Luca's Farewell to Renault's Peak, Amidst a 7.6% Profit Margin that Barely Covers the Strain of Lagging Electrification

![]() 06/18 2025

06/18 2025

![]() 612

612

Despite raising Renault's profit margin from 0.3% to 7.6% in five years, the once highly anticipated 'firefighter' ultimately failed to resolve Renault's three core contradictions.

On June 15, 2025, a bombshell rocked the global automotive industry as Luca de Meo, who had led Renault Group for five years, unexpectedly announced his resignation, effective July 15. In his statement, the Italian executive cited a desire to "seek new challenges outside the automotive industry," a decision that immediately garnered widespread industry attention.

In his farewell speech, Luca fondly reminisced about his tenure's significant achievements: "There comes a time in life when one must step aside after achieving success. At Renault Group, we have jointly created historic performance records."

Data reveals that under his leadership, Renault achieved an operating profit of 4.3 billion euros in 2024, with a profit margin of 7.6%, surpassing its set targets. Notably, Luca's 'Renaulution' strategic transformation plan successfully positioned the century-old automaker in the new race of electrification and intelligence.

Paradoxically, despite Luca's departure coinciding with Renault's peak performance, capital markets exhibited considerable unease.

On June 16, the opening day of trading in Paris, Renault's share price plummeted by 8%, eroding over 3 billion euros in market value in a single day. Analysts attributed this to investors' concerns about Renault's development prospects in the post-Luca era, particularly during a critical period of deep adjustment in the global automotive industry.

Currently, Renault Group has yet to announce a successor. The industry generally believes that Renault's new CEO will face three major challenges: advancing electrification transformation, addressing global competition from Chinese automakers, and maintaining the stable development of the Renault-Nissan-Mitsubishi Alliance. Luca successfully navigated Renault through the 'Ghosn incident' crisis during his tenure, and his abrupt departure undoubtedly adds uncertainty to the future of this French automotive giant.

Historical Performance and Strategic Concerns

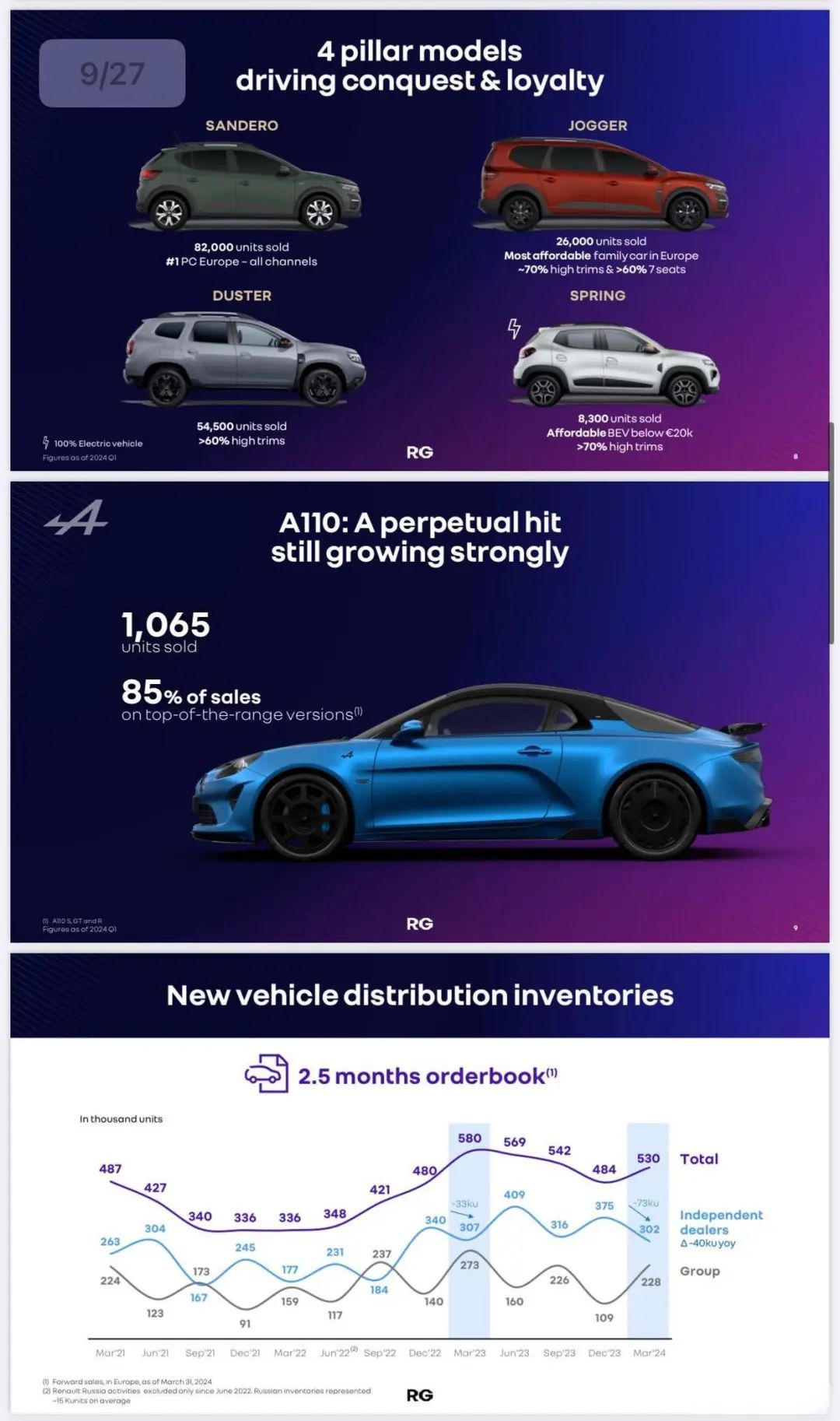

Under Luca's stewardship, Renault Group delivered impressive 2024 financial report data.

From a data perspective, Renault Group's financial performance in 2024 was indeed commendable: revenue reached 56.2 billion euros, up 7.4% year-on-year, with an operating profit of 4.3 billion euros, setting a new record. Free cash flow was as high as 2.9 billion euros, up 21% year-on-year.

More remarkably, its net cash financial position in the automotive business climbed to 7.1 billion euros, almost doubling from the previous year, indicating excellent operational performance.

However, behind these dazzling figures, as the fifth-largest automaker in Europe, Renault faces unprecedented strategic challenges and industrial transformation pressures, including a two-year lag in electrification, a globalization imbalance with a 63% dependency on the European market, and a technology gap with electric vehicle models accounting for less than 10%.

Taking the Renault brand as an example, it attempts to strike a balance between premiumization and electrification, with 41.3% of its models being C-segment and above in Europe, a 15% increase over four years. However, this premiumization strategy inherently conflicts with its electrification transformation: while luxury brands such as BMW and Mercedes-Benz have launched comprehensive electric product lines, Renault lacks high-end electric models, resulting in a lack of genuine market competitiveness.

In the realm of electrification, Renault Group claims that its sales of electrified models in Europe account for 33%, but data shows that pure electric models only account for 9%, with hybrid models accounting for 24% of the share. This reveals Renault's strategic hesitation on the pure electric technology path, and its current lineup of electric models is still in a transitional phase.

More worrisome, even in this transitional year, the sales share of electric models in the fourth quarter only reached 12%, far below leading brands in the European market. This transformation speed contrasts sharply with Europe's stringent carbon emission policies, and Renault acknowledged in its 2025 financial outlook that the 'negative impact of European CO2 emission regulations (CAFE)' would drag down its operating profit margin by about 1%.

Furthermore, Renault Group's performance in regional markets is also noteworthy.

Financial report data shows that Renault performs robustly in the European market, with European retail sales accounting for 63% of the group's total sales. The Renault brand ranks first in the French passenger car, electric vehicle, and light commercial vehicle markets. Its highly concentrated regional market layout, however, suggests an over-reliance on the European market.

Compared to more globalized competitors such as Toyota and Volkswagen, Renault has a weak presence in key markets such as North America and Asia-Pacific. Particularly in China, the world's largest automotive and electric vehicle market, Renault's business layout is still in the 'reshaping and strengthening' stage, with the gap with local Chinese electric vehicle enterprises continuously widening.

Moreover, another strategic risk faced by Renault Group lies in insufficient R&D investment. While emerging electric vehicle enterprises such as Tesla and BYD, as well as traditional rivals like Volkswagen and BMW, are significantly increasing their R&D investment in electrification and intelligence, Renault's pace of technological innovation lags significantly.

The financial report rarely mentions investment in cutting-edge technology R&D, instead emphasizing that 'accelerated cost reduction' will be the driver of performance improvement in 2025. This defensive counterattack strategy seems overly cautious in an era of accelerated change in the automotive industry, appearing inadequate compared to the broader environment.

Alliance Strategy Continues to Loosen

Even more severe challenges lie hidden in alliance cracks.

In 2020, Luca switched from Volkswagen Group to Renault at a time when the Renault-Nissan-Mitsubishi Alliance was fracturing following the arrest of former Nissan CEO Carlos Ghosn, coupled with the industrial impact of the pandemic. However, five years later, the alliance's cooperation has not become closer.

On April 1, Renault Group officially announced that it had reached a consensus with Nissan to revise a series of proposed equity and cooperation rules based on 25 years of alliance cooperation. The 'New Alliance Agreement' stipulates that both parties will reduce their locked-in commitment ratio from the current 15% to 10% to enhance flexibility in cross-shareholding.

Currently, Renault and Nissan each hold 15% voting rights shares in each other, while Renault also holds a 18.7% stake in a French trust company. However, following the alliance's internal disintegration caused by Ghosn's arrest and escape, the trust company has been selling its shares in recent years. Nevertheless, the contents of this agreement do not cover shares held by the trust company.

On another note, Renault also announced that it would acquire a majority stake in Nissan's joint venture in India, meaning that Nissan will exit production operations in the Indian market, focusing on sales and services. Renault, however, will continue to produce cars for Nissan at their joint venture plant in Tamil Nadu, India. Industry data shows that the plant has an annual production capacity of over 400,000 vehicles, but its current utilization rate is only about one-third.

As one of Nissan's major shareholders, Renault has expressed its openness since Nissan approached Honda last year. Multiple foreign media outlets have also evaluated this as Renault's desire to offload its 'hot potato' shares in Nissan as soon as possible.

Undoubtedly, the ties between Nissan Motor and Renault Group and Mitsubishi Motors at the capital and board levels have weakened, and the share reduction plan further indicates that Renault Group and Nissan Motor are gradually loosening their close ties that have lasted for over two decades.

There are even speculations that the future Renault CEO will further promote the alliance's shift from 'capital bundling' to 'contractual cooperation,' releasing funds through equity reductions, sharing capacity to reduce costs, and collaborating on technology modularization to maintain the alliance's existence, while leaving room for both parties' independent strategic transformations.

After all, the alliance has essentially entered the 'post-community era,' where the depth of cooperation depends on the economic benefits of specific projects rather than equity ties.

Luca's sudden departure is emblematic of the transformation dilemma faced by traditional European automakers - when peak financial performance encounters the deep ravine of strategic transformation, the capital market responds with a brutal revaluation, evidenced by a single-day evaporation of 3 billion euros. Despite raising Renault's profit margin from 0.3% to 7.6% in five years, Luca ultimately failed to resolve Renault's three core contradictions.

As pointed out by Morgan Stanley analysts, "The loosening of capital ties will force Renault's new CEO to fight on three fronts simultaneously - maintaining modular technology sharing within the alliance framework, addressing the impact of Chinese automakers' market share exceeding 12% in Europe, and balancing the strategic value and financial burden of Nissan, which is a 'hot potato.'"

The window of opportunity for Renault's transformation is rapidly narrowing, and the ultimate question that Renault's new helmsman needs to answer is already clear: How can a traditional giant supported by cash flow from fuel vehicles reshape the genes of the century-old Renault amidst the wave of electrification?

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.