How the Top Three LiDAR Players are Performing Midway Through 2025

![]() 08/04 2025

08/04 2025

![]() 546

546

In the first half of 2025, the LiDAR application market saw significant undercurrents.

At the start of the year, the automotive industry was still buzzing with the slogan of "equal rights in intelligent driving." However, the Ministry of Industry and Information Technology promptly issued an announcement banning exaggerated promotion of L2+ assisted driving, emphasizing that safety must remain paramount. The "Safety Requirements for Combined Driving Assistance Systems of Intelligent Connected Vehicles" clearly outlined technical standards for L2+ perception capabilities, pushing the question of "whether LiDAR is necessary" to the forefront. Additionally, with the launch of various L3 autonomous driving systems, the number of LiDAR units mounted surged to five, with line counts exceeding 500, making safety redundancy the new standard.

In the robotics market, lawn mowing robots and unmanned delivery robots emerged as major players, becoming another significant application market for LiDAR products after the automotive sector.

As automotive safety requirements escalate and robotic market demand grows, how have the top three LiDAR manufacturers—RoboSense, Hesai Technology, and Innovusion—responded to these new opportunities?

RoboSense - Emphasizing Performance

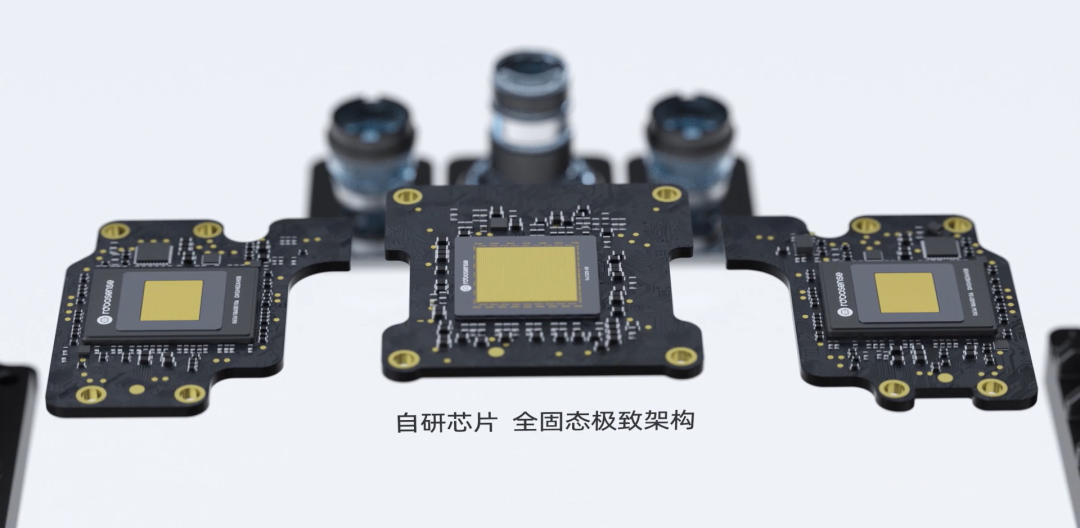

On January 3, 2025, RoboSense CEO Qiu Chunchao announced that "LiDAR has fully entered the digital era," focusing on high-performance, high-line-count products to counter competitors' price wars in the mid-to-low line count segment. The goal is to break the vicious cycle of price wars with a six-month to one-year technological advantage.

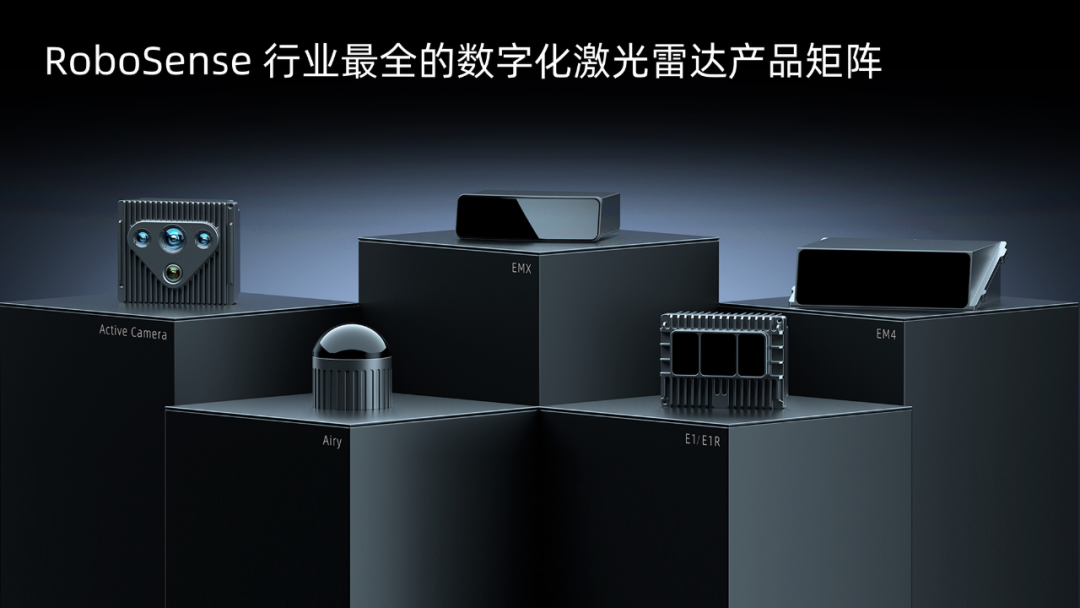

In the following three months, RoboSense released multiple new products, including the EMX and EM4, all embracing digitalization.

The EMX targets the high-end intelligent driving market, boasting a "true 192-line" product that outperforms mid-line-count solutions in resolution, size, and heat dissipation. The EM4, aimed at L3 and above levels of autonomous driving, offers customized solutions ranging from 520 to 2160 lines. It has already been mass-produced and installed in vehicles, including the Zeekr 9X, and is featured in four models. In a short period, the EM4 is the only choice for automakers to build L3 mass-production vehicles.

By the first half of the year, the EM series had secured orders from five global automakers for 17 models, covering leading and new energy OEMs worldwide.

In the non-automotive market, RoboSense sold 11,900 robot LiDAR units in Q1, collaborating with over 2,800 robot customers globally. Its E-platform products, based on Flash pure solid-state technology, secured a 3-year order of 1.2 million units from Koomai Technology, dominating the lawn mowing robot market. The Airy hemispherical radar, launched this year, increased its line count from 32 to 192 lines, providing more options for lawn mowing and humanoid robots.

RoboSense is not just shipping LiDAR to robotics companies but also expanding into embodied intelligence-related categories, including Active Cameras and dexterous hands. As the embodied intelligence sector gains traction, this direction is expected to be another growth driver for RoboSense.

From a technical perspective, RoboSense leads the digital route, with its core support being the self-developed digital SPAD-SoC chip that began mass production in the second half of 2024. This chip supports large-area digital signal output and offers significant advantages in resolution and detection distance.

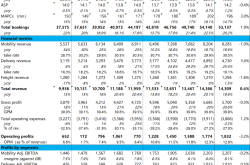

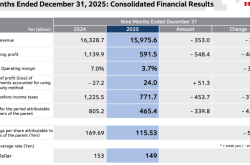

RoboSense's gross profit margin increased by 6.3% year-on-year in the first-quarter financial report of 2025, indicating an improving profit trend. This rebound also provides room for performance growth in the second half of 2025.

Hesai Technology - Aggressive Pricing Strategy

In an interview with Reuters, Hesai Technology CEO Li Yifan stated that in 2025, the company would halve the price of LiDAR to access lower-priced vehicle models, setting the tone for Hesai's aggressive pricing strategy to win the market. This approach helped Hesai rebound from early 2025's sluggish installation figures, with a noticeable increase in installations and some recovery in quarterly revenue data.

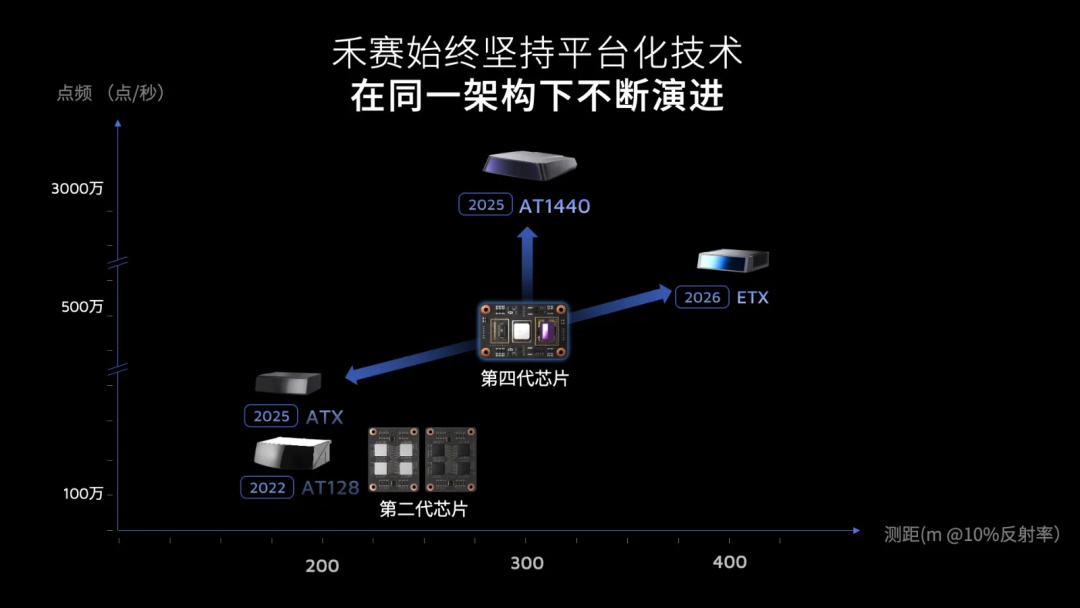

On April 21, Hesai Technology released the "Qianliye" LiDAR perception solution for L2 to L4 autonomous driving and launched three new-generation automotive-grade LiDAR products: ETX, AT1440, and FTX.

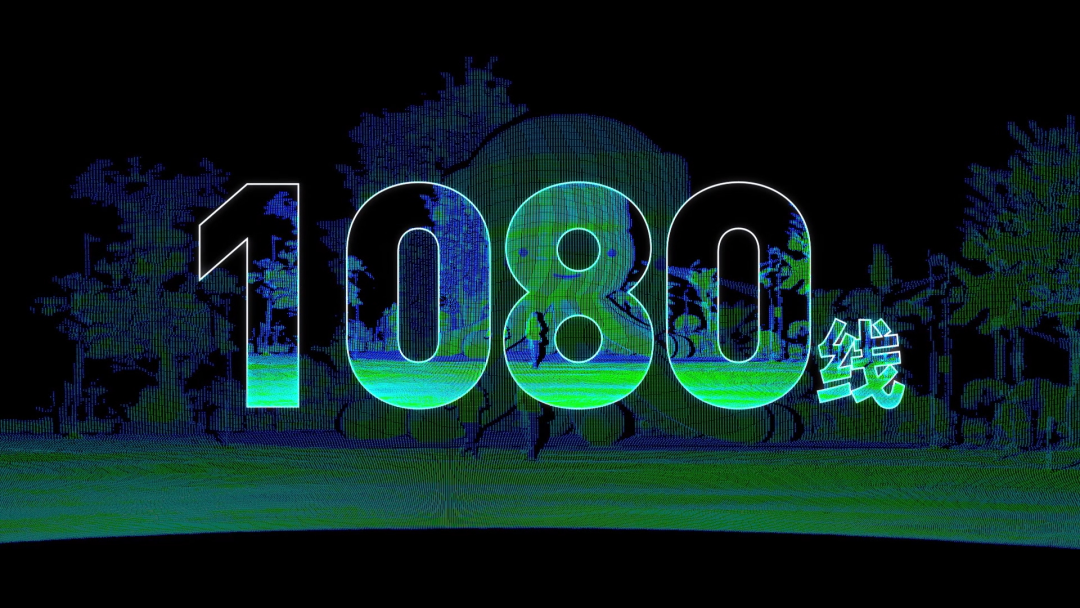

The ETX focuses on the L3 market, equipped with Hesai's self-developed chip, enhancing ranging capability by 30%. The AT1440 claims to be "the world's highest line count quasi-mass production automotive-grade ultra-high-definition LiDAR." Although not yet mass-produced for vehicles, its simplified version, the AT36, has been launched, maintaining the same appearance as the AT1440 but with a reduced line count of 360 lines, further exploring the intelligent driving market. The FTX is positioned for L2-L4 human scenarios, tapping into the consumer market with high cost-effectiveness.

To further expand the market, Hesai has shifted its focus to mid-to-low line count products. One of its main automotive-grade product lines, the ATX series, reduces the line count to 64 lines and the price to hundreds of yuan, successfully entering the 100,000-yuan vehicle platform.

So far, the ATX series has secured orders from 11 leading domestic and foreign automakers, with over 50,000 units delivered in the first quarter of 2025.

In the non-automotive market, Hesai's series of products, including the JT, extensively covers multiple high-growth markets such as mobile robots, delivery robots, cleaning robots, and lawn mowing robots. Among them, the JT16 LiDAR, designed for lawn mowing robots, focuses on cost control with a 16-line solution and has secured an order of 300,000 units from the Dreame brand, breaking Lanwo's dominant position.

Currently, Hesai focuses on LiDAR product shipments in the robotics field, with stable shipping capabilities, engaging in direct competition with RoboSense's broader robotics business. However, regarding RoboSense's expansion into embodied business, Hesai has not yet shown signs of transforming from a hardware supplier to an embodied intelligence solution provider.

From a technical perspective, Hesai has not followed RoboSense in digital transformation but instead continues with the SiPM technical architecture. This architecture supports Hesai's self-developed fourth-generation chip technology platform, offering cost control advantages but facing physical limit challenges, unable to support high line counts and high-density point cloud output. Nonetheless, the FTX, a new product showcased at its 2026 conference, indicates that Hesai has not given up on the digital front.

In the first-quarter financial report of 2025, Hesai's main ADAS product's gross profit margin declined by 1% compared to 2024, with fierce price competition directly compressing its gross profit margin. With the installation of new products in the second half of the year, the trend of gross profit margin improvement remains to be seen.

Innovusion - Striving for IPO

On December 20, 2024, Innovusion reached a business combination agreement with the special purpose acquisition company TechStar Acquisition Corporation (7855), planning to go public through a backdoor listing. On February 12, 2025, it submitted application materials to the Hong Kong Stock Exchange. To support its listing process, Innovusion is also seeking new growth breakthroughs in products and business.

At the product level, its product matrix is expanding from high-performance offerings to multiple product lines. The high-performance "Falcon Series" adopts a 1550nm solution and continues to supply NIO.

In the non-automotive market, its "Sparrow Series" adopts a 905nm+SiPM solution, tapping into the unmanned delivery sector with a price advantage and successfully securing LiDAR orders from Jiushi Intelligence, a leading unmanned delivery enterprise, from Hesai's hands. This move not only diversifies its reliance on NIO but also leverages unmanned delivery vehicles in the robotics and L4 autonomous driving fields to open up new growth potential beyond the automotive market.

Furthermore, Innovusion is transitioning to a longer-term technical route. It is reported that its next-generation pure solid-state LiDAR product has entered the research and development stage.

To successfully go public, Innovusion is striving to overcome difficulties such as "relying solely on NIO," "running out of cash flow," "expanding losses," and "lacking competitive technology" through a strategy of "low prices, multiple categories, multiple markets." Whether Innovusion can break through these bottlenecks and successfully list through "losing money to gain popularity" remains to be seen by the market.

Conclusion

Compared to 2024, technology is gradually iterating, moving from traditional analog architectures to digital architectures. The technical route of LiDAR has converged, but market competition has intensified, showcasing new differentiation.

RoboSense focuses on technology, Hesai focuses on pricing, and Innovusion focuses on financing. In 2025, each of these three manufacturers has made its own strategic choice.

As market demand expands, the automotive market becomes more intelligent, and service robots and general robotics demand begins to surge, the potential for embodied intelligence is vast. The LiDAR landscape has not yet reached its halfway point.

-- END --