Surprise Launch: Tesla's Optimus in China by Year-End? Unitree Ignites Price War at RMB 39,900!

![]() 07/28 2025

07/28 2025

![]() 514

514

On July 27, Beijing time, the "Science and Technology Innovation Board Daily" sent a "Science and Technology Innovation Board Telegram" at 17:02:11 stating:

A Tesla insider has revealed that the third-generation Tesla robot (Optimus 3) is currently undergoing real-world testing at a US factory, with an anticipated launch in China's consumer market by 2025, poised to enter households and other consumer scenarios.

This revelation comes as a shock. The latest information on Tesla's Optimus 3 emerged from the highly credible source of Tesla's Q2 earnings call just three days prior.

During Tesla's Q2 earnings call on July 24, Musk stated:

"The Optimus 3 prototype will be available by the end of this year. We are currently refining its design, using a version close to 2.5. He further noted that aiming for an annual production of 1 million units within the next five years is reasonable."

At this juncture, questions arise:

While it was anticipated that Optimus would enter China, and even mass production in China has been a goal pursued by Shanghai, the news that it will enter China's consumer market by 2025 is highly unexpected.

Why was this significant and unexpected news not disclosed by Musk during the Q2 earnings call?

It's noteworthy that Tesla's Q2 earnings report was bleak, with nearly all indicators declining, including double-digit drops in both revenue and net profit.

Musk undoubtedly recalls sleeping next to the Model 3 production line at the Fremont factory in California and the intense pressure Tesla faced from Wall Street's short-selling frenzy. It was China that came to Tesla's aid, facilitating the rapid establishment of a factory in Shanghai, which was built and operational within a year, revitalizing Tesla and propelling Musk to become the world's richest person.

Musk certainly realizes that news of Optimus entering China's consumer market and integrating into households and other consumer scenarios would have an impact on Tesla akin to the localization of Model 3 in China, potentially even greater.

Given the significance of this news, why didn't Musk mention it during the earnings call? It's worth noting that six senior executives, including Musk, attended the call, a rare occurrence indicating the immense pressure the company was under. Its share price plummeted by over 8% on the first trading day after the earnings report was released.

For Tesla and Musk, Optimus indeed desperately needs the Chinese market. Similarly, the Chinese market also needs Tesla's Optimus, just as it needed Tesla's new energy vehicles years ago to stimulate and drive the development of China's industrial chain and the maturity of its supply chain.

The robotics sector is a much larger market than the new energy vehicle sector, with the potential to unleash tremendous productivity when combined with AI. This represents a new frontier in the competition between China and the US. It is inevitable that Optimus will enter China and be locally produced, most likely in Shanghai.

China's robot companies are also experiencing rapid growth, with several excellent robots or embodied intelligence companies emerging, such as Zhiyuan Robotics, which recently spent RMB 2.1 billion to acquire the A-share listed company SWANCOR, and Unitree Technology, which has just entered the guidance stage for listing on the Science and Technology Innovation Board.

There are also companies that have gone public in Hong Kong, including UBTECH (the first humanoid robot company to list in Hong Kong), Geek+, and UFACTORY, among others. Furthermore, there are numerous startups frequently raising funds in the primary market, including Fourier Intelligence, Zhongqing Robotics, Qianxun Intelligence, Yinhe General, Zhuji Power, Xinghaitu, Zibian Robotics, Tashizhinav, and many more.

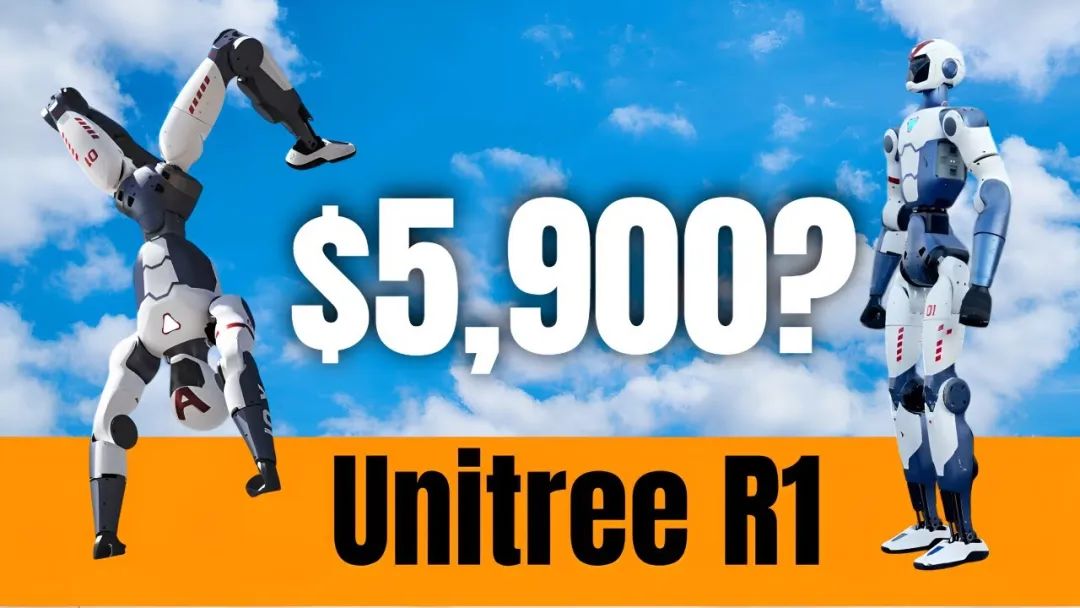

Two days before the news broke that Tesla plans to enter China's consumer market for household use by the end of 2025, on July 25, Unitree Technology announced the launch of its third humanoid robot, the R1, priced starting at RMB 39,900, significantly cheaper than the G1's RMB 99,900. The R1 is also the cheapest bipedal humanoid robot to date. According to introductions, the R1 features a total of 26 joints, integrates a multimodal large model for voice and image recognition, weighs only 25KG, and supports self-modification.

In Musk's vision, the selling price of Optimus is $20,000. Upon entering China, it becomes evident that competing on price is out of the question, and technology must be the focal point. Comparing the R1 to Optimus is akin to comparing a spicy fish head dish to a Model 3 or a hypothetical budget Model 2.

Of course, in the new energy vehicle sector, the competitor to a hypothetical Model 2 would certainly not be a spicy fish head dish. Therefore, perhaps the competitor to Optimus will not be the R1, and Chinese robot companies will introduce a reinforced line of humanoid robots to compete with Optimus.

This is the competitive landscape that humanoid robots are destined to face, one that is far more intense than the new energy vehicle sector.