"AI Godfather" Bows to China: The Unstoppable Rise of Domestic Computing Power

![]() 07/25 2025

07/25 2025

![]() 519

519

Author | Chuan Chuan

Editor | Da Feng

Jen-Hsun Huang's recent humility in China is undeniable.

Amidst the cicada's chirping in Beijing's midsummer, Huang stepped into the Chain Expo venue donning a Tang suit, creating a symbolic moment in technology history. He even learned Chinese and delivered his maiden Chinese speech, marking a significant gesture.

This Silicon Valley luminary, famously known as the "AI Godfather," has visited China three times in six months, signaling Nvidia's strategic anxiety about the Chinese market. When news broke that the US government had approved the lifting of the ban on H20 chips, the capital market erupted, and Nvidia's market value surged by RMB 1.16 trillion in a single day.

However, this boost for Nvidia masks a profound shift in the global AI industry landscape.

The Cycle of "Castrated Chips": A Dilemma in Technological Containment

The lifting of the H20 chip ban is essentially a phased product of the technological rivalry between China and the US.

This AI accelerator card, tailored for the Chinese market, boasts technical specifications that can be described as a "downgraded version" of Nvidia's product line: its peak computing power stands at just 15% of the flagship H100, memory bandwidth is compressed to 4TB/s, and interconnect speed is cut to 1/15.

This design of "making the best of a bad situation" stems from the US Department of Commerce's stringent application of the Export Administration Regulations (EAR), which, by precisely delineating technological red lines, maintains technological deterrence against China while preserving commercial maneuvering space.

Looking back to 2023, Nvidia launched the A800/H800 series in an attempt to break the blockade, but the US Department of Commerce abruptly added them to the control list in October of the same year.

This "Russian doll"-like technology blockade caused severe supply chain disruptions: the CTO of an autonomous driving company revealed that the 2,000 H20 chips procured in April 2024 were shelved due to the ban, with the testing restart alone costing RMB 8 million in labor expenses. What's more intriguing is that when H20 faced a second sales ban in April 2025, its inventory loss had reached USD 5.5 billion, directly leading to Nvidia's provision for a potential order impairment of USD 15 billion.

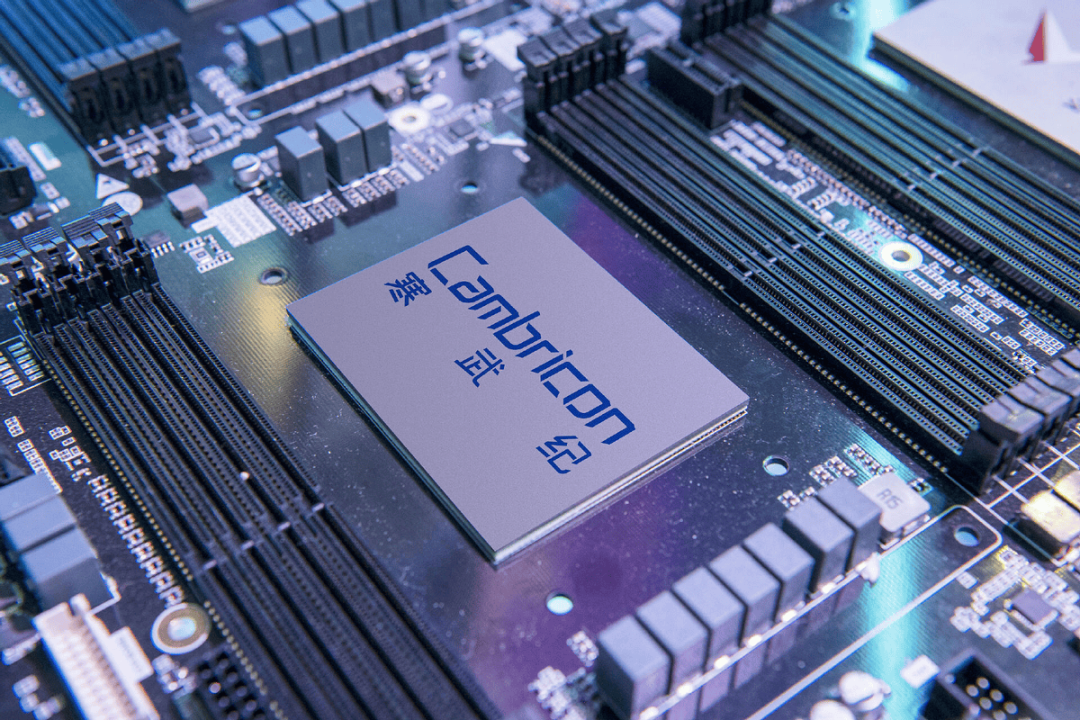

The side effects of this technological containment are evident. In 2024, Huawei's Ascend 910C surpassed H100 in actual test efficiency, Tianshi Intelligence's Tianshi Tianhai 100 achieved a market share of over 15% in the financial sector, and Cambricon's Thinker 590 stunned the market with a quarterly revenue growth of 42.3 times.

IDC data shows that in the first half of 2025, the share of domestic computing power reached 42%, an increase of nearly 30 percentage points compared to 2022. Huang Jen-Hsun acknowledged at Computex 2025: "Huawei's technological breakthroughs are rewriting the rules of the game."

The Collapse of Market Territory: A Retreat from 95% to 50%

The strategic value of the Chinese market to Nvidia is evident in Huang Jen-Hsun's jam-packed business schedule. During his third visit to China in 2025, he not only appeared at the Chain Expo in a Tang suit but also emphasized in Chinese at the media conference: "China accounts for 51% of global developers, and there is the fiercest competition for innovation here." Behind this overture lies a steep decline in Nvidia's market share in China, from 95% to 50%.

The sales ban crisis in Q2 2024 marked a turning point. When the H20 supply chain was disrupted, Chinese vendors swiftly filled the market gap within just three months: Kunlunxin's third-generation P800, Moore Threads' MTT S80, and other products achieved full production capacity, and Cambricon even recorded a quarterly revenue growth of 42.3 times. The head of an intelligent computing center in Shenzhen revealed: "The domestic chips we urgently procured at that time had slightly inferior performance compared to H20, but through model compression and algorithm optimization, the inference efficiency was actually improved by 18%."

The migration of AI laboratories is quite illustrative: researchers spent three months migrating the originally CUDA-based codebase to the Ascend platform, achieving 92% of the training efficiency of the original system. "Now students are more willing to try domestic frameworks," admitted the laboratory head, "just like when Android replaced Symbian, the openness of the ecosystem is crucial."

A Breakthrough in Independent Innovation: From Follower to Rule Maker

The rise of China's AI computing power is essentially a synergy of technology, policy, and market forces. In Qianhai, Shenzhen, the Yangtze River Computing G220K V2 server cluster supports smart city projects with a computing power of 230 EFlops per second, and its liquid cooling technology reduces energy consumption by 40%. This "hardware and software collaboration" breakthrough stems from the country's strategic support for the RISC-V architecture – the 2024 "AI Chip Industry White Paper" clearly included independent instruction sets as a key research direction, and the Ministry of Finance implemented a 200% additional deduction for R&D expenses for related enterprises, saving Cambricon alone RMB 1.2 billion in taxes and fees.

In terms of ecosystem construction, Huawei Ascend's "Computing Power Joint Laboratory" model is exemplary. Through cooperation with Sugon to achieve full-stack optimization of chips, servers, and operating systems, its Gui'an Intelligent Computing Center has shortened the interruption time for large model training to 2.8 days and recovery time from failures to just 10 minutes. This vertical integration capability is eroding Nvidia's competitive edge. The case of Horizon Robotics' Journey 6 chip is even more compelling: through an open platform strategy, its in-vehicle AI solutions have penetrated 10 mass-produced vehicle models, with overseas market growth reaching 45%.

In basic research, Chinese scholars are breaking through computing power bottlenecks.

The DeepSeek team developed the trillion-parameter model Kimi K2, which reduces memory requirements by 37% through mixed-precision computing, achieving a misdiagnosis rate of 0.3% in medical image analysis. This innovation not only secured a 50,000-unit order for Ascend chips from Saudi Arabia but also prompted the International Telecommunication Union to include Chinese technical standards in the AI governance framework.

Faced with the strategic value of the Chinese market, Nvidia adopts a "price for time" strategy. The upcoming GB200 chip is priced at USD 6,500-8,000, a 50% reduction compared to H20. Although its GDDR7 memory design improves energy efficiency, its computing power is only 20% higher than that of consumer-grade graphics cards. This "castrate and recastrate" strategy exposes the crisis of technological generational gap – when Huawei's Cloud Matrix 384's hierarchical communication mechanism reduces bandwidth consumption by 30%, Nvidia's architectural advantage is diminishing.

At the policy game level, disagreements have emerged within the US. The Trump administration attempted to exchange the lifting of the H20 ban for commercial benefits, but hawkish senators demanded a re-examination of export controls. This uncertainty has forced Nvidia to activate "Plan B": secretly developing the next-generation GPU architecture in Silicon Valley while increasing production capacity in Malaysia and Vietnam. However, the transfer of the industrial chain faces practical challenges – China boasts the world's most comprehensive semiconductor material supply chain, and in 2024, the revenue of 110 integrated circuit enterprises on the STAR Market grew by 22.2%.

In this protracted battle, China has demonstrated unique strategic resolve. The "East Data to West Computing" project promoted by the National Data Administration Bureau has formed eight hub nodes and ten data center clusters, with a total computing power exceeding 230 EFlops. When the liquid-cooled intelligent computing center in Gui'an, Guizhou, supports trillion-parameter model training with green electricity, Silicon Valley's carbon footprint becomes a vulnerability in its technological path.

The moment Huang Jen-Hsun removed his leather jacket at the opening ceremony of the Chain Expo symbolized the renewed recognition of the Chinese market by Silicon Valley elites. As the H20 chip returns to the market with a compromise mark, it faces a China that is no longer technologically dependent. From the cluster training of Ascend 910C to the edge inference of Jiangyuan D10, from Cambricon's financial risk control to Horizon's in-vehicle intelligence, China's AI industry is scripting a new technological paradigm.

The ultimate revelation of this game lies in: true computing power hegemony does not hinge on the nanometer competition of chip processes but on the ability to cultivate an open and innovative technological ecosystem. As 16 global AI chip enterprises announce compatibility with the DeepSeek model and the open-source community contributes over 100 million NPU IP cores, the world is witnessing a wave of democratization of computing power. As Huang Jen-Hsun admitted in an interview: "The future of AI lies not in the peak computing power of chips but in how to truly make computing power serve humanity." This may be the most profound annotation of this industrial upheaval.