Audi Revises Electrification Strategy: Realism Trumps Idealism

![]() 06/20 2025

06/20 2025

![]() 530

530

Introduction

Farewell to idealism. In June 2021, Audi announced on its official website that from 2026, it would solely launch pure electric models, gradually phasing out gasoline vehicles by 2033. This commitment was set to mark its fourth anniversary next week. However, a recent turn of events has seen Audi's global CEO, Gernot Dollner, personally confirm that gasoline vehicle production will continue until around 2035, or possibly longer.

"Another 7, 8, or maybe 10 years," Dollner remarked, effectively withdrawing Audi's established full electrification timeline. Gasoline vehicles will continue to contribute to profits, with the possibility of extending production beyond the mid-2030s.

Foreign media quipped, "The fourth anniversary of embracing pure electric vehicles has turned into a day of divorce, and even the timing for ceasing gasoline vehicle sales dare not be mentioned. It seems gasoline vehicles will be cherished for a long time to come." Dollner further stated that Audi will introduce a new series of internal combustion engines and plug-in hybrid vehicles from 2024 to 2026 to ensure greater flexibility in its product lineup.

Following Mercedes-Benz and Volvo's gradual stance "softening," Audi could no longer resist the pressures of reality. Amid changing market dynamics and sluggish sales of pure electric vehicles, Audi had to abandon its previous idealism, extending the "lifespan" of gasoline vehicles in the market and providing a more stable long-term strategy for the company's transition.

01 Adjusting Course to Align with Reality

Audi's initial electrification roadmap was announced under the leadership of then-CEO Markus Duesmann. After Dollner took the helm in September 2023, Audi's strategic direction was re-evaluated. Considering the market conditions of the past two years, it had to hit the "pause button" on its aggressive pure electric transformation.

In 2024, Audi sold 1.671 million new vehicles globally, a year-on-year decline of 12%. Among these, deliveries of pure electric models amounted to approximately 164,000, not only failing to serve as the "growth engine" for the brand but also declining by 8% compared to 2023.

The adjustment of electrification strategies poses a challenge for all automakers. The nature of the automotive industry dictates that strategic and technological choices will influence the product matrix for years to come, closely tied to sales and survival.

Among the three major German luxury brands, only BMW had not previously committed to a phase-out date for gasoline vehicles or provided a specific timeline for "full electrification." Audi and Mercedes-Benz had initially leaned towards pure electric vehicles but now recognize that the transition from gasoline to pure electric will take longer than anticipated.

Mercedes-Benz has postponed its plan for electric vehicles (including hybrids) to account for 50% of total sales. Porsche has abandoned its goal of electric vehicles accounting for 80% of sales by 2030. Since last year, Audi has repeatedly emphasized the deployment of main sales models ensuring a "dual track" of gasoline and pure electric, recently overturning its previous electrification goals entirely.

Volvo's initial plan was also relatively aggressive, aiming for pure electric models to account for 50% of sales by 2025 and selling only pure electric vehicles by 2030. However, the brand later adjusted its target to an electric vehicle (plug-in hybrid and pure electric) sales ratio of 50% to 60% by 2025 and at least 90% by 2030, with the remainder being hybrid models.

Haste Makes Waste –

In the process of electrification, more automakers are realizing the importance of gradual progress. All new developments in the automotive industry chain exhibit a cyclical nature, spiraling upwards. Like intelligentization, electrification cannot be rushed. It requires upholding traditional values such as reliability and safety while comprehensively considering market demand.

Especially in Europe, high vehicle prices, limited driving ranges, and immature charging facilities have become core deterrents for electric vehicle buyers.

Charging infrastructure is a thorny issue requiring significant public and private investment. In Europe, whether at the national or regional level, public services are not the top priority for this topic. Data shows that 70% of public charging stations in the EU are concentrated in Germany, France, and the Netherlands.

In contrast, the Chinese market has witnessed gradual improvement in charging facilities, policy inclination, and multiple rounds of subsidies, allowing the new increment of pure electric vehicles to have broad development potential. In Europe, once subsidies cease and consumer motivation wanes, traditional automakers find that the fundamental base supporting profitability remains gasoline vehicles.

02 The "Late Spring Cold Snap" of Electric Vehicles in the US

Compared to European automakers, American automakers face greater difficulties. A recent Bloomberg report points out that Trump is striving to overturn electric vehicle policies supported during the Biden era, and subsequent actions may continue to lag the US in electric vehicle development.

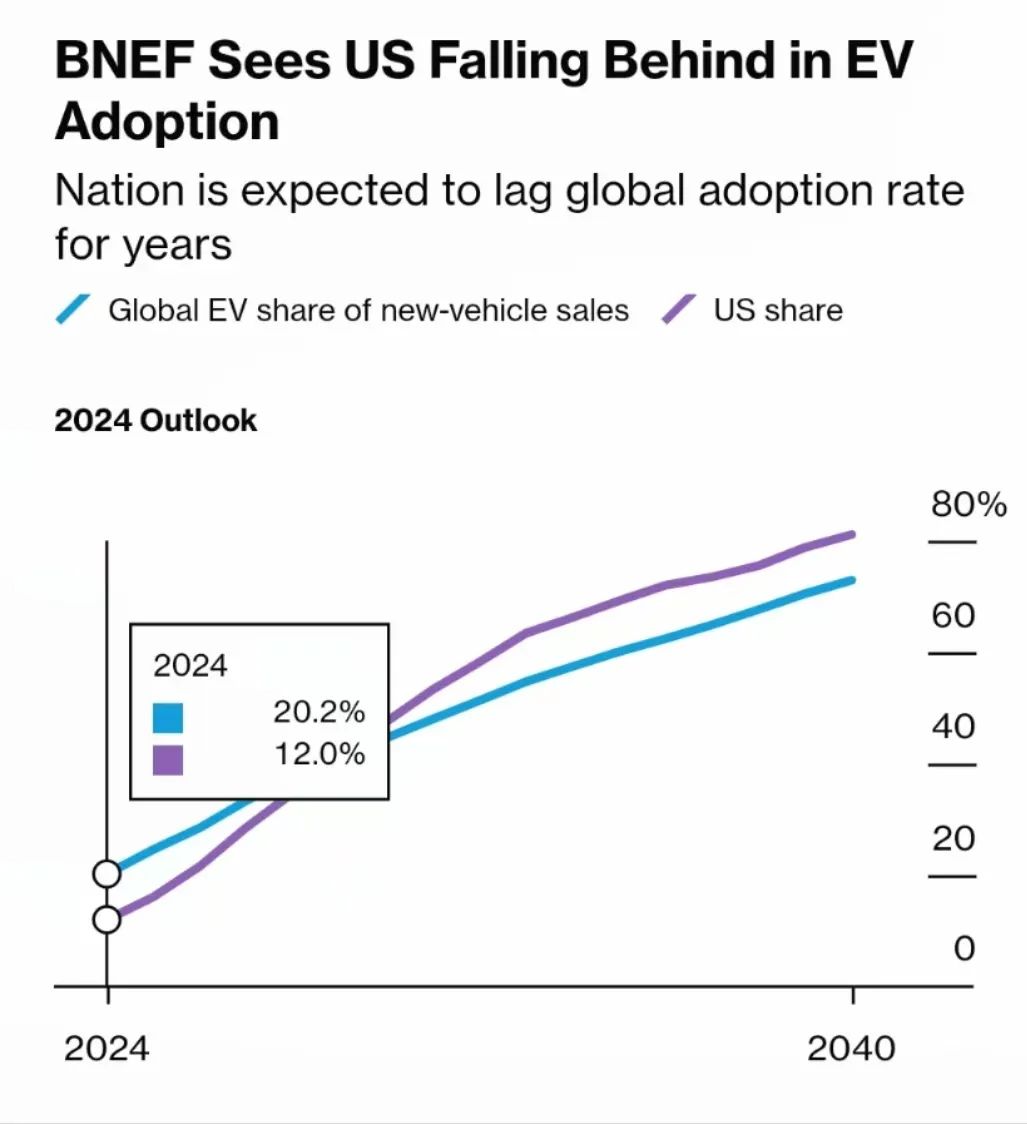

BloombergNEF (BNEF) recently released a report stating that the Trump administration's comprehensive suppression of electric vehicle policies is pushing the country's automotive manufacturing into an awkward situation – the US will lag behind China and Europe in electric vehicle adoption and may struggle to reach the global average penetration rate even by 2040.

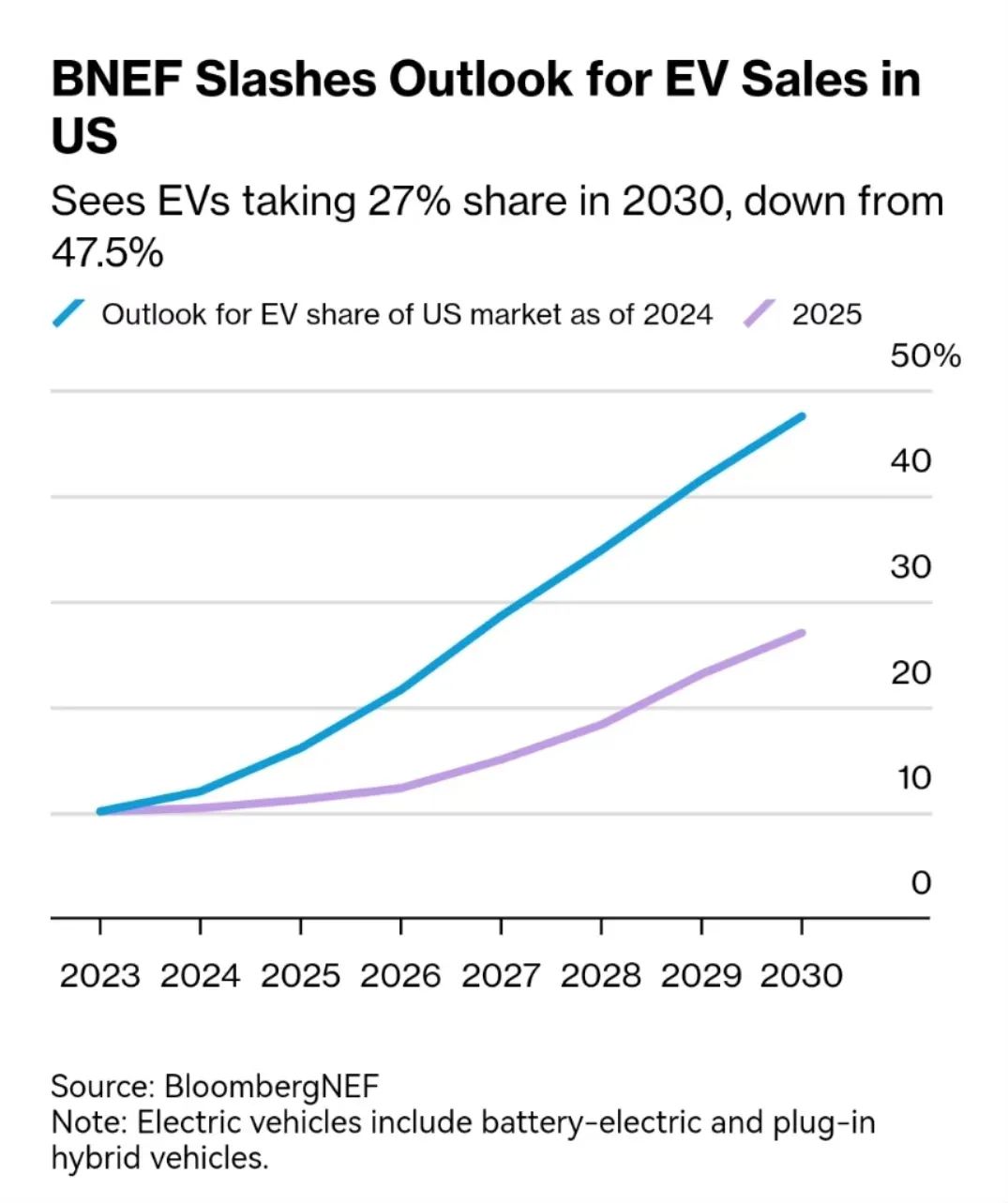

"This is a policy setback," multiple media outlets, including Bloomberg, have commented. The latest data from BNEF shows that the Trump administration's policies will severely impact the US auto industry, particularly new energy vehicles. The agency has downgraded its near- and long-term sales outlook for electric vehicles in the US for the first time, cutting its sales forecast for pure electric vehicles by 14 million units by 2030.

14 million units represent a significant impact on the US auto market, which is in the midst of its electrification transformation. If this trend continues, local automakers such as General Motors, Ford, and Tesla will pay a heavy price for the Trump administration's new policies. Automakers must adjust their new energy strategies, and many decisions, once made, have irreversible impacts.

On his first day back in the White House, Trump ordered the cancellation of electric vehicle subsidies and other support measures, which later sparked strong opposition from multiple states.

In May this year, 17 US states and Washington, D.C., focused their efforts on Trump's electric vehicle policy, accusing him of halting a federal funding plan for electric vehicle charging stations and illegally withholding billions of dollars originally intended for building more charging stations.

Regarding the future of the US automotive industry, Biden and Trump have opposite approaches. During Biden's tenure, he proposed multiple ambitious electric vehicle plans aimed at reducing the US's carbon emissions and vigorously developing clean energy. Trump strongly opposes this and made overturning many of Biden's plans and withdrawing multiple funding projects to promote fossil fuels his first act upon entering the White House.

According to the CEO of US electric vehicle charging station supplier Vontier Corp., if the Trump administration insists on cutting federal funds, the installation rate of electric vehicle charging stations in the US will plummet. By 2030, the number of highway charging stations in the US is likely to be only 200,000, half of the previous estimate.

This also means that Trump's new round of policies will not only severely impact the adoption and sales of the electric vehicle market but also the infrastructure, which is the foundation for the long-term development of electric vehicles.

Greater uncertainty stems from state-level policies in the US. If Trump subsequently eliminates state exemptions for low-carbon regulations (especially California-led policies), the outlook for electric vehicle sales will further deteriorate.

California has always been able to set stricter vehicle emission standards than the federal government, thanks to a special exception in the Clean Air Act for the state. Currently, California is the only state in the US that can set stricter vehicle emission standards than the federal government, but the Clean Air Act also allows other states to adopt California's regulations, and 17 states, including Oregon, New York, and Massachusetts, have already done so.

If Trump's resolution is implemented, considering California's pioneering role and importance in the entire US electric vehicle market, its impact will not be limited to the California electric vehicle market but will also harm the entire development process of electric vehicles in the US, further lagging behind other regions of the world.

In contrast, China maintains a strong momentum in its electric vehicle transformation process. In addition to having infrastructure ahead of the rest of the world, another main reason is that the "economic account" of electric vehicles in China is favorable.

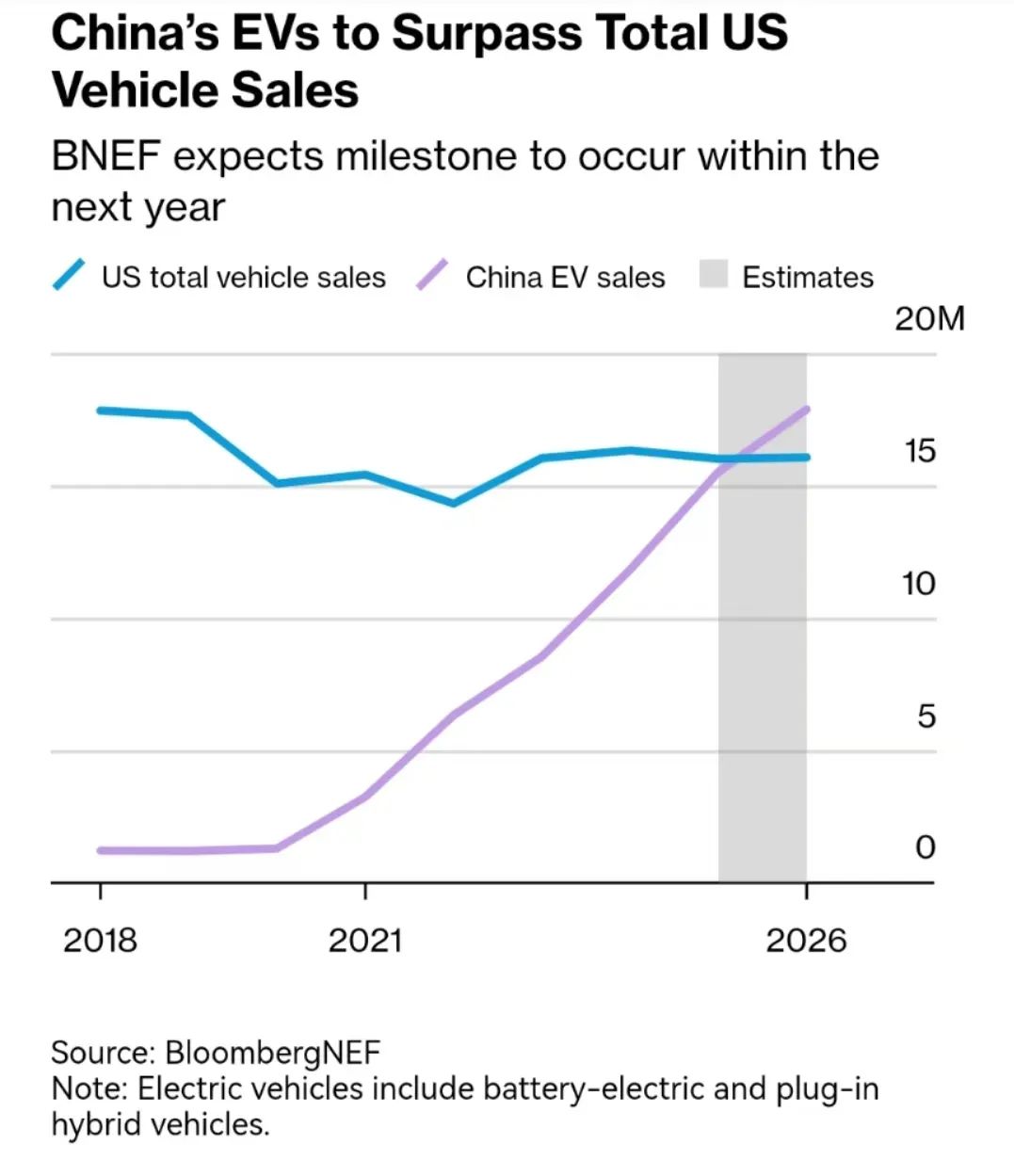

China is the only large market where the average price of electric vehicles is lower than that of gasoline vehicles of the same level, meaning that China can achieve cheaper electric vehicles than gasoline vehicles. BNEF predicts that within the next year, the scale of China's electric vehicle market will exceed the total volume of the entire US auto market, a scenario that US automakers are unwilling to see.

Responsible editor: Du Yuxin, Editor: He Zengrong