American Auto Market | Mexico May 2025: Nissan Dominates as Chinese Brands Surge

![]() 06/17 2025

06/17 2025

![]() 519

519

In May 2025, Mexico's new car market remained largely stable, experiencing a minor year-on-year decline of 0.2% with sales of 119,900 units, marking the third-highest tally for the month in nearly eight years.

Nissan maintained its strong position at the top, while Chevrolet saw a notable decline, and Toyota defied the trend to overtake Volkswagen, leading to subtle shifts in the market landscape. In terms of models, Nissan solidified its leadership with several top-selling models, and the newly launched Magnite also impressed, jumping to 11th place on the sales chart within a short period.

Moreover, Chinese brands shone brightly, with Changan witnessing a remarkable surge of over 250%, MG maintaining its market influence, and newcomers like Great Wall and Foton continuing to expand. Chinese automakers' influence in Mexico is rapidly increasing, achieving comprehensive penetration from brand to product level.

01

Mexican Auto Market

Overall Situation and Mainstream Brand Performance

In May 2025, total new car sales in Mexico amounted to 119,959 units, a slight year-on-year decrease of 0.2% but still maintaining a historically high level, ranking third behind May 2024 and May 2017. Cumulative sales from the start of the year reached 593,361 units, up 1.1% year-on-year, showcasing robust market resilience.

Overall Brand Competition Landscape

Nissan continued to lead with monthly sales of 22,573 units, up 8.4% year-on-year, expanding its market share to 18.8%. Its dominance in Mexico is attributed to a diverse product lineup and strong brand recognition, with models like Versa, NP300 pickup, March, Sentra, Kicks, and the new Magnite occupying key positions in their respective segments.

Chevrolet, despite retaining second place, saw sales decline by 6.7% year-on-year to 14,528 units, indicating waning competitiveness. Especially in the small car and entry-level markets, its key models face competition from Japanese and Korean brands, as well as price-advantaged models like MG.

Toyota, ranking third, emerged as one of the most eye-catching Japanese brands this month, with sales increasing by 10.7% year-on-year to 10,974 units, overtaking Volkswagen for the first time.

Volkswagen slipped to 10,164 units, down 3.8% year-on-year, as its traditional sedan lineup (like Virtus and Jetta) became less appealing to younger consumers.

Kia and Mazda ranked fifth and sixth, respectively, with modest growth, particularly Mazda, which witnessed an 8.8% year-on-year increase.

Hyundai, Ford, and MG comprised the second tier, contributing sales of 4,652, 4,596, and 3,979 units, respectively. Among them, MG has become the most prominent Chinese brand in Mexico. Notably, Ram sales soared to 3,233 units this month, a 79.2% year-on-year increase, successfully entering the top ten, primarily due to the precise positioning of the Ram 700 and 1200 models in the commercial market and pricing strategies driving sales.

In terms of models:

Nissan Versa remained the sales leader with 6,702 units, down 11% year-on-year.

Chevrolet Aveo jumped to second place with 5,167 units, surpassing the Nissan NP300 pickup.

Kia K3, Mazda 2, and CX-30 maintained strong performances in the sedan and crossover SUV markets.

Nissan Magnite, launched just three months ago, has risen to 11th place on the sales chart with 1,977 units sold this month. As a small crossover, its stylish design and practical configuration have won over young Mexican users, marking the initial success of Nissan's strategy in the compact SUV market.

02

Chinese Brands Continue to Penetrate

Changan Leads the Rise

In the Mexican market, Chinese brands continued to exhibit robust expansion momentum, transitioning from "quantity" to "quality".

Changan Automobile ranked 17th this month with sales of 1,550 units, up 253.9% year-on-year, making it the mainstream brand with the highest growth rate. Changan's success is attributed to the rapid sales of its main models, such as CS35 Plus and Yidong. CS35 Plus's price advantage and relatively complete configuration combination in the SUV market make it highly attractive in the Mexican entry-level family car market.

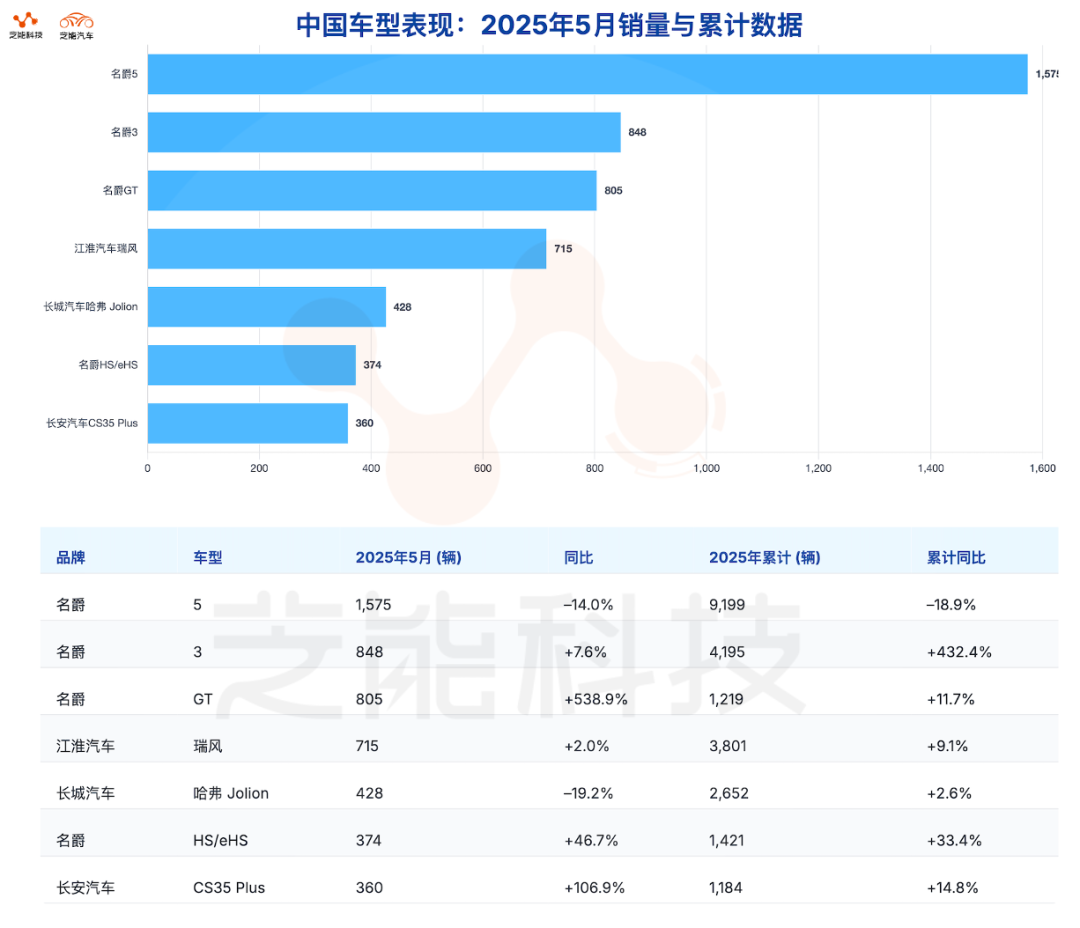

MG, as one of the earliest Chinese brands to enter Mexico, ranked ninth this month with sales of 3,979 units and a market share of 3.3%, stably maintaining its position in the mainstream market. Models like MG 5, MG 3, and MG GT have established a strong presence in the compact and sedan markets. While MG 5 saw a slight year-on-year decline, GT and MG 3 performed impressively, with the latter recording a year-on-year increase of 538.9%.

JAC sold 1,950 units this month, down 7.2% year-on-year, but still maintained its 15th position in the market, with a stable market foundation. Its models, such as Frizzon, JAC 8, JAC 4, and JAC 2, are deployed across multiple segments. While none have become a runaway success, they collectively support the brand's overall performance.

Great Wall Automobile's sales in May declined by 16.3% year-on-year to 1,096 units, but its main SUV models, Haval Jolion and Haval H6, still maintained a certain sales level, indicating that its brand influence in Mexico is forming. The main challenge for Great Wall lies in its slightly slower product update rhythm.

In terms of model sales:

MG 5 ranked 20th with 1,575 units, while MG GT entered the top 50 with 805 units, and MG 3 also recorded 848 units, demonstrating multiple breakthroughs in the compact sedan and small hatchback markets.

Changan CS35 Plus and Yuexiang sold 360 and 321 units, respectively, creating differentiated competition in the entry-level SUV and small sedan markets.

Chinese brands in the Mexican market are entering a stage of "multiple brands, multiple models, multiple channels". Compared to the early model of sales growth driven by a single hit product, the current layout emphasizes the completeness of the product line, the breadth of channel construction, and the enhancement of brand recognition.

Mexican consumers' acceptance of Chinese brands is also continuously increasing, laying the groundwork for the next stage of high-end and intelligent product launches.

Note: BYD did not report data to the Mexican Automobile Association, hence BYD's data is not included in the statistics.

Summary

In May 2025, Mexico's auto market remained generally stable, with Chinese brands quietly reshaping the competitive landscape. Brands like Changan, MG, JAC, and Great Wall are gradually establishing competitive advantages in different market segments through a combination of pricing, configuration, and channel strategies.