As Humanoid Robots Approach Mass Production, Who Will Reign Supreme in the Industrial Chain?

![]() 07/25 2025

07/25 2025

![]() 445

445

When Zhiyuan Robotics sealed a mobile order worth 124 million yuan, the planetary roller screws nestled in a factory in Wuxi, Jiangsu, quietly rotated with pinpoint accuracy of 0.001 millimeters.

The outcome of this humanoid robot mass production race was unexpectedly dominated by an auto parts enterprise. Best, the unsung hero of turbocharger components, is charging into the core territory of humanoid robots with impressive momentum, sparking a wave of localization in precision manufacturing.

The "Steel Tendons" of Humanoid Robots.

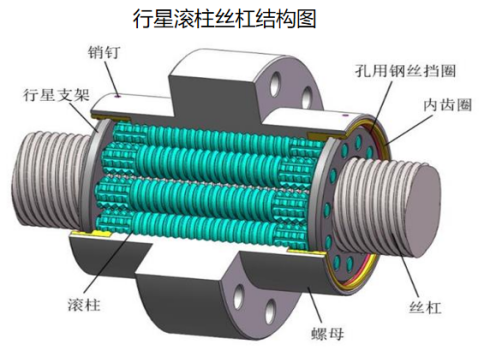

Deep within the joints of Tesla's Optimus, ten pencil-thick metal bars endure tremendous force. These planetary roller screws, priced at over 2000 yuan each, are Best's sharp sword aimed at the hundred-billion-yuan market. With a value share of 19%, they constitute the "most expensive joint," costing over 10,000 yuan per humanoid robot.

Boasting nanometer-level accuracy and a lead error ≤3μm/300mm (1/25 of a hair strand), this localization breakthrough shatters the 40-year monopoly held by Japan's THK and Germany's Schaeffler.

"It's akin to transforming rotating DNA into linear motion," explained the chief engineer in the lab. As the motor drives the nut to rotate, 32 hardened rollers revolve planetarily between the threads, condensing 98% transmission efficiency into a compact space. Behind this feat lies equipment investment worth hundreds of millions.

The German Liebherr grinding machine introduced in 2023 can sculpt the screw thread profile with an accuracy of ±1 micrometer.

The Arms Race in Screw Capacity.

Turbocharging Under the Wave of Hybridization.

While peers fret over the decline of fuel vehicles, Best has struck gold in the hybrid sector.

Turbocharger structural components serve as the "heart" of the AITO M5. The intermediate housing withstands temperatures of 1100℃, and the impeller spins at 200,000 RPM. With a value share of 30%, each set sells for over 800 yuan, boasting a gross margin of 38%. Hybrid dividends: Hybrid vehicle sales surged 80% in 2024, propelling the global market to $20 billion.

Lightweight precision parts include Tesla die-casting components and aluminum alloy controller housings with a 40% weight reduction. Hydrogen energy layout features fuel cell bipolar plates with a sealing accuracy of 0.05mm. Full coverage of the three electric systems includes on-board charger components already in use in BYD Dolphin.

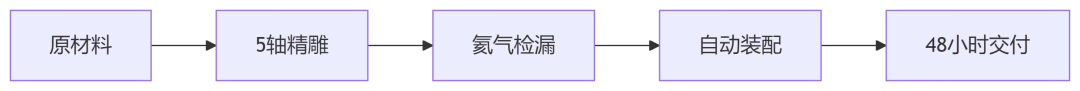

Even more daunting is its manufacturing prowess.

This production line has enabled Best to secure orders from 90% of the world's turbocharging giants, with Germany's Bohma Technology even labeling it a "zero-defect supplier".

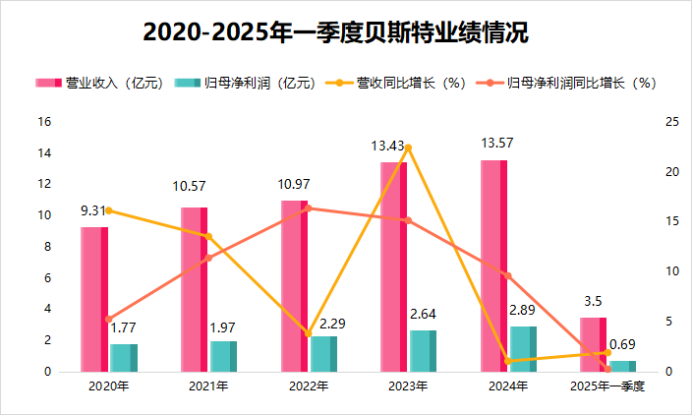

Financial report data reveals that Best's revenue has consistently grown from 931 million yuan in 2020 to 13.57 billion yuan in 2024, with net profit increasing from 177 million yuan to 289 million yuan. In the first quarter of 2025, the company achieved revenue of 350 million yuan and net profit of 69 million yuan.

The Secret to a 35% Gross Margin.

In an era where the manufacturing industry's gross margin has generally dipped below 20%, Best has maintained a gross margin exceeding 35% for five consecutive years, thanks to three formidable barriers.

1. Material Genome Database: High-temperature alloy formula with chromium, nickel, and molybdenum content precise to 0.01%. Vacuum melting technology with a porosity of <0.001%. Surface nitriding treatment achieving a hardness of HRC60+ (over twice that of a surgical knife).

2. Equipment Black Hole: German Kapp grinding machine with a roundness error of ≤0.5μm. Japanese Mazak turning and milling center boasting a positioning accuracy of 0.003mm. Self-developed visual inspection system scanning 200 feature points per second.

3. Automotive-Grade Quality Control: PPM (parts per million) <15 (industry average of 200). 24-hour temperature variation testing in the laboratory (-40℃ to 150℃). Full-process data traceability (each part has an "ID card").

"We manufacture turbines like Swiss watches," said Chairman Cao Yuhua, holding up a turbine wheel component. This component, with a rotor clearance of 0.15mm, determines whether the turbocharger can withstand centrifugal forces comparable to those in an F1 race car.

Three Critical Challenges for Mass Production of Screws.

Despite holding orders from Zhiyuan Robotics, Best's screw ambitions still face rigorous tests.

Mass Production Breakthrough Roadmap.

More critically, it's about cost. Raw material cost reduction by substituting bearing steel with bainitic steel, slashing the price by 40%. Process revolution with cold rolling forming replacing cutting, boosting material utilization from 30% to 85%. Equipment reuse by modifying turbine production lines to accommodate screw production.

"The unit price must drop to 1800 yuan by 2025," the production director decreed at the pledge meeting. This price will render domestic screws 35% cheaper than imported counterparts, fully igniting the mass production engine for humanoid robots.

The Fission Logic Behind the 289 Million Yuan Net Profit.

While peers witness profits dwindling in price wars, Best's financial report demonstrates remarkable resilience.

Double Helix Growth Structure: The fundamental automotive business, generating revenue of 13.57 billion yuan, provides stable cash flow (growth rate of 15%). The emerging core of robots, with an estimated gross margin exceeding 50% for the screw business. Capacity leverage: synergistic production of 5.6 million turbine parts and 500,000 screws.

Technology Monetization Formula: 1 patent = 3 new products = annual revenue of 50 million yuan. A total of 217 authorized patents. Patent product revenue accounts for 68%, representing the industry's highest R&D investment conversion rate.

With the release of 1.4 million new energy components, Best is forging a golden cycle of "automobiles nurturing R&D, robots generating profits." This explains why its valuation has leaped from 20 times PE in the manufacturing industry to 50 times PE in the robotics sector.

The "Chinese Time" of Precision Manufacturing.

In the temperature-controlled workshop in Huishan District, Wuxi, the newly launched planetary roller screws undergo final testing. The laser interferometer reveals a cumulative error of 2.8μm over a 300mm stroke. This figure not only surpasses the German DIN standard but also signifies the dismantling of the iron curtain of high-end monopoly in China's precision manufacturing.

From enabling turbochargers to operate stably at 400,000 RPM to crafting transmission joints as flexible as human tendons for humanoid robots. From serving the fuel vehicle era to empowering the humanoid robot revolution. Best's 20-year journey encapsulates China's manufacturing evolution towards "precision".

As Cao Yuhua inscribed on the latest screw sample: "All great machines begin with the persistence of 0.001 millimeters."

Note: (Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors act at their own risk based on this information.)

- End -