Industry Unanimously Calls for an End to 'Involution'!

![]() 06/17 2025

06/17 2025

![]() 659

659

A relentless 'price war' without boundaries ultimately harms both enterprises and consumers in the long term.

The automotive 'price war' that commenced in 2023 intensified significantly by 2025.

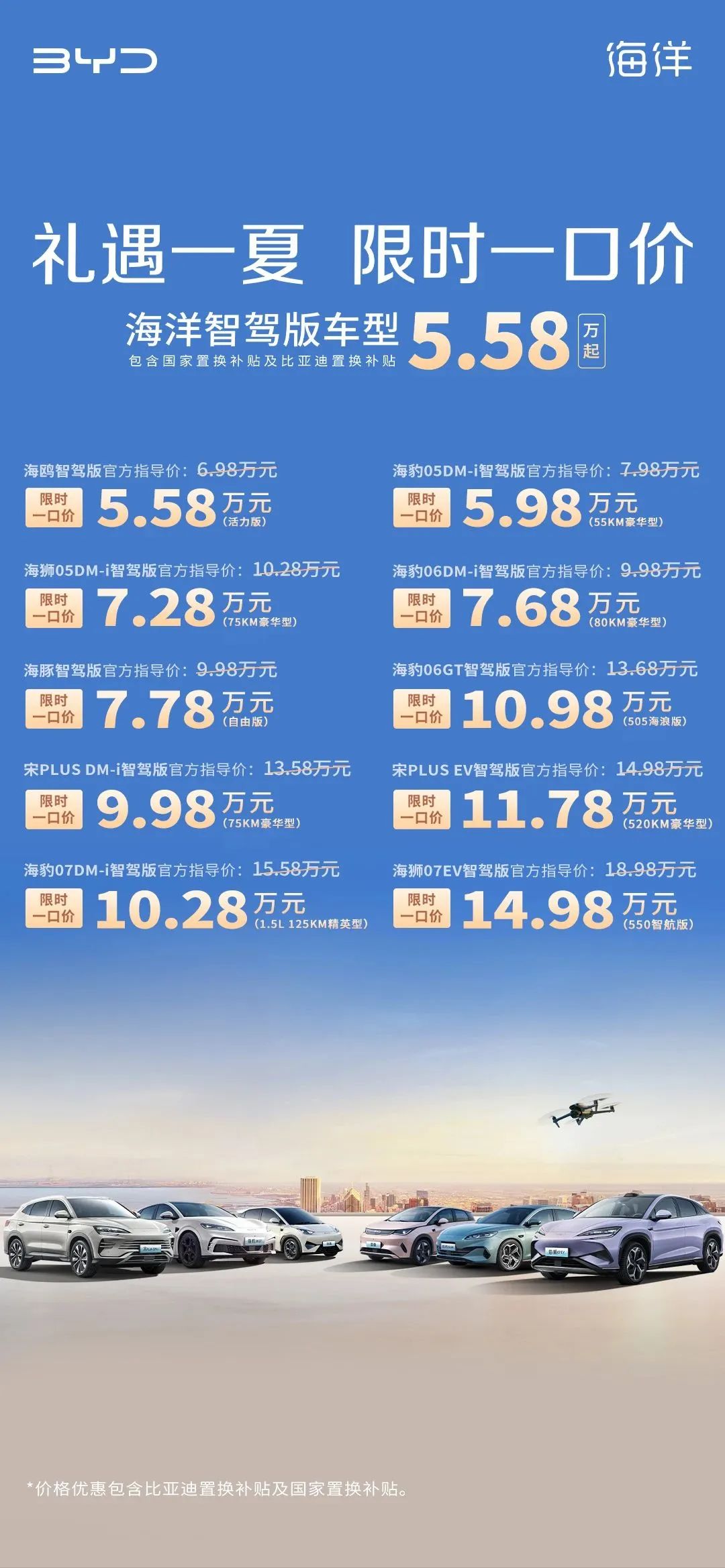

In May of this year, BYD announced that 22 intelligent driving models from its Dynasty and Ocean series would participate in a limited-time promotional event, offering discounts of up to 53,000 yuan. This move sparked a chain reaction within the automotive industry, with Geely, Leap Motor, GAC Aion, and other auto companies swiftly following suit to slash prices in an attempt to seize market share.

Indeed, since 2025, the automotive industry has witnessed multiple rounds of model price reductions. According to incomplete statistics, in the first four months of 2025 alone, over 60 models reduced their prices, and in May, this number surged to over 100 models. Some models experienced price drops exceeding 50,000 yuan, and even low-priced cars priced at around 30,000 yuan reemerged, roughly equivalent to the cost of two high-end smartphones.

At the 2025 China Automotive Chongqing Forum, which opened on June 6, Wang Xia, president of the China Council for the Promotion of International Trade's Automobile Branch, stated in his speech, 'Moderate price reductions and orderly competition are typical phenomena in a market economy and a necessary phase for an industry to mature. However, unbridled price wars and blind technological frenzy inevitably squeeze enterprises' reasonable profit margins, thereby impacting product and service quality. In the long run, this is detrimental to both enterprises and consumers.'

Frenzied price wars and increasingly prolonged payment terms are exerting pressure on upstream and downstream industries. On June 10, four OEMs—FAW, Dongfeng, GAC, and Thalys—unusually made simultaneous announcements, declaring they would shorten supplier payment terms to within 60 days. The following day, BYD, Chery Group, XPeng Motors, and other auto companies successively announced they would unify supplier payment terms to within 60 days. Following the price war and technology war, the automotive industry has embarked on 'positive involution,' steering the industrial chain towards a virtuous cycle.

The smoke of the 'price war' rises once again.

Image source: BYD

On May 23, BYD announced that 22 intelligent driving models from its Dynasty and Ocean series would participate in a limited-time promotional event. Among them, the starting price of the Qin PLUS DM-i was reduced to 63,800 yuan, while the prices of the Seal 06 and Seagull intelligent driving versions were lowered to 76,800 yuan and 55,800 yuan, respectively.

Shortly thereafter, Geely Galaxy launched a limited-time subsidy for its entire product line, with the Xingyuan pure electric car starting at 59,800 yuan, a direct reduction of 9,000 yuan from the original price. Leap Motor set the starting price of its 2026 C10 model at 122,800 yuan, but through a combination of an '800V high-voltage platform + LiDAR,' it brought configurations originally reserved for the high-end market down to the 140,000 yuan level. Chery announced short-term price promotions, encompassing over 30 models from brands such as Chery, Chery Fengyun, EXEED, and Star Era. Additionally, the price of the Cadillac XT4 dropped to 159,900 yuan. The entire industry once again descended into a frenzy of 'trading volume for price.'

'The Chinese auto industry is becoming stronger and better through involution.' Li Yunfei, general manager of BYD Group's Brand and Public Relations Department, said in a speech at the 2024 China Automotive Forum that in the past four years, the R&D investment of mainstream Chinese auto brands has been 2.5 times that of four years ago. Compared to past independent and joint venture models, recent Chinese cars are not merely products; their services and quality are also improving through involution.

However, regarding whether the automotive industry can 'become stronger through involution,' other auto company leaders hold differing views. At the 2025 China Automotive Chongqing Forum, Yang Xueliang, senior vice president of Geely Holding Group, bluntly stated, 'Some companies hold high the banner of 'involution,' and some companies strive to be 'kings of involution,' taking pride in 'involution.' If this persists, the healthy ecosystem of the automotive industry, nurtured by the country's vast fiscal expenditure, may be led astray by these so-called 'kings of involution.' Yang Xueliang emphasized that 'involution' is the lowest level of competitive behavior, a suicidal and vicious competition widely recognized by economic and academic circles, and today, the Chinese automotive industry is witnessing increasingly fierce 'involution.'

Regarding questions about initiating a 'price war,' BYD believes this is 'technology for the people' rather than vicious competition. 'BYD can afford to engage in any price war initiated by anyone. Similarly, we do not engage in price wars but instead use technological innovation, efficiency improvements, and scale expansions to pass the value generated on to our users,' Li Qian, BYD's secretary to the board, said in an interview after the conclusion of BYD's 2024 fiscal year annual shareholders' meeting. From BYD's perspective, its price reductions are not engaging in a 'price war' but rather reflecting the cost reductions brought about by technological scale expansions in vehicle prices, thereby benefiting users.

For a while, the discourse between auto companies was fraught with tension.

Collective voices opposing 'involutionary' competition

In fact, the automotive industry possesses a long industrial chain centered around vehicle manufacturing, extending upstream to raw material supply, parts production, technological research and development, and other links, and downstream to sales, maintenance, and other areas. The entire industry is interconnected, and disorderly 'price wars' squeeze the profit margins of all chain links, causing shocks throughout the entire industrial chain, with the vast majority of practitioners facing the risk of declining income.

At the 2025 China Automotive Chongqing Forum, representatives from OEMs, suppliers, and dealers unanimously voiced their opposition to vicious competition that 'sacrifices quality for price,' pointing out its erosion of the industry's foundation.

'Changan Automobile firmly opposes vicious competition without moral or legal boundaries.' Zhu Huarong, chairman of Changan Automobile, admitted that the current fierce competition has put tremendous pressure on Changan Automobile and the over 1 million employees within its dealer and supplier chains, and that sustainable and healthy development also faces enormous challenges.

Zhang Xinghai, chairman of Thalys Group, believes that the industry's 'involutionary' competition adversely affects the supply chain, parts quality, and safety standards. 'Involutionary competition also disrupts the coordination of the industrial chain, weakening industrial resilience and endogenous momentum, which is not conducive to the industry's sustainable development,' Zhang Xinghai said.

'The price war is damaging the entire automotive ecosystem.' Dr. Murongte, Chief Technology Officer of Continental's Automotive Subgroup in China, proposed, 'I hope the automotive industry can return to its original order and a healthy competitive environment. Healthy competition involves providing the best products at the best prices, not unsafe products at the lowest prices.'

The warning from data is more intuitive: statistics released by the National Bureau of Statistics reveal that the profit rate of the automotive industry in 2024 was only 4.3%, lower than the average level of 6% for downstream industrial enterprises. In the first quarter of 2025, the profit rate of the automotive industry continued to decline, reaching only 3.9%, far below the average level of 5.6% for downstream industrial enterprises.

'For some time, the industry's profitability has declined. Involutionary competition, primarily manifested as disorderly 'price wars,' is a crucial factor in the decline of industry profits.' The China Association of Automobile Manufacturers stated in the 'Initiative on Maintaining Fair Competition Order and Promoting the Healthy Development of the Industry' that after-sales service guarantees for products and corporate innovation and development require continuous investment, and disorderly 'price wars' will further squeeze corporate profit margins, seriously affect the normal operation of enterprises, and impact the safety of the industrial chain and supply chain, leading the industry into a vicious cycle.

Wang Xia also emphasized, 'Auto companies must not export the atmosphere of 'involution' overseas. The international market environment has a low tolerance for price wars and short-term behavior. If 'involution' evolves into 'external involution,' it will muddy the valuable incremental market into a red ocean market, bringing only harm and no benefit.'

How to return to a normal market environment?

'There are no winners in 'price wars' and 'involutionary' competition.' Duan Jianjun, president and CEO of Beijing Mercedes-Benz Sales Service Co., Ltd., bluntly stated that competition in the automotive industry has never been a 100-meter sprint but a marathon. If enterprises aim to go far and steady, they must adhere to the value bottom line, must commit to long-term investment, and should continuously enhance technology, experience, and value.

'It is crucial for enterprises to remain calm and prudent and to rationally recognize future market development trends. Only in this way can they make objective judgments,' Li Xueyong, executive vice president of Chery Automobile Co., Ltd., said. 'We must adhere to what we believe in. Chery insists on technology as the foundation and achieves continuous technological leadership in the transformation towards intelligence and electrification. Additionally, we must adhere to the globalization strategy. Only by becoming a world-class enterprise can we achieve more stable development amidst competition.'

Zhu Huarong believes that in the next one to two years, the Chinese automotive industry may revert to rational competition and a healthy and sustainable value line.

'Involutionary' competition has garnered the attention of relevant departments. On May 31, the China Association of Automobile Manufacturers issued an urgent initiative, emphasizing that auto companies should operate in compliance with laws and regulations, prohibit dumping below cost price and false advertising, and prevent disrupting market order and damaging the long-term interests of the industry.

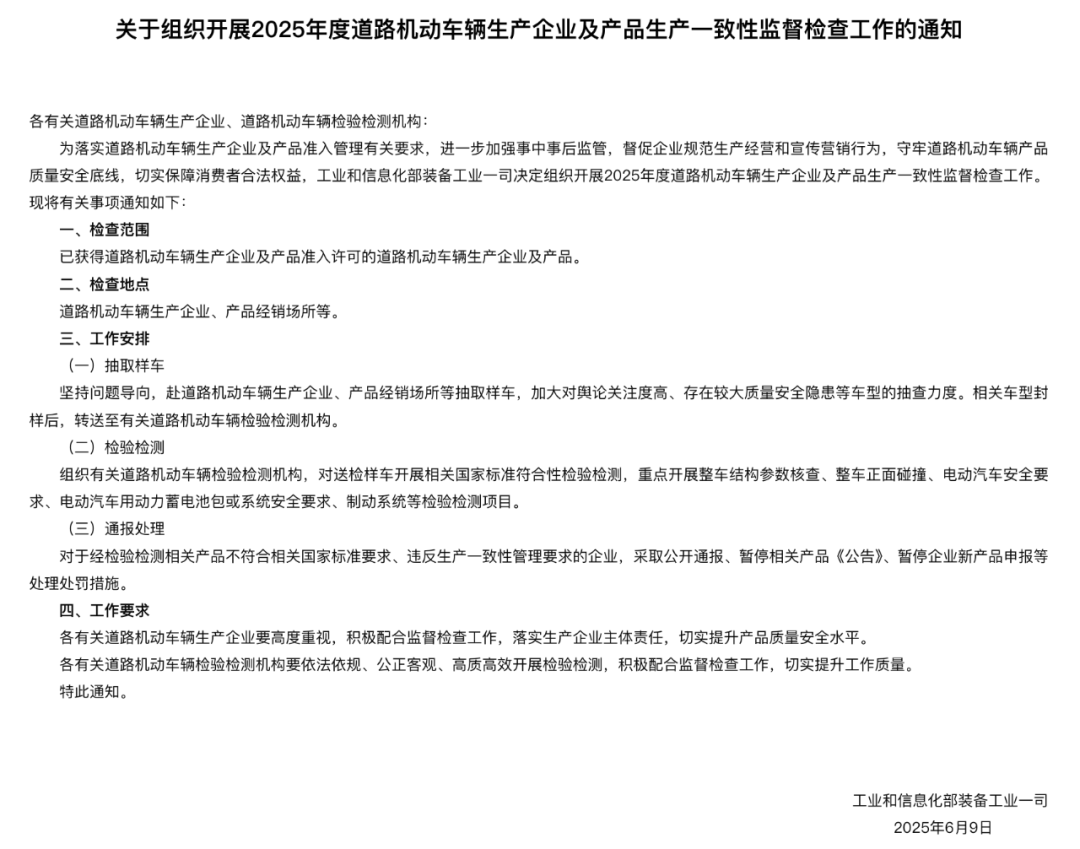

The relevant person in charge of the Ministry of Industry and Information Technology expressed support for the initiative proposed by the China Association of Automobile Manufacturers, stating that they would intensify efforts to rectify 'involutionary' competition in the automotive industry, strengthen spot checks on product consistency, cooperate with relevant departments in conducting anti-unfair competition law enforcement, and take necessary regulatory measures to resolutely uphold a fair and orderly market environment.

Immediately thereafter, on June 3, the All-China Federation of Industry and Commerce Automobile Dealers Chamber of Commerce also voiced its concern, pointing out that the price war has had a severe impact on dealer operations, calling on the entire industry to resist 'involutionary' competition, maintain a fair and healthy market environment, and promote high-quality development of the automotive industry.

Image source: Screenshot from the Ministry of Industry and Information Technology website

While the benefits of the 'price war' are alluring to consumers, concerns about whether product quality will be compromised have also arisen. On June 9, the Ministry of Industry and Information Technology issued the 'Notice on Organizing and Carrying Out the 2025 Annual Road Motor Vehicle Manufacturers and Product Production Consistency Supervision and Inspection Work,' clarifying that it will increase spot checks on models with high public attention and significant potential quality and safety hazards, building a robust quality defense line for consumers.

Currently, China is transitioning from being a large automotive country to a powerful automotive country, with new energy and intelligence driving China's automotive industry to achieve overtaking in a different lane, and its international status and influence are increasing daily. Against this backdrop, Chinese auto companies should pursue common progress while maintaining a competitive mindset, promoting the transformation of the industry from 'scale expansion' to 'ecological maturity.'