Japanese Electric Vehicle Sales Surge, Prompting Anxiety Among Domestic Brands

![]() 06/17 2025

06/17 2025

![]() 629

629

Introduction

Domestic and joint venture brands are poised for another round of intense competition.

Last month, Auto Commune published an article titled "The 100,000-150,000 Yuan Market: The Toughest Nut to Crack for New Energy Vehicles," highlighting that joint venture brands' gasoline vehicles still hold a significant share, with domestic brands' plug-in hybrids likely to be the next game-changer. However, some brands have bypassed the plug-in hybrid transitional phase and directly launched pure electric models.

But succeeding in this lucrative segment isn't straightforward. Many netizens comment that budget-conscious consumers prioritize practicality, reliability, and cost-effectiveness when purchasing their first car, fearing the wrong decision. Vehicles in this price range must offer versatility, with consumers seeking the best value for money, balancing quality and affordability.

Even today, only a handful of brands, such as BYD and GAC AION, have made a significant impact in this segment, being pioneers or leaders in the new energy automotive industry.

As latecomers, Geely and Changan have gained ground with their extensive networks and quality products. Meanwhile, brands like NIO and XPeng, willing to compete in the low-price market, have also secured a foothold.

The question arises: Among the numerous domestic brands, at least 70 have sales. This includes well-known traditional automakers like Chery, Great Wall, Wuling, Roewe, and MG. Despite their gasoline vehicles being active in this segment, they haven't showcased any pure electric models yet.

01 An Unformed Market

The 100,000-150,000 yuan price range is the golden track in China's passenger vehicle market, accounting for over 30% of total sales and serving as the primary battleground for joint ventures and independent brands. This high proportion signifies enormous market potential, attracting various brands to establish their presence.

From a profit and market layout perspective, this segment is crucial for brands to achieve profitability and expand their market. Stable sales help share R&D, production, and other costs, enhancing profitability. Successfully occupying this market also lays a solid foundation for brands to expand their product lines upwards or downwards, improving market adaptability and competitiveness.

From a consumer perspective, this price range caters to a large number of first-time and family car buyers. First-time buyers often have limited budgets, with 100,000-150,000 yuan being affordable. They have high expectations for a car's practicality, configuration, and later usage costs. Family car buyers additionally consider space and safety.

Traditional joint venture automakers once dominated this market with brand premium but have seen their market share shrink in recent years. Classic models like Volkswagen Lavida and Nissan Sylphy now face competition from independent brands offering L2-level assisted driving, 8155 chip infotainment systems, or hybrid systems, while joint venture products still rely on "three major components" as selling points, with intelligent configurations limited to high-end models.

However, they haven't easily relinquished this important market. Despite the impact of new energy vehicles, joint venture gasoline vehicles still occupy a considerable market share, leveraging years of brand influence, vast sales and service networks, and resisting new energy vehicles' offensive through price reductions, configuration upgrades, and improved fuel economy.

For new energy vehicle brands, this segment is key to expanding market share and promoting new energy adoption. From 2019 to 2024, retail sales in this segment soared from 1.206 million to 11 million, an almost nine-fold increase. However, the segment's new energy vehicle penetration rate is still below the market average, indicating vast untapped potential.

Launching high-cost-performance, long-range, highly intelligent, and safe models in this segment will give brands an edge in the new energy competition. With many new cars entering the market, competition in this segment will intensify in 2025.

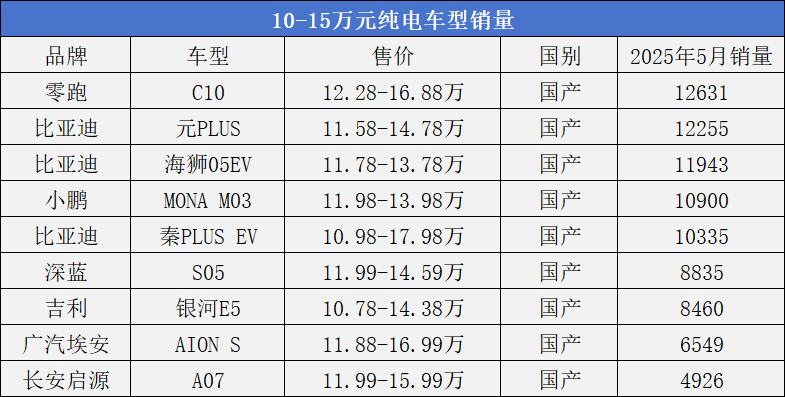

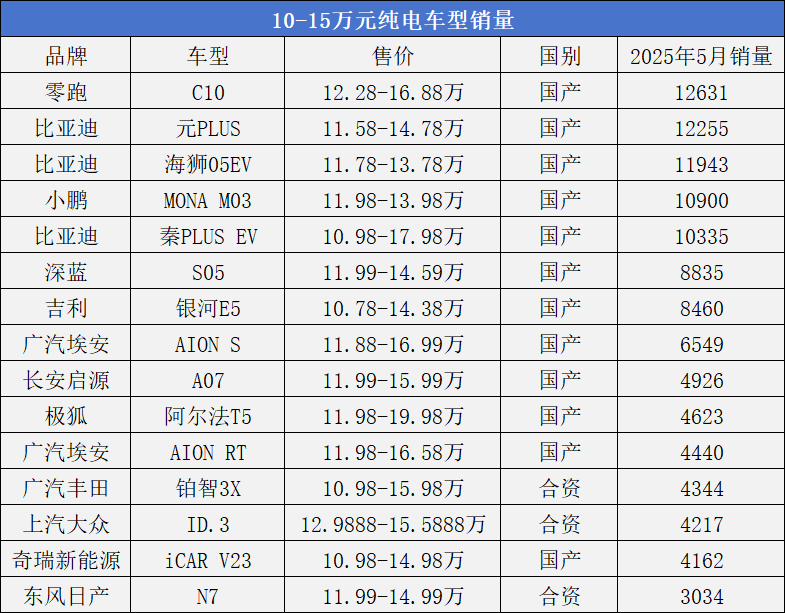

The May 2025 sales ranking of pure electric vehicles in the 100,000-150,000 yuan segment shows little change from previous months. Familiar brands and models dominate, with others still struggling to make inroads.

This underscores the challenge for pure electric vehicles in this segment. The stable situation reflects the fierce and entrenched competition. Leading brands and models have established unassailable market barriers through long-accumulated brand influence, mature sales channels, and user reputation.

Consumers tend to choose familiar and trusted brands. New entrants struggle to gain recognition due to lack of market awareness. Hence, amid consumption upgrades and intensified competition, the competition logic has evolved from a price war to a comprehensive contest encompassing technological reserves, user insights, and system efficiency.

02 Joint Venture Brands Begin to Challenge

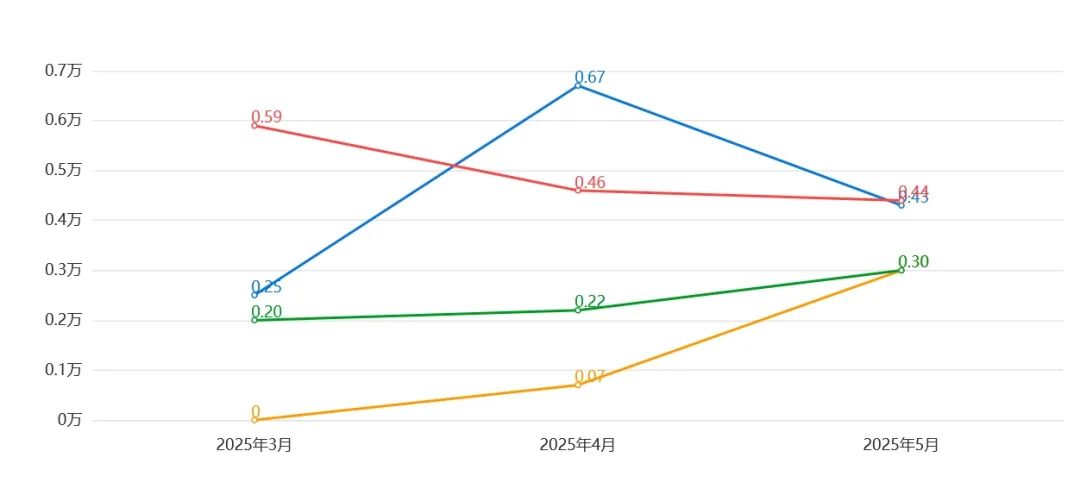

Surprisingly, joint venture brands struck first in this round, with models like GAC Toyota BZ3X and Dongfeng Nissan Ariya leading the charge. BZ3X sold 6,727 units in April and 4,344 in May, while Ariya, launched on April 27, sold 3,034 units in May with 20,000 confirmed orders.

This isn't an accident. Joint venture brands have deep technical expertise and unique advantages in core technologies like battery management and chassis tuning. Their mature supply chain and strong manufacturing capabilities allow better cost control, ensuring product quality and delivery speed.

Crucially, GAC Toyota and Dongfeng Nissan listened to Chinese users, designing vehicles with Chinese standards, utilizing local supply chains, and fully authorizing the Chinese team. This has made BZ3X and Ariya the most successful transformations by joint venture brands.

These models' advantages are evident, accurately meeting consumer demands for range, intelligent technology, design, comfort, and pricing. With joint venture brands' reliable quality reputation, consumers are willing to pay for these models amidst numerous choices.

Although these models' sales are nascent, they show potential. In contrast, May's list veterans, being in the market for over a year, risk being overtaken by newcomers if they don't continuously invest in technological innovation, configuration upgrades, and user experience optimization.

Behind BZ3X and Ariya, GAC Toyota and Dongfeng Nissan have mature supply chains and deep manufacturing expertise, enabling rapid product distribution through vast offline channels. Once pure electric models' adaptation issues are resolved, and production capacity and market penetration increase, their sales growth will be significant.

For domestic brands, joint venture brands' strong entry into the new energy market is a wake-up call. Domestic brands have overtaken in new energy by accurately capturing local market demands, flexible product strategies, and rapid iteration capabilities.

However, as joint venture brands focus resources and technologies on new energy, competition will enter a new stage. If domestic brands don't promptly strengthen core technology barriers, such as continuous breakthroughs in battery range, intelligent driving, and infotainment systems, relying solely on cost-effectiveness and first-mover advantages will be insufficient to withstand joint venture brands' counterattack.

When joint venture and domestic brands stand on equal footing in terms of product strength, market competition will evolve into an all-out "close-quarters combat." This will drive the entire 100,000-150,000 yuan pure electric vehicle market's continuous upgrading but will also prompt brands to accelerate reshuffling. Only brands with genuine strength will survive this fierce market competition.

Editor-in-Chief: Du Yuxin Editor: He Zengrong