Can NIO, the “Resilient Champion of New Forces”, Leap Out of Losses This Year?

![]() 06/18 2025

06/18 2025

![]() 598

598

Lead

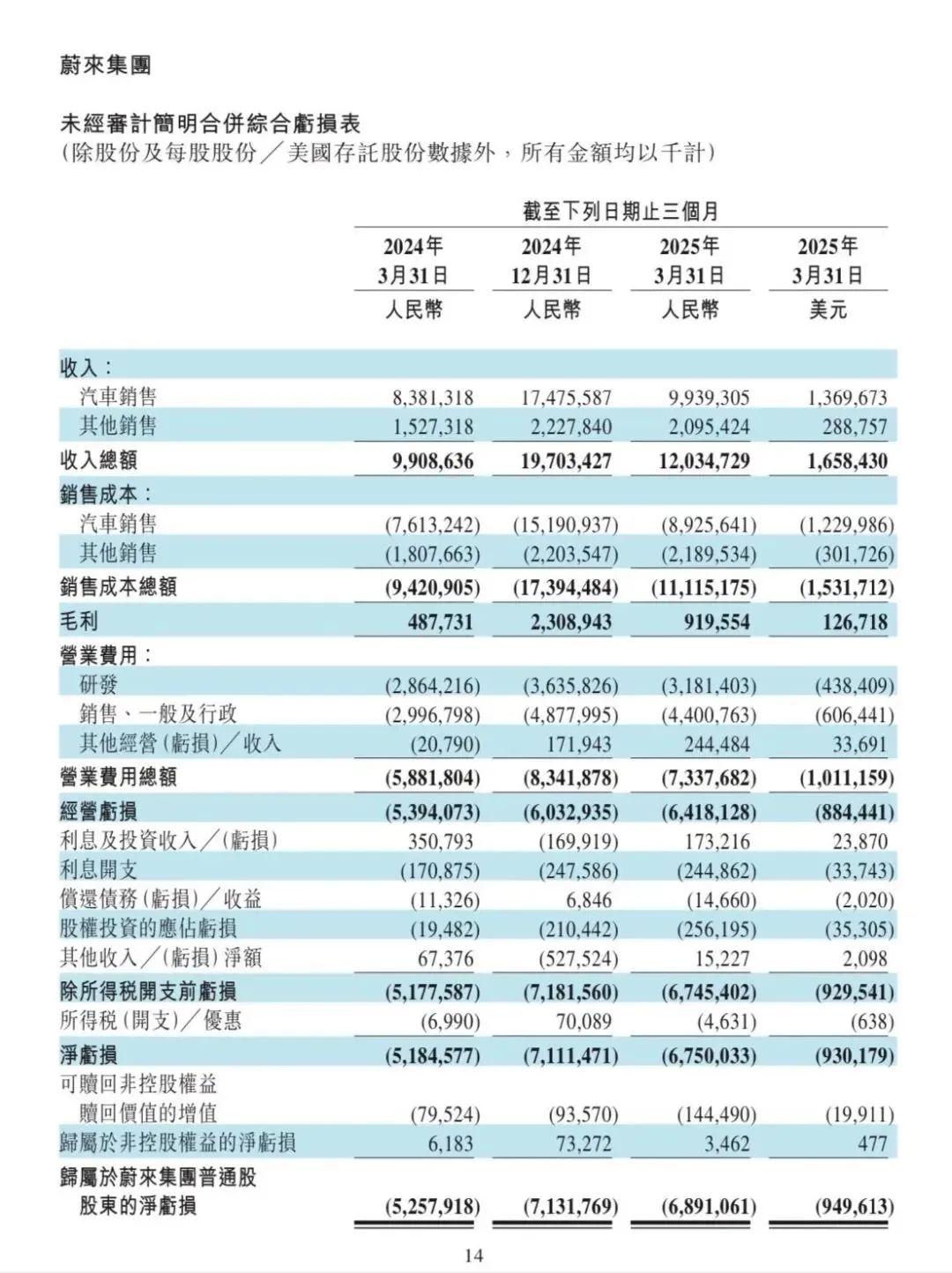

NIO aims to achieve profitability this year, but what will propel it to this goal? In the first quarter of this year, NIO incurred a loss of 6.891 billion yuan. Amidst the fierce competition in the current automotive market, where does its future lie?

Produced by | Heyan Yueche Studio

Written by | Cai Jialun

Edited by | He Zi

23,008 words in full text

4 minutes to read

The landscape of new energy vehicle (NEV) manufacturers continues to undergo significant shifts, with some players being eliminated almost annually.

As the "legendary resilient champion" among new force automakers, NIO has survived the "turbulent years from 2016 to 2019" and the "comprehensive new energy transformation of the market from 2019 to 2023." However, in the current highly competitive automotive market, does the continuously loss-making NIO still have a viable strategy?

From "NIO-XPeng-Li Auto" to "Li Auto-XPeng-NIO"

Over the decade of ups and downs for new force automakers, the ranking of NIO-XPeng-Li Auto has evolved into Li Auto-XPeng-NIO. This ranking remains remarkably consistent whether based on market value, profitability, or market sentiment.

Li Auto, as the only profitable brand among "NIO-XPeng-Li Auto," despite its market growth slowing down after 2024 due to saturation in the extended-range market and challenges in transitioning to pure electric vehicles, reported a net profit of 650 million yuan in the first quarter of this year, a year-on-year increase of 9.4%.

While XPeng remains in a loss-making state, it has swiftly tapped into the volume market with its low-price strategy. Revenue in the first quarter reached 15.81 billion yuan, a year-on-year increase of 141.5%, and net losses narrowed from 1.368 billion yuan in the same period last year to 664 million yuan. Notably, following the launch of volume models and channel reforms, XPeng's gross sales margin also increased from 12.89% to 15.56%.

In contrast, NIO's revenue in the first quarter of 2025 was 12.03 billion yuan, a year-on-year increase of 21.46%, but its net loss reached 6.891 billion yuan, a year-on-year surge of 31.06%. Its asset-liability ratio rose to 92.55%, while the industry average generally ranges between 60% and 70%. Alarmingly, NIO has 26 billion yuan in cash remaining, down from 41.9 billion yuan at the end of last year. Additionally, NIO's shareholders' equity is 7.315 billion yuan, but the shareholders' equity attributable to the parent company has fallen to a negative value of -366 million yuan. If the first-quarter loss rate persists, NIO has limited time for adjustments.

NIO's founder, Li Bin, recently stated at a media communication meeting that the debt ratio in the automotive industry is not low globally, which is related to the industry's characteristics. He acknowledged that due to losses and high-intensity R&D and infrastructure investments, NIO's debt ratio is relatively higher. However, he also emphasized the quality of the balance sheet and financial transparency.

NIO's share price is on a downward trajectory. On June 16, 2025, NIO's closing price on the U.S. stock market was $3.52, significantly below its issue price of $6.26. Its total market value of $7.906 billion ranks last among "NIO-XPeng-Li Auto," lagging far behind Li Auto's $30.186 billion and XPeng's $17.722 billion on the same day.

Although NIO has received a cool reception in the capital market, it is reassuring that sales are showing a trend of recovery. Cumulative sales of NIO's three brands in May increased by 13.1% year-on-year, with 13,270 new vehicles delivered under the NIO brand, 6,281 new vehicles delivered under the Roadster brand, representing a month-on-month increase of 42.8%, and 3,680 new vehicles delivered under the Firefly brand in its first full month of deliveries.

In Li Bin's words, "The first quarter of this year was the lowest point in the past three years, but the most difficult time has passed," and he reiterated the goal of "achieving profitability in the fourth quarter."

However, the real challenge facing NIO is that the new energy market is even more competitive now than it was in 2019. How can NIO replicate its 2019 turnaround? How can it achieve the target of monthly sales of 50,000 units in the fourth quarter?

Change and Consistency at NIO

NIO has faced multiple questions regarding its sluggish sales, multi-brand strategy, and battery swapping strategy. From Li Bin's recent performance, which differs from the past, it seems that after a decade of ups and downs, NIO may have found its own survival strategy in China's new energy market.

Despite numerous uncertainties, NIO has proactively adjusted its tactics since last year, making revisions in product updates, self-developed technology, channel integration, and sales models.

At the product level, the refreshes of NIO's new ES6, EC6, ET5, and ET5T models have stabilized NIO's foundational position. Especially with adjustments to the central control screen, smart chips, and chassis suspension, NIO, which prioritizes user needs, has genuinely listened to feedback and delivered sincere products. Coupled with the pricing strategy of increasing quantity without raising prices, NIO has maintained its brand image while satisfying potential customers' needs.

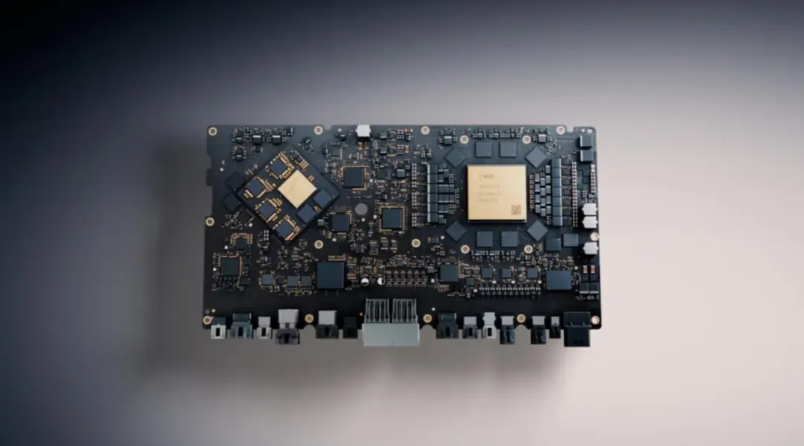

At the level of self-developed technology, NIO's in-house "Shenji NX9031" intelligent driving chip, "SkyOS · Tianshu" all-domain operating system, and "Tianxing Intelligent Chassis" have been fully mass-produced and installed in the new 5566 models. The first version of NIO World Model (NWM) based on the Banyan platform is also gradually being deployed on 400,000 vehicles. From the underlying electronic and electrical architecture to software applications, NIO has formed a closed-loop technology system, laying a solid foundation for a new energy automaker.

At the sales level, starting this year, NIO's sales model has fully transitioned to an inventory model, preparing inventory vehicles for 1/2 to 1/3 of monthly sales. It is undeniable that NIO's inventory model does put some pressure on dealers. However, based on previous instances where NIO and Roadster experienced "explosive orders but lagging deliveries," this adjustment in NIO's sales model has significantly accelerated the delivery cycle of new vehicles.

Regarding overseas markets, NIO originally planned to use Firefly as an entry point, continuing the path of boutique small cars and directly competing with overseas brands. However, due to various reasons, Firefly was positioned in China as the third brand. Nevertheless, from recent announcements by NIO, it will intensify its expansion into seven European markets—Austria, Belgium, the Czech Republic, Hungary, Luxembourg, Poland, and Romania—in the next two years, with its main products being NIO and Firefly.

Of course, the actual effectiveness of its overseas expansion will only become evident in NIO's subsequent battle reports. After all, at this stage, although there is increasing clamor for self-owned brands to go overseas, not many self-owned brands have actually achieved results in overseas markets.

At the level of channel integration, NIO has conducted more precise stratification for its three brands: NIO, Roadster, and Firefly. NIO insists on maintaining its brand height, Roadster undertakes the tasks of market expansion and cash flow generation, and Firefly is responsible for incremental sales and overseas markets. In terms of organizational structure, Roadster's R&D, supply chain, and quality departments fully report to Li Bin, and the Firefly Business Unit is also included in NIO's product design and R&D cluster. The three brands have returned to NIO's larger system, reducing duplicate construction and accelerating the R&D process. The most notable result is that Roadster's sales team has been reduced, but sales have increased by 40%.

With the implementation of NIO's in-house achievements, the improvement of its product matrix, and the enhancement of organizational efficiency, it is evident from the sales data in April and May that NIO has received positive market feedback, with sales of all three brands gradually increasing.

Li Bin's plan is for the combined monthly sales of the three brands to reach 50,000 units in the fourth quarter of this year, with the NIO brand expected to achieve a scale of 20,000 to 25,000 units, an increase of about 20% compared to last year. The Roadster brand needs to sell 25,000 units per month, with the Firefly brand serving as an incremental supplement.

Commentary

Can the goal of "50,000 NIOs" be achieved? NIO sold 13,270 vehicles in May, with both year-on-year and month-on-month declines exceeding 30%. This was partly due to the impact of the transition period for the replacement of main models, as the new ET5, ET5T, ES6, and EC6 models were only fully launched and delivered in mid to late May. Additionally, it was because the promotional clearance of old models ended, and the actual transaction price increased by more than 10%, suppressing some demand in the short term. In the current fiercely competitive environment of new energy vehicles, it is challenging for NIO to aim for a monthly sales volume of 50,000 units. However, with the continuous launch of new models, if a popular star model emerges, NIO may see a turnaround. Nevertheless, as more and more new forces have already breached the red line of losses, the time left for NIO is limited.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)