Thousands of Driverless Cars Racing, LiDAR Prices Plunging: The Singularity Moment of Autonomous Robotaxi - What's So Singular About It?

![]() 08/04 2025

08/04 2025

![]() 534

534

Introduction

On July 15, Luobo Kuaipao announced a partnership with Uber to sign an order for the "largest vehicle fleet in history" for driverless cars – thousands of vehicles to be deployed across Asia and the Middle East by year-end, with future expansion globally.

The news sparked widespread social media buzz: some hailed it as the "iPhone 4 moment" for autonomous driving, while others quipped that LiDAR had finally transformed from a luxury item to a daily necessity.

Meanwhile, in Beijing Yizhuang, a Pony.ai seventh-generation Robotaxi quietly surpassed 2 million kilometers without incident; in Shenzhen Futian, 300 unmanned delivery vehicles raced against red lights, mirroring the hustle of food delivery riders.

The "singularity moment" for global Robotaxi is no longer a mere PPT slogan but a reality driven by four Orin X chips, 170 million safe kilometers, and a vehicle cost of 200,000 yuan.

So, what exactly is singular about this "singularity"? Let's dive in.

I. From "Can It Run" to "How Much Can It Run": The Scale Competition Begins

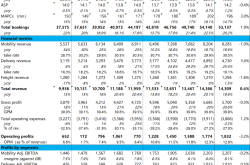

In 2025, the Robotaxi industry revolves around one word: "volume." Luobo Kuaipao boasts 15 cities globally, 1000 vehicles, and 1.4 million trips in Q1, up 75% YoY. By year-end, it will partner with Uber to deploy thousands of vehicles in the Middle East and Asia. Waymo operates 1500 vehicles in 4 US cities with 250,000 weekly orders, expanding to 7 cities by 2026. Pony.ai aims for thousands of vehicles by year-end, tens of thousands in three years, with mass production partners like Toyota, GAC, and BAIC. WeRide plans 15 new cities in the UAE, Switzerland, and Zurich. If Robotaxi were bike-sharing, 2024 was the "trial launch of blue bikes," while 2025 is the "deployment of a sea of colors." Behind this scale competition lie policy green lights, hardware cost reductions, and algorithm maturity.

II. LiDAR "Prices Plummet": The Cost Inflection Point Has Truly Arrived

A decade ago, Velodyne sold a 64-line LiDAR for $80,000. Today, Luobo Kuaipao's sixth-generation driverless car features four long-range LiDARs costing just 35,000 yuan.

1. Cost Reduction Through Scale:

The global L2+ mass production wave in 2025 will push annual LiDAR demand into the millions. As scale expands, marginal costs decrease, leading to price plummets.

2. Cost Reduction Through Technology:

MEMS, rotating mirrors, and Flash solutions flourish, AI and large models are widely used, and new materials evolve rapidly. 200-meter detection and 360° coverage are now standard features.

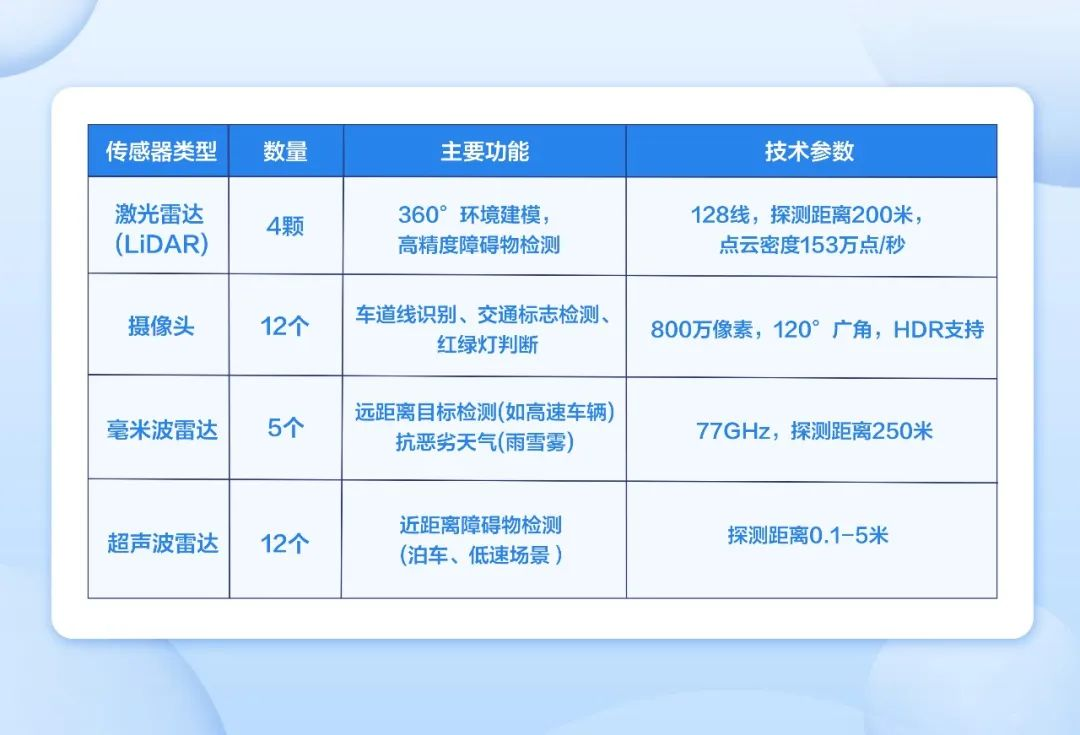

Luobo Kuaipao's sixth-generation driverless car sports 4 LiDARs, 12 cameras, 5 millimeter-wave radars, and 12 ultrasonic radars.

Sensor Configuration of Luobo Kuaipao's Sixth-Generation Driverless Car

3. Cost Reduction Through Data:

A LiDAR running 300 kilometers daily contributes 100,000 kilometers of training data annually, with marginal costs approaching zero. LiDAR is no longer a "toy for the rich" but the "airbag" of driverless cars – a standard feature that must excel.

III. Safety Ledger: Accident Rate of 1/14 that of Human Drivers

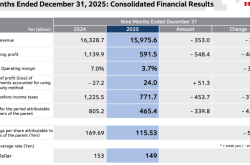

Luobo Kuaipao's public ledger reveals that autonomous driving has safely operated for 170 million kilometers, provided 11 million services, and boasts an accident rate 1/14 that of human drivers, with safety comparable to domestic large aircraft C919.

Luobo Kuaipao's triple insurance of LiDAR + high-precision maps + visual redundancy reduces misdetection rates in rainy and foggy weather by 3 times compared to pure vision.

Pony.ai's autonomous Robotaxi has logged 500,000 hours of unmanned operation with an accident rate 10 times lower than humans.

Waymo's autonomous Robotaxi data from the California DMV shows 0.68 takeovers per million miles, while Tesla's pure vision system has 3.2 takeovers per million miles.

Insurance companies have responded swiftly: Guangzhou is piloting exclusive premiums for Robotaxi, 30% cheaper than traditional taxis.

Drivers are beginning to worry about their jobs, with jokes circulating that "the difficulty of getting a driver's license in the future will be equal to getting a PhD."

IV. "Fishing Guide" for Going Abroad: Why Is Dubai the First Stop?

Global expansion isn't about spreading thinly but "fishing where the fish are abundant."

1. Advantages of the Middle East:

The Middle East boasts low population density, high oil prices, and expensive drivers. For instance, labor costs in Dubai are 2.5 times higher than in Shanghai, and demand for Robotaxi, priced 20% higher than ride-hailing services, still exceeds supply. Such wealthy yet sparsely populated places are ideal for emerging technologies like Robotaxi!

2. Policy Support:

The Middle East welcomes AI and other high-tech, with very friendly policies. They have clear roadmaps and timetables for driverless vehicles: Dubai aims for 25% driverless traffic by 2030, Abu Dhabi by 2040, and Saudi Arabia by 2030.

3. Uber's Assistance:

Uber has seized the autonomous driving market, becoming the largest driverless vehicle platform. With 18 million monthly active users in the Middle East, Luobo Kuaipao can "call a driverless car with one click" via Uber's platform. WeRide and Pony.ai have also partnered with Uber, focusing on overseas markets like the Middle East and East Asia.

The overseas costs for Chinese players are also low. For example, Luobo Kuaipao's sixth-generation driverless car and Pony.ai's seventh-generation car cost only one-third of Waymo's hardware costs.

V. Ledger for the Next Decade: From Thousands to Millions of Vehicles

Goldman Sachs predicts that China's Robotaxi market will grow 757 times from 2025 to 2035, reaching a market size of $47 billion in 2035.

1. Vehicles:

From 4100 vehicles in 2025 to 1.9 million in 2035, with first-tier cities contributing 42% and second-tier cities 50%. Manufacturing cost per vehicle will drop from $20,100 to $18,900, and the cost per kilometer of operation is expected to be 30% lower than that of taxis.

2. Employment:

By 2030, Beijing, Shanghai, Guangzhou, and Shenzhen may add 100,000 new jobs for "driverless car dispatchers" and "remote safety officers," with driving school instructors transitioning to learning Python.

VI. Final Thoughts: After the Singularity, No More "Pilots"

A decade ago, Waymo cautiously tested in Phoenix; today, 1000 Luobo Kuaipao vehicles simultaneously take orders in Wuhan, Dubai, and Hong Kong.

A decade ago, LiDAR was the "holy grail of the lab"; today, it's the "seat belt of driverless cars."

As mileage soars from tens of thousands to hundreds of millions of kilometers, costs plummet from millions to hundreds of thousands, and policies evolve from "allowing testing" to "encouraging operations," the singularity moment of Robotaxi is no longer a question of "whether it will come" but "how fast it will come."

The next stop, with millions of driverless cars online simultaneously, will be greeted by a unified prompt sound across the city sky:

"Please fasten your seat belt, next stop – the future."

In summary, Unmanned Cars believes that the Robotaxi industry stands at the cusp of an era, with LiDAR leading the way and major players "racing" in the global market. Let's look forward to this future full of endless possibilities! Dear reader, what do you think?