Billions of Capital Betting on AI Glasses: Who is Wagering, and Who Will Reign Supreme?

![]() 07/25 2025

07/25 2025

![]() 606

606

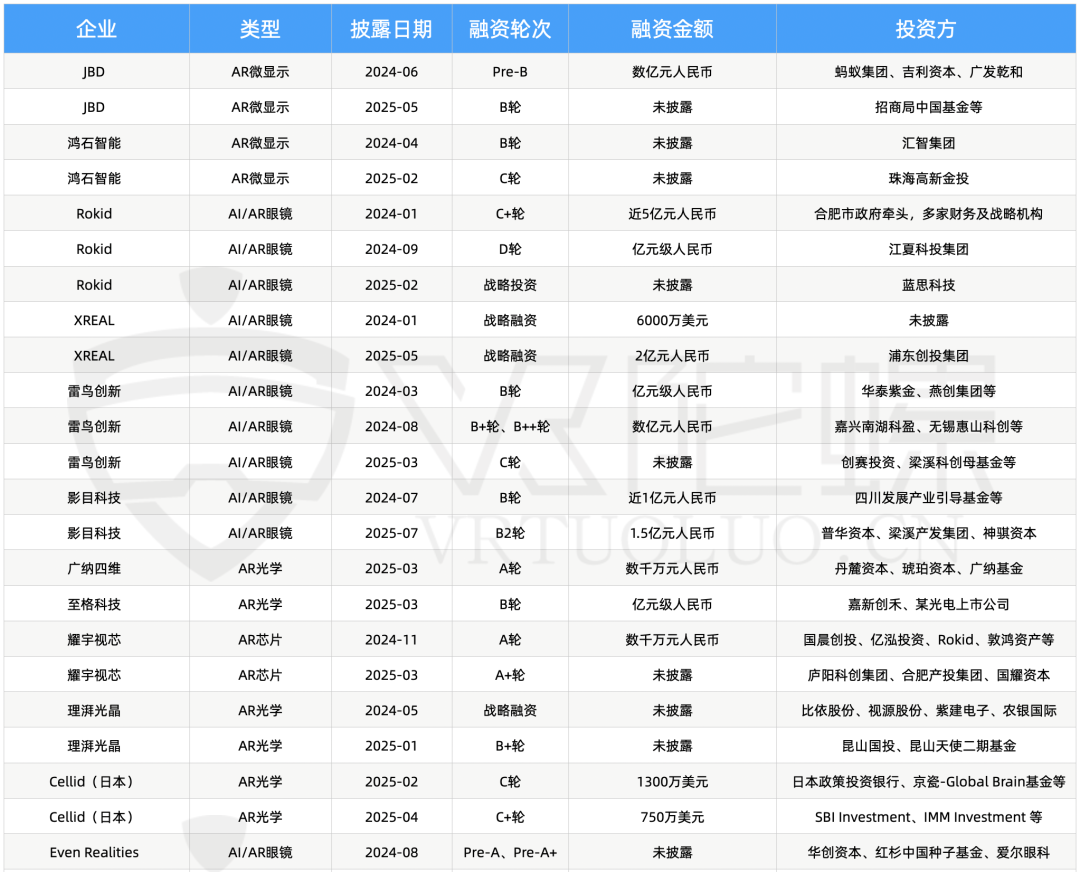

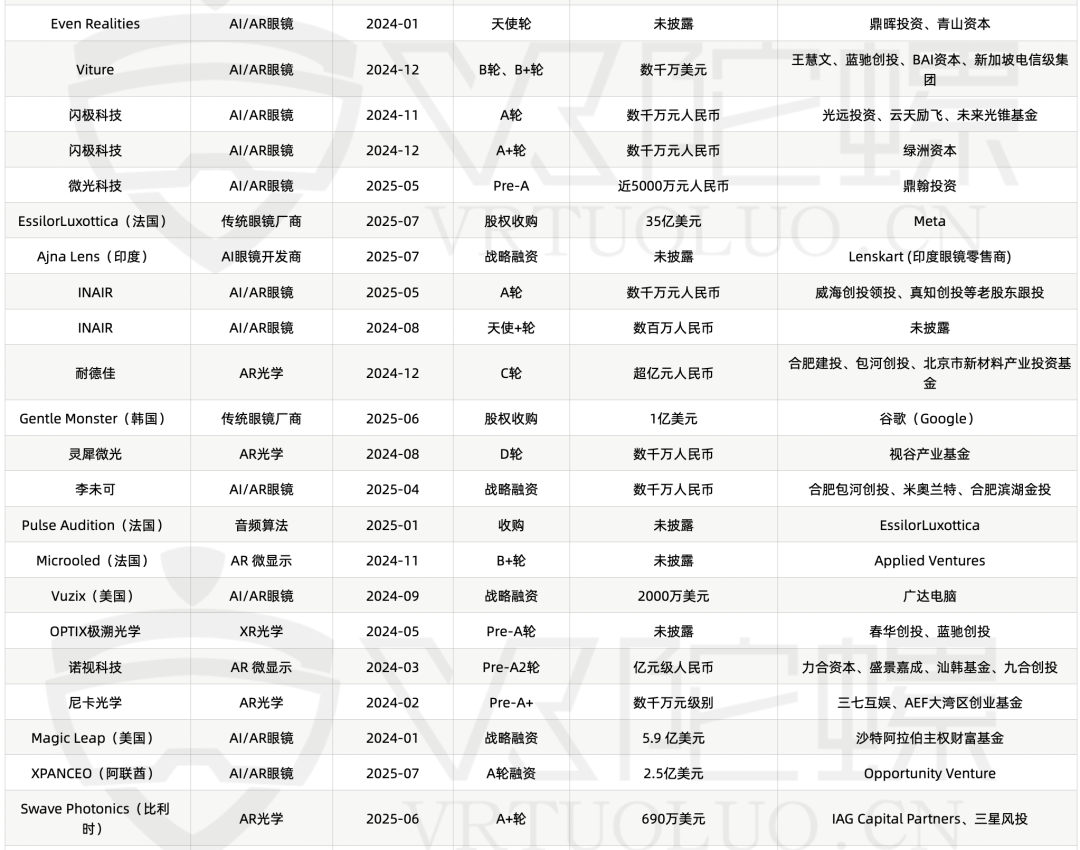

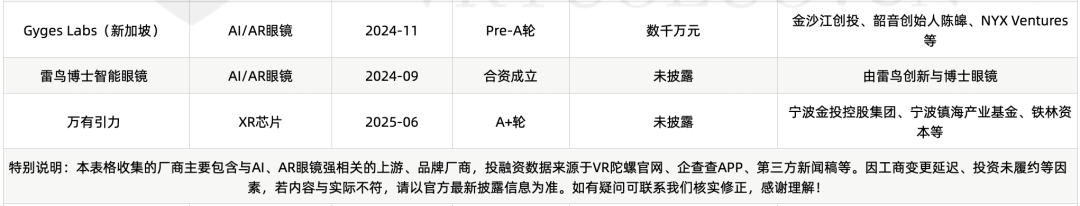

Since Ray-Ban Meta sales surpassed the million mark last year, the AI glasses industry has surged in popularity, and the capital market has followed suit. From tech giants to financial capital, government industry funds, and traditional glasses manufacturers, related investment and financing events have sprung up like mushrooms after rain.

According to incomplete statistics from VR Pandao, the total disclosed financing amount in this sector has surpassed ten billion yuan in the past year and a half. This influx of capital is reshaping this burgeoning technology industry with unprecedented force.

Capital Wind Vane: Where is the Money Flowing?

From the financing data, it is evident that most domestic funds have flowed towards brand manufacturers with core products and market influence. Concurrently, investment in upstream core supply chains also holds a significant position.

The brand side is the primary battleground for attracting capital. Brands such as LeTV Innovation, Rokid, INMO, XREAL, EVM, MultiScreen, and Shanji have all completed two or more rounds of financing in the past year, with amounts ranging from tens of millions to hundreds of millions of yuan.

Investors are heavily betting on brands because they directly control the relationship with end-users, manage the software ecosystem, and ultimately capture a lion's share of the profits in the product value chain. Capital is seeking the next "Xiaomi" or "Huawei," betting that brands can establish loyal user bases and insurmountable moats through high-quality software and hardware experiences and rich services. Related reading: "618 Report: AI Glasses Sales Increase 7 Times, LeTV Innovation Dominates Half the Market"

The upstream supply chain remains a "battleground that must be contested." On one hand, the core experience of AI glasses cannot be divorced from technological breakthroughs in "light, display, and chip." On the other hand, the business scope of upstream component suppliers usually extends beyond AI glasses, effectively diversifying industry fluctuations and possessing certain "hedging" attributes.

Since 2024, new rounds of financing have been completed by companies such as JBD, Hongshi Intelligence, Microoled (France), XR chip manufacturer YaoYuShiXin, WanYouYinLi, XR optics manufacturer GuangNaSiWei, and Nika Optics.

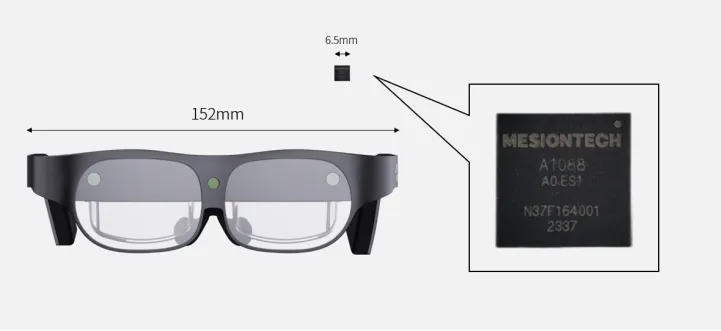

Taking YaoYuShiXin as an example, its first XR coprocessor chip A1088 can be applied not only in the VR/AR and AR-HUD fields but also extended to robots, drones, and other fields requiring computer vision processing. Related reading: "Exclusive | XR Chip Manufacturer YaoYuShiXin Completes Series A Financing, with Orders Reaching Hundreds of Thousands of Chips"

Of course, among the entire investment and financing landscape, giants are still more prominent. Meta's investment of up to $3.5 billion in EssilorLuxottica (share acquisition) is the largest single investment in the entire AI glasses investment and financing data. In addition, a series of "national team" investors are also highly visible.

National Team Efforts, Government Funds Actively Entering the Market

The "national team" capital led by local governments is profoundly impacting the industrial landscape, an upgraded version of the "investment attraction" model with distinct Chinese characteristics.

Local governments are playing the role of strategic venture capitalists, actively constructing localized, highly resilient, and globally competitive industrial clusters through equity investment. As China's "strongest venture capital city," Hefei's approach can be considered a textbook for industrial investment, and it is vigorously deploying in the AI glasses industry.

Since 2024, the Hefei Municipal Government has led the completion of nearly 500 million yuan in Series C+ strategic financing for the AR/AI brand Rokid and has also invested in upstream AR chip supplier YaoYuShiXin, AR/AI brand manufacturer LiWeike, and XR optics manufacturer Naidejia. Previously, Hefei also invested in Micro-LED microdisplay manufacturer JBD and Micro-OLED manufacturer Shiya Technology, the latter of which is currently aiming for a listing on the STAR Market.

Hefei's "Metaverse Industry Development Plan" released last year shows that by 2028, Hefei will establish a metaverse industrial cluster with nationwide influence. To this end, in terms of industrial agglomeration, Hefei will cultivate and introduce 300 metaverse ecosystem enterprises, build 20 leading enterprises in metaverse industry sub-sectors, and establish more than three metaverse industry innovation and development leading areas.

The Hefei model is also a template being replicated and promoted nationwide. In July 2024, Sichuan invested nearly 100 million yuan to bring the headquarters of AR manufacturer INMO Technology from Shenzhen; in August 2024, Jiaxing Nanhu injected funds into LeTV Innovation, and LeTV's XR optics R&D and manufacturing headquarters landed in Nanhu; in May 2025, Weihai Venture Capital led the Series A round with tens of millions of yuan to promote the relocation of MultiScreen (INAIR) headquarters from Beijing to Weihai, Shandong; in May 2025, Pudong Venture Capital Group made a strategic investment of 200 million yuan in XREAL and introduced the XREAL headquarters to Pudong...

To some extent, what the government is investing in is not just AR/AI glasses enterprises but the future of traditional electronics industry upgrades and digital transformations. Compared to the short-term VC model, its core objectives are more long-term and strategic: promoting local employment, attracting industrial clusters, enhancing supply chain resilience, and enhancing the overall reputation of the regional economy.

Reassessing the Channel Value of AI Glasses, Traditional Glasses Manufacturers Have Become Key Variables

In addition to investment and financing events by startups, we have also seen increasingly frequent moves by tech giants in the entire AR/AI glasses industry, and traditional glasses manufacturers have begun to appear on the list.

Meta's collaboration with EssilorLuxottica, the world's largest eyewear manufacturer, has set an industry benchmark and allowed Meta to taste success. To a certain extent, it also proves that the success of AI glasses cannot be separated from the advantages and capabilities of traditional glasses manufacturers in channels, lens fitting, design, branding, etc.

In July 2025, Meta invested approximately 3 billion euros to acquire nearly 3% of EssilorLuxottica's shares and plans to increase its shareholding to about 5% in the future, continuing to invest in AI glasses.

Facing Meta's strong layout, Google is also executing a classic "Android-style" counterattack strategy. According to reports, after failing to cooperate with EssilorLuxottica, Google turned to invest in another fashion glasses manufacturer. In June 2025, Google announced an investment of $100 million to acquire about 4% of the Korean trendy glasses brand Gentle Monster.

This move is the cornerstone of Google's XR strategy. Google is building "Android XR" to provide operating system support for the next generation of computing devices, including AR/AI glasses and XR headsets. By collaborating with hardware partners such as Gentle Monster, Warby Parker, and Samsung, Google hopes to replicate its successful model in the smartphone sector.

The domestic market strategy layout is equally efficient. In September 2024, the first listed company in the domestic eyewear retail industry, Dr. Glasses, and consumer-grade AR brand LeTV Innovation (RayNeo) established a joint venture, "LeTV Doctor Smart Glasses." In August 2024, well-known ophthalmology medical service institution Aier Eye Hospital also invested in AR/AI glasses startup Even Reality. Earlier investments include the leading color contact lens brand moody investing in Gyges Labs and Yashi Group investing in YeMu Technology. Related reading: "From To C to VC, Traditional Glasses Manufacturers Seek Change"

The combination of AI glasses manufacturers and traditional glasses manufacturers is essentially a resource complementation based on their respective needs: technology companies are eager to quickly break through market barriers with the help of traditional manufacturers' well-established channel networks and accumulated brand reputations; while traditional glasses manufacturers are also unwilling to miss out on the opportunities in the emerging technology wave and urgently need to achieve transformation and upgrading through cooperation to gain a foothold in the industry transformation.

These cross-border partnerships, government investments, and capital flows together constitute a vivid picture of the AI glasses industry on the eve of its explosion. As all players are in place, the initial question becomes increasingly urgent: In this multi-billion-dollar capital gamble, who will ultimately emerge as the winner?

Who Will Be the Winner of AI Glasses?

To answer this question, we must realize that the final outcome of the AI glasses sector will not be a single winner-takes-all scenario but rather different types of winners emerging at different stages and levels.

The most certain "winner" in the short term is undoubtedly the upstream core supply chain. During the chaotic period of the "hundred glasses war," no matter how terminal brands change, they cannot bypass upstream suppliers of "light, display, and chip." With high technical barriers and a wide range of customers, they are not tied to the fate of a single brand, thus being able to maximize their enjoyment of the benefits of the entire industry's growth. Capital's pursuit of companies like JBD and YaoYuShiXin is paying for the certainty of the entire sector.

Secondly, there are the mid-term game-changers, brand manufacturers that define "killer applications." The current situation of hundreds of brands competing on the same stage is destined to move towards consolidation, and only a few will ultimately emerge. The winners will not just be the companies with the strongest hardware parameters but rather the brands that can take the lead in finding and defining "killer applications" and creating "iPhone moments" for users. This requires strong comprehensive strength and is the focus of fierce competition among leading brands such as LeTV Innovation, EVM, and Rokid.

Furthermore, there are the indispensable "invisible winners" - traditional glasses manufacturers. As mentioned above, traditional glasses giants, with their irreplaceable channels, brands, and professional services, have become necessary partners for technology companies to reach the mass market. They may not become technology platforms themselves, but through strategic cooperation, they can determine which technology platform can reach consumers faster and more widely, thereby playing a crucial role in "creating kings." In this transformation, EssilorLuxottica, Dr. Glasses, etc., through open cooperation, can not only enjoy the commercial dividends of the new era but also reshape and consolidate their core value in the industry.

Written at the End

The current "hundred glasses war" is an inevitable stage on the eve of market explosion, but it is destined to be unsustainable. With the maturing of technology, the completion of market education, and the clarification of consumer scenarios, the industry will inevitably move towards consolidation, ultimately forming a new stable landscape centered around a few core players. The tens of billions of yuan poured in over the past year have provided critical ammunition for this final battle. Capital is in place, key players are accelerating their moves, and the industry reshuffle is imminent.