European Auto Market | May 2025 in Israel: The "Middle Eastern" Wave Rises as Chery and JETOUR Achieve Record Sales

![]() 06/16 2025

06/16 2025

![]() 616

616

In May 2025, the Israeli auto market experienced robust growth of 16% year-on-year, reaching a monthly sales volume of 26,000 vehicles.

Amidst the market's overall recovery, Chinese automakers shone particularly brightly. Chery and JETOUR both set new sales records in the local market, rapidly ascending to the forefront. Numerous other Chinese brands also witnessed significant growth in Israel, heralding a robust rise of the "Chinese car wave."

01

Market Overview and Competitive Landscape

In May 2025, new car registrations in Israel totaled 25,983 units, a 16% increase from the previous year, marking the strongest month so far this year.

From the beginning of the year to May, cumulative sales amounted to 142,641 units, up 10.4% year-on-year, indicating a comprehensive market recovery from the pandemic and economic turmoil.

From a brand perspective:

◎ Japanese automakers continue to dominate the market. Despite a 9.5% year-on-year decline in sales, Toyota retained its position as the monthly sales leader with 3,043 units, accounting for 11.7% of the market share. However, its cumulative market share for the year has been surpassed by Hyundai, which ranked third this month with 2,585 units, a year-on-year increase of 84.9%.

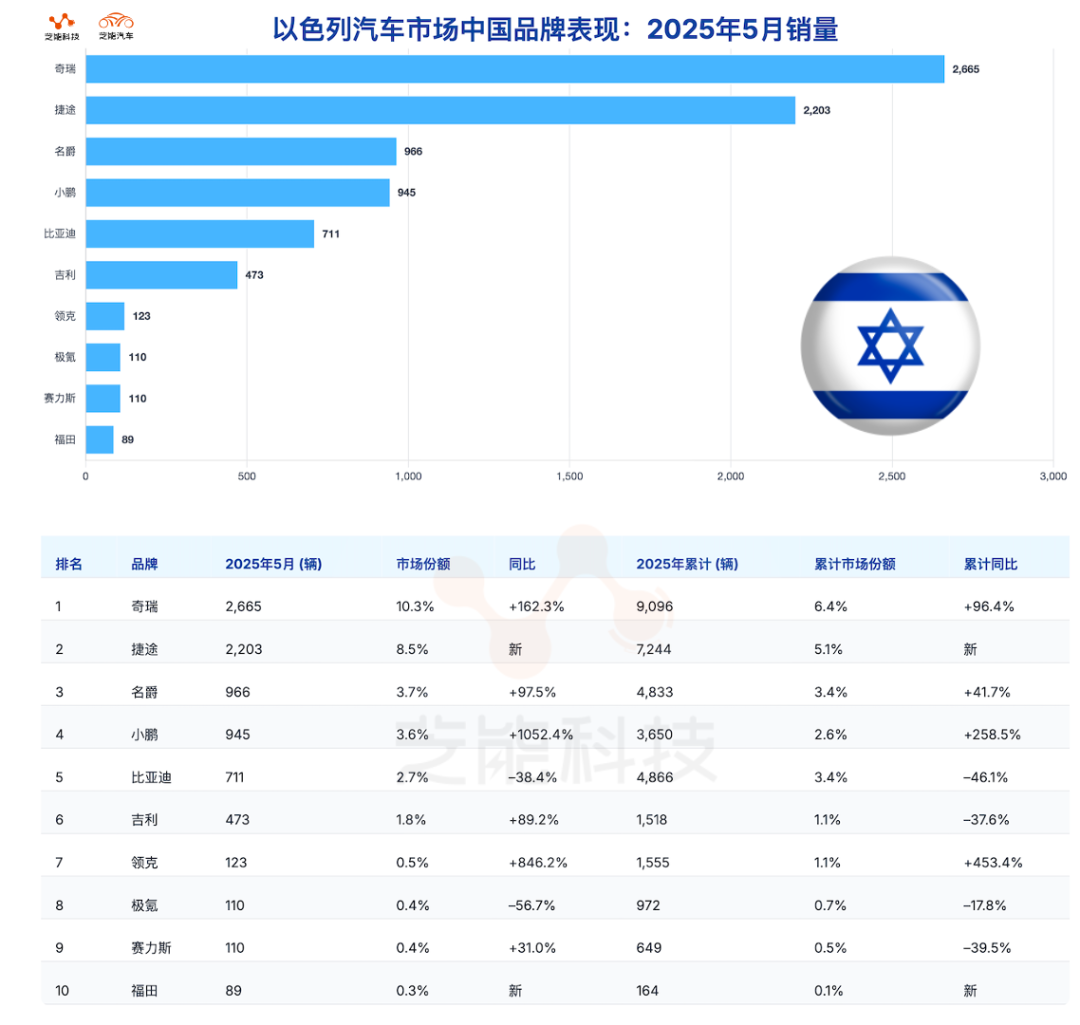

◎ The Chinese brand Chery surged to second place with sales of 2,665 units, a remarkable 162.3% year-on-year increase, setting a new record in the Israeli market. JETOUR, also part of the Chery Group, debuted in the top four with sales of 2,203 units, capturing an 8.5% market share and solidifying its position in the mainstream market within months. These "sibling brands" have posed a significant challenge to traditional Korean and Japanese brands.

◎ Other notable performers include Mazda (up 139.8%), MG (up 97.5%), and the new electric vehicle player XPeng, whose sales surged 1052.4% year-on-year, breaking into the top ten amidst fierce competition.

02

Collective Ascendancy of Chinese Brands

Chery and JETOUR Lead the Charge

May 2025 marked a "milestone" for Chinese automakers in the Israeli market. The combined performance of Chery and JETOUR was nothing short of "phenomenal":

◎ Chery: Ranked second in the overall market with monthly sales of 2,665 units, accounting for 10.3% of the share. It has consistently set new records over the past six months, underscoring the success of its product strength, channel development, and pricing strategy.

◎ JETOUR: Within its first year in the market, it sold over 2,200 units this month, breaking the 8% market share barrier for the first time. Closing in on established Korean brands Kia and Hyundai, JETOUR has become a hot topic in the market.

◎ XPeng: As an emerging brand, it soared to ninth place with 945 units, a year-on-year increase of over 10 times, highlighting the strong interest of Israeli consumers in intelligent electric vehicles.

◎ MG: Recorded nearly double growth this month with sales of 966 units, solidifying its position in the top ten.

◎ BYD: Despite a year-on-year decline, its cumulative sales remain stable at the forefront, reflecting its deep roots in the electric vehicle market.

◎ Geely: Ranked 13th with sales of 473 units, a year-on-year increase of nearly 90%. While its ranking is slightly lower, its growth momentum is robust.

◎ Brands such as Lynk & Co, Zeekr, AITO, Nezha, Yema, Dongfeng, Hongqi, JAC, and Fengxing also achieved varying degrees of sales breakthroughs. Notably, Hongqi achieved a year-on-year growth of over 15 times, symbolizing the gradual testing of Chinese premium brands in overseas markets.

Chinese automakers have not only achieved quantitative breakthroughs. Among the top-selling brands, Chinese brands occupy three seats (Chery, JETOUR, XPeng), with a combined market share exceeding 25%. When including stable performers like MG, BYD, and Geely, the share of Chinese brands in the Israeli market nears 30%.

The Israeli market is emerging as a key component in the global strategy of Chinese automakers, alongside South America, Russia, and Southeast Asia.

Compared to other markets, Israeli consumers show a higher acceptance of technological and intelligent features and are more open to trying emerging brands, providing valuable space for Chinese new energy vehicles and intelligent connected models as a "testbed" for market entry.

Summary

The performance in May 2025 underscores that the Israeli market has become a prominent example in the internationalization drive of Chinese automakers. The joint leadership of Chery and JETOUR represents not only a sales victory but also a tangible demonstration of the enhanced global recognition and influence of Chinese brands.