Caught in the "Growth Curse": The Dilemma and Breakthrough of Robot Vacuums

![]() 08/05 2025

08/05 2025

![]() 669

669

Author | Chen Wen

Source | Insight New Research

Is the robot vacuum industry still a viable business venture in 2025?

On one hand, established players engage in fierce competition, leading to increased industry concentration. Some companies are laying off employees to streamline operations, while others continuously venture into new fields in search of new growth opportunities. Founders have even made headlines for "not focusing on their main business."

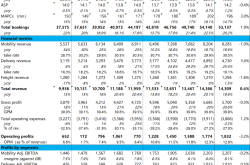

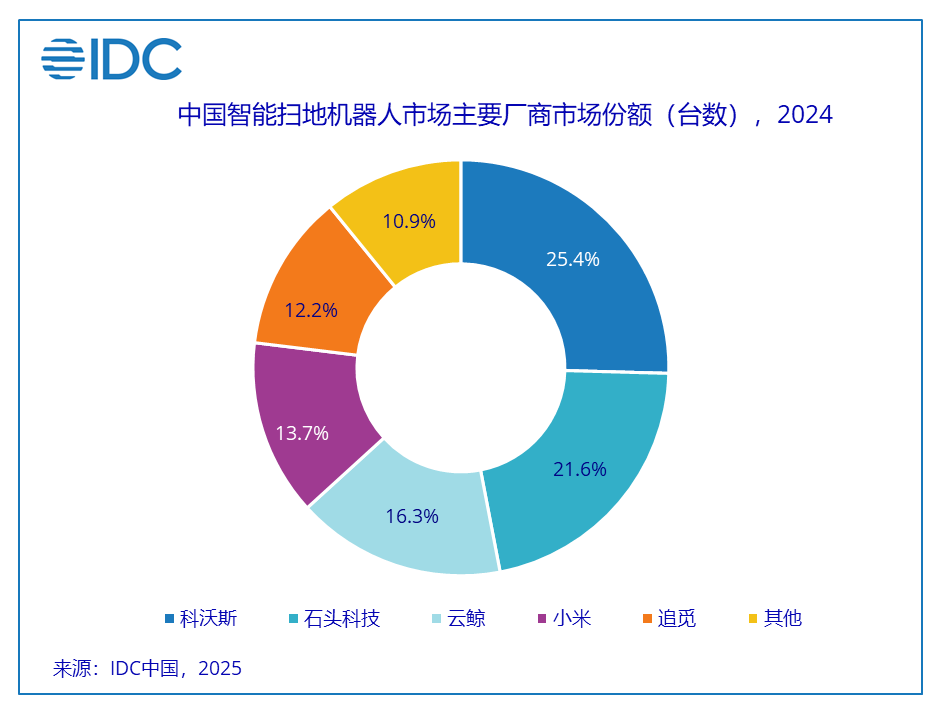

IDC statistics reveal that in 2024, the top five robot vacuum brands in China—Ecovacs, Roborock, Narwal, Xiaomi, and Dreame—accounted for nearly 90% of the domestic market share, leaving minimal room for other brands.

On the other hand, new players continue to enter the market undeterred.

In the first half of this year, Pudu Robotics launched its new commercial cleaning robot, the PUDUCC1Pro, officially entering the cleaning market. Not long ago, DJI announced that its robot vacuum, developed over four years, will be released on August 6.

Furthermore, Midea Group has established a new retail company to further expand terminal service scenarios, while Ecovacs has set up a wholly-owned subsidiary in Huzhou to deepen the integration of intelligent hardware and consumption scenarios through regional layout.

It is evident that after periods of rapid and unorganized growth, robot vacuums have entered a new round of competition.

01 Where Did the Profits Go?

From a data perspective, the growth of the robot vacuum industry remains relatively stable.

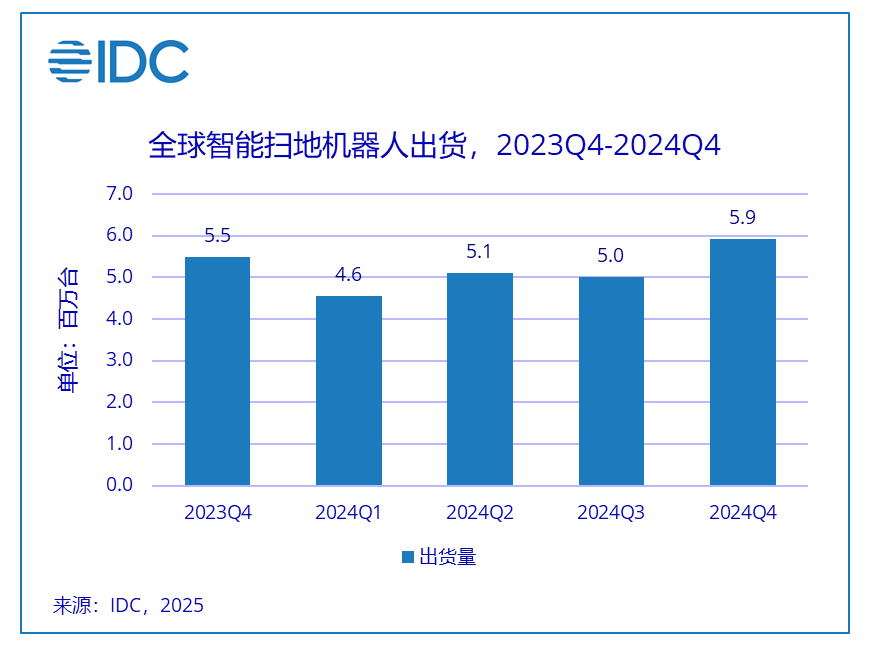

IDC data shows that in 2024, global shipments of smart robot vacuums reached 20.603 million units, with sales of $9.31 billion, representing year-on-year growth of 11.2% and 19.7%, respectively. The average selling price increased by 7.6% to $452. Notably, global shipments of robot vacuums in the fourth quarter increased by 7.8% year-on-year, slowing down compared to the first three quarters.

AVC data indicates that in the first five months of this year, the online retail sales of cleaning appliances in China amounted to 11.4 billion yuan, with a year-on-year increase of 16.4%. The retail volume was 9.92 million units, up 2.0% year-on-year. Among them, the retail sales of robot vacuums increased by 20.1% year-on-year. Additionally, as Chinese brands accelerate their overseas expansion, eight out of the top ten global market share holders are Chinese brands, with a global market share of 63%.

Despite increased sales volumes and expanded market shares, the profits of robot vacuum companies are declining.

Taking Ecovacs and Roborock, two companies that have disclosed financial information, as examples:

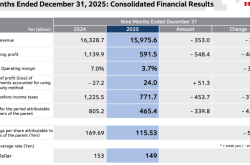

Ecovacs, once known as the "king of robot vacuums," has seen its net profit decline since 2022, with a drop of over 60% in 2023. Last year, Ecovacs' revenue reached 16.542 billion yuan, and although its net profit increased by 31.07%, the absolute value was only 806 million yuan, less than half of its peak in 2021.

Roborock's sales data is also impressive. According to IDC statistics, in 2024, Roborock achieved the first place in global sales volume and sales revenue, with shipments increasing by 20.7% year-on-year.

However, in terms of profitability, while Roborock's revenue increased significantly by 38.03% last year, totaling 11.945 billion yuan, the net profit attributable to shareholders of the listed company turned negative, decreasing by 3.64% to 1.977 billion yuan. In the first quarter of 2025, the divergence between the company's revenue and profit was even more pronounced, with revenue increasing by 86.22% year-on-year and net profit attributable to shareholders decreasing by 32.92% year-on-year.

Regarding the reasons for the decline in net profit growth, Ecovacs pointed out in its 2022 and 2023 financial reports that rising costs and expenses, asset impairment losses caused by inventory price declines, fierce price wars in the industry, and continuously high R&D investments have collectively led the company into a situation of "increasing revenue without increasing profits."

Roborock explained in its 2024 financial report that the increase in costs and expenses, the decline in gross profit margins due to intensified market competition, and fluctuations in non-operating gains and losses have jointly impacted profitability.

While we have only presented two cases, the fact that robot vacuums are experiencing increased revenue but not increased profits reflects a common dilemma faced by the entire industry.

02 Latecomers Unafraid of Problems

On the user side, robot vacuums that have undergone multiple iterations still cannot complete cleaning tasks like humans.

For instance, if there are slightly larger particles on the ground, the robot vacuum cannot only fail to suck them up but will also push the trash around the room, often pushing large pieces of trash into corners and turning around as if nothing happened.

Additionally, stains that humans can easily wipe away with a cloth remain difficult for robot vacuums to clean, even after spinning around several times. When they roll over sticky dirt such as pet feces or soup stains, it becomes a "disaster," leaving traces of the robot vacuum's path throughout the house.

Furthermore, in narrow spaces under dining tables with many obstacles, robot vacuums often send out distress signals indicating that they are "trapped." Due to misjudgments of spatial location and indoor environment, robot vacuums often get stuck, making them seem like "babies" that need constant care.

As the positioning of robot vacuums shifts from "tech toys" to "smart appliances," users' requirements and expectations for them also change:

In the past, minor collisions and incomplete cleaning during use were tolerable;

Nowadays, with unsatisfactory cleaning efficiency and not being a rigid household need, robot vacuums have become somewhat awkward.

To boost sales, manufacturers have engaged in fierce competition in terms of pricing, talent, patents, and more. Under extreme internal competition, profits are naturally diluted.

Since the industry is already so internally competitive, why are new players entering the market at this time? There are two main reasons.

First, the low penetration rate of the industry indicates that there is still growth potential in the market.

According to the "2025 China Robot Vacuum Industry Status Development Report," the household penetration rate of robot vacuums in China is only 6.9%, still a significant gap compared to the 15% penetration rate in the United States. However, the penetration rate in high-tier cities has peaked at 20%; while in low-tier cities, constrained by factors such as consumption capacity and market education, the market has not yet fully opened, and it will take time for the penetration rate to increase.

This means that, unlike traditional home appliances, the robot vacuum market is not yet saturated, and it is still uncertain who will emerge as the final winner.

Second, the trend of quantity and price in the market shows that users' willingness to consume has not waned.

AVC data shows that the Chinese robot vacuum market experienced a period of rapid growth from 2018 to 2020, with annual sales exceeding 6 million units.

However, since 2021, market sales have begun to decline, falling to 5.78 million units in 2021 and further descending to 4.41 million units in 2022 (a decrease of 23.8% year-on-year). Although there was a slight recovery to 4.58 million units in 2023, this was still only 76% of the 2020 peak. In 2024, stimulated by the "national subsidy" policy, sales rebounded to 5.39 million units.

In terms of prices, the average price of robot vacuums was 1687 yuan in 2020, and it has increased every year since then. By 2024, the average price ranged between 3282 yuan (online) and 4710 yuan (offline).

Declining sales and rising prices reflect the existence of market demand, with users willing to pay for innovation. However, activating more demand requires matching innovation of a corresponding degree.

In fact, since the technological innovation of the third-generation base station in 2021, robot vacuums have undergone multiple functional innovations such as automatic water supply and drainage, full base stations, chassis lifting, laser navigation, AI obstacle avoidance, and self-cleaning. Recently, there have also been morphological changes with the addition of mechanical arms. In an industry context where the product form of robot vacuums has not yet been fully established, like Dyson, newcomers can completely rise to prominence with a disruptive innovation.

03 Will DJI Be the Catalyst?

How much impact will new players entering the market have on the market structure? The industry generally believes that DJI is the most uncertain factor.

Liu Run, a columnist for Forbes China, interpreted DJI's shift to making robot vacuums as "overflowing innovation," capable of forming a technology breakthrough with dimensionality reduction.

First, the core functions of robot vacuums are mainly supported by three technologies: visual perception, precise positioning, and path planning. DJI's drone products operate in complex three-dimensional spaces, with technical difficulties far exceeding the path planning of robot vacuums on a two-dimensional plane. Therefore, for DJI, making robot vacuums is almost a "piece of cake."

Second, the key to success in crossing over into new product categories lies in whether core technologies can be transferred and whether user brand recognition does not need to be cultivated anew after the transfer.

Obviously, DJI has pushed the technology of spatial intelligence to its limit. If the perception algorithm can avoid tree branches, then avoiding data cables will not be an obstacle. The key is that users have complete trust in DJI's technological capabilities. Just like Huawei and Xiaomi, when they transfer their technological accumulation and market reputation in the mobile phone industry to smart wearables, smart homes, and the automotive sector, users still trust them.

However, one point of uncertainty is that the current focus of competition in the robot vacuum market is no longer on underlying technologies, but rather on the comparison of full-chain marketing capabilities such as market strategies, brand recognition, and channel construction.

Regarding DJI's most confident technology transfer, some industry insiders believe that there are essential differences between drones and robot vacuums.

The former's core is dealing with high-speed obstacle avoidance in dynamic environments, such as tree branches and wires, and its algorithm prioritizes ensuring stable flight. Its obstacle avoidance system is designed to be "non-contact." The latter's core is object recognition in static environments, such as debris and pet feces, and its working principle requires the robot vacuum to actively contact the ground and apply cleaning pressure.

Especially in an industry context where core functions are basically determined, market competition has entered into a complex function internal competition of "all-in-one base stations," "automatic washing and drying," "mop lifting," etc., competing for the ability to further enhance user experience through innovation.

From the above analysis, it can be seen that DJI actually faces quite a few challenges. However, regardless of the outcome, a new round of reshuffling in the industry is imminent. Whoever can truly break through "pseudo-intelligence" and meet users' rigid demands for "truly clean and truly worry-free" will be the first to land in the future red ocean.

This revolution about efficiency and experience is far from over.