Chery and LG Collaborate to Introduce 46 Cylindrical Batteries to China: A Bold Move!

![]() 06/17 2025

06/17 2025

![]() 521

521

Chery Automobile has been making significant strides recently, partnering with top international suppliers across various domains.

According to South Korean media reports, LG Energy Solution has announced a landmark agreement with Chery to supply cylindrical batteries for electric vehicles (EVs). Under this agreement, the Korean battery manufacturer will furnish Chery with a total of 8GWh of next-generation 46-series cylindrical batteries over the next six years, sufficient to power approximately 120,000 electric vehicles. The supply is set to commence early next year and will be integrated into Chery's flagship electric vehicle models.

Additionally, Desay SV has inked a cooperation deal with Chery Automobile to jointly develop an integrated cockpit and driving central computing platform. Built on Desay SV's independently developed intelligent central computing platform ICPS01E, this platform employs an innovative single-chip multi-domain fusion solution, pioneering the industry's first mass-producible SOC product that seamlessly integrates the cockpit and driving system.

Chery's collaborations with these two new partners in the realms of power batteries and intelligent driving are poised to bolster its competitiveness in the mid-to-high-end market. Notably, LG Energy Solution's partnership with Chery marks the first time a Korean battery company has directly supplied cylindrical batteries to a Chinese automaker, breaking the longstanding dominance of local players like CATL and BYD, who together hold nearly 70% of the Chinese market share. Meanwhile, the "8775 Integrated Cockpit and Driving Central Computing Platform" co-developed by Desay SV and Chery leverages a single-chip multi-domain fusion solution to reduce hardware components, lower costs, and support L4-level autonomous driving requirements.

Clearly, Chery Automobile's objective is to enhance the competitiveness of its new energy products and compete with companies like NIO and Xpeng in the RMB 200,000 to 300,000 price range.

Diversified Technological Approaches

In this strategic partnership, LG Energy Solution introduces the 46-series large cylindrical power battery, featuring a revolutionary tabless design that significantly improves battery system performance by reducing internal resistance by 30% and enhancing thermal management efficiency by 20%.

In terms of key performance indicators, this new battery boasts an energy density that surpasses the industry benchmark of 300Wh/kg. It also offers rapid charging, achieving an 80% charge in just 15 minutes. Furthermore, it demonstrates a clear edge in manufacturing costs, with LG Energy Solution utilizing an innovative dry electrode process that reduces production costs by 17%-30% compared to traditional wet processes. Simultaneously, this process lowers production energy consumption by 30% and saves on equipment space and labor hours.

The 46-series cylindrical battery boasts over five times the capacity and power of existing cylindrical batteries, coupled with high production efficiency.

Desay SV and Chery, with Desay SV responsible for system integration and algorithm optimization and Chery providing vehicle verification resources, have collaborated to finalize function definitions and conduct real-vehicle testing.

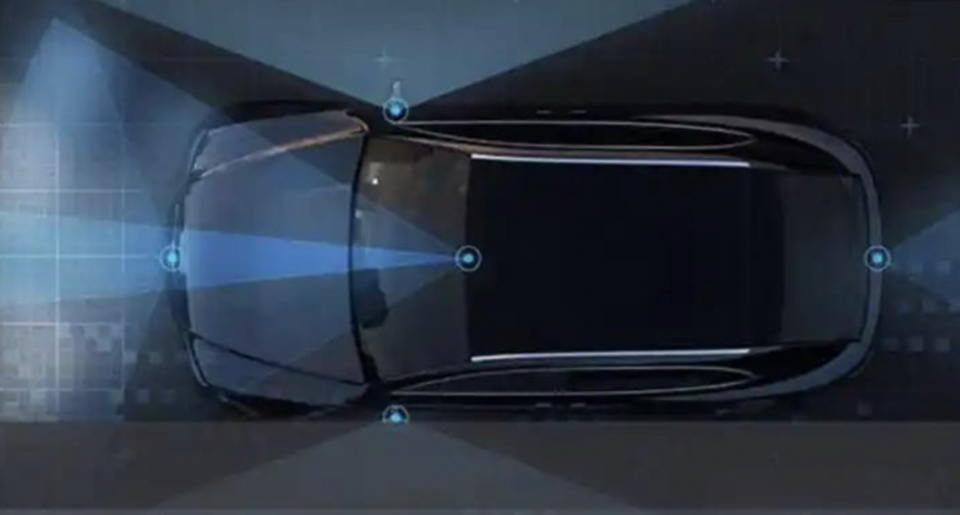

Desay SV has unveiled a new generation of integrated cockpit and driving central computing platforms. Its strength lies in a single chip that concurrently supports both digital cockpit (e.g., multi-screen interaction, AR navigation) and intelligent driving (e.g., highway NOA, memory parking) functions, striking a balance between high performance and low power consumption.

Compared to the conventional "cockpit chip + intelligent driving chip" combination (such as Qualcomm 8155+8620), the single-chip solution offers approximately 15% savings on chip costs. It also streamlines ECUs and wiring harnesses, reducing vehicle weight and installation complexity, thereby helping automakers shorten R&D cycles and lower overall system costs by 20%-30%.

Desay SV's vertical integration capabilities in hardware (including sensors and domain controllers), algorithms, and system integration, coupled with the cost reduction of the integrated cockpit and driving solution, render the entire system solution highly competitive. It enables features such as multi-screen interaction and AR navigation in the cockpit while supporting mid-level assisted driving functions like highway pilot-assisted driving, urban memory pilot-assisted driving, and cross-floor memory parking.

Beyond meeting the demands of L4-level autonomous driving hardware and software systems, this technological solution is well-suited for the mainstream consumer market at the RMB 100,000-150,000 level, aligning with the current industry's push for equal access to intelligent assisted driving.

Strategies Amidst Intense Competition

China's new energy vehicle market is transitioning from a price war to a value war, with market competition shifting from "cost-oriented" to "technology-driven".

In 2025, industry leaders like BYD and Geely spearheaded price reductions, prompting widespread follow-up actions across the sector. Leading automakers expanded their market share through price wars, plunging the entire industry into a painful cycle of rising revenues but stagnant profits. In 2024, China's automotive industry profit rate stood at merely 4.3%, lower than the 6% average for downstream industrial enterprises. From January to March 2025, the automotive industry profit rate further dipped to 3.9%, below the 5.6% average for downstream industrial enterprises during the same period. Meanwhile, total revenue for the same period amounted to RMB 10.65 trillion and RMB 3.26 trillion, with year-on-year growth rates of 4% and 7%, respectively. Notably, the combined profits of China's top seven automakers in 2024 amounted to only 30% of Toyota's profits during the same period (RMB 80.3 billion vs. RMB 237.7 billion).

As the penetration rate of new energy vehicle models reaches the critical 50% mark, China's auto market growth slows, prompting automakers to adopt a "volume over price" strategy to compete for market share. According to incomplete statistics, over 200 models experienced price reductions in the domestic auto market in 2024, with over 60 models witnessing price cuts in the first four months of 2025. In May alone, over 100 models reduced prices, with some hitting as low as RMB 30,000.

This has prompted regulatory authorities to introduce measures to rectify the situation, while automakers reflect on the consequences of vicious competition and explore solutions for future development.

Chery Automobile's case is emblematic. Its collaborations with LG and Desay SV address battery endurance and intelligent driving, elevating consumer expectations for EV endurance, fast charging, and intelligence while controlling costs and accelerating the transition from "electrification" to "intelligence" demand. Importantly, Chery possesses full-stack independent R&D capabilities, avoiding "choking points," and leverages global top-tier supply chain resources and experience to foster technological collaboration and innovation, thereby cultivating its own competitive edge.

On a broader note, LG Energy Solution's Nanjing factory currently boasts a localization procurement ratio of 75%, presenting development opportunities for local suppliers and enhancing domestic supporting capabilities in high-end battery materials. This not only attracts more capital investment but also accelerates industry-wide upgrading.

People's Car Reviews

While collaborations hold promise, they are not without challenges. New products and technologies require extensive reliability verification. For instance, LG's 46-series batteries must overcome issues related to thermal management (like serpentine cooling tube design) and yield rates. Similarly, Desay SV's integrated cockpit and driving platform necessitates market testing, and initial costs may be relatively high, posing significant challenges.

In the future, Chery Automobile, LG Energy Solution, and Desay SV will need to substantiate their efforts with tangible results.