The "Brain" of Robots Takes Off: How Far Behind is the "Body"?

![]() 08/06 2025

08/06 2025

![]() 485

485

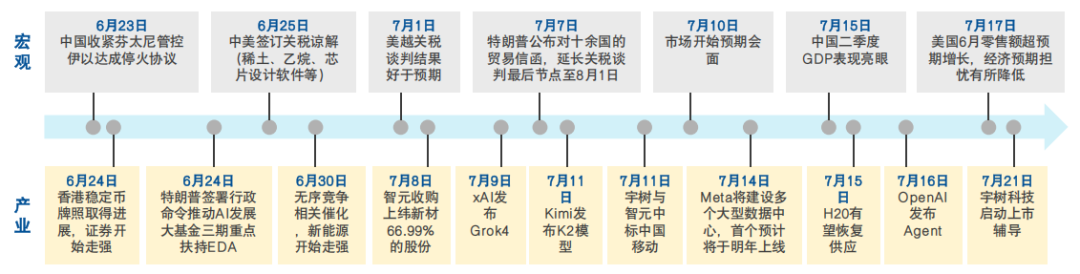

Recently, the AI hardware sector in A-shares has doubled in value, following the lead of NVDA. Similarly mirroring the trend in US stocks, the Robotics ETF Yifangda (159530) has surged over 20% since our mention on June 24th.

Currently, four North American CSPs have confirmed substantial growth in AI investment for next year. Last night, major US AI model manufacturers embarked on a new round of competition. AI can be likened to the "brain" of robots; the faster AI advances, the quicker the application of robots will accelerate.

Thus, when projecting AI's valuation from now until next year, robots should also be viewed from a forward-looking perspective. With the World Robot Conference set to commence in two days, smart money has already started positioning in advance. The Robotics ETF Yifangda (159530) merits continued attention at this juncture.

Catalysts for the Future Performance of Robots

Previously, we noted that after encountering a series of setbacks in the second quarter, market funds would now focus more on companies with genuine performance and revenue.

The initial wave of speculation in robots was broad-based, with various companies capitalizing on the concept to increase their value. However, market funds have come to realize that robots need to be integrated with "brains" to achieve true commercialization.

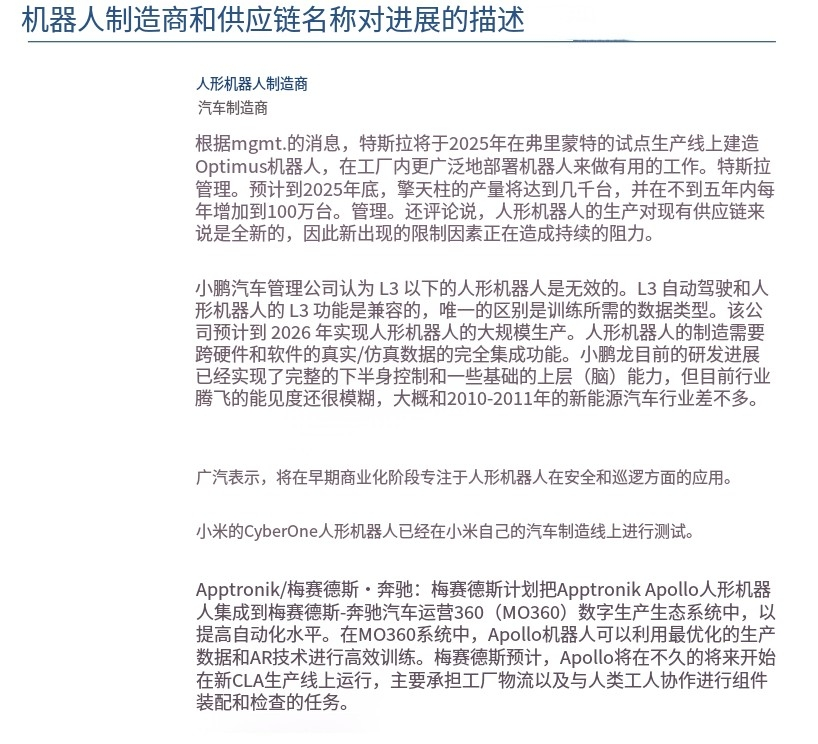

In other words, robots can perform tasks but cannot do so without a "brain." Only Tesla possesses the financial muscle to develop both hardware and robot "brains," encompassing robotaxi, the Gork large model, and the Optimus robot.

Currently, robots stand at a pivotal turning point, akin to AI at the start of this year. AI's industrial trend has been progressing well, but the market is concerned about short-term setbacks, causing a lag in stock price reactions. As AI hardware/applications develop rapidly, we should anticipate accelerated progress in robots as well.

Several catalysts drive the future of robots:

1. Tesla's Positive Momentum: In the short term, Tesla's delayed orders have had a fully digested negative impact in the second quarter, leading to a 20% increase over the past two months. For Tesla, the focus on selling cars is far less significant than robots. To reverse its valuation, Tesla will rely on the narrative of integrating robots and robotaxi.

Domestic robots have a strong correlation with Tesla but do not bear the negative impact of Tesla's car sales. We await positive news from Tesla placing additional orders with domestic hardware companies for robots.

2. Emerging Domestic Demand: Leading domestic company Unitree Technology is initiating the listing process, and new domestic projects are continuously emerging, particularly demonstration applications in key areas like logistics and manufacturing.

This month, the World Robot Conference, China Embodied Intelligence Robotics Industry Conference, and Humanoid Robot Games will showcase more new robot applications, providing a phased boost to sector sentiment.

Furthermore, domestic automakers like Xiaomi, Xpeng, and GAC are following Tesla's footsteps in developing robots, gradually increasing the demand for robot hardware in China, which is no longer solely reliant on Tesla's revenue.

3. Sentiment Diffusion in the Technology Sector: As mentioned earlier, AI and robots are intertwined, with AI serving as the "brain" and robots as the "body." When AI rises, the "body" on the hardware side benefits from the sentiment diffusion among technology sector funds. However, funds selectively target companies with revenue support and Tesla orders.

What Might Funds Choose?

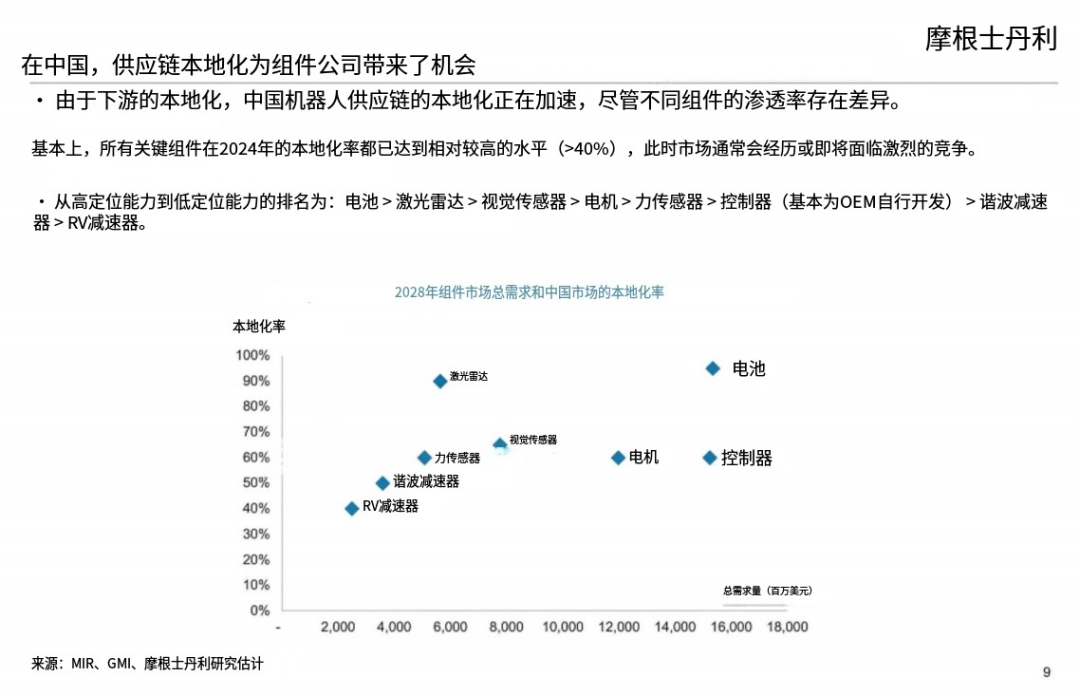

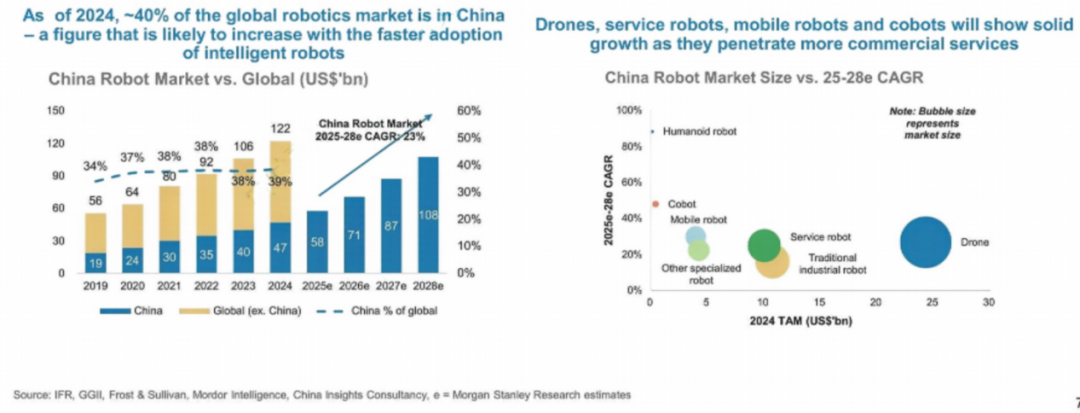

From a market size perspective, Morgan Stanley estimates that the Chinese robotics market will double between 2024 and 2028. By 2024, the Chinese robotics market will account for about 40% of the global total, with a size of $47 billion.

Morgan Stanley expects the robotics industry's compound annual growth rate to reach 23%, reaching a market size of $108 billion by 2028.

Morgan Stanley's report states that in the long run, humanoid robots will become the largest category of robots. Morgan Stanley believes sensors, vision systems, motors, and reducers are areas worth tracking.

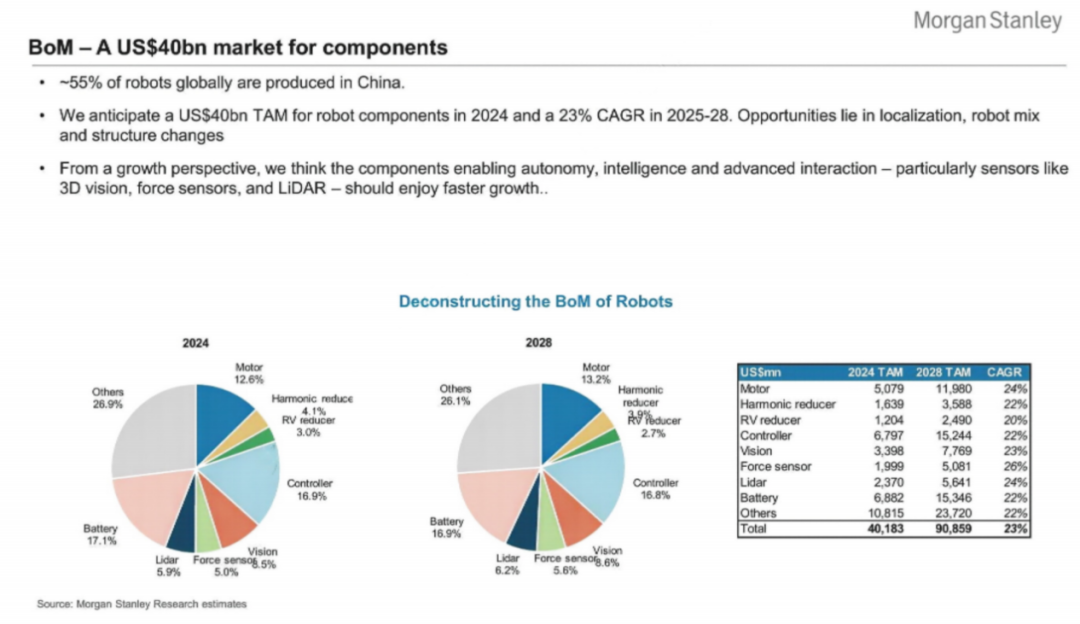

In the robot bill of materials (BoM), motors and batteries account for the largest proportion, while sensors and vision systems exhibit the fastest growth. Morgan Stanley believes 55% of global robots are produced in China, and the total addressable market (TAM) for robot components will be $40 billion in 2024, with a predicted compound annual growth rate of 23% by 2028.

By 2028, Morgan Stanley expects motors and batteries to be the largest TAM categories, accounting for 13% and 17% of the total BoM, respectively, while sensors and vision systems offer the strongest growth potential.

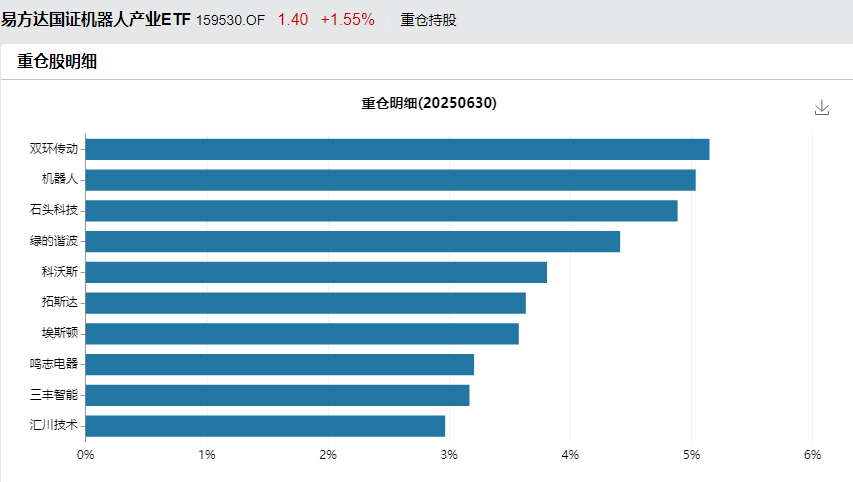

Following Morgan Stanley's report logic, the current areas with advantages in robot core components include sensors, vision systems, motors, and reducers. Companies fitting these categories are all covered by the Robotics ETF Yifangda (159530).

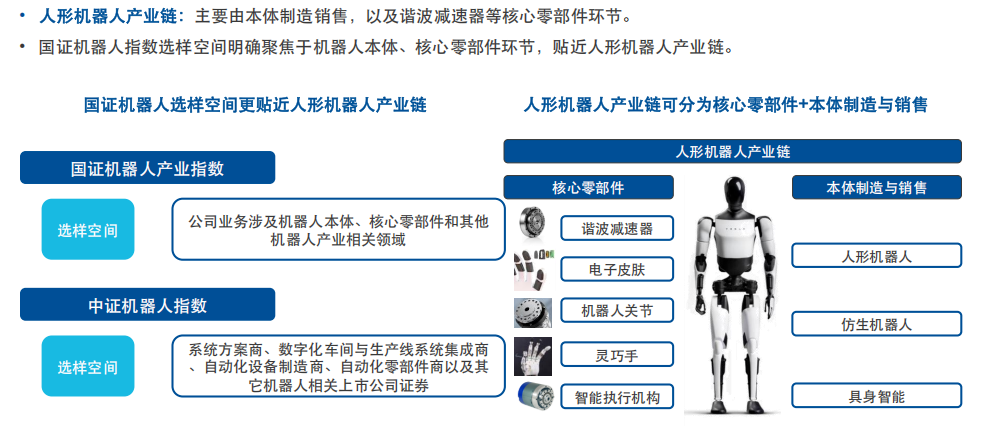

This ETF tracks the ChinaSec Robotics Industry Index. Since its revision on April 10th this year, the index has accumulated a return of 24%, 4-5% higher than similar indices, offering better index elasticity and a higher proportion of humanoid robots, adjusted from 37% to 54%.

Although the robotics sector encountered a series of setbacks in the second quarter, it has experienced some short-term correction.

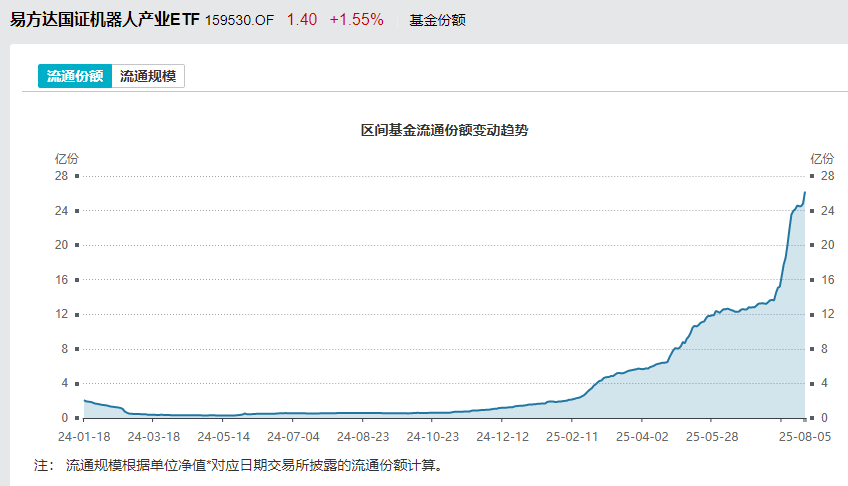

However, from a fund share perspective, the fund's circulating scale has surged from 177 million yuan to 3.6 billion yuan. Long-term funds optimistic about robots have taken advantage of the second quarter's correction to continuously increase their allocation.

Therefore, returning to the initial point, as the growth certainty of AI as the "brain" of robots increases, robots, which will be the largest application end of AI in the future, should also perform well. Participating through the Robotics ETF Yifangda (159530, OTC link 020972/020973) and allocating from an industry-wide perspective is a more suitable choice for investors, avoiding the risk of selecting the wrong company and allowing investors to share in the beta of the industry's high-growth trajectory.