Small and Medium-sized AI Enterprises Struggle to Pass the 'College Entrance Examination'

![]() 07/04 2025

07/04 2025

![]() 770

770

As soon as the college entrance examination concludes, large AI models worldwide become exceedingly busy.

Models such as Doubao, DeepSeek, ChatGPT, Yuanbao, ERNIE Bot, and Tongyi Qianwen have sparked a wave of 'AI exam fever'. Reports indicate that during last year's college entrance examination, the scores of these large models barely crossed the threshold for first-tier universities, but this year, they have collectively advanced to the elite 985 universities. Notably, Doubao is said to have even surpassed the admission lines of Tsinghua and Peking Universities.

While the top-tier large models are enjoying themselves in the 'exam hall' of the college entrance examination, small and medium-sized AI startups find themselves in an increasingly precarious situation.

In the first half of this year, five of the once-popular 'Six Little Tigers' of large models witnessed changes among a total of 13 AI executives. Wave Intelligence has recently dissolved, Zhujian Intelligence has been halted for six months due to cash flow pressures, overseas Stability AI lost over US$30 million in the first quarter of 2024, and Scale AI was acquired by Meta.

Broken capital chains, the brink of bankruptcy, seeking sales... These have largely become the common plight of small and medium-sized players in the global large model industry. Data from last year revealed that from the release of ChatGPT to July 2024, 78,612 newly registered AI enterprises in China disappeared, accounting for 8.9% of the total new additions during the same period.

By 2025, with large enterprises further diversifying, opportunities for small and medium-sized AI startups will diminish.

Talent, capital, technology, traffic... What remains for small and medium-sized AI enterprises?

As of the end of February 2025, the user base of domestic AI-native apps reached 240 million, with a monthly growth rate of 88.9%. By March 2025, DeepSeek led the AI-native app industry with 194 million monthly active users, followed by Doubao and Tencent Yuanbao with 116 million and 41.64 million monthly active users, respectively.

However, in 2024, the top three applications were Doubao, Kimi Smart Assistant, and Wenxiaoyan. Kimi's decline was particularly stark, with only 18.2 million monthly active users, far fewer than Doubao, which was once its peer. In fact, the shifting rankings over time offer insight into the situation of small and medium-sized enterprises.

Talent, capital, technology... The three indispensable elements in the AI race are fading away from small and medium-sized enterprises.

First, regarding talent, the scarcity of talent in the large model race has been comparable to that of chips over the past year. Data shows that China has a shortage of over 5 million AI talents, with a supply-demand ratio of 1:10, and basic-level talents are the most in demand. Nevertheless, AI startups represented by the 'Six Little Tigers' have experienced continuous talent loss.

Incomplete statistics indicate that at least 22 executives have left the Six Little Tigers since 2024. Interestingly, many of these departing executives have returned to the fold of large enterprises:

Several core members of ZeroOne have successively joined ByteDance; Duan Nan, the head of the video generation model at Jieyue Xingchen, joined JD.com; coincidentally, Scale AI was acquired by Meta, and its founder joined Meta to oversee AI business; last year, Lei Jun personally poached talent from DeepSeek, which became a trending topic on social media...

Why do talents that small and medium-sized AI startups cannot retain enter large enterprises? This is naturally closely tied to 'money'.

Reports indicate that large enterprises are generous when it comes to AI talent. According to Time Finance, the daily salary for intern positions in leading enterprises can reach up to RMB 2,000, and overseas enterprises are even more generous. It is reported that OpenAI offers generous stock options when poaching talent, with a median total salary reaching US$925,000 (approximately RMB 6.7 million).

In this inherently capital-intensive race, small and medium-sized enterprises obviously do not possess such a robust foundation, not to mention that AI enterprises have not had many opportunities for "serial investment" by capital.

Data shows that nearly 30% of "specialized, refined, innovative, and unique" small and medium-sized AI enterprises have received investment, but only 2% of those invested enterprises have received "serial investment", and even fewer enterprises have received investment from top-tier capital. Currently, capital investment in large models is becoming increasingly cautious. Taking Wisdom Spectrum, which was still raising funds in the first half of 2025, as an example, its single financing amount did not exceed RMB 1 billion.

Compared to last year, Wisdom Spectrum's cumulative financing amounted to nearly RMB 7 billion. In December 2024, its single financing amount reached up to RMB 3 billion.

Without capital, not only is it difficult to retain talent, but technological development also has to be temporarily halted. Reports indicate that up to 72% of IT and financial leaders say that AI costs are becoming "uncontrollable", gradually leading some enterprises to abandon training super large models. For instance, at the beginning of 2025, ZeroOne took the lead in adjusting its team, abandoning ultra-large models, and focusing on applications.

The scale of computing power and model performance are no longer the goals of AI startups.

This shift has also become the primary reason for the departure of technical talents. Not only ZeroOne but the expenditure of enterprises on large models accounted for about 25% of their innovation-specific budget a year ago, and today, it has dropped to 7%, which means that for the vast majority of enterprises, AI is no longer an exploratory project.

The dual shortage of talent and capital will ultimately be reflected in technology. According to "Industry Express", only about 11% of small and medium-sized enterprises in the AI race have innovative patent achievements in computer vision and natural language processing, and only 18% have patent achievements in large model innovation.

Currently, large enterprises are ambitious.

ByteDance, Tencent, Baidu... It seems that they are all determined to succeed in AI. Tencent Yuanbao invested approximately RMB 300 million in a month for traffic acquisition and promotion across Tencent's ecosystem of products; ByteDance launched more than a dozen AI applications simultaneously and strictly restricted advertising placement for non-ByteDance AI products.

This has forced other large models to use platforms like Bilibili, Kuaishou, and Xiaohongshu as their main traffic acquisition channels. As mentioned in Bilibili's financial report, as early as the first quarter of 2024, Bilibili's advertising revenue from the AI industry increased fivefold year-on-year, and the CPA offer given by Moon's Dark Side on Bilibili was as high as about RMB 30.

However, nowadays, this RMB 30 has become an unaffordable sum for "Moon's Dark Side" and other enterprises. Consequently, Yuanbao replaced Kimi to enter the top three AI applications. In 2025, large enterprises with money, power, talent, and technology will only become more dominant.

A capital game with 'ulterior motives'?

Currently, Baidu, Tencent, iFLYTEK, ByteDance, and 360 have all released AI application assistants. According to a report from Zheshang Securities, ByteDance's capital expenditure is expected to reach RMB 160 billion in 2025, doubling from last year's RMB 80 billion. In February of this year, Alibaba announced that it will invest more than RMB 380 billion over the next three years to build cloud and AI hardware infrastructure, with an investment amount exceeding the total of the past decade.

Unable to compete with large enterprises in terms of capital, talent, and traffic, small and medium-sized AI startups have moved beyond the stage of struggling with technology and turned their focus to other niche markets.

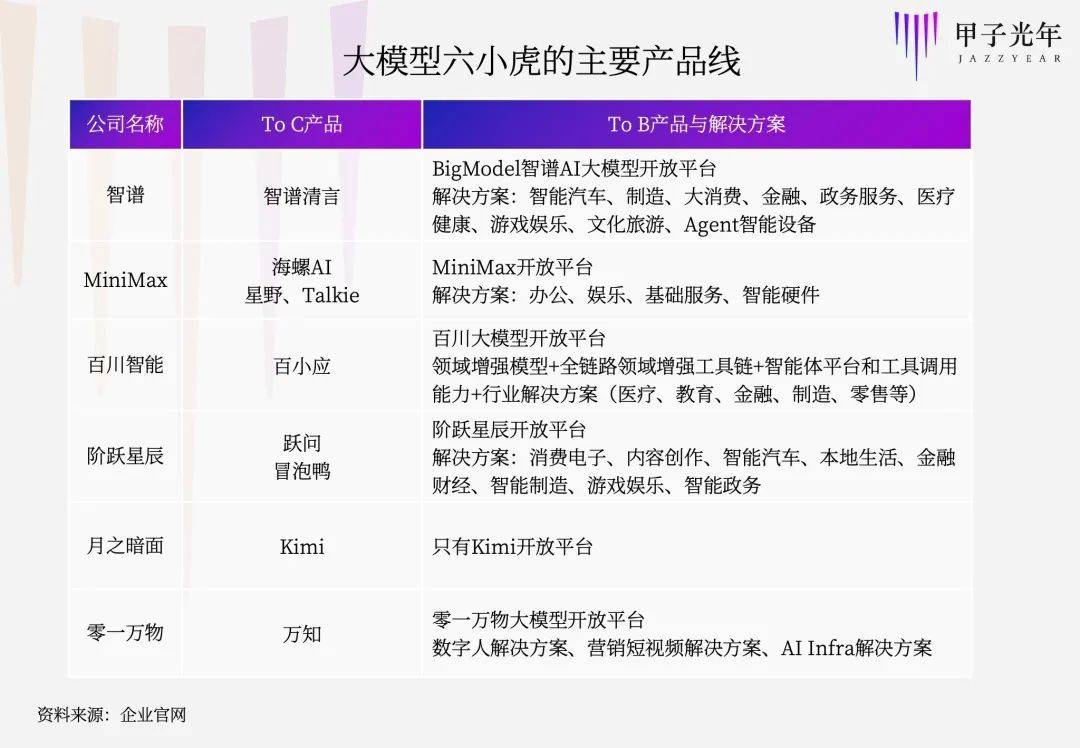

For example, Baichuan Intelligence disbanded its business groups responsible for finance and education, focusing on the medical AI track; MiniMax opened an API platform; Jieyue Xingchen reduced and adjusted its AI social tool "Bubble Duck" business and cooperated with leading enterprises in the automotive and embodied intelligence sectors to develop vertical agents; Moon's Dark Side bet on content communities to seek self-sufficiency.

It is evident that from C-end to B-end, with increasingly vertical businesses, this is currently the main direction of AI startups.

This is understandable, after all, by 2025, the trend in the AI industry has gradually shifted from basic large models to embodied intelligence, agents, and other application areas. To survive smoothly, startups need to further concentrate resources. Currently, the rate of return is not only troubling enterprises but also requires careful consideration by capital before entering the market.

Reports indicate that Wisdom Spectrum's commercial revenue growth exceeded 100% in the first 11 months of 2024. According to Caijing Magazine, Wisdom Spectrum's revenue in 2024 reached RMB 300 million, but its losses amounted to as high as RMB 2 billion, meaning that its commercial revenue has not yet covered its losses. In the second half of last year, Sequoia China internally reassessed its investment in AI large models.

Whether commercialization can be achieved has become the primary consideration of capital, and small and medium-sized enterprises must live within their means. Vertical tracks may still hold opportunities, and this change is even more pronounced in 2025, even globally.

According to data provided by venture capital firm UpHonest, in 2023, niche and segmented AI track startups accounted for 19% of the YC startup accelerator, while horizontal and general AI track startups accounted for 49%. However, by 2025, the proportion of AI startups in niche and segmented tracks increased to 40%, while those in horizontal and general tracks accounted for only 26%.

However, interestingly, while the Six Little Tigers struggle with financing and going public, domestic large model "top streamer" DeepSeek has always been vague about its capital situation. Since the beginning of 2025, there has been much speculation about DeepSeek's financing, but the company has never made a clear response regarding related financing.

On the evening of February 19, market news claimed that DeepSeek was facing urgent needs for computing power expansion due to its popularity and was considering external financing for the first time. Relevant personnel from DeepSeek pointed out that the financing news were all rumors. A while ago, there were rumors that Alibaba planned to invest in DeepSeek with a valuation of US$10 billion, which were subsequently denied.

To date, the financing situation of DeepSeek remains a mystery, and there are mixed opinions within the industry. Many believe that DeepSeek has the endorsement of Quant hedge fund HFT and may not be short of money, but this view seems somewhat "naive" compared to the burn rate across the entire AI race.

It is worth noting that in the AI industry, conflicts such as overlapping customer bases and interest divergences between capital and enterprises are becoming increasingly common, and OpenAI is no exception. Reports indicate that a large portion of OpenAI's revenue once had to flow back to Microsoft's cloud services business, its "golden sponsor". According to the profit-sharing agreement disclosed by both parties, Microsoft can obtain 75% of OpenAI's profits until its principal investment is repaid.

In fact, as early as 2023, there were reports that Microsoft had poached some major customers from OpenAI.

A typical example is Morgan Stanley, one of Wall Street's major banks and a "core customer" of OpenAI. It is reported that Morgan Stanley purchases some OpenAI model services through Azure. According to Microsoft's financial report, up to 18,000 customers purchase OpenAI software through Azure, higher than the 11,000 in August of the current year.

In 2025, cracks have appeared in the relationship between OpenAI and Microsoft, which may be a point of vigilance for DeepSeek.

For AI startups, it is becoming increasingly difficult to compete with giants for a share of the pie, and those with capabilities simply no longer insist on capital shelter but instead focus more on independence. In a capital game with "ulterior motives", life is becoming harder for other players.

Will small and medium-sized AI enterprises ever have a 'day in the sun'?

According to QuestMobile data, in March 2025, the monthly active users of AI-native applications reached 270 million. Compared to the total monthly active users of 1.259 billion on China's mobile internet, the penetration rate is only 21.4%; the average daily usage time of users is only 123 minutes. In other words, AI products have not yet formed a rigid demand in the entire internet industry. With further improvement in penetration, there may still be opportunities for new AI products in the future.

Small and medium-sized AI startups would rather bleed than withdraw, probably waiting for the next day in the sun. Not only in China but also overseas, according to data from the U.S. Bureau of Labor Statistics, the U.S. AI market is expected to reach US$126 billion by 2025, with most of this attributed to small and medium-sized enterprises.

But where lies the future of small and medium-sized AI enterprises? Simply seeking value in the B-end may not be reliable, after all, the price war for large model To B has already reached its extreme.

Taking Wisdom Spectrum as an example, the price of its model invocation has been reduced to nearly the lowest level in the industry, with the price of GLM-4-Flash being only RMB 0.06 per million tokens. Moreover, bidding for large models is basically converging towards large enterprises. In a statistic from the first half of last year, China Telecom, iFLYTEK, Baidu Cloud, and China Mobile won the most large model projects, respectively.

The thriving landscape of AI applications is intrinsically linked to the capabilities of foundational models. Currently, the prowess of these models directly shapes the user experience and can even dictate the success or failure of an entire enterprise. In March, DeepSeek's chatbot witnessed over 16.5 million monthly visits, a testament to its model's prowess.

When compared to the operational costs of other models, DeepSeek's surge in popularity is undoubtedly attributed to its model's capabilities. While smaller AI startups struggle, large corporations remain steadfast in enhancing their model's capabilities. For instance, ByteDance has invested heavily across the entire technology stack, encompassing computing power chips, cloud computing (Volcano Engine), model development, and application layers.

Furthermore, 2025 has heralded the "era of agents" within the AI industry. Even external players such as Ant Group, Qifu Technology, and other leading enterprises have officially launched financial agent products. Looking ahead, agents appear to be a central focus in the competition for large models.

As OpenAI CEO Sam Altman has publicly stated, "We will witness increasingly advanced models, but I believe the next significant breakthrough will emanate from agents." However, a Capgemini report reveals that only about 10% of enterprises have commenced using AI agents, with 82% planning to integrate them into their workflows within the next three years.

This presents a prime opportunity for small and medium-sized AI startups to seize.

Moreover, multimodal technology holds immense importance. According to Google's relevant reports, the global multimodal AI market is projected to reach $2.4 billion by 2025 and soar to $98.9 billion by the end of 2037. Industry insiders believe that a unified multimodal large model can address all comprehension challenges, with the primary value of multimodal data being its potential to elevate the upper limits of intelligence.

Currently, one of China's prominent tech startups, known as the "Six Little Tigers," has set its sights on this domain. Public information indicates that Jieyue Xingchen, established just two years ago, has released a cumulative total of 22 self-developed base models, 16 of which are multimodal, accounting for over 70% of its portfolio, earning it the moniker of "multimodal king" within the industry.

As we near the midpoint of 2025 and witness AI applications like Doubao, DeepSeek, and ChatGPT gaining direct access to prestigious universities like Tsinghua and Peking, let us hope that in 2026, AI startups will possess the credentials to "pass the college entrance examination" and achieve even greater heights.

Dao Zong You Li, formerly known as Waidaodao, is a new media outlet within the internet and technology sphere. This is an original article, and any form of reprinting without retaining the author's relevant information is strictly prohibited.