Quark AI Disrupts Baidu's Dominance

![]() 08/05 2025

08/05 2025

![]() 473

473

With Quark successfully captivating young users and redefining "search as a service" through innovative capabilities like "deep thinking" and the "AI super frame," Baidu finds itself confronted with a harsh reality: dwindling core online marketing revenue and a steady loss of youthful demographics. The battle for search supremacy is not merely about product iteration; it's a paradigm shift involving ecosystems, interests, and future discourse power.

Written by | Xiaotian

If you ask which AI sector is most competitive in 2025, AI search would undoubtedly be among the top contenders. According to the "AI Search Product Evaluation 2025" report by IDC, a renowned market research firm, Alibaba's Quark tops the list with a product performance score of 4.8, surpassing traditional search engine Baidu for the first time.

This report underscores Quark's exceptional performance in complex search reasoning, result professionalism, and accuracy, marking the emergence of a "new king" in the general search industry. Simultaneously, the report reflects that Baidu, long the leader in China's search market, is facing unprecedented challenges amidst the AI wave. Despite its AI layout over a decade ago, Baidu appears sluggish in deeply integrating its core search business with AI.

As Quark attracts young users and reshapes "search as a service" through its innovative capabilities, Baidu grapples with declining core online marketing revenue and user loss. The ultimate struggle for search dominance is not just about product iteration; it's a paradigm shift involving ecosystems, interests, and future discourse power.

1. The "Invisible Champion" in AI: The Ascent of Quark AI

For a long time, Quark wasn't a name that came to mind when discussing search engines. This Alibaba product was often viewed as a "small but beautiful" tool-type application with a user base far smaller than Baidu's. Its business model was limited to tool-type products, with clear monetization paths like cloud storage memberships and document services, but with evident ceilings.

However, since the AI wave surged in 2023, especially in 2025, Quark has quietly transformed from a "cloud storage" tool to an "AI super frame" through its profound understanding and swift implementation of AI search, becoming a formidable force in the AI landscape.

Quark AI's rise is fueled by its precise penetration into vertical scenarios and "deep thinking" about user needs. In February 2023, Quark pioneered the "Deep Thinking" module, breaking the traditional search model of merely returning links or simple answers. When users input questions, the system no longer merely matches keywords but understands, analyzes, and reasons about the queries. The IDC report emphasizes that AI search's core competitiveness lies in being "irreplaceable in scenarios," such as having exclusive data, customized algorithms, and scenario-based service expansion. Quark grasps this core and demonstrates robust "scenario penetration power" in various niche scenarios like education, health, shopping, and travel.

Take the education scenario, for instance. Quark's "College Entrance Examination Knowledge Base," "College Entrance Examination Volunteer Big Model," and the country's first "Volunteer Report Agent" have generated over 12 million professional volunteer reports through the "task planning - execution - inspection - reflection" framework. This represents not just an upgrade from basic information acquisition to intelligent decision support but also establishes a strong user mindset in the national-level scenario of the college entrance examination. In the health field, the "Quark Health Big Model" has successfully passed the written exam evaluation of chief physicians in 12 core disciplines in China. Its "slow thinking ability" can derive the final answer in stages and depth when faced with complex medical issues, supported by a professional and authoritative medical knowledge base.

The expansion of these deep scenario-based services has transformed Quark from an information "provider" to a "solver" and "decision supporter" for user problems. In 2024, Quark built a boundless "AI Super Frame" architecture by integrating Alibaba's Tongyi Qianwen large model. This architecture transcends the traditional search tool form. Users only need to input natural language instructions, and the system automatically analyzes needs and completes full-link operations, realizing a seamless experience of "searching, storing, and using in one go".

For example, when planning a trip, Quark AI can actively dissect vague needs (like "departing from Shanghai, going to the northwest during National Day, 7 days, budget of 15,000 yuan, wanting to balance natural scenery and culture") and "think first, then search, and finally output" like a human. It proactively seeks details, obtains real-time data, and utilizes resources from the Alibaba ecosystem (such as Gaode Maps, Fliggy, and Taobao) to generate a structured and executable itinerary plan encompassing routes, budget allocation, hidden attractions, and even pitfall avoidance guides. This closed loop of "recognition - decision - transaction" turns search into the scheduling hub of the Alibaba ecosystem. Users initiate not just a simple information retrieval but a new journey of problem-solving, task completion, and creativity stimulation.

It's worth mentioning that Quark's rise also benefits from its unique "search gene + ecosystem synergy" dimensional strike. Inheriting Alibaba's Quark search engine capabilities, it supports real-time crawling of price, review, and ranking data from e-commerce platforms (like Taobao and JD.com) to generate dynamic competitive product reports, aiding merchants in optimizing dynamic pricing strategies. Functions such as industrial production of product copywriting and sentiment analysis of user reviews are deeply tailored to e-commerce scenarios, significantly enhancing decision-making efficiency and conversion rates.

Moreover, Quark boasts a vast group of young users. According to QuestMobile data, 50% of its users are under 25 years old, with post-00s comprising more than half. These Generation Z users have a higher acceptance of AI and are more willing to try new interaction methods. Quark accumulated a significant number of young users early on through its "ad-free, pure search" features and practical functions like cloud storage. This user base, combined with Alibaba Group positioning it as a strategic-level innovation business ("New Four Dragons") alongside 1688, Xianyu, and DingTalk, and as a key application for Alibaba's AI-to-C bet, has injected strong resources and strategic priority into its AI transformation.

IDC views Quark's surpassing Baidu in product performance as the "first time a new leader has emerged in the general search industry," undoubtedly the best footnote to Quark's AI strategy.

2. Baidu AI's Transformation Challenges and Realistic Pressures

Compared to Quark's rapid breakthrough, Baidu, the long-time dominant player in China's search market, seems to be struggling in the AI search wave. Although Baidu is one of the earliest Chinese internet companies to layout AI, with deep AI technology accumulation (like the Wenxin large model), it has encountered unprecedented transformation difficulties in deeply integrating its core search business with AI.

The crux of this dilemma lies in the conflict between traditional search advertising, the "lifeblood," and the underlying logic of AI search. AI search pursues "efficiency" and "directly solving problems," tending to provide accurate answers or complete solutions, thereby reducing the time users spend repeatedly screening and navigating through information. In contrast, the traditional pay-per-click advertising profit model relies on users' "clicks" and "jumps" to achieve commercial monetization through ad exposure and traffic distribution.

This inherent contradiction makes Baidu face the risk of weakening its main revenue stream when promoting AI search changes. For a long time, Baidu appears to prefer "gradual improvements" under the premise of "not affecting core advertising revenue," such as adding AI-generated auxiliary information or selected summaries to search results, while retaining the original advertising model and content ecosystem. Under this strategy, AI technology's penetration into the core search business is superficial, the interaction paradigm remains unchanged, and it fails to offer users a "one-stop" direct experience.

However, the real-world crisis is accelerating the decline of the core business. Generation Z has higher information acquisition requirements. They desire to swiftly and accurately find needed information and obtain a more personalized, diversified, and immersive experience. QuestMobile data shows that at the beginning of 2025, the average daily usage time of Baidu Search among the core user group aged 18-35 dropped sharply by 18%, with a continuous loss of young users. Short video platforms like Douyin and Kuaishou, as well as vertical applications like Xiaohongshu and Zhihu, have also significantly diverted traditional search demand, further eroding Baidu's user base.

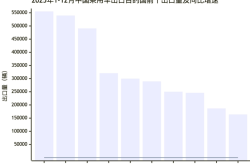

Statista data reveals that Baidu's share of China's search market has gradually decreased from 87% in November 2021 to 60% in 2024. The irreplaceability of traditional keyword search is collapsing, and the migration of user habits often precedes the collapse of business models.

The adjustment of advertiser budgets has further exacerbated Baidu's commercial difficulties. QuestMobile data shows that 70% of the budget in the consumer goods industry flows to platforms like Kuaishou and Taobao, with Baidu's share being less than 5%, only higher than long-video platforms like iQIYI, and has been declining for several consecutive quarters.

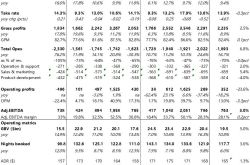

Baidu's first-quarter 2025 financial report indicates that its core online marketing revenue decreased by 6% year-on-year, marking a decline for several consecutive quarters. Although the monthly active user base of Baidu App is still growing (reaching 724 million in Q1 2025, a year-on-year increase of 7%), the commercial value derived from this growth has not been effectively converted, and the contribution of user volume changes to commercial revenue has fallen short of expectations. With the rise of super apps like WeChat and Douyin, Baidu's value as a "traffic entrance" has been severely diluted, and its traditional advertising business faces tremendous growth pressure.

Under internal and external pressures, Baidu has made attempts to break the deadlock. On July 2, 2025, at Baidu AI DAY, it announced the biggest revision to its search product in nearly a decade, upgrading the traditional search box into an all-inclusive "AI super entry point." This "frame" supports ultra-long text, file search, and multimodal inputs like voice, images, and videos, integrating shortcuts like "AI Writing," "AI Drawing," and "AI Travel," attempting to transform search from a passive information provider into an active demand satisfier. Simultaneously, it introduced "Baikan" to replace traditional link lists, integrating search results into an information stream with mixed layouts of images, texts, audio, and video, and accessing intelligent agents and real-person services, aiming to create a closed-loop experience of "search as a service".

However, compared to players like Quark and Doubao, Baidu's AI transformation is not early; it can even be described as sluggish. Before this, these emerging players had already successively integrated various intelligent agents and AI functions, supported ultra-long text and multimodal inputs, and directly output structured solutions, functionally replacing search engines to a certain extent.

More critically, regarding business models, Baidu attempts to break the deadlock with "intelligent agent advertising," making advertising part of AI answers and shortening user decision paths with "service-oriented recommendations." However, the challenges faced by this new model are far more complex than imagined: Can users easily distinguish between "genuine AI recommendations" and "forced advertising"? How to quantify the effectiveness evaluation of intelligent agent advertising? Moreover, will this "paid answer" model repeat the controversy caused by Baidu Baike's paid editing of entries by enterprises, ultimately diluting user trust?

For Baidu, whether to transform is a difficult choice between certain decline and uncertain growth. As search shifts from "providing links" to "providing answers," where the revenue comes from becomes a fundamental question Baidu must readdress. The collapse of Wuhan Baijie is undoubtedly the most glaring footnote to the cracks in traditional search advertising. After AI turns over the old table, those who can build a new one are most likely to survive. Whether Baidu can "revolutionize itself" in this paradigm shift and recreate the search dominator in the AI era remains to be seen.