After Analyzing Google, Meta, and Microsoft's Latest Financial Reports, AI's Crucial Role Becomes Clear

![]() 08/05 2025

08/05 2025

![]() 462

462

This article is based on publicly available information and is intended for informational purposes only. It does not constitute investment advice.

Last week, American tech giants Google, Meta, and Microsoft released their latest financial reports. These reports revealed robust revenue and profit growth, increased capital expenditures, and optimistic future guidance, showcasing their exceptional performance.

Behind these impressive financial results lies a dual-faceted narrative, highlighting two key drivers of their growth: the traditional "Technology + Retail" cycle and the emerging "AI Internal Cycle."

Using these financial reports as a starting point, we delve into the new logic underpinning the technological evolution that supports the stellar performance of these tech giants.

01 Google, Microsoft, and Meta: A Comparative Analysis

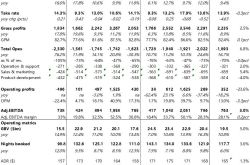

Let's first take a closer look at the specifics of their financial reports:

(1) Revenue and Profits Exceed Expectations

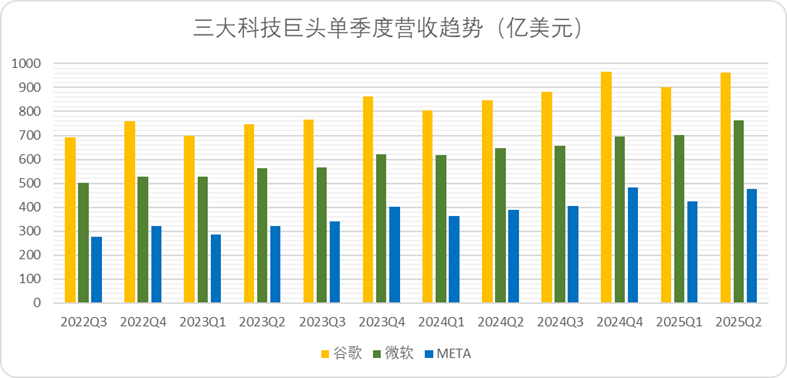

In terms of revenue, Google reported $96.4 billion in the second quarter, marking a 14% year-over-year growth and surpassing consensus estimates. Microsoft recorded $76.4 billion in revenue, up 18% year-over-year, setting a new high since 2024. Meta, too, reported $47.5 billion in revenue, a 22% year-over-year increase, achieving a new high over the past four quarters.

Chart: Quarterly Revenue Trends of Google, Microsoft, and Meta, Source: Choice Financial Client, Corporate Financial Reports

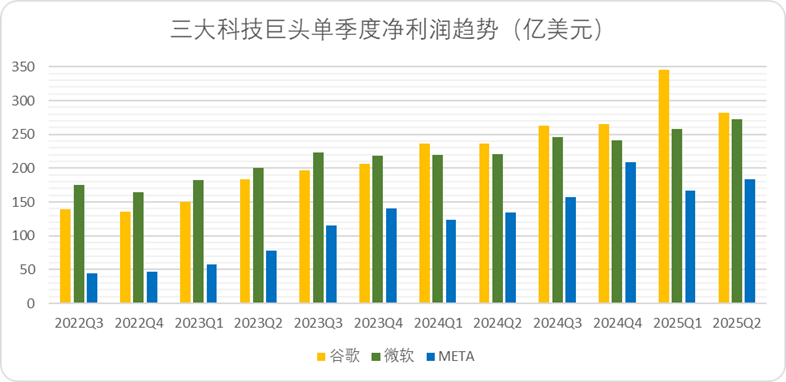

Profit-wise, Google recorded $28.2 billion, a 19% year-over-year increase; Microsoft reported $27.2 billion, up 24%; and Meta posted $18.3 billion, with a 38% growth rate.

Both in terms of revenue and profit, these tech giants have delivered remarkable results.

Chart: Quarterly Net Profit Trends of Google, Microsoft, and Meta, Source: Choice Financial Client, Corporate Financial Reports

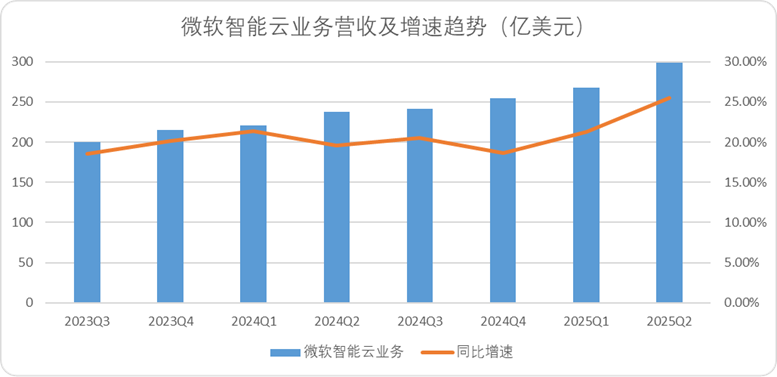

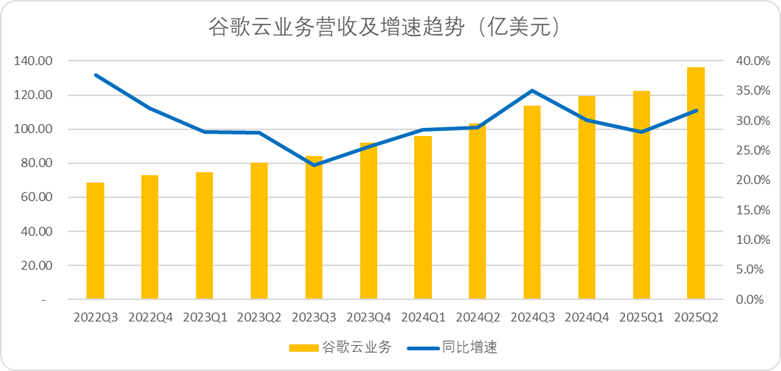

(2) Cloud Services Maintain High Growth

Breaking down their businesses, both Google and Meta's advertising businesses performed well (detailed later). Additionally, the growth rates of Google Cloud and Microsoft's cloud services stood out significantly. Microsoft's Intelligent Cloud business grew at 26%, with Azure's full-year revenue growth exceeding 30% and quarterly growth nearing 30%. Google Cloud's overall growth rate also reached 31.5%.

AI is currently benefiting most from advancements in computing power infrastructure.

Chart: Quarterly Revenue and Growth Rates of Google Cloud and Microsoft Cloud, Source: Choice Financial Client, Corporate Financial Reports

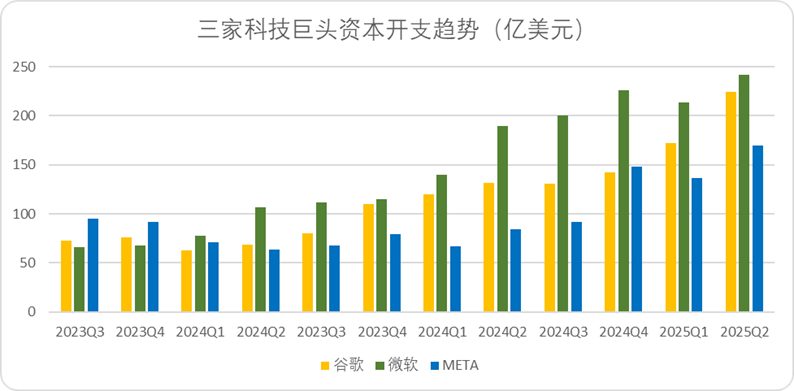

(3) Capital Expenditures Accelerate and Show No Signs of Peaking

While generating revenue, these companies are also investing heavily. Their second-quarter capital expenditures hit new highs. Microsoft's quarterly capital expenditure reached $24.2 billion, up 27% year-over-year and exceeding expectations by $2.8 billion. Meta's second-quarter capital expenditure was $17 billion, doubling year-over-year (due to a low base in the same period last year) and exceeding expectations by $3.3 billion. Google's second-quarter capital expenditure was $22.4 billion, up 70% year-over-year and exceeding expectations by $5.2 billion.

Moreover, the high growth in capital expenditures is far from peaking. Meta and Google have raised their capital expenditure expectations for the next quarter, and Microsoft's CFO signaled that capital expenditure expectations for the first quarter of the new fiscal year will reach $30 billion. The capital expenditures of these leading companies are all accelerating.

Chart: Quarterly Capital Expenditure Trends of Google, Microsoft, and Meta, Source: Choice Financial Client, Corporate Financial Reports

In addition to their impressive financial performance, these tech giants have also raised their future expectations. Meta provided a growth guidance of nearly 20%, while Google and Microsoft's expectations are equally optimistic.

In summary, these three tech companies have achieved impressive revenue and profit growth, primarily supported by advertising and cloud services. Their capital expenditure actions are also accelerating significantly, and their future outlooks are relatively optimistic.

02 The Traditional "Technology + Retail" Cycle Continues to Drive Growth

Upon deeper analysis, we find that the essential factor supporting the strong stock market performance of leading American tech companies remains the "Technology-Consumption" cycle of the Internet era.

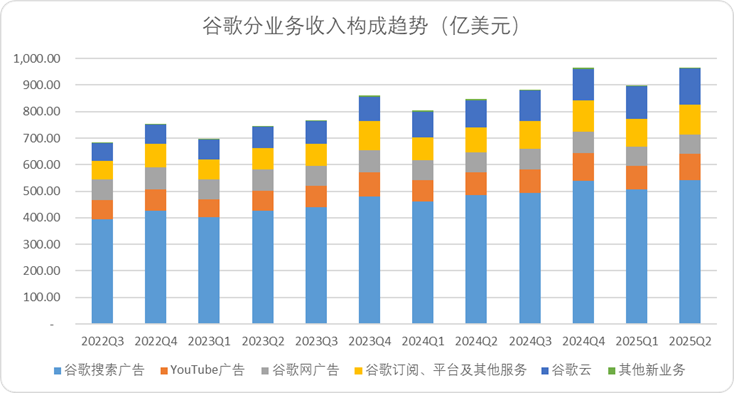

Breaking down their revenue contributions by business lines, we see that apart from cloud services, Microsoft's software (M365 series) and LinkedIn did not experience very high growth rates (though they maintained relatively high levels), fluctuating between 10-15% in recent quarters. In Google and Meta's business lines, advertising, alongside cloud services, has become a significant growth engine.

Taking Google as an example, in the second quarter of this year, its three advertising businesses (search advertising + YouTube advertising + Google Network advertising) collectively increased by 5.5 percentage points quarter-over-quarter, outperforming all other businesses, including Google Cloud.

Chart: Quarterly Revenue Trends by Business for Google, Source: Choice Financial Client, Corporate Financial Reports

Meta, even more so, derives almost all of its revenue from advertising. Its revenue growth in the second quarter was almost entirely driven by its strong advertising performance, with advertising revenue increasing by 22% year-over-year.

Google attributes the strong performance of its advertising business to AI. During the earnings call, it was stated that the advertising department optimized the entire sales process through AI, with AI max in Search significantly improving conversion rates and Demand Gen tools enhancing ad click-through rates.

Meta's earnings call also centered around AI. Its Advantage+ program certainly contributed to the growth of the advertising business. However, the call did not directly link the strong performance of the advertising business to AI products. It simply mentioned progress in the self-driving AI agent built with Llama4, which helped improve Facebook's algorithm, enhancing content quality and engagement, but also noted that the scale was still small and the impact limited.

While AI products have always been a top priority for tech giants, and AI has indeed driven the growth of the advertising business, the rapid rise in advertising revenue in a single quarter cannot be solely explained by AI technology upgrades. The "Technology + Retail" cycle, shaped by the US in the Internet era, also plays a crucial role in driving growth.

Since the inception of Internet advertising, most tech companies (including those in China) have established a positive cycle: "increasing capital expenditures to attract users - selling product advertising to the retail or consumer industry - the rapid development of the retail industry increasing ad spending - continuing to increase capital expenditures after cash inflows".

Currently, in the early stages of the AI era, this logic is still being maintained. Google and Meta's strong second-quarter performance gave them confidence to increase capital expenditures, and the robust advertising business is also inseparable from the contributions of the retail and consumer industries.

According to a report by Magna, a market intelligence agency under IPG, at the end of last year, the US digital media market was in a historic upcycle. In 2024, "non-cyclical advertising expenditures" (excluding Olympic or political expenditures) increased by 8.9%, marking the strongest growth in nearly 20 years.

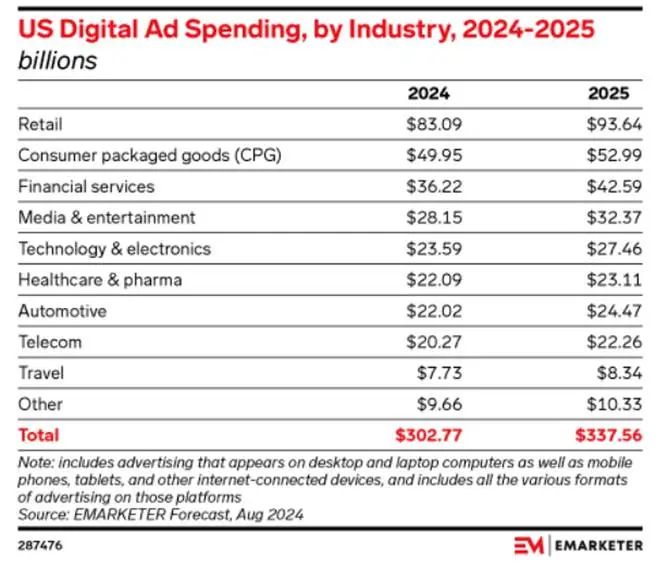

According to eMarketer's forecast last year, the retail industry leads digital media ad spending, with particularly notable growth rates since this year.

Chart: Forecast of US Digital Advertising Spending by Industry for 2024-2025, Source: eMarketer

Additionally, cross-border online retail platforms have been major ad spenders in recent years, quickly resuming their ad spending efforts after a brief impact from tariffs in April.

According to Appgrowing's "White Paper on Global Mobile Advertising Marketing Strategies in H1 2025," in the first half of 2025, Temu topped the app promotion list, with Shopee, TikTok, Carrefour, and Shein also making the top 20 in app spending.

Retail enterprises' ability to support the growth of tech giants' advertising businesses is not only due to the effectiveness improvements driven by AI technology but also essentially due to the high development of the US retail industry itself. Here are two data points to support the logic of strong ad spending by the retail industry:

· In June, US retail sales increased by 0.6% month-over-month, reversing the negative impact of tariffs in April-May (possibly also related to price increases). Over the past five years, annual retail sales have been higher than the same period values, with consumption increments from Latino immigrants also noteworthy.

· In early August, Amazon released its financial report, showing that its cloud business growth fell short of expectations, but its pan-retail business growth reached 12%, with a quarter-over-quarter increase of nearly 5 percentage points, indirectly confirming the strong performance of the retail industry.

As the largest advertiser, the retail industry itself has performed well and is naturally willing to continue increasing ad spending to expand its market. This explains why Google and Meta's advertising businesses achieved such outstanding performance in the second quarter.

03 A New Growth Engine for Tech Giants: The AI Internal Cycle

In reviewing ad spending trends in the retail industry in the first half of this year, we discovered another potential logical thread supporting the fundamental performance of leading American tech companies. Although its current proportion and impact are relatively small (primarily relying on retail consumption ad spending), the industry chain is relatively complete and reasonable, aligning more with the narrative of the new era: the AI Internal Cycle.

According to Appgrowing's report, in the first quarter of this year, the ad spending growth of overseas AI applications was significant. Taking March as an example, the month-over-month growth rate reached 5%. Breaking down the categories, most saw good growth rates, with notable increases in the number of ad placements for AI companions, text generation, and AI education.

Chart: Classification and Trend of AI Application Ad Spending, Source: Appgrowing

The US is a major consumer country. During the Internet and mobile Internet eras, relying on strong consumption power and purchasing willingness, the ARR (Annual Recurring Revenue) of American tech companies was much higher than that of application products in other regions.

Today, the same logic applies to AI products. Most of the top 10 ad-placed products in the list (excluding a few products) have relatively high pricing and impressive payment rates:

· Grammarly, a popular writing assistance tool on YouTube (technically not an AI-native product), has an annual membership of about $144. The basic version has almost no functionality, and its ARR reaches $700 million.

· AI Tutor, a star product in the AI education sector, based on the GPT4o+ model, has a monthly pricing of $15, with advanced products using more models priced at $25, $60, and $200, respectively. The payment rate is not disclosed.

· Talkie, a domestic AI companion product launched by MiniMax, uses a game-like paid model - card drawing. According to "Emergence of Intelligence," its annual revenue last year may have been $70 million.

· VisualMind AI, currently priced at $98 per month or $498 per year for the premium version.

· Nova-AI Chatbot, a chatbot product built on the ChatGPT model, is priced at $5 per week, $10 per month, or $40 per year, making it the relatively lowest-priced product on the list.

Setting aside limitations on advertising spending, if we consider the ranking of top AI Native companies, the annual recurring revenue (ARR) of cutting-edge AI applications in the North American market, such as Midjourney, Anysphere, Eleven Labs, Gamma, Photoroom, and other notable small-scale AI applications, has surpassed $50 million.

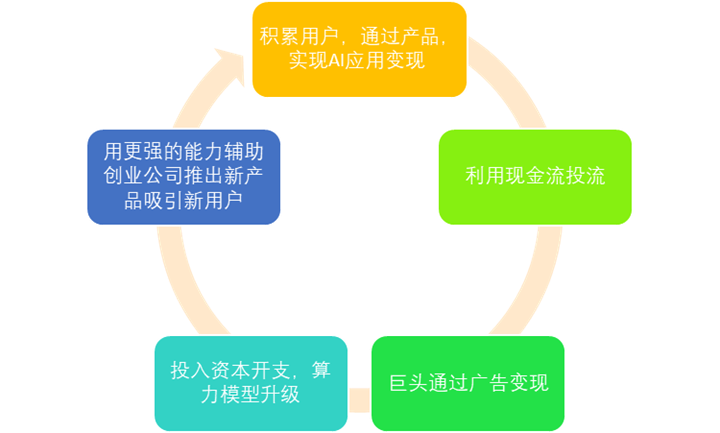

The capacity to sustain corporate revenue stability naturally spurs more companies to invest in promoting their products, thereby driving the advertising and model revenue of tech giants while also stimulating demand for cloud computing. As tech giants' revenues surge, there will be increased liquidity for capital expenditures, enhancing model capabilities and computing infrastructure to support AI niche applications, ultimately fostering an AI internal cycle.

Figure: AI Internal Cycle Diagram, Source: Brocade Research Institute

Admittedly, the contribution of AI applications to the revenue of internet giants is relatively modest at this stage, but once the trend takes hold, it will create momentum. As the AI industry evolves, the internal cycle's cash flow will become increasingly robust, potentially forming a more efficient cycle than traditional technology + retail in terms of capital efficiency.

04 Conclusion: A New Round of Battle for Global Technological Dominance

The AI internal cycle logic revealed in the financial reports of the three major technology giants may offer insights into the development of our AI industry.

Three months ago, Peng Zhiqiang, founding partner of Shengjing Jiacheng Venture Capital, undertook a two-week in-depth visit to AI startups and venture capital institutions in Silicon Valley, sharing his insights in a special live broadcast titled "AI Final Thoughts and Silicon Valley Trip." His research notes align with the views we express today. Here is a brief summary of some of Peng Zhiqiang's perspectives:

Currently, there is a high level of enthusiasm for AI innovation and entrepreneurship in Silicon Valley. Enterprise service and SaaS companies are continuously launching AI applications, with AI companies dominating billboards on both sides of the road. Whether it's giants like Microsoft and OpenAI, unicorns like NotionAI, or numerous startups, they are all thriving, signifying that Silicon Valley is in an exhilarating phase of AI innovation.

Silicon Valley AI companies exhibit a strong sense of commercialization. The commercialization instinct of American companies is deeply embedded in their DNA, and the willingness to pay of both C-end and B-end customers in the US is indeed admirable.

Perhaps this commercialization instinct is the crux of American technology companies' ability to construct an AI internal cycle.

Regarding the current state of our technological development, Peng Zhiqiang believes that both C-end users and B-end enterprises show weak willingness to pay for Chinese SaaS companies or AI application companies. Consequently, AI applications must achieve extreme results-oriented performance and even compete in the physical world—that is, returning to energy, mining, computing power, electricity, supply chains, materials, hardware, or equipment—to generate substantial profits.

From a broader perspective, our current approach to technological development has not fully diverged from the mindset of manufacturing development. The flow of capital throughout society resembles a reward-based commendation system where only ultimate victory can potentially lead to an IPO, traffic acquisition, and cash rewards in the physical world. Before that, everything is merely speculative.

In summary, our current capital narrative tends to reward only after "final victory" rather than continuously nurturing staged innovations to achieve efficient capital utilization cycles.

This also implies that companies will fall into a final-stage mindset when developing products, unable to establish a positive cycle at the capital level that supports long-term development, posing greater challenges to the commercialization of Chinese entrepreneurs.

Nevertheless, from the basic material needs of the masses to the technological infrastructure spanning the heavens and earth, our country has never lacked grand narratives of catching up and surpassing in the long term.

If we can recognize that the narrative of technological development needs to rely on successive cycles rather than merely pursuing the final victory, perhaps we can provide corresponding guidance from the capital and policy levels, thereby fostering a relatively loose and more prosperous technological development ecosystem that supports business closed loops.

The AI ecological cycle has emerged as a new engine for the growth of technology giants and a new frontline in the battle for global technological dominance.