Kuaishou Keling AI's Pursuit of a "Hollywood" Dream

![]() 07/25 2025

07/25 2025

![]() 600

600

Written by | Hao Xin

Edited by | Wu Xianzhi

This summer, a unique film titled "New World Loading" hit theaters, boasting a runtime of 180 minutes and being entirely produced by AI. With its concise narrative, rich elements, and visually striking scenes, many have likened it to an "AI version of Love, Death & Robots" (rated 9.4 on Douban).

The unsung hero behind this AI masterpiece, "Kuaishou Keling AI," harbors an ambitious "Hollywood" dream.

Last year, Kuaishou Keling collaborated with nine renowned directors, including Li Shaohong, Jia Zhangke, and Tim Yip, to launch the "Keling AI Director Co-Creation Program," resulting in nine AIGC film shorts. This year, in June, Keling AI participated in the "Jackie Chan A Plan Seventh Phase" training, where participants were tasked with creating AI film shorts using Keling AI tools within a limited timeframe and budget.

Kuaishou Chairman and CEO Cheng Yixiao mentioned that currently, paid subscription members from the prosumer (P) segment contribute nearly 70% of Keling AI's operating revenue. Here, P refers to professional users such as self-media video creators and advertising marketing professionals.

This explains Keling's high-profile approach to "face-brushing": to penetrate high-end circles, seek endorsements from industry professionals, create benchmark cases, and achieve widespread influence and word-of-mouth promotion.

Such tactics are common in the industry. In recent years, the technology sections of film festivals have almost become networking events for AI video companies, with founders personally presenting their projects to attendees.

What sets Keling AI apart is its ability to strike a balance between technology research and development, traffic exposure, and commercialization, with efficient and effective conversion being its key differentiators.

According to official Kuaishou data, in the first quarter of this year, Keling AI's revenue reached 150 million yuan. Just ten months after its launch (i.e., March 2025), its annualized revenue run rate (ARR) exceeded 100 million dollars, surpassing even the star AI programming product Cursor.

From traffic competition to commercialization and future territory planning, Keling is not just dreaming; it meticulously calculates every aspect.

Traffic Breakthrough

Since its inception, AI video has targeted both domestic and international markets.

Xie Xuzhang, co-founder of Aishi Technology, shared, "Enterprises involved in AI model applications must be prepared to go overseas from day one." Aishi Technology's AI video product, "PixVerse," launched its overseas version in early 2024 and its Chinese version, "Paiwo AI," in June 2024. By that time, PixVerse's cumulative global user base had surpassed 60 million.

Xie Xuzhang initially considered globalization for two reasons: first, to directly compete with strong players like Runway and Google, honing technical and product capabilities, believing that "a good product inherently possesses global appeal"; secondly, there weren't many players in the overseas AI video space at that time, and successful cases like Douyin and Kuaishou had already proven the strength of Chinese teams in video technology, making it worth a try given limited initial resources.

Relying on Kuaishou, Keling has a clearer path for globalization: traffic and user acquisition in the early stages, followed by commercial conversion in the later stages.

Whether domestic or international players, traffic investment marketing is the first step, but how to invest is crucial. On this issue, different companies have varying strategies.

According to Similarweb statistics (April to June 2025), Keling leads in external link traffic, accounting for 59.94%, with nearly 85% of traffic directed to its official website. Bytedance Jimeng has weaker traffic investment, with most traffic coming from its popular editing tool "Jianying." PixVerse's primary traffic conversion comes from the Apple website, with another portion coming from ChatGPT.

These three companies are currently the major players in the AI video space. Keling's main strategy is to focus on investing in its website, centralizing all traffic there. Jimeng relies on its ecosystem, gaining exposure through its popular products. PixVerse leverages the advantages of C-end social platforms, focusing its marketing efforts on the App side.

Traffic investment data is quite intuitive. According to June data from the AI Product Rankings, Keling has a clear advantage on the web side, with 16.31 million visits. Jimeng and PixVerse far exceed Keling in monthly active users (MAU) on the App side, with 30.12 million and 21.21 million, respectively.

While both invest in traffic, Keling chooses external link traffic diversion websites, which are cheaper than investing in Apps, with lower initial investment and maintenance costs. The benefit of centralized traffic investment is that it facilitates the cultivation of user usage habits in the early stages. Many functions of AI video require an immersive experience that relies heavily on the website. If Keling wants to retain professional users, it must let them try the full version of the functions on the website.

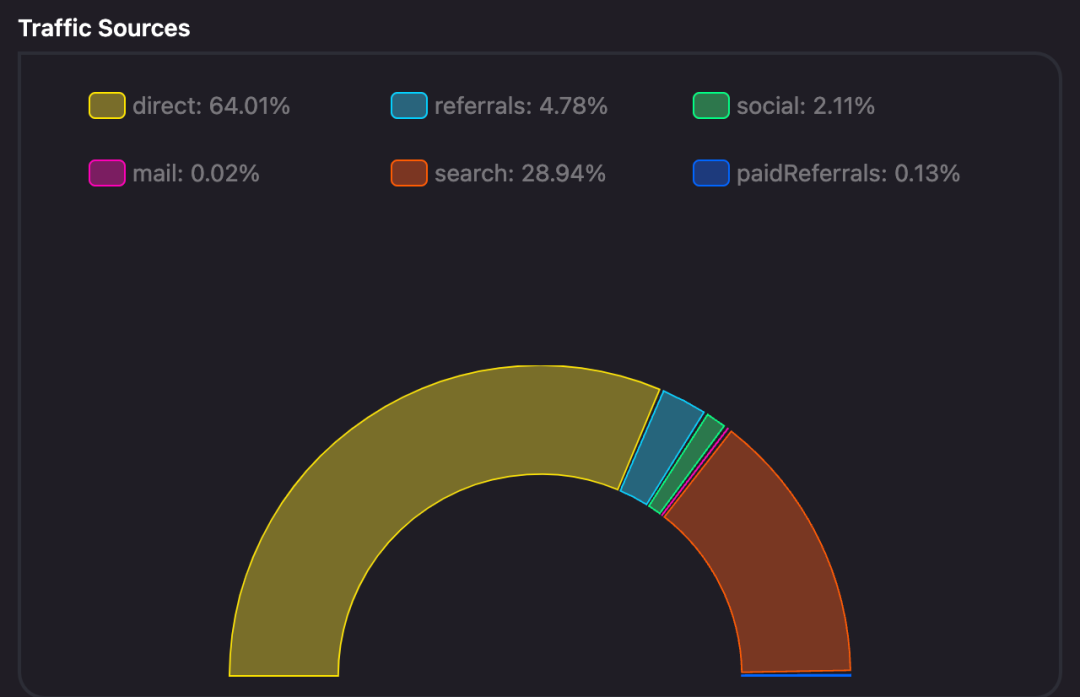

Tap4 AI data shows that the website traffic investment effect exceeds expectations, with Keling's current direct traffic accounting for 78.17%. This is a relatively high proportion, indicating that a significant number of users directly enter the website address or access Keling through bookmarks, gradually breaking free from complete dependence on website jumps. However, AI video will ultimately need to be transformed into a productivity tool, and the indicator reflecting this in data is the web page retention rate, an area where Keling still has room for improvement.

(Source: Tap4 AI website)

Compared to Bytedance Jimeng, Keling's shortcomings become apparent. Without substantial traffic investment, Bytedance Jimeng's App side achieved MAU growth through internal redirection, meaning Jianying users are also frequently opening Jimeng. From a data perspective, Jimeng's current MAU is nearly 15 times that of Keling. This may indicate that Keling's ecological advantages have not been fully unleashed, and the synergy between "Kuaishou-Kuaiying-Keling" has not yet been fully realized.

The first battle for traffic breakthrough is over, with Keling leveraging its website to drive traffic and increase the overall user base through volume.

As of April 2025, Keling AI's global user base exceeded 22 million. In the past 10 months, its MAU increased by 25 times, with over 168 million videos and 344 million images generated.

Monetization Conversion Rate

The website's disadvantage is that users often click and leave immediately. It's like a funnel where traffic rushes in and then disappears, making it difficult to retain high-quality users.

If you observe, AI video players on the market are all walking on "two legs": using the website to drive traffic and the App for conversion and monetization.

The App side is necessary as it can convert some complex processes into "one-click operations," such as encapsulating shot scripts and special effects parameters into drag-and-drop modules, while the web page requires multi-platform jumps. Like Jimeng, which is in the Douyin ecosystem, users are more accustomed to mobile operations. Popular special effects require access to mobile camera and album permissions, while also facilitating user sharing, all of which compensate for the deficiencies of the web side.

More importantly, a closed-loop payment system can be constructed within the App, enabling more mature commercial monetization and data asset accumulation. Therefore, taking the number of App downloads and revenue as reference dimensions can provide a concrete understanding of the commercialization of AI video products.

Here we select PixVerse and Keling for comparison. Although the two products have different routes, they each have their own strengths.

PixVerse is primarily C-end focused and once gained popularity with models and templates like "Venom," with its App surpassing TikTok to reach fourth place in the US overall rankings, and related video creations accumulating over billions of views on platforms like TikTok. Keling focuses on a professional and high-end route, generating several waves of popularity through model effects, which ultimately reflected in user scale and traffic.

For Apps mainly based on subscriptions or in-app purchases, there is a positive correlation between downloads and revenue.

Data shows that from July 31, 2024, to June 30, 2025, PixVerse's total downloads from the Apple Store were 42.37 million, with a total revenue of 3.02 million dollars (approximately 21.59 million yuan). The average revenue per download user is 0.07 dollars, with an open rate of 49.29%, an average of 15.62 sessions, an average session duration of 1 minute, and an average time per user of 17 minutes.

During the same period, Keling's total downloads from the Apple Store were 6.52 million, with a total revenue of 2.92 million dollars (approximately 20.88 million yuan). The average revenue per download user is 0.45 dollars, with an open rate of 39.53%, an average of 24.63 sessions, an average session duration of 53 seconds, and an average time per user of 24 minutes.

In terms of customer acquisition capabilities, PixVerse's total Apple Store downloads are 6.5 times that of Keling, possibly benefiting from its traffic investment on Apple and its low threshold and high universality, attracting more user downloads. Although Keling's download volume is slightly lower, combined with its revenue performance, it indicates that it does not pursue a "broad net" customer acquisition strategy but rather aims to attract "high-value potential users," employing a more precise customer acquisition strategy.

This is consistent with the P-end route mentioned by Cheng Yixiao, resulting in a high annualized revenue run rate and commercial monetization efficiency.

Keling's ARPU (Average Revenue Per User) is 6.4 times that of PixVerse, and with only 15.4% of PixVerse's downloads, its total revenue is almost the same, reflecting stronger user willingness or ability to pay for Keling, with a significant effect of its user screening strategy.

The above cases only reflect a corner of Keling's commercialization, but the signal they convey is clear: Keling has moved beyond the stage of purely pursuing scale to achieve high commercial returns, serving P-end and B-end professional user groups.

Imagination

Keling is highly valued within Kuaishou, prompting the establishment of the "Keling AI Business Unit" and ranking it as a first-tier business department alongside the main site, commercialization, e-commerce, internationalization, and local life. This is also the only newly established independent business unit at Kuaishou in the past three years.

For Kuaishou, Keling has long exceeded the significance of a single product, symbolizing Kuaishou's future to some extent. Keling has completed the phased verification of "technology-traffic-commercialization," and on this basis, it possesses both internal and external attributes.

The core of Keling's internal attribute is the "Ecosystem Synergy Amplifier."

Kuaishou's traffic and users can be deeply reused through Keling. By "targeted penetration" into groups such as e-commerce merchants and content creators, it precisely reaches high-value groups, reducing external customer acquisition costs.

Kuaishou's commercialization paths, including advertising, local lifestyle services, e-commerce, and live streaming, also provide ready-made landing scenarios for Keling. Keling can serve as a tool for Kuaishou e-commerce merchants, expanding B-end revenue; provide technical support for high-quality content creators, sharing in content revenue; and even become a value-added service item in Kuaishou's "membership system" to increase user pay rates.

The main external goal is for Keling to stand on its own and carry the banner of commercialization.

To date, Keling has established cooperation with thousands of enterprise customers, including Xiaomi, Amazon Web Services, Freepik, BlueFocus, NetEase, and more. The sectors where AI video can cut in are concentrated in e-commerce, internet services, gaming, automobiles, fast-moving consumer goods, and film and television.

Lemon Film's collaboration with Keling explores a new way of film and television promotion. For seven upcoming works, Keling was used to create AIGC dynamic posters. In cooperation with NetEase's "Ni Shui Han," it innovated the AI "image to GIF" gameplay, attracting players to pay by generating customized characters.

Photon Planet also learned that Keling has established a strong technical mindset in the AI video space. Although some large companies have self-developed video models, they still prefer to integrate the Keling large model in certain specific functions and ecosystem open systems.

However, considering the gradual nature of industry penetration, Keling's commercialization still faces many challenges.

Different industries exhibit variations. For example, in the gaming and internet services industries, there is a high demand for AI video generation, with relatively lax quality requirements and a higher adoption rate. In industries such as automobiles and fast-moving consumer goods, customers cherish their brand image "feathers" and are more cautious about AI tools, only occasionally using them to create an "AI feel."

This has led to uneven penetration levels of AI video. According to industry estimates, the overall penetration rate of AI materials is currently around 30%.

In sectors like e-commerce, gaming, and network services, the penetration rate of AI among certain typical customer bases has already surpassed 60%. However, in the film, television, and short drama industries, AI's usability falls short of expectations, primarily concentrated in the procurement phase. For operational tasks and entrepreneurial concepts, AI penetration stands at 50%, but this figure dwindles to 15%-20% when it comes to filming and post-production special effects.

Therefore, Keling's commercialization journey is still in its nascent stages, with various industries at varying points along the continuum from mere usability to optimal utilization.