Alibaba's Radical Transformation: A $430 Billion Gamble on the AI Revolution

![]() 08/04 2025

08/04 2025

![]() 537

537

Source | YuanMeiHui

A ten-thousand-word resignation letter shone a spotlight on Alibaba's "big company disease." Simultaneously, this Chinese internet giant is embarking on the most radical self-revolution in its history—a $430 billion bet on the future of AI.

On Alibaba Day in May 2025, Jack Ma quietly appeared at Alibaba's headquarters, "Hu Pan Cottage," a replica of the company's startup origins that has become a symbol of its spirit. Standing beside current CEO Wu Yongming, both encouraged employees to "persist in the entrepreneurial spirit."

A few days prior, Wu Yongming posted a letter to all employees on Alibaba's internal network with a straightforward title: "Returning to Our Roots, Restarting as Entrepreneurs." He declared, "Alibaba's DNA does not contain 'preservation' but only 'creation'."

Alibaba's self-revolution has been swift and thorough.

In the widely circulated resignation letter from former Alibaba employee Yuan An, this "veteran" bitterly described the company's current state of "bloated organization, slow decision-making, and dispersed businesses." Some Alibaba employees even joked that a simple decision requires approval from multiple layers of departments, consuming time and effort. These "slow approvals" have made Alibaba sluggish and caused it to miss many development opportunities.

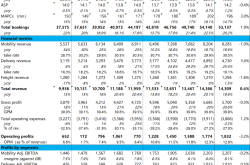

Now, Alibaba's management is undertaking comprehensive changes with the determination to cut off its own arm: the partnership team has shrunk drastically from 26 to 17, the smallest since the company's IPO in 2014; founding members of the "Eighteen Arhats" like Peng Lei and Dai Shan have stepped down from the core of power, and the 39-year-old Jiang Fan has become the youngest member of the Partnership Committee.

The outside world eagerly anticipates what profound changes Alibaba will undergo next.

01

Return of the Founding Veterans

On September 10, 2023, the curtain of Alibaba's power transition was officially drawn. Joseph Tsai succeeded as Chairman of the Board, and Wu Yongming took over as CEO of the group and acting Chairman and CEO of Alibaba Cloud Intelligence Group. This marks the return of Alibaba's power core to the founding team.

Image Source: Alibaba Announcement

Subsequent personnel adjustments can be described as the largest-scale "reshuffle" in Alibaba's history. By June 2025, Alibaba's partnership team had been streamlined from 26 to 17, with 9 senior partners exiting, including Peng Lei and Dai Shan, members of the "Eighteen Arhats." The founding team was reduced to only four partners: Jack Ma, Joseph Tsai, Wu Yongming, and Jiang Fang. Meanwhile, the 39-year-old Jiang Fan entered the Partnership Committee, becoming the youngest decision-maker.

In response, some economists believe that Alibaba is "bidding farewell to the old and welcoming the new." However, as a vast empire with 240,000 employees, shouting about returning to entrepreneurship itself presents a fundamental contradiction. "For a big company to truly activate its entrepreneurial spirit, it needs to break the interest structure that is far more entrenched than its organizational structure," said the aforementioned person.

Wu Yongming also pointed out the pain points in his internal speech: "Facing the risks and opportunities brought by the AI technology revolution, Alibaba must put aside its past achievements." He especially emphasized the need to "discard path dependence."

In fact, the firm bet on AI did not begin after Wu Yongming's return. As early as the end of 2022, when OpenAI launched ChatGPT, it made Jack Ma realize Alibaba's lag in the AI field. Since then, on multiple public occasions, Jack Ma has repeatedly emphasized the importance of AI to Alibaba's future development.

For example, on the 20th anniversary of Ant Group, Jack Ma suddenly appeared at the Hangzhou headquarters and pointed out the importance of AI in a brief speech: "Twenty years ago, when we seized the opportunity of the internet, we thought it was the biggest transformation. But now I dare to assert that the changes brought by AI in the next 20 years will completely reconstruct all existing business models." He especially pointed out that the current industry's predictions about the impact of AI are generally "systematically underestimated."

To strengthen the signal of change, Alibaba also replicated "Hu Pan Cottage," a symbol of its entrepreneurial origins, to its headquarters park.

02

$430 Billion Gamble

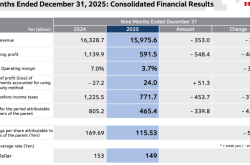

On February 24, 2025, Alibaba announced that it plans to invest at least RMB 380 billion over the next three years in building AI and cloud infrastructure, equivalent to the total technology investment over the past decade.

After the news broke, public opinion was in an uproar, but the capital market did not seem to take kindly to it. According to Wind data, from February 24 to 25, Alibaba's Hong Kong stock price fell for two consecutive days, with a change of -5.7%.

Image Source: Alibaba Announcement

Five months later, Alibaba added an additional RMB 50 billion in investment in digitizing the service industry, intending to create a "service version of Taobao."

"The amount of these two investments is indeed large, the largest in Alibaba's history and unprecedented among Chinese private enterprises," Alibaba Chief Financial Officer Xu Hong responded to the media regarding the two massive investments.

The two investments represent both directions Alibaba believes in and the two wheels driving its future. "The RMB 380 billion is for investing in cloud computing and AI technology and infrastructure, while the RMB 50 billion is for leveraging domestic demand. The potential of AI and domestic demand in the Chinese market are the two directions we are optimistic about," said Xu Hong.

It is evident that AI has become a certain future that Alibaba is betting on. However, compared to foreign giants, Alibaba's investment still appears somewhat "conservative."

According to comprehensive reports, Amazon has proposed that total capital expenditures for all businesses in 2025 are expected to increase to over $100 billion, with most of the increase going to AI; Alphabet, Google's parent company, also plans to increase capital expenditures from $52.5 billion in 2024 to approximately $75 billion, with most of the expenditure going to AI infrastructure; Meta has set its AI investment budget at $60 billion to $65 billion.

After the Private Economy Symposium in February 2025, Alibaba initiated these plans, which were both a response to the "two health" policy and a life-or-death decision facing the intergenerational leap of AI technology—if the computing power base cannot be built within 3-5 years, Alibaba may lose its competitive eligibility forever.

Strategic focus has become the core of the transformation. After Joseph Tsai's return, he clarified that Alibaba will focus on the two major directions of "e-commerce, cloud+AI" in the future. This has also led to a significant contraction in business, such as "divesting" from new retail businesses, selling Intime Department Store and RT-Mart, and abandoning home furnishing giant Red Star Macalline.

According to Red Star Macalline's announcement on July 26, Hangzhou Haoyue Enterprise Management Co., Ltd., a subsidiary of Alibaba, plans to reduce its shareholding in the company by no more than 130 million shares, accounting for 3% of the company's total share capital, through centralized bidding and block trading. Based on Red Star Macalline's closing price of RMB 3.11 per share on July 25, Hangzhou Haoyue's reduction in shareholding amounted to approximately RMB 400 million.

It is evident that Alibaba is accelerating its focus on e-commerce and AI+cloud core businesses and gradually exiting non-core businesses such as new retail at the appropriate time.

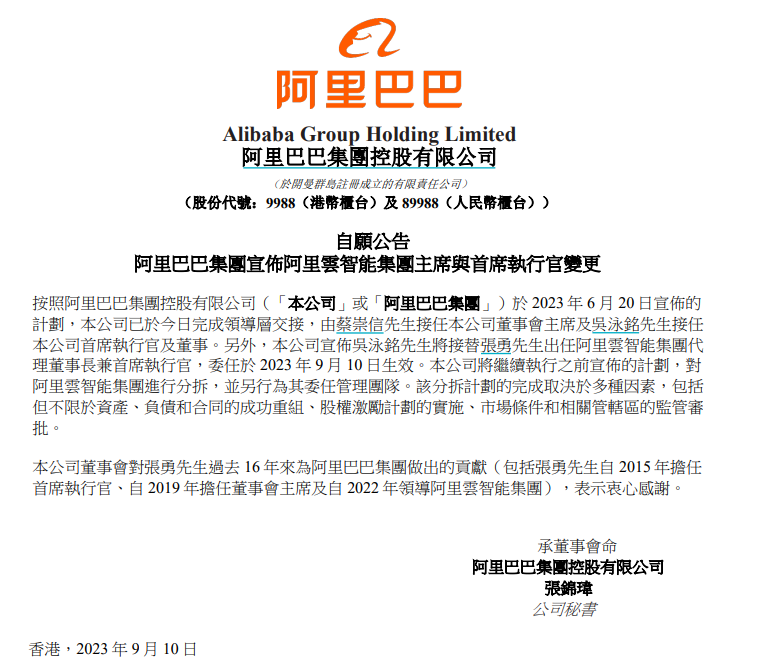

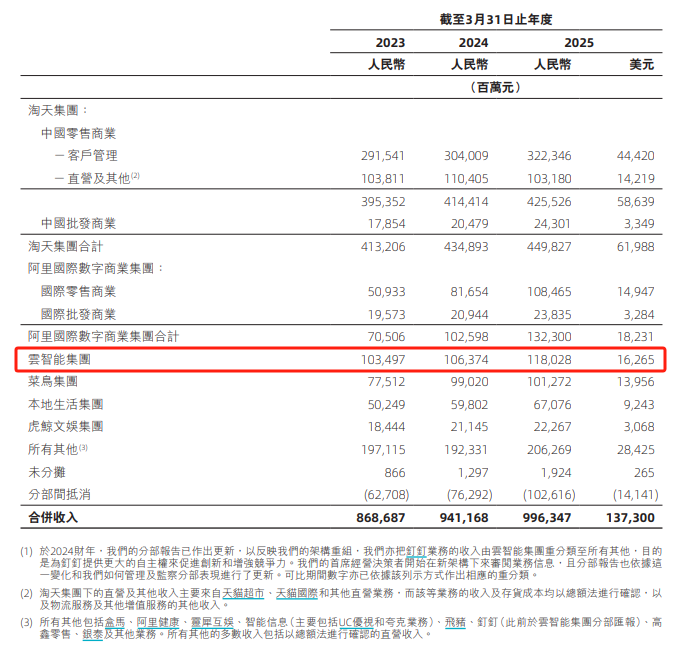

The AI business, which Alibaba is focusing on, has not disappointed either. Alibaba Cloud, as the core AI-driven business, achieved double-digit growth driven by the continuous growth of AI demand, with AI-related product revenue achieving triple-digit year-on-year growth for seven consecutive quarters, according to the 2025 fiscal year annual report.

Image Source: Alibaba Financial Report

This bold gamble seems to have shown initial results.

03

AI Strategy Shows Initial Results

Within the Alibaba system, the AI revolution is transforming from a strategic slogan into concrete actions.

On July 30, 1688 launched "1688 Source Selection," relying on AI technology to create 100 "super products." In fact, as early as more than two years ago, 1688 had already begun exploring AI, launching over 70 AI projects in 2024, dissecting every link of "finding goods, selecting goods, inquiring, paying, and fulfilling" to experiment with whether AI could be used to redo each one.

After the explosion of DeepSeek's popularity, 1688 established an AI strategy promotion group to promote the rejuvenation of the organization, quickly reducing the number of projects from over 70 to 10 after the 2025 Spring Festival and ranking them.

This transformation has brought practical benefits. Over the past year, AI technology has driven a 20% to 30% increase in conversion and repurchase rates on the 1688 platform. The platform aims to achieve a 50%-100% increase by 2025.

At the technical infrastructure level, Alibaba Cloud has become an important support for the AI strategy. According to an IDC report, in China's AI infrastructure market in 2024, Alibaba Cloud ranked first with a 23% share, exceeding the combined total of the second and third places. However, hidden worries have emerged in specific areas—in the booming AI chip market, Huawei's Ascend chips have already surpassed Alibaba's Hanguang chips in market share.

AI Chip Conceptual Image | Created by YuanMeiHui

From the perspective of specific AI products, Alibaba's prominently launched Tongyi Qianwen large model has demonstrated strong vitality. This open-source model family, with over 400 million global downloads, has spawned 140,000 custom models. However, its commercialization process has not yet allowed the market to see a clear future.

In addition, at the 2025 World Artificial Intelligence Conference, Alibaba released its first self-developed AI glasses—Quark AI Glasses, making it the third internet company to enter this field after Baidu and Xiaomi. This move also surprised the market.

"A platform that can support AI innovation requires huge infrastructure investment," Xu Hong explained the logic behind the RMB 380 billion investment. However, some market voices have questioned whether Alibaba can maintain its cash cow e-commerce business while also burning money to support its cloud business. When Tencent Meeting relies on subsidies to seize the cloud market, will Alibaba Cloud dare to engage in a price war?

04

Awaiting Market Validation

Behind this transformation lies Alibaba's sober recognition of its chronic issues.

Wu Yongming admitted in an internal letter that "breaking through oneself is a difficult transformation." Taobao and Tmall Group subsequently shifted its strategic focus from GMV to real transaction volume and user experience.

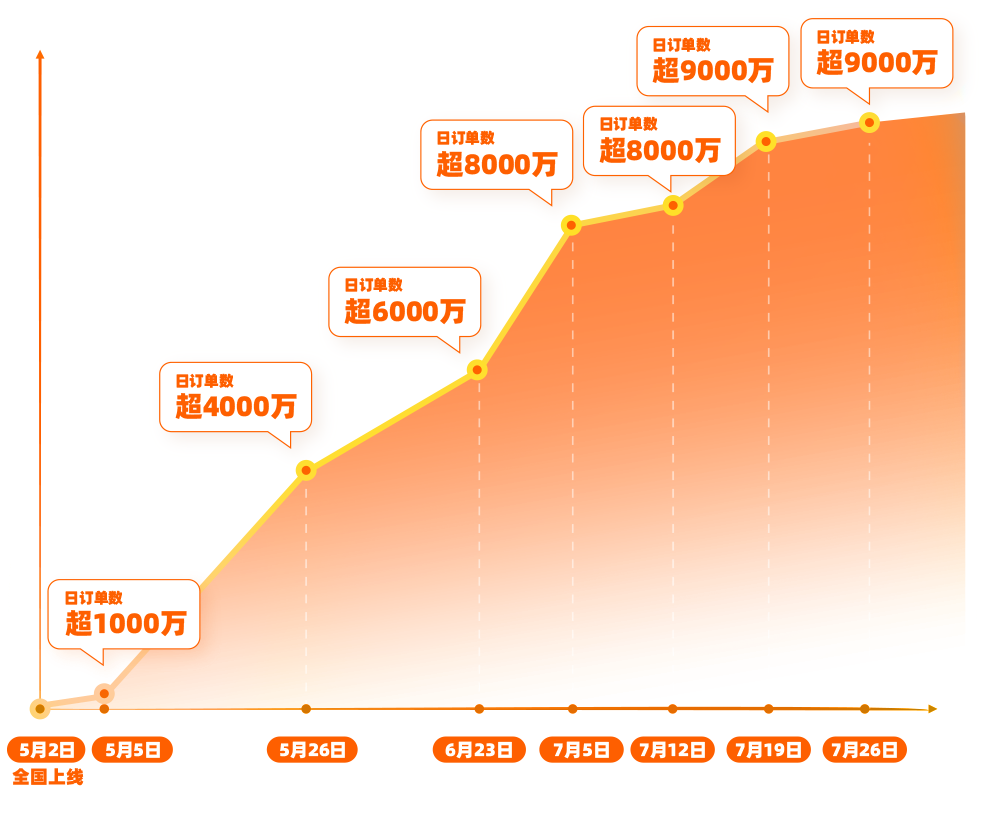

In late June 2025, Wu Yongming issued an email to all employees announcing the integration of Ele.me and Fliggy into Alibaba's e-commerce business group. Shortly after the integration, Jiang Fan immediately led Taobao Flash Sales to launch a fierce subsidy war, reigniting the battle in the food delivery sector, with daily order volume surging from 10 million orders in May.

On the two recent Saturdays (July 19 and 26), Taobao Flash Sales announced that its daily orders exceeded 90 million. Meituan's daily order volume for the same two days was above 120 million, with a stable gap of 30 million orders between the two.

Screenshot from Ele.me promotional poster

Behind this fierce attack, Alibaba may not be coveting the food delivery business but rather engaging in external defense to revitalize assets.

In this regard, some market views believe that Alibaba's integration of Ele.me and Fliggy into Taobao and Tmall is a strategic upgrade from pure e-commerce to a large consumer platform. Both Ele.me and Fliggy have strong local attributes, and the integration of e-commerce platforms has become an industry trend, with Meituan and JD.com having previously deployed in the instant retail sector.

Compared to the "domestic demand" results of the food delivery war, Alibaba's AI technology return cycle is also expected to further accelerate. According to Goldman Sachs' predictions, from fiscal years 2025 to 2027, the proportion of Alibaba Cloud's AI-related revenue in total revenue will increase from 8% to 29%, with specific revenue amounts expected to be RMB 9.9 billion, RMB 29 billion, and RMB 53 billion.

This growth forecast is mainly due to the efficient utilization of AI servers and the popularity of AI applications and agents. Alibaba Cloud's pricing advantage in AI training and inference, especially under the tight supply of high-end GPUs, will bring it higher profit margins.

However, amid fierce global competition, Alibaba will not have an easy time in the AI field.

Data shows that Tencent's R&D investment reached RMB 70.69 billion in 2024, with a cumulative investment of RMB 340.3 billion over the past seven years since 2018. Among them, artificial intelligence is a key area of deployment. Moreover, against the backdrop of continuously increasing investment in AI, Tencent is accelerating AI penetration across all products based on a "self-developed + open source" multi-model strategy.

In addition, Huawei, ByteDance, and others are also accelerating their increase in R&D investment in AI. ByteDance has formed a complete AI product matrix of "CapCut + AIGC + Doubao."

The worldwide challenge of integrating the service industry also looms ahead. Xu Hong once said that the digitization of the catering industry is only 20%, leaving huge room for growth.

Furthermore, data indicates that within the next two to three years, the market size of new service industry e-commerce will surpass RMB 10 trillion. This figure underscores the potential domestic market that Alibaba aims to capitalize on with its substantial RMB 50 billion investment.

Currently, within the vibrant confines of Alibaba's campus, young managers are traversing the office buildings, tasked with transforming the substantial RMB 380 billion technology investment into tangible productivity. Concurrently, in 1688 factories, innovative AI-designed products continue to roll off the assembly line, signifying a new era of automation. In Cainiao warehouses, intelligent robots have already replaced one-third of manual pickers, although engineers are still fine-tuning algorithms to recognize irregularly shaped packages, ensuring optimal efficiency.

Joseph Tsai's strategic insight that "AI will become the core competitiveness of all businesses" is now facing a rigorous test. As Tongyi Qianwen's global downloads exceed 400 million, with over 140,000 derivative models, and as Jiang Fan leads Taobao Flash Sales in a fierce challenge to Meituan's territory, the question arises: can Alibaba's "morale" endure this renewed market scrutiny?

The outcome of Alibaba's bold gamble will serve as a litmus test for whether Chinese internet technology enterprises can achieve a genuine transformation during the AI revolution. This transformation encompasses not only technological breakthroughs but also a fundamental reconstruction of organizational genes. When seasoned professionals in Cainiao warehouses mentor AI robots to recognize fragile items, the AI breakthrough within China's private economy is subtly finding its path forward through these intricate details.