such as JETOUR, Jaecoo, and Omoda, creating a complementary mix of price points and styles. As of May, the combined market share of Chery's three brands had exceeded 17%, building a comprehensive product matrix and enhancing the brand's risk resistance.

Summary

In May 2025, the overall automotive market in Russia continued to languish, but Chinese brands performed impressively.