Domestic AI Chip Market Ignites: Cambricon Aims to Raise 3.985 Billion Yuan, Intensifying Rivalry for Large Model Computing Power

![]() 07/25 2025

07/25 2025

![]() 620

620

By Yang Jianyong

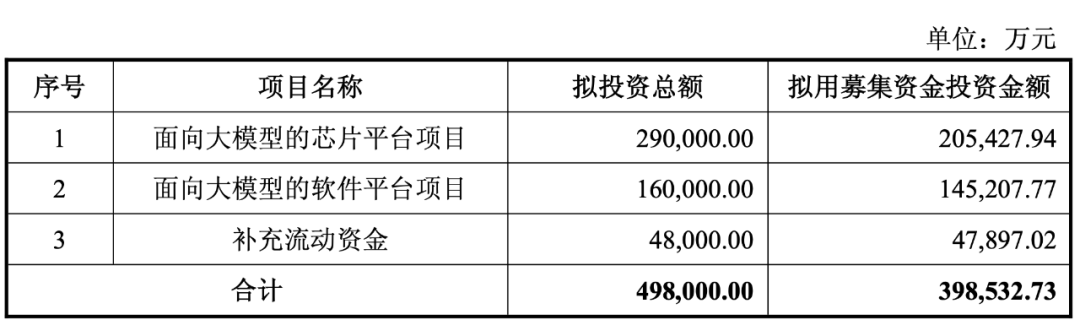

Recently, Cambricon announced adjustments to its private placement plan, aiming to raise a maximum of 3.985 billion yuan for projects focused on large model-oriented chip platforms, software platforms, and working capital supplements. Notably, this revised amount is nearly 1 billion yuan less than the initial private placement target of 4.98 billion yuan.

Cambricon's current private placement capitalizes on the new wave of AI development driven by large models. This fund-raising investment will further bolster chip R&D, design capabilities, technical reserves, and product competencies, thereby consolidating and enhancing its market competitiveness.

Since the launch of ChatGPT in late 2022, artificial intelligence has ascended to new heights, ushering in a new era of growth for the global AI market. According to IDC, the global AI market is projected to reach $632 billion by 2028.

Concurrently, the global semiconductor market is experiencing robust growth fueled by AI infrastructure construction and surging memory demand. Gartner data reveals that global semiconductor revenue will hit $655.9 billion in 2024, marking a 21% increase from 2023.

Overall, generative AI is accelerating industrial intelligence and propelling large-scale AI development worldwide. AI-driven demand for high-performance chips from large models is escalating daily, particularly for NVIDIA's high-performance chips, which have propelled the company to become the world's largest semiconductor chip manufacturer.

Benefiting from the significant surge in GPU demand, NVIDIA has soared to the top with revenues of $76.692 billion, surpassing Samsung Electronics and Intel for the first time.

It is noteworthy that the global demand for NVIDIA's AI chips is unprecedentedly strong, driving revenue multiplication and substantial profits. Consequently, the stock price has continued to rise, making NVIDIA the world's first listed company to surpass $4 trillion in market capitalization, a financial marvel and the planet's strongest stock with a current market value of $4.21 trillion (approximately RMB 30.2 trillion).

Undoubtedly, in the era of generative AI, NVIDIA stands as the biggest winner. However, in China, there is a formidable competitor, Cambricon, often referred to as the Chinese version of NVIDIA. Cambricon has also impressed in the capital market, with a market value that once exceeded RMB 300 billion yuan and currently stands at RMB 243.5 billion.

Cambricon's stellar performance in the capital market is primarily attributed to its breakthrough in large model technology, which has created unprecedented demand for AI computing power and opened a new era of growth, reversing its long-term loss dilemma. With revenues soaring, it has achieved profitability, reporting profits for two consecutive quarters. Secondly, investors are optimistic about the commercial prospects of AI, given the unprecedented opportunities presented by large models.

Influenced by the combined factors of large models' demand for AI chips, continuous operational improvements, and the creation of competitive products, Cambricon has secured a favorable position in the smart chip market competition.

It is worth mentioning that the AI chip sector where Cambricon operates is dominated by chip giants such as Intel, AMD, and NVIDIA. NVIDIA still maintains an absolute advantage in the global AI chip landscape.

Particularly, the recent lifting of the ban on NVIDIA's H20, a chip specifically tailored for the Chinese market, will allow it to re-enter the domestic market, posing significant competitive pressure on Cambricon. Technology giants will likely prioritize purchasing NVIDIA chips, with cloud computing giants like ByteDance and Tencent being key buyers.

For a considerable period, the development of AI large models by Chinese technology enterprises has heavily relied on NVIDIA's high-performance chips. Unfortunately, in recent years, the United States has restricted domestic enterprises from acquiring NVIDIA's high-performance chips, aiming to hinder the growth of China's AI industry.

However, due to China's restrictions on high-end chips, domestic substitution is accelerating. Notably, with the emergence of DeepSeek, which boasts excellent performance and open-source capabilities, various industries have fully adopted it, enabling more enterprises to deploy AI applications at low costs while aiding China in building its own AI ecosystem.

At the chip level, domestic AI chips are compatible with DeepSeek, further reducing reliance on high-end chips like NVIDIA, thereby fostering a software and hardware ecosystem for domestic AI chips.

Amidst the trend of domestic substitution, Cambricon, as a company focused on AI chip research and development, has achieved remarkable revenue growth this year. In the first quarter of 2025, revenue reached 1.11 billion yuan, a year-on-year increase of 4230%, with a net profit of 355 million yuan, marking profitability compared to the same period last year.

Finally, large models' billions of parameters consume immense computing power, leading to a significant increase in demand for computing power. Simultaneously, all sectors are striving to reduce their dependence on NVIDIA.

As a result, Cambricon has also embraced a historical opportunity in large models, with a 42-fold revenue increase in the first quarter serving as the best evidence. By leveraging the newly raised funds, it aims to enhance AI chip technology and gain the competitive edge to rival international chip manufacturers, supporting the domestic AI chip industry's bright future.

Yang Jianyong is a contributor to Forbes China and expresses his views solely as an individual. He is dedicated to deeply interpreting cutting-edge technologies such as artificial intelligence, AI large models, the Internet of Things, cloud services, and smart homes.