Asian Auto Market | Indonesia May 2025: BYD Climbs to 6th, Chery Hits Record 7th

![]() 06/18 2025

06/18 2025

![]() 675

675

In May 2025, the Indonesian automotive market encountered significant downward pressure, with wholesale sales plummeting 14.9% year-on-year.

While most mainstream Japanese brands witnessed notable declines, Chinese brands, notably BYD and Chery, made countertrend advancements. Chery, in particular, surged to 7th place, setting a new all-time high in the Indonesian market, showcasing the growth potential of Chinese automakers in Southeast Asia.

This article delves into the Indonesian market trends and the performance of Chinese brands, revealing the evolving competitive landscape.

01

Indonesian Market Overview:

Decline of Traditional Brands, Rise of Chinese Brands

In May 2025, Indonesian auto wholesale sales totaled 60,613 units, a 14.9% year-on-year decrease; retail sales amounted to 61,339 units, down 15% year-on-year.

These figures suggest that the Indonesian auto market has yet to recover from months of decline, with the total market volume for the first five months dipping to 317,000 units, a 5.4% reduction. Retail sales have fared even worse, with year-to-date sales down 9.1%, indicating persistent weakness in end-user demand.

In terms of brand performance, traditional Japanese brands remain dominant but are generally under pressure.

◎ Toyota maintained its absolute lead with monthly sales of 20,000 units, despite a 10.6% year-on-year decline, further expanding its market share to 34.6%.

◎ Daihatsu ranked second with 11,000 units sold monthly, a substantial 25.5% year-on-year drop.

◎ Mitsubishi and Suzuki fell by 31.8% and 32%, respectively, while Honda plummeted 56.6% year-on-year to fifth place.

Overall, the top five Japanese brands collectively declined, with their combined market share shrinking, paving the way for new brands.

In terms of models, traditionally popular cars performed mixedly.

◎ Toyota Kijang Innova retained its top position with 5,173 units sold, a slight decline but still holding an 8.5% market share.

◎ Daihatsu Gran Max Pikap performed robustly, increasing 2.3% year-on-year, being the sole model among the top eight to show growth.

◎ Other popular models such as Avanza, Sigra, and Calya generally experienced double-digit declines.

◎ Honda Brio, Suzuki Carry, and Mitsubishi Xpander also faced significant pressure, indicating that the market demand for urban commuter vehicles and light commercial vehicles is undergoing an adjustment period.

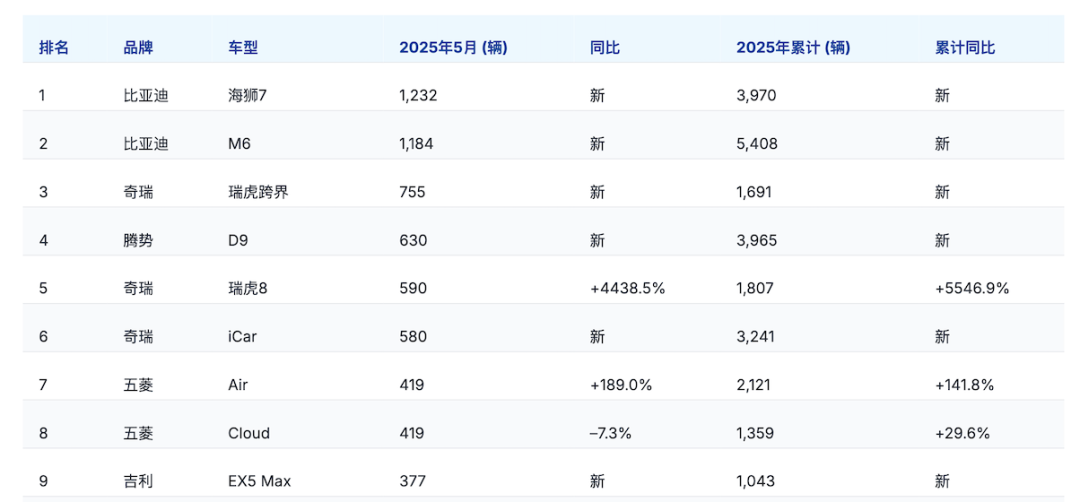

◎ In the realm of new energy and electric vehicles, BYD Dolphin 7 continued its strong performance from the previous month, slipping slightly to 13th place but still setting a new record for Chinese EV sales in the Indonesian market with 1,232 units sold.

◎ Meanwhile, Denza D9 and BYD M6 also entered the top 25, signaling a growing acceptance of EVs among Indonesian consumers.

02

Bucking the Trend: Chinese Brands

Chery Sets a New Record

This month, Chinese brands collectively shone in the Indonesian market.

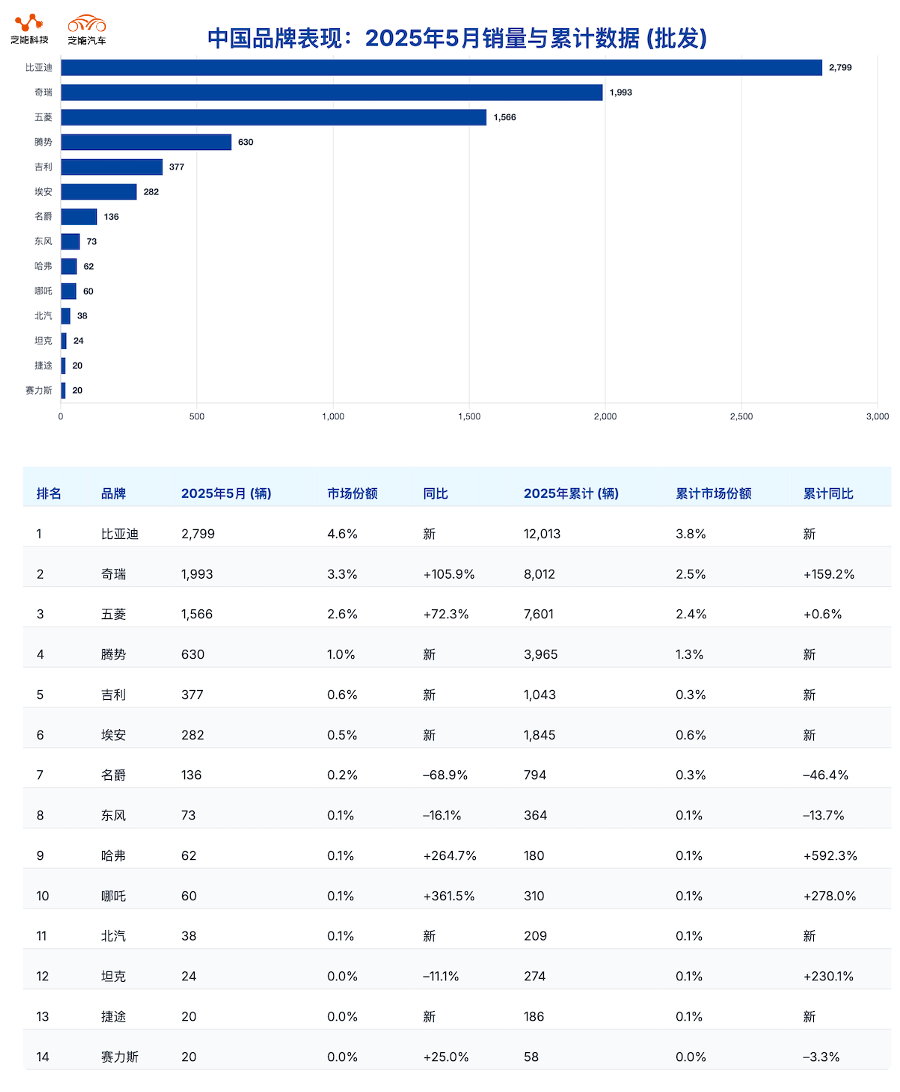

◎ BYD extended its strong performance from the previous month, ranking 6th with wholesale sales of 2,799 units and a market share of 4.6%.

◎ More impressively, Chery witnessed a leap, with sales of 1,993 units surging 105.9% year-on-year, entering the top seven of the Indonesian wholesale market for the first time and achieving its best ranking since entering the Indonesian market.

Looking at specific models, Chery's mainstay models such as Tiggo Cross, Tiggo 8, and iCar all performed well.

◎ Tiggo 8 saw a year-on-year surge of 4,438.5% in sales with 590 units, indicating its successful entry into the Indonesian mid-size SUV market.

◎ iCar also achieved outstanding sales of 580 units, demonstrating the brand's competitiveness in the market for new-generation smart electric compact cars.

◎ Additionally, Chery OMA E5, despite a slight decline in sales, still maintains a significant presence in the pure electric vehicle market.

BYD, with its comprehensive product offensive, has achieved success across high-end, pure electric, and MPV markets.

◎ Dolphin 7 firmly holds the top spot among new energy vehicles, while M6 surpassed 1,000 units sold, becoming one of the few popular pure electric MPVs in the Indonesian market.

◎ Denza D9 has begun to make its mark in the high-end new energy MPV segment, ranking 24th on the wholesale list with 630 units sold, becoming the only high-end new energy vehicle to enter the top 25 in the Indonesian market.

Other Chinese brands such as Wuling, Geely, Great Wall Motors, and Dongfeng Xiaokang are also actively deploying their strategies.

◎ Wuling's overall sales exceeded 1,500 units, primarily concentrated in small multi-purpose vehicles like Air EV, Alvez, and Confero.

◎ Geely achieved sales of 377 units with EX5 Max, showcasing a clear growth trend despite being a newcomer.

◎ Great Wall Motors' Haval and Tank brands also entered the list with modest monthly sales of 62 and 24 units, respectively, demonstrating their strategic intention to gradually penetrate the Indonesian market.

◎ Dongfeng Xiaokang remained stable, focusing on the low-cost commercial compact vehicle segment.

New energy vehicles are emerging as the "breakthrough" for Chinese brands in the Indonesian market. Driven by government incentives and urban consumption upgrades, the acceptance of Chinese new energy vehicles in Indonesia is steadily increasing. Brands like BYD, Chery, and Denza are swiftly building competitive advantages by offering a comprehensive range of products from A0-class electric vehicles to high-end MPVs.

Summary

In May, the overall automotive market in Indonesia remained on a downward trajectory, but profound changes were occurring within the market structure. The dominance of traditional Japanese brands is being challenged, particularly in the fields of electric vehicles and cost-effective SUVs, where Chinese brands are accelerating their market share capture.