AI Glasses: The Schrödinger's Circle of Mass Adoption

![]() 07/04 2025

07/04 2025

![]() 749

749

Source | BohuFN

AI glasses are perched at the precipice of widespread adoption. On June 26, Xiaomi officially launched its maiden AI glasses, priced at a competitive 1999 yuan. Presently, several models are marked 'out of stock' on Xiaomi's flagship store on JD.com. Recently, renowned analyst Ming-Chi Kuo also predicted Apple's AI glasses roadmap, anticipating a release in Q2 2027.

Moreover, the AI glasses market is bustling with activity, as both new entrants and established players flood the scene with new products. Meta announced a collaboration with EssilorLuxottica to launch Oakley Meta glasses; StarVision, the parent company of Baodao Eyewear, introduced NSVE x BleeqUp, an AI sports camera glasses co-brand; Liweike Technology unveiled three AI glasses simultaneously.

Overnight, AI glasses have seemingly transformed from a niche gadget to a mass-market product. However, over the years, they've repeatedly flirted with mainstream success, only to fade from public discourse once a major player enters the fray.

Yet, off the launch event stage, AI glasses remain a rarity on city streets. The reality is that they often falter at the threshold of explosion due to practical concerns like functional compatibility and price.

Nonetheless, the entry of Xiaomi, Apple, and other smart terminal giants, armed with robust technology and ecological resources, is poised to shatter existing technological barriers and consumer perceptions. AI glasses, long on the cusp of a breakthrough, may finally deliver the knockout punch.

01 Are AI Glasses Truly on the Verge of Mass Adoption?

According to incomplete statistics, over the past six months, more than 30 domestic and international manufacturers have released AI glasses, including tech giants like Xiaomi, Baidu, Meta, and StarNothing, as well as emerging brands like INMO Technology, Rokid, and ThunderBird, and traditional eyewear makers like LOHO and Baodao Eyewear.

Concurrently, the capital market has stirred. Since late last year, AI glasses-related stocks in the A-share market have seen continued strength. Around Xiaomi's AI glasses launch, several concept stocks recorded cumulative gains exceeding 10%.

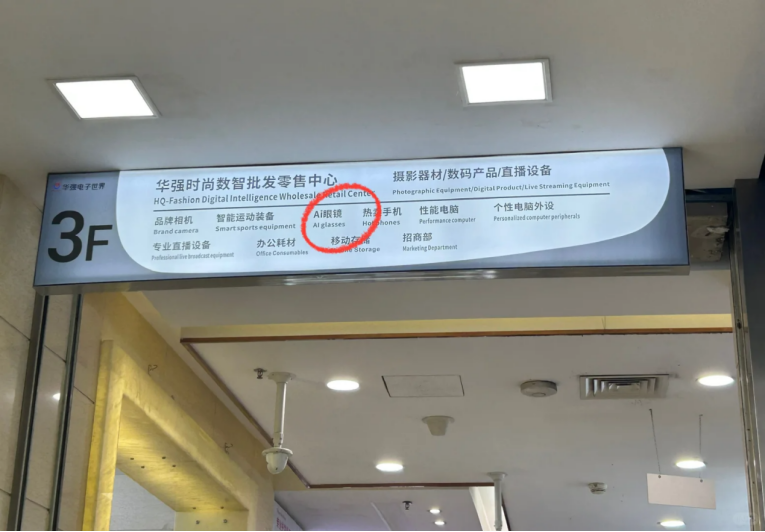

Even vendors in Shenzhen's Huaqiang North have sensed business opportunities. Some consumer electronics enthusiasts noted that stalls originally selling Bluetooth headphones have shifted to AI glasses, with 'big brand alternatives' prominently displayed.

Furthermore, data from various institutions supports the growing popularity of AI glasses. Sigmaintell predicts global sales will reach 5.7 million units in 2025, a year-on-year increase of 110%. CITIC Securities is even more optimistic, forecasting shipments of around 10 million units for the entire year of 2025.

Consumers surrounded by AI glasses appear to have reached a consensus: AI glasses are indeed on the brink of takeoff. However, looking back, smart wearables akin to AI glasses have already flirted with mainstream success multiple times.

Around 2021, AR/VR devices, epitomized by Meta Quest and ByteDance's Pico, garnered immense attention but ultimately fell into consumer obscurity.

In September 2023, Meta collaborated with Ray-Ban to create 'Ray-Ban Meta,' but users were more drawn to its fashionable design than its AI features. It wasn't until April last year, when the new Ray-Ban Meta integrated the Meta AI large model, that it was deemed a true 'intelligent assistant' akin to those in sci-fi films.

This product's popularity heated up the AI glasses market. In the second half of 2023, more tech companies and internet giants flooded into the AI glasses space, making the 'hundred glasses war' a focal point in tech circles for a time.

However, amidst this frenzy, AI glasses presented starkly different performances on data and user fronts. While AI glasses made rapid strides in marketing narratives, consumers remained in the 'wait-and-see' stage, far from 'embracing' them in real-world scenarios. Dai Qianhui, an analyst at Head Leopard Research Institute, noted in an interview that the current penetration rate of AI glasses in China is less than 1%.

On one hand, the surge in AI glasses shipments over the past year was built on a low base. In 2023, China's AI glasses shipments were around 500,000 units. It was only after the launch of the latest Ray-Ban Meta in 2024 that the AI glasses industry experienced a comprehensive explosion.

According to Wisdom Information, global AI glasses sales reached 2.34 million units in 2024, with Ray-Ban Meta accounting for over 95% of sales. This indicates that while the AI glasses market appears abundant, it's currently only sufficient to satisfy a niche audience. For instance, China's best-selling Leiniao V3 AI glasses have sold less than 1,000 units in the past 30 days on their e-commerce flagship store.

On the other hand, AI glasses still grapple with user experience deficiencies. Despite continuous miniaturization of components like chips, sensors, and batteries, it remains challenging to balance high computing power, long battery life, and wearability—an 'impossible triangle.'

While AI glasses' weight has been steadily reduced, with a common weight of around 40g, compared to traditional glasses weighing 20g-30g, consumers may still feel discomfort after prolonged wear. Additionally, insufficient battery life is a pervasive issue.

Furthermore, some AI glasses' intelligent functions face numerous challenges. For instance, AI functions are concentrated in low-frequency scenarios like question-answering, translation, and tour guiding, often requiring mobile phone operation, failing to form a closed ecological loop.

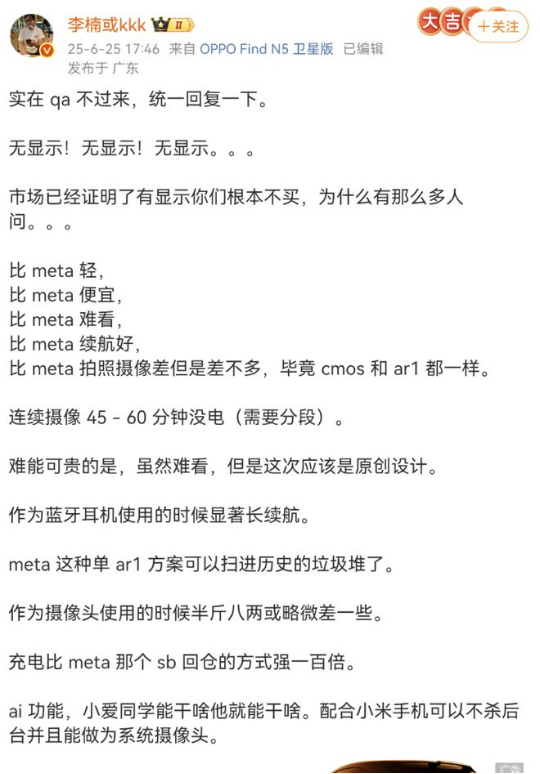

Li Nan, a former senior executive at Meizu, shared his views on Xiaomi's AI glasses via social media. He believed that Xiaomi's AI glasses surpass Meta in technological platform and battery life but rely heavily on XiaoAi Classmate, limiting their overall AI capabilities.

An electronics agent in Huaqiang North remarked, 'AI glasses equipped with large models are pricey. Most people buy them out of novelty, but not everyone wants to wear glasses. Headphones have a broader application range and are cheaper.'

When consumer novelty wanes, whether AI glasses are 'hot' or 'not' becomes akin to 'Schrödinger's cat.' Some see astronomical shipment growth, while others await a compelling reason to buy.

02 Land Grabbing and Playing the 'Ecosystem Card'

However, for most AI manufacturers, while product user experience is crucial, seizing the market first is equally vital. AI glasses are not just smart products but also traffic entry points connecting users with virtual reality.

Furthermore, a vast ecosystem lies behind AI glasses, but attracting developers and users is prerequisite. Only when most users start wearing them can AI glasses manufacturers continuously develop the ecosystem.

Therefore, since last year, major AI manufacturers have accelerated new product launches, targeting original AI glasses pain points for iteration and upgrade. For instance, in terms of price, AI glasses have become increasingly affordable.

Products that sold for tens of thousands of yuan three years ago now retail in the 2000 yuan range. Coupled with national subsidies including AI glasses in the scope of digital product subsidies, consumers can try them for as little as a few hundred yuan, further lowering the purchase threshold.

The change in weight is even more apparent. ThunderBird's new-generation AR glasses X3 Pro, leveraging full-color arrayed light waveguide technology, significantly reduces the optical module size, with the frame weighing just 76 grams. Liweike's City Air frameless model further cuts weight to 23 grams by omitting fancy features.

At the hardware level, AI glasses are converging with high-end smartphones. Xiaomi's AI glasses, for example, employ a dual-chip architecture comprising the Qualcomm Snapdragon AR1 chip and Hynix's BES2700H chip, capable of supporting complex tasks like real-time translation and intelligent object recognition while ensuring high-quality image output.

At the software level, glasses manufacturers are mass-deploying various AI functions. In this process, tech giants and AI glasses manufacturers have begun to 'marry' fervently, consolidating the smart terminal ecosystem.

For instance, Alibaba invested in ThunderBird Innovation to integrate payment, navigation, and social interactions through glasses, creating a 'new human-computer interaction entry point.' Li Shufu mentioned StarV Air2, a product under his StarNothing brand, in a recent public speech, highlighting it as a crucial part of Geely's 'mobile phones + XR + smart cars' business layout. Google announced a collaboration with Chinese company XREAL to jointly launch Project Aura, a new-generation AI glasses to be ecologically deployed on the Android XR platform co-developed by Google, Samsung, and Qualcomm.

From AI glasses manufacturers' actions, it's evident they're striving to dispel the perception that AI glasses are just 'gimmicky products.'

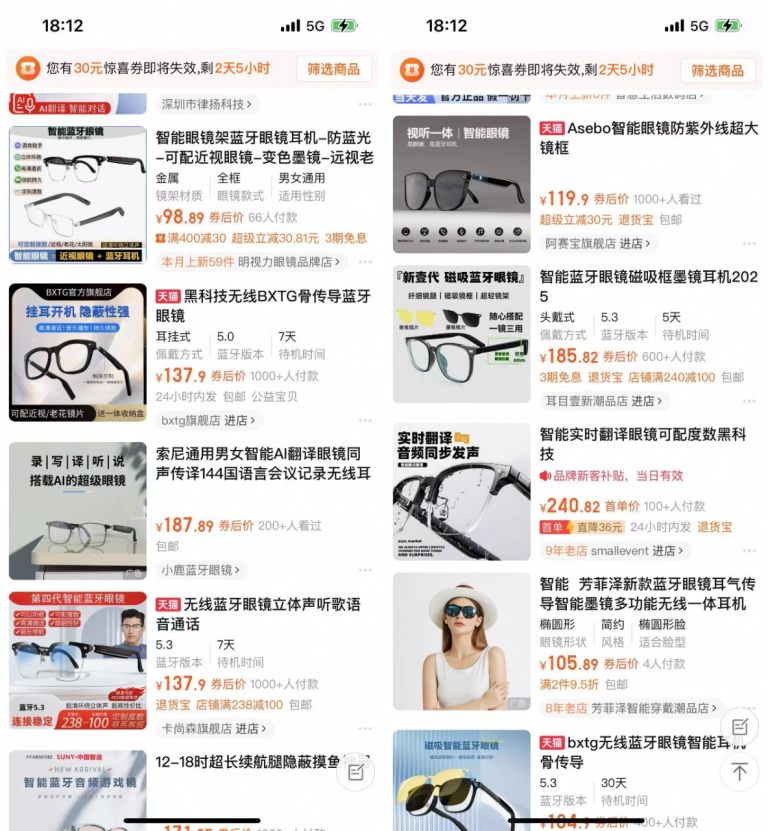

In fact, the hardware threshold for AI glasses isn't high, with many components already mature modules. E-commerce platforms even offer smart glasses within 100 yuan, equipped with basic functions like photography and video recording.

Thus, while thousand-yuan AI glasses offer more intelligent functions, consumers still frequently use them for photography, videography, and audio. Unless AI glasses can fully replace ordinary glasses, transforming from 'functional glasses' to 'conventional glasses with functions,' they'll remain dispensable in consumers' eyes.

Therefore, since this year, AI glasses manufacturers have not only improved the wearing experience and optimized design from a hardware perspective but also set higher software innovation standards, transforming AI glasses from 'nice-to-have features' to 'must-have scenarios':

For example, Baidu's XiaoDu AI glasses support real-time dialect translation and automatic meeting minutes generation. ThunderBird X3 Pro's AR navigation, developed in collaboration with Gaode Maps, projects route arrows directly onto real streets, freeing users' hands for navigation. The imagination of AI glasses in the application layer is further expanding.

03 Xiaomi, the 'Affordable and Abundant' Player, Arrives

However, for the industry to experience a comprehensive explosion, it seems an opportunity was lacking—until Xiaomi entered the fray.

Firstly, Xiaomi's AI glasses carry significant 'market education' weight. Xiaomi has always positioned itself as 'young people's first XX,' from home appliances, cars, to AI glasses. Relying on its 'technological equality' strategy, Xiaomi has become young consumers' go-to choice in various fields.

Lei Jun, Xiaomi's founder, mentioned at the launch event that 'AI glasses are the next generation of personal smart devices.' Xiaomi's AI glasses have successfully piqued consumers' curiosity and demand for this product. A Xiaomi Home store clerk noted that nine out of ten customers inquire about Xiaomi's AI glasses.

Secondly, besides brand appeal, the entry of smart terminal giants like Xiaomi and Apple will significantly drive related industry chain development.

Currently, the AI glasses industry is in its early exploratory stage, with most manufacturers exploring single-function breakthroughs. However, leveraging its globally established supply chain system, Xiaomi's supply chain control enables systematic optimization of modules like optical display, computing chips, and biosensors. This not only further reduces procurement costs but also drives innovation across the industry chain.

Thirdly, Xiaomi's ecosystem is key to AI glasses' integration into daily life. The market recognizes that 'hardware without an ecosystem' is AI glasses' biggest weakness. However, current AI glasses manufacturers hope to achieve scale first, then refine the ecosystem and products.

In contrast, Xiaomi has long been investing in a 'full-scenario ecosystem.' Besides smartphones, it boasts independently developed systems and a diverse range of ecosystem products, providing a solid foundation for Xiaomi's AI glasses to lead the market.

However, to win the upcoming long race, AI capabilities will be decisive. In this regard, internet giants possess stronger comprehensive strength, capable of connecting diverse scenarios like work, entertainment, and life to provide users with a seamless and intelligent experience.

It's foreseeable that the AI glasses industry may undergo a round of reshuffling in the future, with mobile and internet giants' advantages potentially accelerating mergers and acquisitions among smaller manufacturers.

Fortunately, the AI glasses industry remains in a relatively decentralized state. For manufacturers in this sector, those who enter the market early and effectively educate users on how to utilize AI glasses will have a distinct advantage in the long run.

The so-called "hundred glasses war" has commenced. With the entrance of prominent tech giants like Xiaomi, Huawei, and Apple, the initial ripples have begun, signaling the impending onset of a more tumultuous storm. How AI glasses will ultimately shape the future remains an open question, one that will be jointly explored by a multitude of participants.

The cover image and accompanying visuals of this article are subject to the copyright of their respective owners. Should any copyright holder feel that their work is unsuitable for public viewing or should not be used without compensation, please reach out to us promptly, and we will take immediate steps to rectify the situation.