Reassurance: Auto Replacement Subsidies Continue Despite Local Adjustments

![]() 06/20 2025

06/20 2025

![]() 683

683

One can quench thirst by merely imagining plums, or by drinking poison.

Recently, many salespeople have spread panic to close deals, falsely claiming that the national subsidy funding pool has been exhausted and that subsidies will soon be suspended. They even went as far as to compete for quotas across various counties and cities.

Indeed, a wave of auto subsidy suspensions has swept the nation recently.

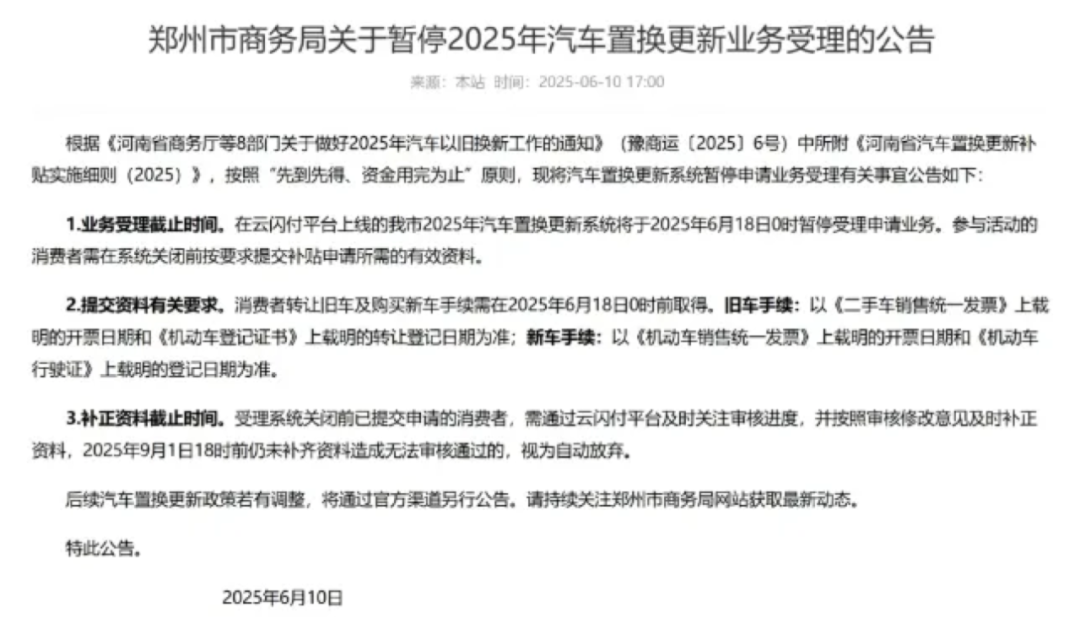

Luoyang suspended subsidies on June 12, Xuchang on June 13, Xinjiang fully suspended auto replacement and update subsidies from June 15 at 24:00, Zhengzhou suspended auto replacement subsidies from June 18, and Shenyang plans to suspend five subsidies, including auto replacement and update, from June 30 at 24:00.

Furthermore, cities such as Nanjing, Suzhou, Wuxi in Jiangsu, and Jiaxing, Huzhou in Zhejiang have already suspended subsidies at the end of May or the beginning of June.

Officially, the acceptance of auto replacement and update business for 2025 is suspended.

It's important to note that the word used here is "suspended," not "stopped." The National Development and Reform Commission (NDRC) and Ministry of Finance have stepped forward to urgently debunk these rumors, stating that the nationwide deadline for the 2025 national subsidy policy remains December 31, and the current suspension is merely a phased adjustment.

This year's total funding scale for the ultra-long-term special treasury bonds to support the trade-in of consumer goods is 300 billion yuan, a quota determined long ago.

To enable localities to use funds reasonably, orderly, and sustainably, this year's 300 billion yuan will be allocated in batches. Central funds totaling 162 billion yuan have already been allocated in January and April. The remaining 138 billion yuan of central funds will be allocated orderly in the third and fourth quarters, with local governments providing corresponding supporting funds and arranging sufficient local funds.

It's clear that the "national subsidy" will continue, providing reassurance to consumers who have been intimidated by the salespeople's panic.

Many consumers have become uncertain and started holding onto their money in anticipation of purchases due to the "suspension of subsidies." Many netizens have also suggested that relevant departments should use this suspension as an opportunity to improve policies, for example, by issuing auto replacement subsidies directly to individuals rather than benefiting enterprises.

Data from the Ministry of Commerce shows that as of the end of May, the number of applications for auto trade-in subsidies nationwide reached 4.12 million, with 1.23 million in May alone, a monthly increase of 13%. Notably, nearly 70% of private car purchases were from trade-in customers.

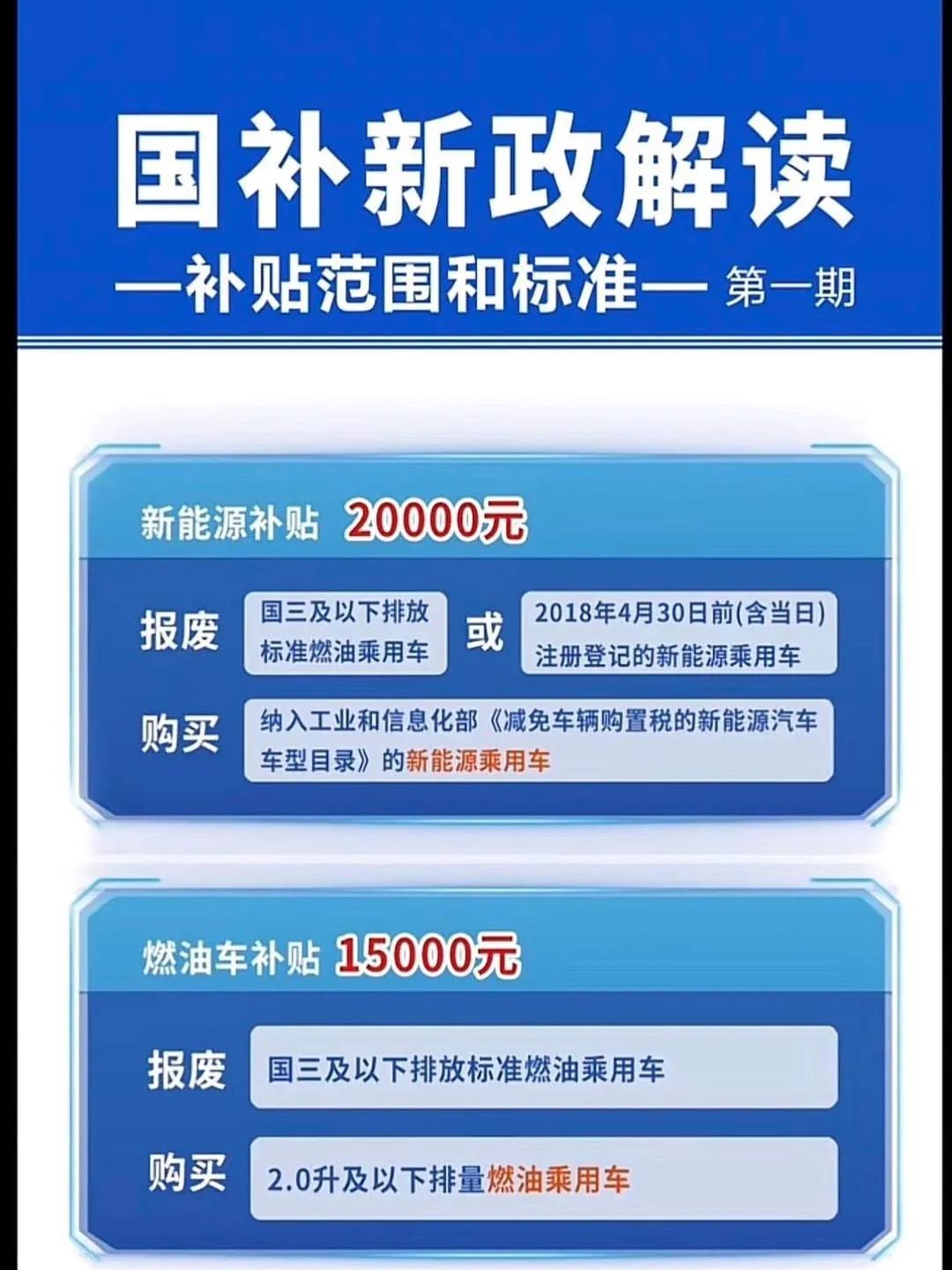

Calculating with a minimum replacement subsidy of 15,000 yuan, auto subsidies had consumed one-third of the entire funding pool by the end of May this year, indicating that a significant portion of the country's consumption subsidies flowed to the auto sector.

Many people wonder why the country's consumption subsidies go to enterprises rather than directly to ordinary people in the form of "consumption vouchers."

From a broader perspective, these 300 billion yuan in subsidies are intended to leverage trillions or even tens of trillions of yuan in consumption. If 15,000 yuan in consumption vouchers were issued, most people would only complete purchases worth 15,000 yuan. However, subsidizing the enterprise side aims to hope that this 15,000 yuan subsidy can leverage the consumption of 100,000-yuan cars.

The significance of replacement subsidies lies in expanding demand as much as possible. The latest data from the China Association of Automobile Manufacturers shows that in 2024, China's auto production and sales totaled 31.282 million and 31.436 million vehicles, respectively, representing year-on-year increases of 3.7% and 4.5%. China has ranked first in global auto production and sales for 16 consecutive years.

The auto consumption market has transitioned from incremental competition to stock competition. Simply put, there are fewer first-time car buyers, and the driving force for consumption lies with families that have replacement needs.

Replacement subsidies give consumers who may or may not buy a sense of getting a good deal, thinking, "I'll replace it sooner or later, so I might as well do it now while there are subsidies."

However, the policy has also given many merchants an opportunity to exploit the system. When the state encourages the elimination of old vehicles with real money, it instantly magnifies the industry of "zero-kilometer used cars," which operates in a gray area. Many merchants disguise new cars as used cars and "brush subsidies" through short-term ownership transfers, pocketing subsidy differences of up to 20,000 yuan.

Regarding this, BC has elaborated in detail in the article "If Selling '0-Kilometer Used Cars' is a Crime, Then We Are Willing to Surrender."

Typically, there is a disparity in policy understanding among policy makers, implementers, and supervisors.

From the perspective of automakers, the significance of replacement subsidies lies in helping enterprises eliminate outdated products before the new battery standard takes effect in July next year.

In the first half of this year, the mandatory national standard "Safety Requirements for Traction Batteries Used in Electric Vehicles" (GB38031-2025), formulated by the Ministry of Industry and Information Technology, was officially released and will be implemented from July 1, 2026.

The main revisions include amendments to the thermal propagation test, further clarifying the temperature requirements, power-on/off status, observation time, and vehicle test conditions for the batteries to be tested. The technical requirements have been adjusted from previously providing thermal event alarm signals five minutes before ignition or explosion to now requiring no ignition or explosion (alarm still required) and no harm to occupants from smoke.

Simultaneously, a bottom impact test has been added to assess the protection capability of the battery bottom after impact, and a safety test after fast charging cycles has been included, requiring no ignition or explosion after an external short circuit test following 300 fast charging cycles.

For the safety of electric vehicles, this is undoubtedly a qualitative improvement. Although some enterprises have stated that their current battery products already meet the new national standard, it remains questionable whether the new batteries have been fully switched and installed in vehicles.

In this regard, when China transitioned from National Standard V to National Standard VI a few years ago, the auto consumption market also experienced fierce price wars. This time, it is merely a matter of channeling the situation through the policy of replacement subsidies at the national level.

Additionally, replacement subsidies aim to stimulate consumption and leverage consumers who may or may not buy, which can also be seen as a form of encouraging premature consumption. However, the benefits are evident, as it can help stabilize GDP growth in the first half of this year to a certain extent.

Compared to previous cycles requiring massive funds from large-scale infrastructure projects and demolitions to navigate troughs, this series of stimulus subsidies is merely a drizzle.

For the auto industry, this is a timely relief. After all, one can quench thirst by merely imagining plums, or by drinking poison.

When subsidies decline, what should remain is not a policy vacuum but a more resilient and innovative industrial ecosystem. This may be the ultimate value of trillion-yuan investments.

At this point, discussing whether China's auto consumption market is policy-driven or market-driven may have lost its meaning. It is foreseeable that after consuming next year's sales in advance and losing the support of subsidies, there will undoubtedly be intense competition among auto enterprises, with some taking the initiative to bear the cost for consumers for a period of time.

What kind of fierce competition will auto enterprises face?

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.