Has Leapmotor "survived"?

![]() 06/20 2025

06/20 2025

![]() 544

544

Written by / Tianji

Can replicating a popular model surpass it?

Since finding its positioning as "the ideal home for young people," Leapmotor's sales have soared. Once on par with NIO as struggling peers, Leapmotor now finds itself in a vastly different situation. After turning a profit in the fourth quarter of last year, it delivered over 80,000 vehicles in the first quarter of this year, a recognized off-season for sales.

Image source: Leapmotor official website

Leapmotor doesn't seem to mind being called "Little Li Xiang." By grasping the positioning of Li Xiang as a popular model and emphasizing "having everything one needs at a discounted price," Leapmotor has achieved success, similar to the internet strategy of "replicating a popular model to become one."

However, after becoming a popular model, we must ask the next question: where is Leapmotor's moat?

Positioned as a mid-to-high-end brand with prices ranging from 150,000 to 300,000 yuan at its IPO, Leapmotor's average selling price has now fallen to 110,000 yuan. After trading price for volume, "cost-effectiveness" has gradually become Leapmotor's positioning in consumers' minds.

This may be a positioning for a popular model, but it is also a dangerous one. Because pursuing "cost-effectiveness" implies two things: 1. Difficulty in making money; 2. Difficulty in premiumization. These two issues have gradually emerged as Leapmotor swung from profit to loss in the first quarter.

After becoming a popular model, how Leapmotor should "survive" has become the challenge for the next stage.

01 Selling more, yet losing money

It is a consensus in the automotive industry that those who gain scale win the world.

For example, Li Xiang. In 2020, Li Xiang sold over 30,000 vehicles with a gross profit of 1.55 billion yuan. By 2024, when Li Xiang delivered over 500,000 vehicles, its gross profit had increased more than tenfold to 29.66 billion yuan. However, Leapmotor, known as "Little Li Xiang," doesn't seem to have broken the curse of thin margins through scale.

In the first quarter of 2025, during the recognized off-season for automobile sales, Leapmotor still delivered 87,552 vehicles, closing in on Li Xiang's 93,000 vehicles. However, Leapmotor's gross margin for the quarter was 14.9%, compared to Li Xiang's 20.5%.

Moreover, in the last quarter of 2024, Leapmotor achieved a profit of 80 million yuan, which turned into a loss of 130 million yuan in the first quarter of this year.

Why didn't scale exert its "magic"?

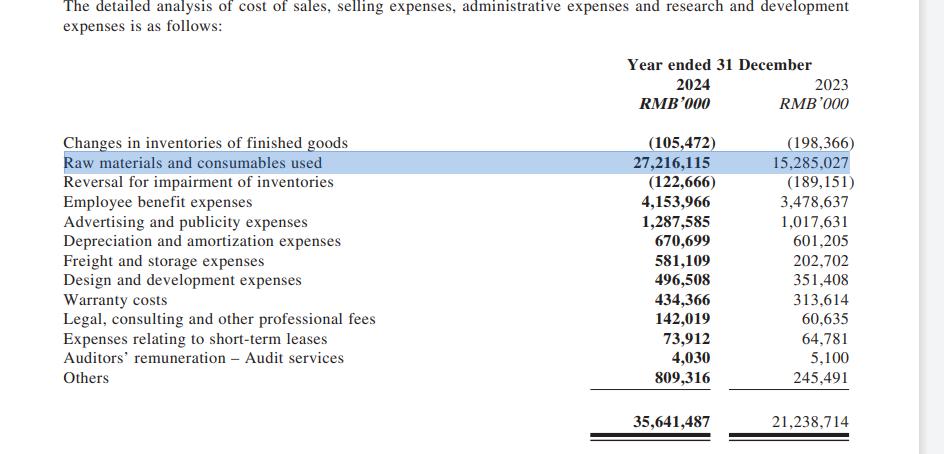

Leapmotor's 2024 annual report provides detailed disclosure of raw material costs. It can be seen that Leapmotor's raw material costs amounted to 27.2 billion yuan, accounting for 92.4% of total production costs, equivalent to a raw material cost of 93,000 yuan per vehicle. The average selling price of Leapmotor vehicles is around 110,000 yuan.

Image source: Leapmotor 2024 annual report

In other words, the cost of parts and components alone accounts for 85% of Leapmotor's selling price. For consumers, this is a carmaker with a conscience in pricing, but for the carmaker itself, it makes cost control more difficult.

Because it is obvious that scale is more easily diluted by fixed costs such as depreciation and labor. Scale has a stronger marginal effect on these costs. When variable costs such as raw materials account for a large proportion of overall costs, it dilutes the "magic" of scale. Moreover, changes in upstream raw material prices are almost beyond the control of enterprises.

On the other hand, Leapmotor's adherence to "full-stack independent research and development" has another factor that "eats" into profits - research and development expenses.

For example, Leapmotor's research and development expenses in 2024 were 2.9 billion yuan, surpassing its gross profit of 2.69 billion yuan with just this one expense, making losses inevitable. In the first quarter of this year, Leapmotor's research and development expenses were 800 million yuan, maintaining a year-on-year growth rate of over 50%.

However, this level of research and development expenses, which thins Leapmotor's profits, appears somewhat insignificant when compared with its peers.

From 2022 to 2024, Leapmotor spent a total of 6.2 billion yuan on research and development, equivalent to XPeng's research and development investment for the entire year of 2024 and less than half of NIO's research and development expenses for 2024. Even Li Xiang, known for its "frugality" among new forces, spent over 10 billion yuan on research and development in 2024.

Leapmotor attributes this far-below-peer research and development level to efficiency. For example, at the end of June 2024, Leapmotor had approximately 3,800 research and development employees and stated that its core research and development team came from the electronics and IT industries. When transitioning to the field of intelligent new energy vehicle research and development, they had a first-mover advantage that many other carmakers did not possess, in short, high efficiency.

But if strong employee capability and high efficiency were enough, then BYD, which invested 54.2 billion yuan in research and development in 2024 with 120,000 research and development engineers, including 5,000 in intelligent driving, and Xiaomi, which invested 24.1 billion yuan in research and development with approximately 22,000 research and development personnel in 2024, would be quite "unconvinced."

Propped up by costs and expenses, Leapmotor has achieved significant sales but has yet to make money.

02 What constitutes "surviving"

In an interview, Zhu Jiangming was asked, "Has Leapmotor survived?" He replied directly: "Not yet."

This is not an overly modest statement. If you look closely, Leapmotor is still under significant pressure. In particular, cash pressure. Selling products well means needing more supporting human and material resources to keep up. In professional terms, Leapmotor is in an expansion phase. Expansion requires spending money.

With the explosive sales of the Leapmotor C10 and C16 in 2024, Leapmotor's operating cash flow rapidly grew to nearly 8.5 billion yuan. However, the accompanying capital expenditures for equipment, rent, labor, and various other aspects also increased, reaching 13.3 billion yuan, completely surpassing the cash flow generated by car sales. Therefore, the overall cash and cash equivalents actually decreased from 11.7 billion yuan in 2023 to 6.4 billion yuan at the end of 2024.

If we compare Leapmotor's balance sheet with that of other new forces, Leapmotor's asset-liability ratio was 73% in 2024, with a debt pressure far exceeding XPeng's 62% and Li Xiang's 56%.

Of course, to "survive" and "thrive," Leapmotor has come up with many solutions.

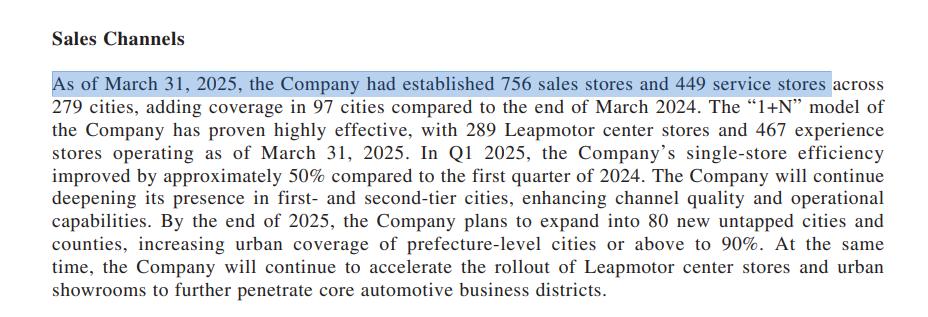

To improve the effectiveness of sales expenses, Leapmotor adopts a "1+N" sales model, which combines a small number of direct sales with a larger number of agents, to help reduce asset investment while rapidly expanding. In terms of results, as of the first quarter of 2025, Leapmotor had 756 sales outlets and 449 service outlets, with its marketing expenses accounting for only 6% of revenue. In comparison, XPeng, which also uses a combination of direct sales and dealers, had a total of 690 outlets in the first quarter, with marketing expenses accounting for 12% of revenue; Li Xiang, which primarily uses direct sales, had a marketing expense ratio of 10%. Overall, Leapmotor's marketing expense control is appropriate.

Image source: Leapmotor financial report

However, this distribution model has also received much controversy and criticism. The original intention of "1+N" is for one city manager to support multiple dealers, but as the number of dealers increases, the difficulty of regional management also increases. Moreover, 4S stores are essentially self-financing, and different dealers may even be in a competitive relationship. For example, a netizen on Xiaohongshu complained that after picking up their car at a store in Yanqing, Beijing, they went to the store in the Asian Games Village for window tinting, only to find out that only those who ordered their cars at the store were given full-car window tinting, while others only received tinting for the four windows; another car owner complained that the 4S store where they picked up their car went out of business, and the free labor for maintenance promised when buying the car was no longer available, and there was even no way to complain.

Zhang Jia (pseudonym), a senior practitioner in the new energy automobile industry, told "Node Auto" that insiders know that different 4S stores of the same brand also have their own KPIs and competitive relationships, but consumers do not understand this. This is a common problem with carmakers adopting a dealership model, and they will ultimately complain about the brand's service issues themselves. Improper dealership management ultimately harms the brand's reputation.

Similarly, the relationship between a brand and its dealers is also a complex subject. Leapmotor has even been "betrayed" by its own dealers, who revealed that Leapmotor "coerced dealers to register cars under employees' names to boost sales," accusing it of "falsifying sales figures."

In addition to service, Leapmotor products themselves are often criticized for "no major problems, but minor issues constantly." During this year's 315, Leapmotor was collectively sent to the "Heimao Complaints" platform by netizens. The "protagonist" of this complaint was the C01 2023 model 606 Intelligent Enjoyment Edition, with over 100 car owners filing complaints about issues such as instability at high speeds, abnormal noises, and malfunctions in the automatic parking function. The C11 has also become a "disaster area" for complaints due to issues with core components such as abnormal noises, loss of speed, motors, braking systems, and transmissions. Of course, Leapmotor has not escaped the common problems of electric vehicles, such as exaggerated range and deposit refund policies...

It should be noted that when Leapmotor went public, its prospectus described the brand as targeting the mid-to-high-end market with prices ranging from 150,000 to 300,000 yuan. With the popular sales of low-priced vehicles, Leapmotor's average selling price in the first quarter has dropped to 110,000 yuan, increasingly far from the "mid-to-high-end" positioning.

Trading price for scale, Leapmotor, which aims to "survive," still cannot avoid the pressures of quality, service, and cash flow.

03 Overseas expansion: a high-risk, high-reward endeavor?

In 2024, Leapmotor ranked 11th in global sales. To survive, it must at least enter the top five.

Relying solely on trading price for volume will only increase pressure, so Leapmotor must explore new markets. Therefore, overseas expansion has become a necessary path.

Not long ago, Leapmotor opened its first store in Hong Kong. "Choosing Hong Kong may be due to policy promotion and further internationalization," Zhang Jia told "Node Auto." Firstly, the Hong Kong government provides first registration tax exemptions, low annual license fees, and accelerated charging infrastructure construction for electric vehicles, significantly reducing user ownership costs. From January to April 2025, the penetration rate of new energy vehicles in Hong Kong has reached 68%, and Leapmotor's cost-effective products align with consumer demand under policy incentives. Secondly, like Hong Kong, the European market also uses right-hand drive vehicles. After leveraging Hong Kong's policy incentives to develop right-hand drive vehicles, it will be smooth to further penetrate this model into Europe.

Image source: AutoHome Research Institute

When it comes to overseas expansion, the first thing that comes to mind is localized layout, which means burning money. To solve this problem, Leapmotor has come up with a solution - reverse overseas expansion. Leapmotor and the Stellantis Group jointly established "Leapmotor International," a joint venture with the rights to export, sell, and manufacture products in markets outside Greater China.

Obviously, what Leapmotor wants to do is leverage the Stellantis Group's mature sales channels and reputation to improve its efficiency in going overseas.

However, as Wu Qiang, Co-President of Leapmotor and the operator of the Stellantis and Leapmotor joint venture project, said, "Don't think overseas expansion is so easy, especially for companies like us that have never done it before. Although the Stellantis Group helps us, we should see more challenges rather than seeing gold everywhere."

"Node Auto" believes that discourse power may be Leapmotor's first challenge. The Stellantis Group holds a 51% stake in the joint venture, which may mean that Leapmotor will have to make concessions in terms of product positioning, pricing, and other discourse powers. Of course, at the moment, Leapmotor seems more like it is clinging to the "leg" of the Stellantis Group, and this concession doesn't seem to be a problem. However, it may plant the seed of a hidden danger.

There are precedents for automotive alliances collapsing due to equity distribution issues. Nissan and Renault are a typical example. When Renault rescued Nissan from the brink of bankruptcy, Nissan's sales surpassed Renault's. However, due to equity distribution issues, the profits earned were distributed to Renault, which ultimately led to the split between the two companies.

If the challenge of profit distribution is still premature, then how Leapmotor, which focuses on cost-effectiveness, can increase sales and make money while going overseas is a more immediate challenge.

For example, Leapmotor's sales volume in Hong Kong is only around 40,000 to 50,000 vehicles per year. Coupled with the research and development costs of right-hand drive models, this is bound to dilute Leapmotor's profits. Even if the joint venture can share the costs of expanding sales channels, improving the efficiency of production and research and development costs is a problem that Leapmotor must solve to go overseas.

By replicating popular models and trading price for volume, Leapmotor has pulled itself back from the brink of danger. However, this is also a risky move. It is easier for a brand's image to slide down than to climb up. After gaining scale, how Leapmotor will premiumize, globalize, and achieve profitability is the real challenge it must solve to truly "survive".