How Tesla Navigates the Challenges of the Global Electric Vehicle Market

![]() 06/20 2025

06/20 2025

![]() 477

477

Original content by New Energy Perspective (ID: xinnengyuanqianzhan)

Full text: 2751 words, reading time: 8 minutes

Tesla, once a revolutionary force in the electric vehicle industry, now finds its sales curve plummeting like an out-of-control vehicle careening off a cliff.

The China Passenger Car Association estimates that Tesla's wholesale sales in China fell to 61,662 units in May, a year-on-year decrease of 15%, marking the eighth consecutive month of decline.

Image/Wholesale sales of new energy passenger vehicles in May 2025 (including estimates)

Source/Screenshot from New Energy Perspective on the internet

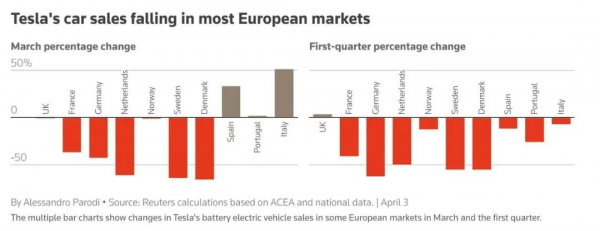

In Europe's major markets, Tesla's situation is even grimmer. In May, new car sales in the UK plummeted by over 45% year-on-year; new car registrations in Germany fell by 36.2% year-on-year; sales in France decreased by 67% year-on-year; and new car registrations in Italy fell by 20.32% year-on-year.

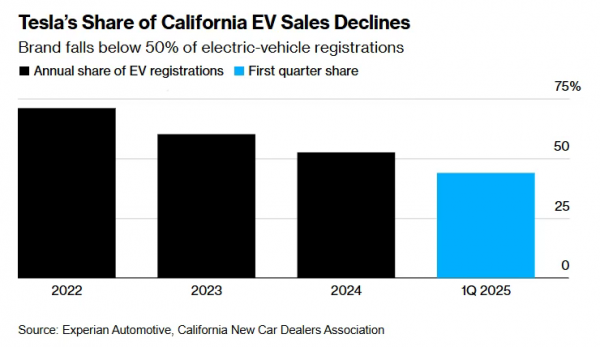

Perhaps the most humiliating blow for Tesla is its loss of the "home base" of electric vehicles in the US. Data shows that Tesla's market share in California slipped to 43.9% in the first quarter of this year, the worst performance since entering the market in 2012.

The three major markets of Europe, the United States, and China, like three axes, announce the downfall of the electric vehicle giant.

The decline had early warning signs. While Musk talked about colonizing Mars on the X platform, Chinese competitors were relentlessly improving their battery, electric drive, and electronic control systems. When he indulged in political maneuvering, 67% of Americans refused to buy Tesla, the Dutch Consumer Association initiated a joint boycott letter, and Tesla's brand favorability in the UK plummeted to 11%...

Tesla's global market share has plummeted from 26% in 2023 to 9.7% in the first quarter of 2025.

Musk's "Iron Man" aura ultimately couldn't withstand delayed product iterations, geopolitical backlash, and a global "technological equality" revolution.

1. US Market: The Base Camp is Taken

The US market, once Tesla's stronghold, is now a microcosm of its decline. In California, the "birthplace" of Tesla, a betrayal is unfolding.

In the first quarter of 2025, Tesla's market share in local electric vehicles plummeted to 43.9%, falling below the 50% warning line for the first time since 2012. Ironically, while overall electric vehicle sales in California grew by 35%, Tesla's registrations declined by 15% against the trend.

Image/Tesla's market share in California from 2022 to Q1 2025

Source/Screenshot from New Energy Perspective on the internet

The once dominant Model 3 has become an "antique" – nine years old without a replacement. When Chinese automakers continuously launch new models with an 18-month development cycle, Tesla's seemingly "archaic" interior, incomprehensible infotainment system, and unreasonable navigation planning have become major pain points for users.

These persistent issues directly led to a 35.9% drop in Model 3 registrations in California, even being overtaken by the Toyota Camry with a slight advantage, creating an embarrassing record of an electric vehicle losing to a fuel vehicle for the first time.

Technological stagnation is just the prelude to the decline. American consumers are embracing the "hybrid revolution" with real money: in 2024, the penetration rate of pure electric vehicles fell from 12% to 9%, while sales of hybrid models surged by 24%. The Toyota Prius, with a combined range of 1,200 kilometers, sucks away Tesla's potential customers like a water pump.

Musk's adherence to the "pure electric only" theory encountered a harsh reality – when the range of the Model Y shrank by 40% during a cold snap, and owners waited in charging station lines for up to two hours, hybrid car owners had already filled up a tank of gas and sped away.

The final straw that broke the camel's back was the "political poison pill" planted by Musk himself. He took on a high-profile role as co-head of Trump's "Government Efficiency Unit" and led a plan to lay off 100,000 civil servants, instantly igniting a wave of protests in 30 American cities calling for "Tesla's downfall".

Image/Survey of 100,000 people in Germany: 94% would not choose Tesla

Source/Screenshot from New Energy Perspective on the internet

In the liberal stronghold of California, this aversion is particularly intense, directly leading to a 15.1% drop in Tesla sales in the state, with 43% of users stating they refuse to buy because of Musk. Over the past year, Tesla's sales in the US have declined by 26.77%, and Model 3 registrations in California have plummeted by 35.9%. Behind these numbers lies the gradual fading of Tesla's glory in the US market, and its position as a local giant has been completely shaken.

2. European Battlefield: Widespread Desolation

Upon entering the European continent, Tesla also encountered Waterloo. The demand for pure electric vehicles in the European market continues to grow, with sales of pure electric vehicles in major markets such as the European Union increasing by over 37% year-on-year at the beginning of this year. Surprisingly, under such favorable market conditions, Tesla, the former giant, experienced a sharp decline against the trend.

According to data released by the European Automobile Manufacturers Association, Tesla's sales in the EU market have continued to decline, with new car registrations falling by 50%, 47%, and 36% respectively in the first quarter of this year.

Germany, its largest market in Europe, suddenly lost the policy dividend it once relied on. After the German government canceled electric vehicle subsidies, Tesla became the biggest victim – sales in January dropped sharply from 3,150 units to 1,277 units; in February, there was a cliff-like drop of 76%; and in April, sales continued to plummet by 45.9% year-on-year, with only 885 units sold.

In the UK, Tesla's new car sales in May were only 1,758 units, a year-on-year drop of over 45% compared to 3,244 units in the same period last year, continuing the cliff-like drop trend of 62% in April.

It should be noted that the overall new car market in the UK is showing signs of recovery. In May, new car registrations in the UK increased by 4.3% to 144,098 units, of which pure electric vehicle sales increased by 28% year-on-year. Against this background, Tesla's sales performance is shocking.

Tesla's sales in France, the Netherlands, Norway, Denmark, and other countries fell by more than 60% – such large declines prompted media headlines to use striking terms like "cliff-like" and "halved".

Image/Changes in Tesla's EU sales in March and Q1 2025

Source/Screenshot from New Energy Perspective on the internet

Musk's political adventures ignited a nuclear explosion in Europe. Musk's increasingly obvious political tendencies in recent years are causing substantial damage to Tesla's brand image, especially in the more diverse and progressive European market. Musk's public support for European far-right politicians directly triggered a strong backlash from young European consumers.

For example, his open praise for German right-wing political parties enraged the entire mainstream society, from trade unions to politics. Germans angrily vowed never to buy Tesla again. When the brand went from being a "pioneer in environmental protection" to a "far-right symbol," the collapse of sales was inevitable.

However, it was the "dimensionality reduction strike" of the Chinese contingent that truly ended Tesla's dominance in Europe. They bypassed EU tariff barriers with plug-in hybrid models and achieved explosive sales growth with their product performance and affordable prices, diluting Tesla's market share.

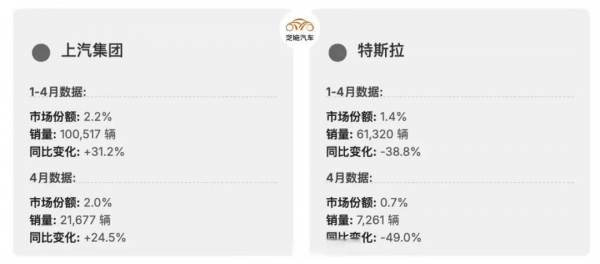

For example, SAIC's sales in the European market increased by 24.5% year-on-year in April, making it the top 10 automaker with sales of 21,677 units; while BYD's pure electric vehicle registrations in the European market also surpassed Tesla for the first time in April. Data shows that BYD's registrations increased by 169% year-on-year that month, while Tesla's fell by 49%.

Image/Sales data of SAIC and Tesla from January to April 2025

Source/Screenshot from New Energy Perspective on the internet

3. Chinese Market: Saturation Encirclement

In China, the "lifeline" of one-third of Tesla's global sales, the crisis seems to be even bloodier.

In February 2025, Tesla's wholesale sales were only 30,688 units, a year-on-year drop of 49.16%, directly falling out of the top ten in new energy sales. The once deified Model Y saw its market share shrink from 7.8% to 5.4%, becoming a second-tier player.

Image/Wholesale sales of new energy passenger vehicles in February 2025

Source/Screenshot from New Energy Perspective on the internet

The collapse began with the complete exposure of Tesla's technological shortcomings. The Model Y's 60kWh battery pack against Xiaomi SU7's 101kWh Kirin battery is like "a battle between a pager and a smartphone"; the 400V platform charges for 30 minutes to provide a range of 300 kilometers, while the ZEEKR 007's 800V high-voltage platform charges 500 kilometers in 12 minutes, leading users to joke that "you can eat two hot pots while Tesla is charging".

More fatal is the fiasco of the autonomous driving FSD entering China: the $6,400 optional package frequently shows "idiocy" under China's complex road conditions – it needs manual takeover to cross speed bumps, misidentifies tricycles, and mistakenly drives into flooded roads on rainy days. Owners sarcastically commented that Tesla's autonomous driving can only recognize the wide roads of Silicon Valley and cannot see the morning rush hour outside the Fifth Ring Road in China.

Image/Tesla FSD price

Source/Screenshot from New Energy Perspective on the internet

Obviously, Tesla's decline is due to both the complete collapse of its technological edge and the joint saturated encirclement of Tesla by Chinese automakers.

On the pricing front, Chinese new energy automakers, led by BYD, have reignited the price war, with some models even dropping prices by up to 53,000 yuan, once again pushing the once arrogant Tesla into a corner.

On the technology front, 24 new models are strangling the Model 3 in the 200,000-300,000 yuan price range: the ZEEKR 7X uses lidar and CDC electromagnetic suspension to create a "ground-hugging flight mode", the AITO Asker R7's HarmonyOS cabin enables seamless transfer between mobile phones and vehicles, and Xiaomi SU7 connects 800 million IoT devices, allowing users to start the home air conditioner just by shouting in the car.

Image/AITO Asker R7 - ZEEKR 7X - Xiaomi SU7

Source/Screenshot from New Energy Perspective on the internet

Faced with the encirclement, Tesla's "arrogance syndrome" is once again acting up, accelerating its decline.

The Shanghai factory has repeatedly suggested adding seat ventilation and a co-pilot screen, but the US headquarters rejected it with the reason of "global unified design"; the Model Y facelift only changed the bumper, leading sales to joke: "Our facelift is simpler than applying a phone screen protector."

When local competitors iterate with an 18-month development cycle, Tesla's product line, which has not been replaced in five years, completely exposes "muscle atrophy" – it's not that China doesn't need Tesla, it's that Tesla needs to relearn China.

The defeats on the three battlefields reveal the same truth: Tesla's crisis is a "triple noose" of product iteration, geopolitics, and technological generation gaps.

When the Model Y is called a "living fossil" in Europe for not being updated in five years, when Tesla stores in California are vandalized due to Musk's political shows, and when Chinese users crush the FSD with Xiaomi SU7 – what Tesla needs is not just autonomous taxis and cheap new cars, but a complete reconstruction from technology, culture to business logic.

Now, Musk has abandoned politics and returned to business, fully returning to Tesla's operations, and even announced the resumption of a 007 work schedule. But is Tesla, which has suffered serious damage, so easy to heal?

[The lead image is generated by AI]