Is Audi's Temporary Pause in Electrification a Strategic Retreat or a Market Adaptation?

![]() 06/20 2025

06/20 2025

![]() 554

554

Surviving the transition until the next competitive phase is paramount, outweighing the rush toward full electrification.

After much deliberation, Audi has finally caught up with peers like Mercedes-Benz, BMW, and Volvo by announcing a temporary halt to its full electrification strategy and withdrawing the previously announced timeline.

On June 18, Audi's global CEO Bram Schot officially confirmed in an interview that the company was abandoning the previous management's goal of full electrification. This includes ceasing the development of new fuel vehicles by 2026 and achieving full electrification by phasing out fuel vehicles by 2033.

The next day, Audi China promptly issued a statement explaining the headquarters' decision to temporarily pause the electrification strategy. The statement demonstrated a strong desire for survival, supporting electrification while providing compelling reasons for the decision. Issuing the statement overnight was a remarkably swift public relations move.

So, is Audi's announcement of a temporary halt to full electrification a strategic retreat or a considered response to the global market?

Global Market, Global Strategy

First, it's essential to acknowledge that the pace of automotive electrification varies significantly across the global market. Major markets like China, the United States, and Europe exhibit vastly different levels of acceptance for electrification.

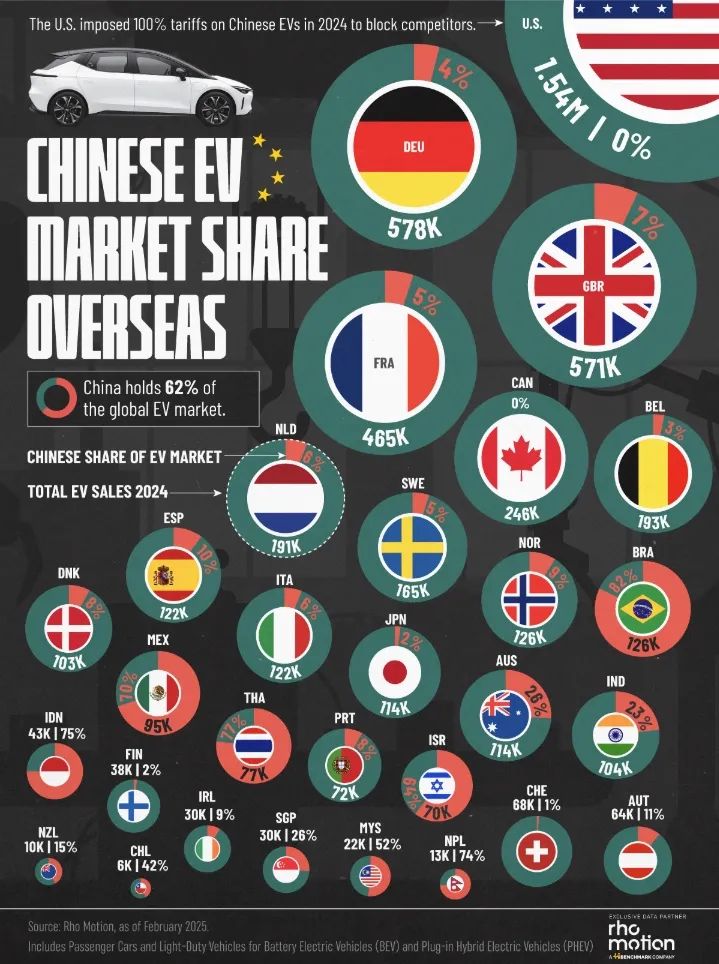

According to the International Energy Agency (IEA), global sales of new energy vehicles in 2024 were approximately 17 million, with a penetration rate of about 20%.

The situation in major markets differs markedly. China boasts the highest penetration rate of new energy vehicles, exceeding 45% and even surpassing 50% for several months. Europe's penetration rate is closer to the global average, at 22.7% according to the European Automobile Manufacturers Association, slightly above the global average.

The US market lags significantly behind. Despite the presence of electric vehicle companies like Tesla, the penetration rate of new energy vehicles is only about 10%. Notably, after Donald Trump took office, he cut subsidies from the previous Biden era, significantly impacting the electric vehicle market.

As for markets like Japan and India, although they are large in size, their penetration rates of new energy vehicles are pitifully low, at about 3% for Japan and only 0.2% for India.

Faced with such a fragmented global market, it's evident that fuel vehicles remain the mainstream despite over a decade of electrification efforts. The global pace of electrification is slow, and full electrification can only be continuously postponed.

All global automakers are acutely aware of this reality. Unlike 20 or 30 years ago, the global automotive market is now completely fragmented. Differences in public facilities and technological levels are affecting the progress of electrification.

For instance, in the European market, although it was one of the first regions to promote automotive electrification and set early goals for phasing out fuel vehicles, the entire region lacks supporting public facilities.

First, charging in Europe is cumbersome and expensive. The density of charging piles in Europe is only one-third that of China, and they are quite costly. The average price of electricity for German residents is about 0.4 euros per kWh, while the price at public charging stations (such as Tesla charging stations) is about 0.7 euros per kWh.

Secondly, Europe's power infrastructure is severely outdated. On April 28 this year, a massive blackout occurred across Spain and Portugal, with some areas experiencing power outages for more than 24 hours, causing severe impacts. The cause of the incident was a mere instantaneous surge in the power grid, which is rarely seen in China in recent years.

With the advancement of electric vehicle technology, high-voltage platforms of 400V and 800V are now common, and the voltage of charging piles has been increased to 1000V, with peak power exceeding 400kW. This places a significant load on the power grid, and a few ultra-fast charging piles could potentially cause a grid collapse in some European countries.

On the other hand, the primary discourse power in electrification is held by Chinese automakers. Traditional fuel vehicle companies aiming to compete in the electric vehicle market must switch tracks and abandon many of their established advantages. Notably, Chinese automakers rely on their supply chain advantages to offer cost benefits that do not exist in other regions.

More importantly, transforming traditional production capacity is challenging. In Europe, where land is relatively scarce, it's difficult to build new electric vehicle factories, and most automakers can only opt to transform existing factories. However, the cost of transforming factories is much higher than building new ones, and it also results in greater personnel cost inputs, leading to high production costs for electric vehicles manufactured locally in Europe.

If Europe is facing these challenges, regions other than China in the global market are likely to have even more pronounced issues. This is the main reason behind the slow progress of automotive electrification, with outdated infrastructure severely hampering the development of electric vehicles.

No Turning Back

Despite the obvious disparities in the global market, for multinational automakers like Audi, it's challenging to press the pause button on electrification entirely. What they can do is delay the retirement of fuel vehicles, as Audi has done.

While electric vehicles face greater resistance in Europe, this does not impede the development of new energy vehicles in Europe or even the global market as a whole. Hybrid models, once disdained by traditional automakers, are becoming the new market mainstream. Hybrid models promoted by Japanese automakers are continuously expanding their market share due to their better fuel economy.

Industry experts predict that by 2030, the global market will form a "30%/30%/40%" pattern of pure electric/hybrid/fuel vehicles, with hybrids evolving from a "transitional technology" to a "core solution for the next decade."

This trend can be observed in recent market changes in Europe. Tesla, once highly regarded, has seen a significant decline in sales in 16 European countries, while sales of Chinese automaker BYD have successfully surpassed Tesla. Behind this shift is the advantage brought by BYD's DM hybrid technology.

In Audi's new strategic transformation, hybrid models will also be elevated to a more prominent position. The company plans to launch 10 plug-in hybrid models, including the A5 PHEV, covering main product lines such as A3, A6, and Q5, by 2025.

Meanwhile, in the Chinese market, Audi is pursuing a dual strategy. On the one hand, it will continue to promote electric models, develop new electric vehicle models based on the PPE pure electric platform, and introduce more domestic suppliers, including Huawei's intelligent driving system.

On the other hand, for fuel vehicles, Audi will invest more in intelligence that aligns with the Chinese market, including introducing Huawei's advanced driver assistance systems, column-mounted shifters, and intelligent cockpits to fuel vehicles, enhancing their competitiveness.

The objective factor behind the temporary halt to full electrification is operational issues. According to financial reports, Audi's parent company, the Volkswagen Group, incurred a loss of 2.1 billion euros in its electrification business in 2024, with each Audi Q4 e-tron incurring a loss of 1,500 euros. With the Volkswagen Group's operating profit declining, it can only cut loss-making businesses to improve its financial situation.

In particular, the fuel vehicle business remains Audi's primary source of revenue, contributing 65% of profits and accounting for over 90% of sales. Abandoning the fuel vehicle business would essentially sever Audi's lifeline.

The temporary halt to electrification is merely a stopgap measure for Audi in response to changes in the global automotive industry. The binary opposition between oil and electricity is difficult to establish in reality, and for the foreseeable future, a coexistence of oil and electricity will prevail.

At the same time, for markets like China with strong penetration of new energy vehicles, Audi's temporary halt to electrification may not necessarily be a negative development. On the one hand, traditional luxury brands, including Audi, are already witnessing their discourse power weaken in the wave of electrification. Many consumers do not consider traditional BBA models when considering electric vehicles, focusing instead on new entrants and other brands.

On the other hand, Audi has established its market presence in China through various fuel vehicle models and technologies. Fuel vehicle models are the foundation of the market, and hybridization could actually be a better selling point. For instance, Buick GL8 achieved a resurgence in the MPV market through its plug-in hybrid technology route, and Audi could also strengthen its competitive advantage through a similar approach.

2025 will be a challenging year for multinational automakers. Faced with significant differences across different markets, it has become difficult to lead global development with a single strategy. Different strategies must be adopted for key markets. Even Japanese automakers, which have been slow in electrification, are gradually handing over the Chinese market to local joint ventures for leadership.

For other relatively weaker markets, the globalization strategy is still effective. However, for stronger markets, only differentiated business approaches can be properly addressed. As stated in the announcement issued by Audi China, facing the Chinese market, Audi can only continuously emphasize that it will not abandon its long-term goal of electrification, as electrification is the mainstream in the Chinese market.

Audi's shift reveals that "transformation endurance" is more crucial than "transformation speed." European automakers need to abandon the romantic narrative of "one-size-fits-all electrification" and seek a dynamic balance in profit protection, technology openness, and regional coordination.

Audi's temporary halt is by no means a step backward but a pragmatic self-rescue for the European automotive industry amidst institutional constraints, technological gaps, and market fragmentation. In the marathon of electrification, "flexible redundancy" is more sustainable than "betting everything on one card."

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.