Emergence of New Automotive Players in 25 Years: Huolala's Leap and Jinyu Auto's Contrarian Entry!

![]() 06/18 2025

06/18 2025

![]() 732

732

Each entrant steps into the arena with distinct ambitions.

Little did anyone anticipate that by 2025, the automotive landscape would still welcome 'new automotive players'.

On June 5, the 'Huolala Duola Auto' service account teased with a poster captioned, 'Huolala Duola Auto's inaugural pure electric van is imminent'.

In the 394th batch of new vehicle declarations published by the Ministry of Industry and Information Technology in April, Changan Kuayue declared a pure electric van with the tail logo 'Duola Bafang', echoing Huolala Duola Auto's announcement.

This suggests that Huolala Duola Auto leverages Changan Automobile's qualifications. The vehicle boasts dimensions surpassing conventional mid-sized vans, with a cargo volume of 7.8m³, a battery capacity of around 40kWh, a CLTC range of about 300km, and a cab accommodating three passengers.

(Source: Ministry of Industry and Information Technology)

Huolala is not the sole 'new automotive player' in 2025. Prior to Huolala, Jinyu Auto, Chueneng New Energy, and others were also sharpening their tools, aiming for the automotive sector. In 2025, amidst a fiercely competitive automotive landscape, the emergence of these new players seems counterintuitive. With the consensus that the window for automotive manufacturing has closed, what exactly do these latecomers aim to achieve? How much disruption can they cause?

The multifaceted faces of new automotive players: logistics, imitations, and battery giants

At the 13th Zhengzhou New Energy Vehicles and Photovoltaic Storage and Charging Exhibition, Henan Jinyu Automobile Co., Ltd. unveiled its maiden pure electric sports car, instantly creating a stir in the industry.

This pure electric convertible sports car from Jinyu Auto, claiming a range of 500 kilometers, resembles the renowned Porsche 911 in design. The rear of the car bears the Chinese pinyin for 'jinyu'. Its craftsmanship is rudimentary, headlights are basic, and it appears as a low-precision model, akin to a millennium-era imitation.

Source: Jinyu Auto official account

Source: Jinyu Auto official account

Jinyu Auto's official promotional rhetoric mentions: 'In 2025, Jinyu Auto and Haima New Energy will combine their strengths for comprehensive and in-depth cooperation in new energy vehicle product definition, styling design, product experience, marketing management, channel construction, and user experience.'

This has been interpreted as 'Jinyu Auto is essentially the reborn Haima New Energy!'

However, on June 11, Haima New Energy Automobile Co., Ltd. issued a statement denying any cooperative relationship with Henan Jinyu Automobile Co., Ltd.

The background of this 'new automotive player' remains momentarily unclear.

Another 'new player', Chueneng New Energy, appears far more legitimate.

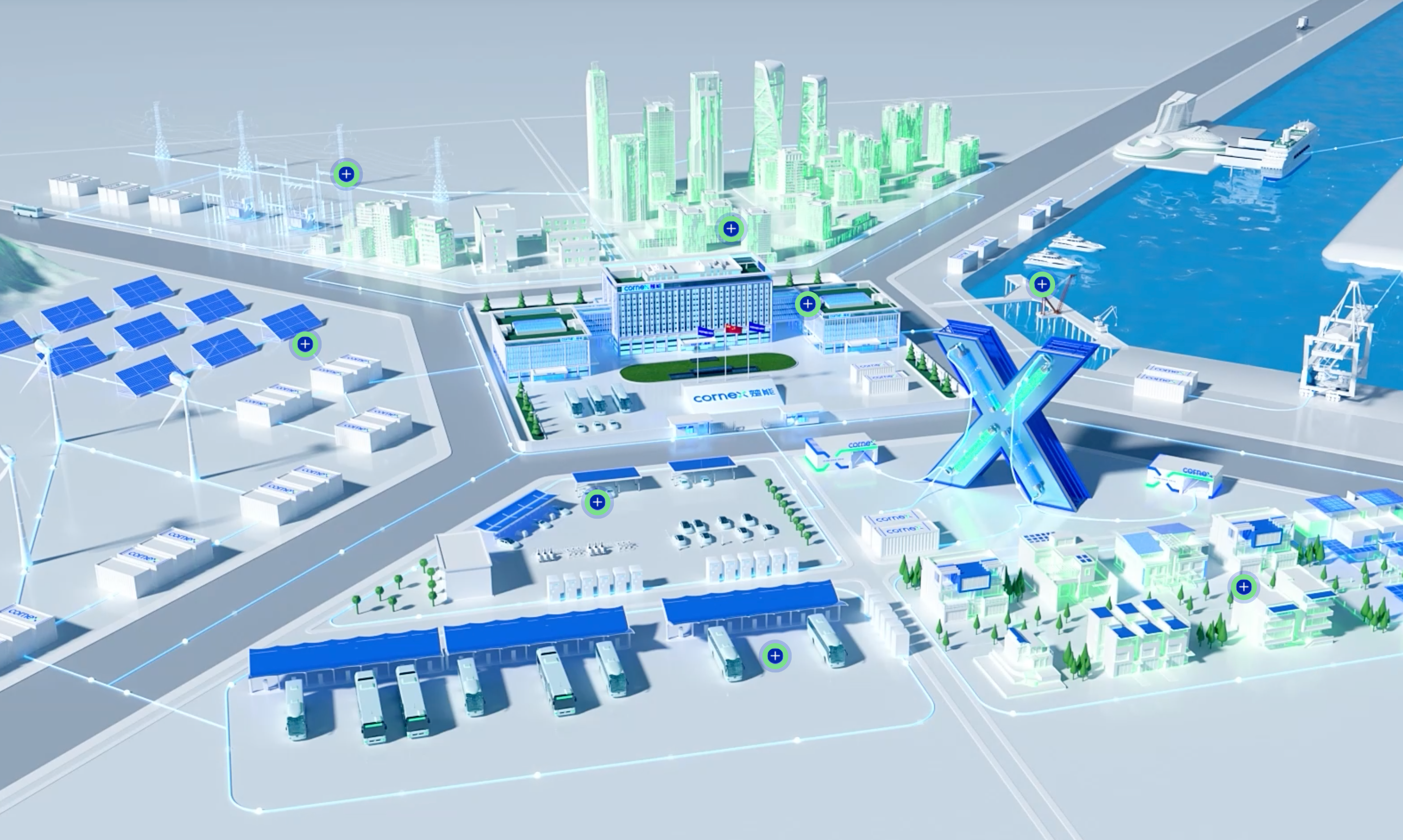

According to 'JiPian Lab', Hubei Chueneng New Energy has ventured into complete vehicle manufacturing, with an automotive business department exceeding 100 personnel. The company boasts a battery production capacity of 110GWh, backed by a top-five dealer group in the country with over 300 4S stores, and possesses a comprehensive supply chain, channels, and funding.

Source: Chueneng New Energy official website

Source: Chueneng New Energy official website

Founded in 2021, Chueneng entered the new energy sector with storage batteries. Just two years later, the company shattered market price floors with a price of 0.5 yuan/Wh.

By the end of 2024, Chueneng's effective production capacity across its three bases surpassed 110GWh, with annual energy storage battery shipments exceeding 20GWh. This year, Chueneng has successfully supplied batteries to automakers such as Dongfeng and FAW, and is gaining traction in the power battery sector.

This means that if Chueneng successfully manufactures cars, it will become the second automaker to enter the complete vehicle market from batteries and supply 100% of its own batteries, following BYD.

New automotive players entering the arena, but not necessarily to profit from car sales?

Entering the automotive arena now serves distinct ambitions for each player.

As a listed logistics platform, Huolala's foray into automotive manufacturing follows a clear business logic, essentially a strategic extension rooted in its core business scenarios.

Its ambition lies in evolving from a platform service provider to an ecosystem controller, forming a data closed loop through the telematics system. This may sound enigmatic, but let me elucidate.

Source: Huolala official website

Source: Huolala official website

In 2025, Huolala re-entered the capital market as 'the world's largest logistics trading platform'. Behind its prospectus' 'three consecutive years of profitability' data lies a multi-faceted game involving capital and labor, platforms and drivers, and markets and policies. This internet freight platform, once heralded by the slogan 'reconstructing the logistics ecosystem with technology', now grapples with the dilemma of 'maintaining transportation capacity at the mercy of the weather'. Many drivers have voiced concerns about the platform's irrational order dispatch, a long-standing issue for Huolala.

How does this relate to automotive manufacturing? In fact, self-developed vehicles offer more and freer avenues for innovation. For instance, embedding a telematics system in self-developed vehicles enables real-time data collection on vehicle location, battery level, and load status, optimizing the platform's order dispatch algorithm. Additionally, data on cargo temperature, humidity, vibration, etc., ensures the transportation of perishable and fragile goods, while driver behavior data aids in insurance rate customization.

In summary, in the short term, customized vehicles can reduce drivers' operating costs and attract more transportation capacity; in the medium term, controlling vehicle data enhances scheduling efficiency and outcompetes rivals; in the long term, it constructs a 'people + vehicle + goods' closed loop, evolving from a matchmaking platform to a transportation capacity service provider.

In essence, automotive manufacturing is crucial for the vertical integration of logistics platforms. Therefore, Huolala's foray into automotive manufacturing is not a gimmick but a strategic move, whose success hinges on ecological synergy.

As for Jinyu Auto, it exudes a strong 'pyramid scheme' aura. Its booth information indicates that investing 1,000 yuan can make one a 'one-star partner', and 10,000 yuan a 'two-star partner'.

Partner benefits focus on recommendation rewards: a 'one-star partner' receives 300 yuan for recommending a 'one-star partner' and 2,000 yuan for a 'two-star partner'; a 'two-star partner' earns 400 yuan for recommending a 'one-star partner' and 3,000 yuan for a 'two-star partner'.

Source: Jinyu Auto official account

Source: Jinyu Auto official account

Clearly, they do not intend to sell cars legitimately. Currently, no relevant information is available in the Ministry of Industry and Information Technology's 'Vehicle Manufacturer Credit Management System' and 'Road Motor Vehicle Manufacturer and Product Information Query System'. Hence, we will leave it at that for now.

Among these three 'new players', the only one seemingly aiming to sell cars legitimately is Chueneng New Energy.

Chueneng's founder expressed his intention to manufacture cars in mid-2024. Currently, Chueneng is actively recruiting for automotive positions, with many industry professionals receiving calls from relevant headhunters.

The combination of funds, channels, and batteries will become Chueneng's key bargaining chips for long-term cost control in the automotive industry's consumption war.

But, can these bargaining chips help break through the siege?

The window is firmly shut, and the dream of automotive manufacturing may prove elusive?

Despite players' confidence, we must acknowledge the reality: manufacturing cars now is akin to throwing money into a bottomless pit.

In early 2024, Apple announced the cancellation of all self-driving electric vehicle project development plans, instead increasing investment in generative AI; Freeland Motors burned through US$500 million without achieving mass production; real estate automotive companies like Baoneng, Evergrande, and Agile Group have essentially declared 'total defeat'.

When Xiaomi Automobile barely squeezed into the race with a 100 billion yuan R&D investment, the harsh reality has already emerged: the automotive industry's entry ticket is being withdrawn, and the window for automotive manufacturing has closed.

Assuming a car is manufactured, this is merely the first, and easiest, hurdle. The real 'hell mode' awaits.

Firstly, policy constraints have tightened significantly. The once 'backdoor listing' path was completely blocked in 2024, and the new regulation stating that qualifications 'can only be revoked' means no 'shells' to borrow. Xiaomi's receipt of the Borgward qualification through special Beijing approval is likely the last 'birth certificate' issued. Coupled with the national capacity utilization rate seriously below the safety line, the state has set stringent thresholds for research and development, patents, and production standards for new players, making it difficult for latecomers to even obtain qualification to participate.

Secondly, the market has transformed from a blue ocean to a brutal red ocean. With a 26.9% market share, BYD dominates with a trinity of 'technology-industry chain-channels', while NIO, AITO, and Leap Motor account for most of the remaining market share.

Even Xiaomi, which delivered a 'decent' result of 137,000 vehicles in its first year, incurred a colossal R&D cost of 105 billion yuan. More severely, the price war has compressed profit margins to the limit, and new brands lack scale and cost advantages, having almost no premium ability and slim chances of survival.

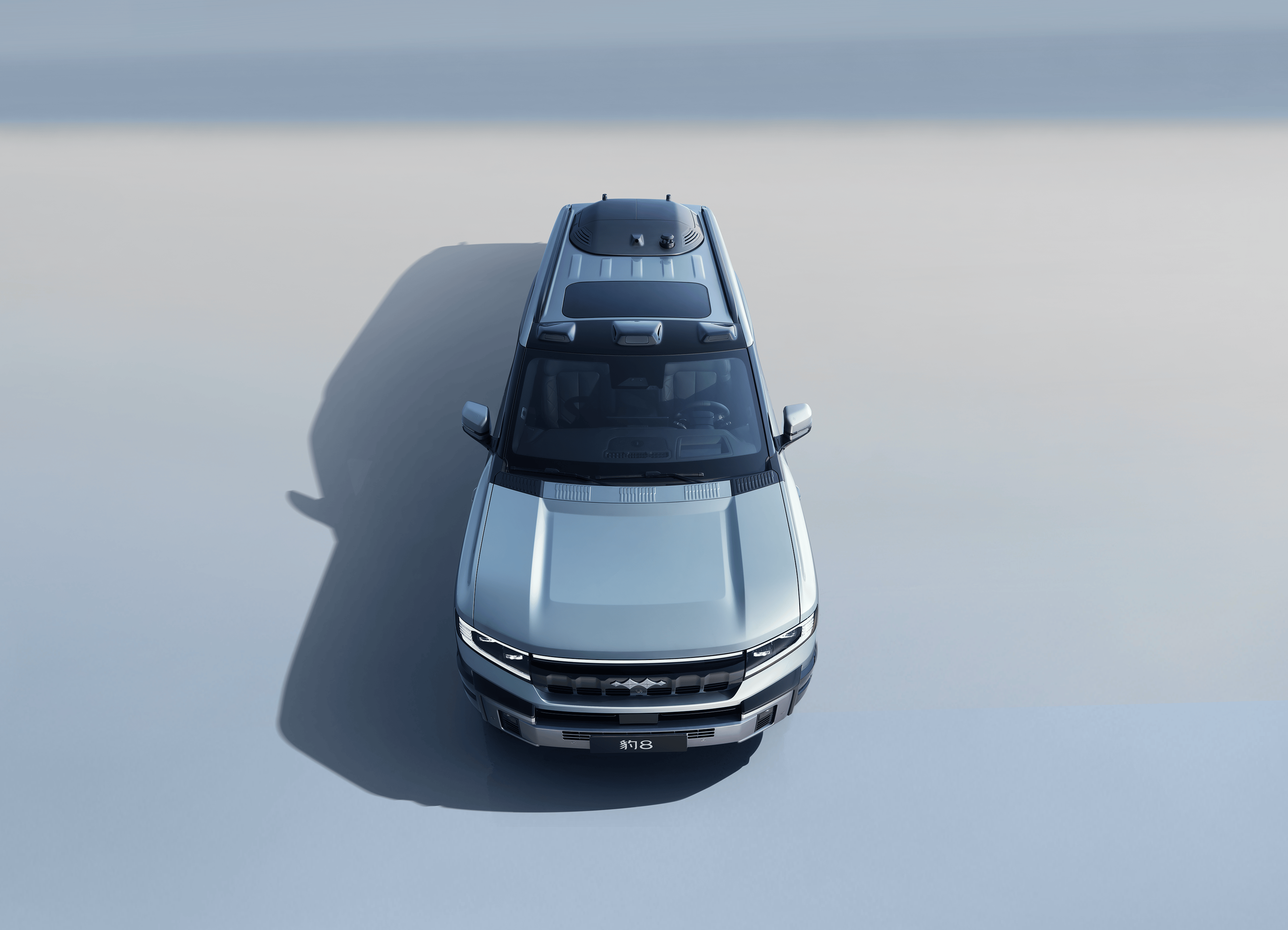

Source: Fangchengbao

Simultaneously, the decline of WM Motor, HiPhi, and NIO, Apple's retreat, and the 'total defeat' of many cross-border automotive ventures have severely eroded consumers' and capital's trust and patience in new players.

Then there's the technological barrier. As Contemporary Amperex Technology Co. Limited (CATL) and BYD's solid-state batteries near commercialization, and NOA in urban areas drops to the 150,000 yuan price range, becoming a standard feature, once a technological generation gap forms, unproduced new products will become obsolete. Latecomers must not only catch up with existing technologies but also bet on the future, posing a significant challenge.

Lastly, a point most overlook is the geographical solidification of the industrial chain, with no room to take root.

Major industrial clusters in the Yangtze River Delta, Pearl River Delta, Chengdu-Chongqing region, and others, leveraging their monopoly advantages in batteries, manufacturing, chips, software, and lithium mines, have deeply bound core resources like land, supply chains, talent, and policies, forming an insurmountable moat. Do new players want to go it alone? Even basic land and power resources are already divided among giants.

Qualification lockdowns, market solidification, technological generation gaps, capital retreats, and resource monopolies all signify that the door to automotive manufacturing has closed.

Therefore, when Xiaomi announced its entry into automotive manufacturing, Lei Jun lamented that Xiaomi's entry was 'just right', which was not modesty but a rush to squeeze into the remaining gap at the end of China's three major waves of manufacturing industry chain maturity, technological explosion, and changes in consumer perception. But for those aiming to enter today, automotive manufacturing has evolved from an era of 'pioneer adventures' to a battlefield of 'giant refinement'.

Those who miss the window period can only watch from the sidelines as an era concludes amidst the torrent of industrial changes.

Huolala, Jinyu Auto, Chueneng New Energy, new automotive players

Source: Lei Technology