NIOA Auto Finally Concludes Its Turbulent Journey After Prolonged Struggles

![]() 06/17 2025

06/17 2025

![]() 631

631

Author | Gao Linglang Editor | Wang Gefa Images sourced from the company's website

On June 14, Zhejiang Zicheng Law Firm, acting as the administrator, officially entered HOZON Auto, the parent company of NIOA Auto, marking the official commencement of bankruptcy reorganization proceedings for the former sales champion of the new energy vehicle sector.

Just three days prior, dozens of former employees were still confronting CEO Fang Yunzhou, demanding unpaid salaries and compensation. The company's new headquarters in Shanghai, which had been operational for less than half a month, was abruptly shut down, with all employees transitioning to remote work.

According to Jiu Pai News, NIOA Auto currently holds total assets of 21.366 billion yuan but is burdened with liabilities amounting to 18.435 billion yuan, leaving a mere 2.931 billion yuan in net assets. Most alarmingly, in January this year, NIOA Auto sold only 110 vehicles domestically, effectively grinding to a halt.

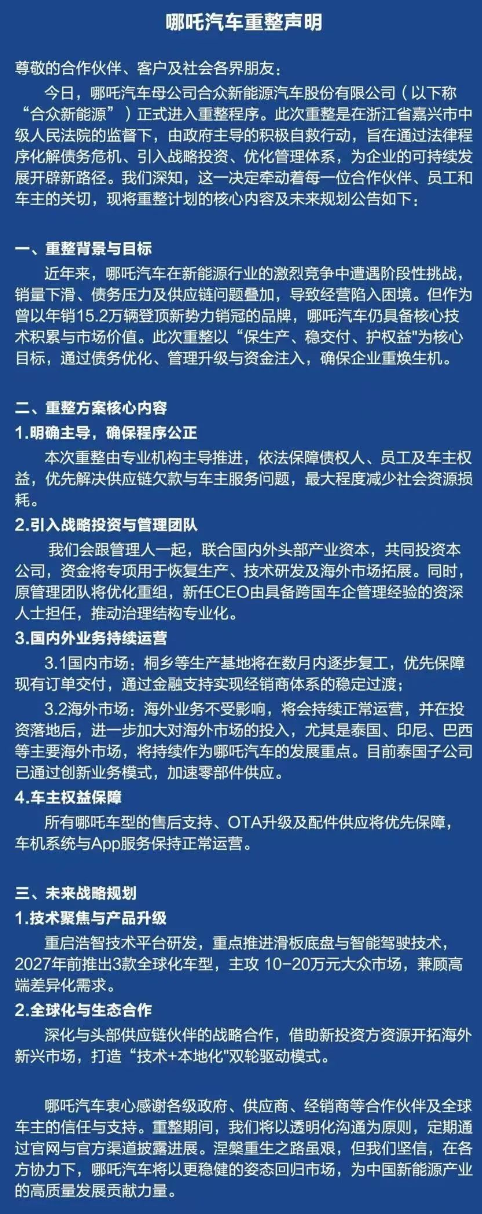

Moreover, on June 12, NIOA Auto issued a statement on its Thai subsidiary's Thai social media platform in Chinese, English, and Thai, announcing the reorganization of the company.

(From the Chinese version of NIOA Auto's subsidiary's statement)

(From the Chinese version of NIOA Auto's subsidiary's statement)

While the statement primarily focused on the reorganization plan, it was only published on the company's official Facebook account in Thailand (with 170,000 followers), emphasizing that the Thai market operations would remain unaffected.

From being a sales champion to teetering on the brink of bankruptcy, NIOA Auto has consistently been a topic of heated discussion. This automaker, which once reached the pinnacle, may have indeed reached its final chapter.

The spark that ignited the situation was the incident on June 11, where employees protested unpaid salaries. According to the employees involved, this was their third action, following protests on May 31 and June 3, during which Fang Yunzhou was absent.

This time, dozens of former employees confronted Chairman and CEO Fang Yunzhou but received a cold response. According to the employees, NIOA Auto owes nearly 400 million yuan in compensation, salaries, and other payments to over 3,000 employees, averaging approximately 100,000 yuan per person.

Some employees have been owed salaries since November last year, while current employees only receive half of their reduced salaries, with housing provident fund contributions suspended long ago.

Adding insult to injury, the company began paying half salaries in September 2023. The HR department had promised N+1 compensation to employees resigning before the end of December 2024, but this promise remains unfulfilled.

A mediation document from the Shanghai Putuo District Labor and Personnel Dispute Arbitration Commission, provided by Wang Yan (pseudonym), a former R&D department employee, states that NIOA Zhihe New Energy Automobile Technology (Shanghai) Co., Ltd. should pay her salary differences and economic compensation by March 24, 2025. However, several months have passed, and the promise remains unmet.

The impact of the unpaid salary protest cannot be underestimated. On June 12, NIOA Auto was compelled to notify all employees to work from home, and the new headquarters in Minhang, Shanghai, which had been operational for less than half a month, was hastily closed.

The new office, which had only recently moved from Putuo District after the Dragon Boat Festival, featured a significantly reduced number of workstations and a smaller area compared to the previous headquarters. Now, even this scaled-down headquarters could not be retained.

The night following the unpaid salary protest, a "NIOA Auto Reorganization Statement" began circulating online. The statement indicated that bankruptcy reorganization would be conducted under the supervision of the Jiaxing Intermediate People's Court in Zhejiang Province to address the debt crisis, introduce strategic investment, replace the existing management team, and search for a new CEO with experience in multinational automakers.

While initially denying that this was an official announcement, relevant NIOA Auto executives later admitted it was one of the alternative plans being considered.

On June 13, the Jiaxing Intermediate People's Court officially issued a bankruptcy case with the case number (2025) Zhe 04 Bankrupt 3, naming HOZON New Energy Auto Co., Ltd. as the respondent and Shanghai Yuxing Advertising Co., Ltd. as the applicant. The administrator institution was confirmed to be Zhejiang Zicheng Law Firm.

At this juncture, NIOA Auto's bankruptcy reorganization proceedings were officially initiated, and the crisis sparked by the unpaid salary protest finally entered the legal process.

NIOA Auto's predicament did not arise overnight but was the culmination of years of strategic missteps. Its 2022 success was largely attributed to the low-priced Nezha V model, priced around 80,000 yuan, which accurately targeted a market gap and achieved robust sales.

However, a year later, NIOA Auto abruptly changed direction, focusing on the high-end market with the launch of the Nezha S and Nezha GT priced around 200,000 yuan. The market response was underwhelming.

Meanwhile, the low-end market share it originally occupied was swiftly eroded by traditional manufacturers such as BYD and Wuling, leaving NIOA Auto in an awkward position, unable to penetrate the high-end market while being squeezed out of the low-end market.

Sales data clearly reflect this dilemma. NIOA Auto sold 127,500 vehicles in 2023, a year-on-year decrease of 16.16%, making it the only brand among the leading new energy automakers to experience negative growth. The situation worsened in 2024, with annual sales of only 64,500 vehicles, less than one-third of the annual target of 250,000 vehicles.

The financial picture is even grimmer. According to the prospectus, NIOA Auto incurred net losses of 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan from 2021 to 2023, respectively, amounting to over 18 billion yuan in losses over these three years.

Now, during the bankruptcy reorganization proceedings, disagreements among various stakeholders have intensified. Of the eight official seats on the NIOA Auto board, Fang Yunzhou holds three seats, Yichun State-owned Assets hold two seats, while 360 Security Technology, Huading Capital, and Nanning State-owned Assets each hold one seat. Tongxiang State-owned Assets serves as an observer.

As the location of the vehicle assembly plant and holder of the "dual qualification," Tongxiang State-owned Assets hopes to resolve lingering issues through bankruptcy reorganization. In contrast, the three shareholders of 360 Security Technology, Huading Capital, and Nanning State-owned Assets aim to retain the corporate entity by introducing new capital. Among them, Toyota Santen Pharmaceutical Co., Ltd. is currently one of the more definite investment candidates.

The employee group is the most pressing concern. An unpaid salary of 100,000 yuan is equivalent to more than half a year's income for ordinary employees, directly impacting their family livelihood. They are more inclined towards quickly receiving compensation through bankruptcy liquidation.

Suppliers' positions are more complex. NIOA Auto owes suppliers a total of approximately 6 billion yuan, with some willing to accept debt-for-equity swaps while others insist on cash payments.

It is evident that NIOA Auto's business strategy has always been fraught with internal conflicts. Zhang Yong insisted on "increasing volume before pursuing quality," neglecting brand building. Zhou Hongyi of 360 once criticized Zhang Yong on streaming platforms for "not understanding marketing."

In fact, NIOA Auto's aggressive move into the high-end market without first consolidating its position in the low-end market created a rift in user perception. Its laxity in R&D during the smart transformation period doomed it to be eliminated by the wave of technological advancement.

Regardless of the final outcome of the reorganization, NIOA Auto's story will become a thought-provoking case in the development history of the new energy automotive industry.

Disclaimer: The content of this article is for reference only. The information or opinions expressed herein do not constitute any investment advice. Readers are advised to make investment decisions cautiously.