Has the Storm Passed for Joint Venture Automakers? Sales Rebound in May for Many

![]() 06/18 2025

06/18 2025

![]() 619

619

Over the past two to three years, joint venture automakers, slow to adopt new energy vehicles, seemed to be overshadowed by domestic automakers. But are joint venture automakers truly doomed? In May, mainstream domestic joint venture automakers showed clear signs of recovery. Meanwhile, domestic automakers still grapple with ongoing price wars and may soon face a strong counterattack from joint venture automakers.

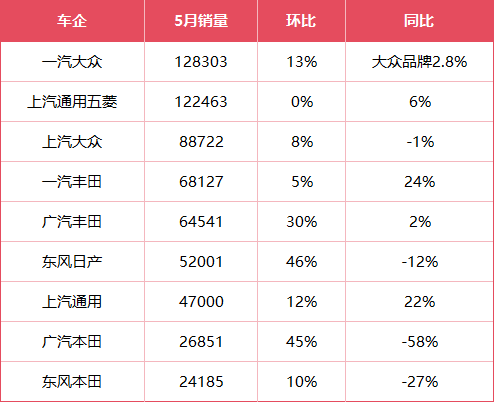

Sales of multiple joint venture automakers rebounded in May.

According to company sales figures, FAW Toyota and SAIC-GM witnessed year-on-year increases of over 20% in May. Despite the impact of price wars initiated by domestic automakers, joint venture automakers did not easily capitulate. They maintained their previous advantages in the fuel vehicle market while also introducing several electric vehicles with strong product capabilities and high cost-effectiveness. For the first time, joint venture automakers are making their presence felt in the niche market traditionally dominated by new forces/domestic brands.

△FAW Toyota sales increased by 24% year-on-year in May

△Some joint venture brands return to positive growth

The basic fuel vehicle market stabilizes

Automotive market consumption has returned to rationality, and the fuel vehicle market has stabilized. This is one of the main reasons for the overall recovery of joint venture automakers.

FAW Toyota performed exceptionally well in May, selling a total of 68,127 vehicles, a year-on-year increase of 24%. High-end models based on the TNGA-K platform accounted for 61% of sales, while electrified models accounted for 48%. Both the RAV4 and Corolla Cross exceeded 10,000 monthly sales, demonstrating impressive performance. The larger proportion of high-end model sales indicates that FAW Toyota's profits are more substantial, giving it more confidence to face price wars.

△FAW Toyota RAV4 and Corolla Cross sales exceeded 10,000 vehicles in May

FAW-Volkswagen sold a total of 128,303 new vehicles last month, with a month-on-month growth rate of 13%, making it the largest-selling joint venture automaker. Volkswagen brand sales reached 73,001 vehicles, a year-on-year increase of 2.8%. The Sagitar, Magotan, and Tayron bore the brunt of Volkswagen brand sales in China. The Audi brand contributed 46,000 vehicles in a single month. In the second half of the year, with the launch of the new Q6L e-tron family and the new Q5L, which have stronger product capabilities, Audi's domestic sales are expected to reach a new level. SAIC Volkswagen sold 88,722 vehicles last month, a year-on-year increase of 8%. Although overall sales volume is still far from the previous fuel vehicle era, SAIC Volkswagen has also completed its recovery. The Tiguan, Passat, and Tharu families, with their good reputation, support half of SAIC Volkswagen's sales.

△The Sagitar, Magotan, and Tayron bore the brunt of FAW-Volkswagen's domestic sales

Joint venture new energy vehicles start to strive for improvement

In terms of new energy vehicle sales, which are currently the focus of all automakers, joint venture automakers are also catching up. With the continuous launch of new models, although joint venture automakers are currently lagging behind domestic brands in sales, the trend of recovering some lost ground is already unstoppable.

According to the China Passenger Car Association's wholesale sales of new energy passenger vehicles in May, SAIC-GM sold 7,523 vehicles, SAIC Volkswagen 7,160 vehicles, Dongfeng Nissan 7,062 vehicles, GAC Toyota 5,279 vehicles, and FAW-Volkswagen 4,689 vehicles. In terms of specific models, Buick GL8 PHEV retail sales reached 7,391 vehicles in May, GAC Toyota BZ3X sales were 4,344 vehicles, and Nissan Ariya sales were 3,034 vehicles. Volkswagen ID.3 sales were 4,217 vehicles, and ID.4 CROZZ sales were 2,600 vehicles.

△Buick GL8 PHEV retail sales reached 7,391 vehicles in May

Among these models, two stand out: Dongfeng Nissan Ariya and FAW Toyota bZ5.

Dongfeng Nissan Ariya received over 20,000 orders within 50 days of its launch, setting a record for the fastest growth among joint venture new energy vehicles. The popularity of this model is not only due to its highly cost-effective price of 119,900 yuan but also because it does not lag behind new force models of the same level in terms of intelligent connectivity. Dongfeng Nissan Ariya uses the Qualcomm Snapdragon 8295 chip to power the new NISSAN OS infotainment system and deeply integrates domestic mainstream AI large models such as iFLYTEK Spark and DeepSeek-R1, providing a very smooth user experience. The NVIDIA Orin chip and Momenta's one-stage end-to-end combined assisted driving algorithm allow Dongfeng Nissan Ariya to rank among the top in China's current intelligent driving segment. Faced with the strong arrival of Dongfeng Nissan Ariya, the Xiaopeng MONA M03, which has continued to sell well since its launch, is facing challenges. After all, Dongfeng Nissan's manufacturing quality, reputation, and overall system capabilities are well recognized in the domestic market.

△Dongfeng Nissan Ariya received over 20,000 orders within 50 days

FAW Toyota's bZ5 follows a similar model to Dongfeng Nissan Ariya. For a mid-size pure electric coupé SUV, the starting price of 129,800 yuan is also very attractive. If the 550km range and 200kW large motor are considered average configurations, then the 15.6-inch screen, 8155 chip, and Toyota Pilot intelligent driving system supported by the Momenta Flywheel large model 5.0 also elevate this model's product strength, narrowing the gap with new force competitors in the same segment.

△FAW Toyota bZ5 sales are promising

The staying power of joint venture automakers cannot be underestimated

Next, mainstream domestic joint venture automakers have either already begun or will soon start walking on two legs: launching models developed by overseas headquarters and new energy models developed domestically or incorporating domestic top-tier intelligent connectivity technology in the domestic market. Taking FAW-Volkswagen as an example, 9 of the 10 new energy models it previously announced are based on the CEA architecture jointly developed by Volkswagen and Xiaopeng. In addition to a smart flagship model in cooperation with Huawei that will officially debut this year, Dongfeng Nissan will also launch 5 new energy models covering pure electric, plug-in hybrid, and extended range by the end of 2026. Following Dongfeng Nissan Ariya, perhaps more and more joint venture brands will find the right key to open the door to the domestic market.

△9 of the 10 new energy models that FAW-Volkswagen will launch are based on the CEA architecture jointly developed by Volkswagen and Xiaopeng

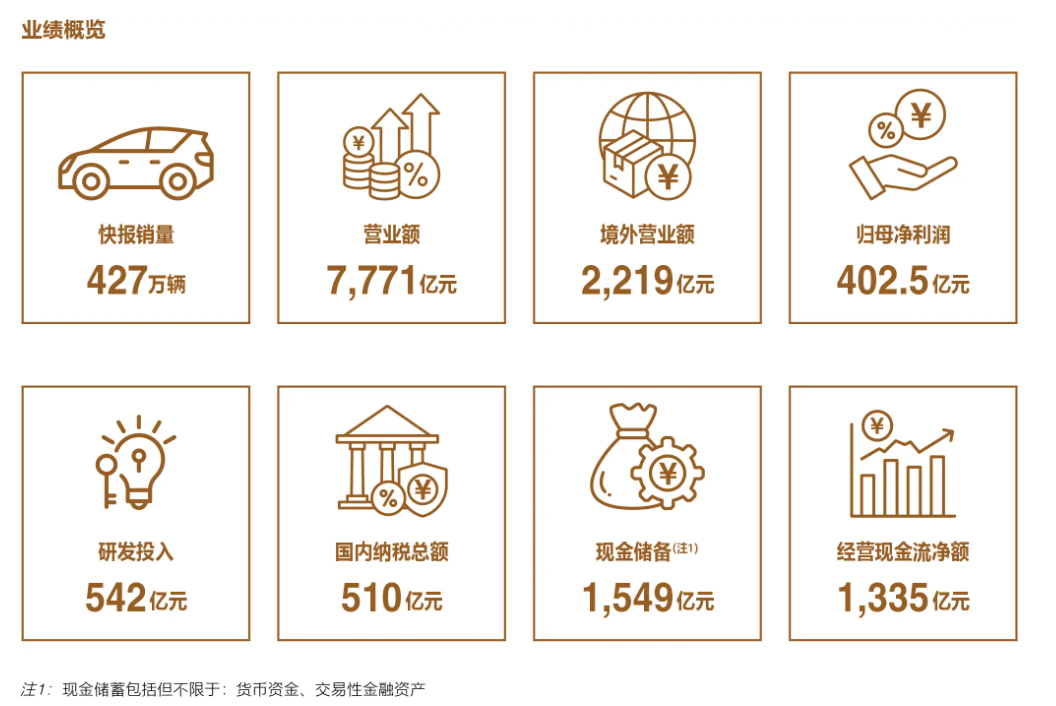

In the past two years, the upward trend of domestic automakers and new force automakers has been very obvious. Whether in terms of sales or popularity, they are undoubtedly top-tier in the domestic market. However, financial reports show that there is still a gap between the profitability of domestic brands and multinational automakers. In 2024, BYD's net profit reached 40.354 billion yuan, and other financial reports from brands such as Thalys, Great Wall, Li Auto, and Geely were also not bad. Toyota's net profit in 2024 reached 4.77 trillion yen, approximately 237.7 billion yuan, exceeding the sum of all domestic automakers. If it were not for the depreciation of the yen, Toyota's net profit would have been even higher.

△BYD's net profit is still far behind Toyota

A higher net profit means that these automakers can allocate sufficient resources for the research and development of new vehicles and new technologies. Even if they have to engage in price wars, they have more confidence. A reality that domestic automakers must face is that most multinational automakers have a global layout. When facing poor performance in a particular country/market, they still have other markets to support their global performance. For most domestic automakers, the globalization strategy has only just begun. To establish a reputation, open up channels, and build the capability for continuous iterative development of models in overseas markets, there is still a long way to go.

In the short term, the sales advantages of domestic brands such as BYD, Geely, Changan, and Chery in the domestic auto market are still relatively obvious. However, judging from the current situation, when joint venture automakers make up for their shortcomings, it will become increasingly difficult for these domestic brands to further seize market share from joint venture automakers. Joint venture automakers have already launched a counterattack and will compete more fiercely with domestic brands. In the future, it is difficult to say who will win. As Li Shufu said, the automotive industry is a marathon with no end. To truly become equal to multinational automakers like Toyota and Volkswagen, whether it is traditional automakers like BYD and Geely or new forces like Xiaomi and Li Auto, there is still a long way to go.

(This article is originally created by "He Yan Yue Che" and cannot be reproduced without authorization)