Car Subsidies Suspended in Multiple Regions: Will the Off-Season Market Feel the Pinch?

![]() 06/17 2025

06/17 2025

![]() 480

480

Introduction

Every reduction in subsidies marks a significant blow to the accounting data for car consumption.

Despite the uncertain economic environment of the past two years, car consumption has notably grown. Undoubtedly, the primary driver behind this growth has been the substantial government subsidies for trade-ins and scrapping and replacement programs, which directly fueled the prosperity of the car market.

However, recently, the momentum behind this growth may be waning as several regions have sounded the alarm on national car subsidies, casting uncertainty over the market's future.

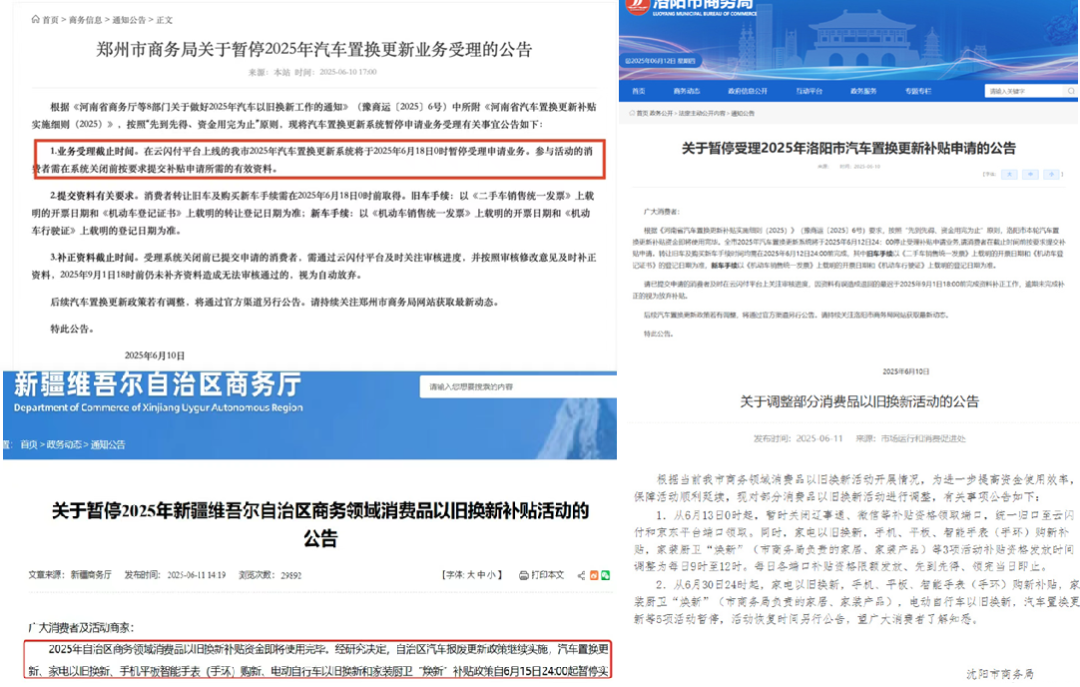

First, regions such as Zhengzhou, Luoyang, and Xuchang in Henan Province have successively announced the suspension of their car trade-in subsidy application businesses. Zhengzhou's suspension took effect at 00:00 on June 18, Luoyang's on June 12 at 24:00, and Xuchang's at noon on June 13.

Subsequently, Xinjiang also issued a notice of national subsidy suspension due to the imminent depletion of trade-in subsidy funds, effective at 24:00 on June 15. However, users who purchased new cars before the 15th have until July 15 to submit their application materials. Reports from Shenyang also indicate plans to suspend car trade-in and update subsidies from the end of June.

Earlier, some cities in Gansu Province had already suspended their trade-in subsidy activities in early May, citing the exhaustion of the first batch of subsidy funds. Officials stated that further notice would be given if subsequent funds became available. Chongqing has also ended its car trade-in subsidies, with officials noting that the current round of funds has been exhausted. However, the second phase of trade-ins is awaiting funding, with potential policies to be introduced in June.

In essence, subsidies are real money, and some places are genuinely out of funds, necessitating their suspension.

To promote car consumption upgrades, the central government allocated 300 billion yuan in ultra-long-term special treasury bonds for consumption subsidies across regions. However, these funds were disbursed in phases: 81 billion yuan for the first batch, another 81 billion yuan for the second batch, with the remainder to follow. This phased disbursement has led to difficulties in sustaining subsidies in some regions after initial funds were exhausted.

Taking Chongqing as an example, its car trade-in and update subsidy for 2025 can reach up to 15,000 yuan, and the currently declared amount has reached 2.15 billion yuan. Such a significant expenditure quickly depleted the initial batch of subsidy funds, necessitating the suspension of subsidy acceptance.

Additionally, varying car ownership levels, consumption capacities, and promotional efforts across regions have led to different consumption rates of subsidy funds. Henan, with its large population and robust car consumption market, may have seen a surge in subsidy applications in a short period, nearing or reaching the budget limit.

Why are subsidies being suspended? On one hand, the state announced that the deadline for car consumption subsidies is December 31, 2025, and only half of the time has passed. On the other hand, from the regions' responses, it appears that the 'national subsidy' is only being suspended to control quantities, not terminated altogether. Therefore, even if local car subsidies are suspended, there is a high likelihood of their resumption in the second half of the year.

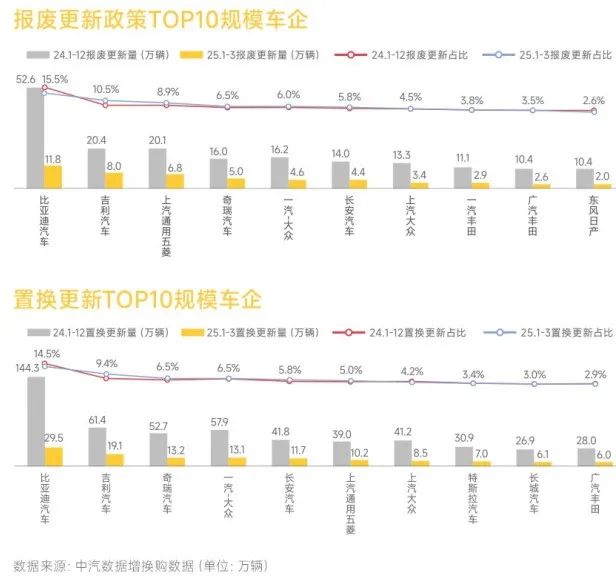

After all, trade-ins have become the biggest stimulus for current car consumption. Statistics show that in the first quarter of this year, nationwide passenger car sales through trade-ins reached 2.793 million units, an increase of 1.002 million units or 56% year-on-year. Notably, trade-ins of old cars for new ones accounted for the majority, with 2.031 million units, an increase of 539,000 units; direct scrapping of old cars for new ones accounted for 463,000 units, an increase of 463,000 units.

According to data from the China Passenger Car Association, driven by the trade-in policy, as of April 24, 2025, nationwide car trade-ins reached 2.705 million units, with an increase of 1.2 million trade-in applications from March 24 to April 24. Among private car buyers in April, upgrade and replacement buyers accounted for nearly 70%, while first-time private car buyers dropped to around 31%.

Data from the China Association of Automobile Manufacturers indicates that the proportion of car upgrades and replacements is expected to rise to over 65% in 2025, signaling a transformative shift in China's car consumption market structure.

Clearly, even if consumers are hesitant to replace their cars, the allure of a 15,000 yuan subsidy, equivalent to several months' income for an ordinary family, is hard to resist.

Besides the shortage of funds in some regions, another critical factor is the exploitation of subsidies by 'ill-intentioned' individuals, leading to irregular operations. These include price hikes before subsidizing, the contentious issue of 'zero-kilometer used cars,' and fraudulent subsidy claims.

Regarding price hikes before subsidizing, while relatively rare due to intense competition in the car industry, many car companies use trade-ins, subsidies, and other means in their promotions to offer minimum one-price deals, a widespread phenomenon.

For instance, many 4S dealerships or manufacturers advertise one-price deals of 30,000 to 40,000 yuan for new cars. However, when consumers visit the store, they find they are ineligible for the deal without an old car to trade in or scrap, effectively dissuading them from purchasing.

Another example is the previously debated issue of 'zero-kilometer used cars.' Car companies or 4S dealerships collude with used car dealers to find scrap or very cheap used cars for trade-ins to obtain government subsidies. In reality, these new cars are 'falsely' sold as 'zero-kilometer used cars' in the used car market, using government subsidy money to lower prices, significantly disrupting new car market prices.

Furthermore, many industry practitioners exploit policy loopholes to fraudulently claim subsidies, such as purchasing scrap vehicles at very low prices in villages to claim subsidies from the government and car manufacturers and replace them with new cars. Sources indicate that some individuals have earned hundreds of thousands or even millions of profits through such methods in just a few months.

These behaviors severely disrupt market order, causing subsidy policies to deviate from their original intent to benefit the people, prompting relevant departments to adjust subsidy policies. Therefore, during the mid-year car consumption off-season, many regions have optimized subsidy policies through system upgrades to buy time for rectifying market chaos.

Moreover, June to August is traditionally a slow sales season for cars, and the suspension of subsidies is a natural outcome of market forces. During the off-season, even increased subsidies may fail to achieve the expected promotional effect. It is better to use this opportunity to optimize and adjust subsidy policies. Additionally, recent promotional activities by car companies have reduced consumers' reliance on subsidies to a certain extent, providing conditions for the suspension of subsidy policies.

Undoubtedly, the suspension of subsidies coupled with the car consumption off-season will lead to a short-term decline in car sales, as it directly increases consumers' car purchase costs. Some budget-conscious consumers may postpone their car purchase plans, exacerbating a wait-and-see attitude. After all, every reduction in subsidies means a significant blow to car consumption accounting data.

Coupled with the recent suspension of high-interest and high-return car loan businesses by major banks, 4S dealerships not only have fewer profit points but also lack a powerful tool for price negotiations with customers. Recently, national ministries and regulatory authorities have interviewed the heads of various car companies, urging them to avoid price wars, not promote the 'one-price' model, and comprehensively address account period issues, allowing each system to return to normal operation.

Therefore, the car market situation during this year's mid-year off-season will undoubtedly be challenging, with a considerable portion of sales likely to shift to the third and fourth quarters. This explains why many car companies or 4S dealerships are already promoting trade-ins of two-wheeled vehicles for four-wheeled ones, such as trading in Yadea for BYD Seagull. Car manufacturers and dealerships are exploring more ways to promote and stimulate growth.

Of course, for the industry and car companies, the impact of suspended subsidies may not be the greatest concern. The core issue lies in finding new growth points for the overdrawn car consumption market as subsidies begin to decline next year. Thinking and foresight in this regard are perhaps more urgent than the current impact of subsidy suspensions.

Editor-in-Charge: Du Yuxin, Editor: Chen Xinnan