Is Lenovo's All-in AI Strategy a Wise Move?

![]() 08/11 2025

08/11 2025

![]() 480

480

According to the latest IDC data, Lenovo topped the global PC market with a 24.8% share in Q2 2025.

While solidifying its position as the leading PC player, Lenovo is fully embracing AI. At the start of last year, during Lenovo Group's fiscal year 2024/25 kickoff conference, Chairman and CEO Yang Yuanqing announced the company's new mission for the next decade: to spearhead the transformation of artificial intelligence.

| Why Transform? |

Corporate transformation is not a new concept, particularly in the manufacturing sector where many large companies have already transitioned from single-business entities to diversified conglomerates. Notable examples include Haier, Midea, and Xiaomi.

Returning to Lenovo, from pioneering the PC market to breaking into the global arena in the 20th century to acquiring IBM's PC business, Lenovo, as China's first truly global enterprise, has secured the top spot in global PC sales and established a comprehensive global supply chain.

The reasons behind this success are straightforward. On one hand, it benefited from the industrial chain dividend, and on the other, Lenovo employed a successful corporate competition strategy, despite periodic public opinion turmoil.

However, this did not deter the company from its established strategy. In fact, after achieving success, Lenovo was more concerned with the subsequent necessity of "transformation."

In 2017, Lenovo temporarily lost its PC throne to HP, and its new mobile business failed to become a significant growth driver. Particularly in fiscal year 2016/17, Lenovo's three main businesses declined, with total revenue shrinking by 4.2%.

Upon closer inspection, Lenovo's business bottleneck stemmed from the fact that the PC business accounted for as much as 70% of its revenue for many years, yet the global PC market has been shrinking, with an unclear growth trajectory. Meanwhile, the mobile phone business failed to reverse its decline post-Motorola acquisition, and cloud services were heavily suppressed by emerging tech companies.

Lenovo's dilemma is both an industry-wide issue and an internal factor. Due to changes in PC hardware form factors and software ecosystems, industry competitors are increasingly at odds. Relying solely on PCs is unsustainable in the long run, as industrial dividends eventually diminish.

Additionally, Lenovo missed the mobile internet wave, where its smartphone business failed to gain mainstream traction. This missed opportunity could have significantly boosted revenue growth.

But Lenovo is indeed poised for change.

In 2017, Lenovo launched the "Three Waves Strategy," aiming to transform from a pure hardware manufacturer to an AI service provider offering "devices + cloud." The plan involved investing $1.2 billion over three years. By 2019, Lenovo had established the "3S Transformation" strategy—smart devices, smart infrastructure, smart solutions, and services—to accelerate a shift towards solutions and services, fostering a diversified business matrix.

In 2025, Lenovo announced its entry into the "Fifth Re-entrepreneurial" cycle, a more decisive bet on AI following its AI strategy exploration. As early as 2023, Lenovo adopted the slogan "AI for All," dedicating 60% of its global R&D resources to AI models and smart factories, and establishing a new CTO office and Agent Corps.

Public information reveals that Lenovo has evolved into a 3S (Smart Products/Smart Infrastructure/Solution Services) full-stack service provider. This not only signifies embracing the times but also highlights the necessity of transformation in certain aspects.

Now, Lenovo aspires to be an AI company even more.

| All-in Hybrid AI |

Unlike many other vendors' AI strategies, Lenovo is more focused on hybrid AI.

Specifically, Yang Yuanqing once stated during the Two Sessions, "AI must be born from reality." Considering the differences between Lenovo's B-end and C-end businesses, it's evident that the core of Lenovo's AI strategy leans towards hybrid artificial intelligence.

"In the next decade, Lenovo will prioritize hybrid artificial intelligence." In other words, Lenovo Group will adopt "Hybrid AI" as its strategic axis for the next decade, leveraging the integration of "personal intelligence + enterprise intelligence + public intelligence" to forge differentiated technology paths and product solutions.

The outside world wonders why Lenovo chose a hybrid route for its business strategy. Is it solely determined by the nature of Lenovo's business?

Public information indicates that Lenovo believes there's a natural information barrier between personal data and corporate data, or private corporate data and public intelligence models. Only by combining personal intelligence that understands user intent with enterprise intelligence in private clouds or local data, as well as public intelligence, can we leverage cloud computing power while ensuring privacy security and personalized services. This is a beneficial exploration path for Lenovo.

Thus, Yang Yuanqing envisions mass-producing and marketing AI PCs, widely deploying enterprise AI solutions, and deeply integrating AI services across industries, comprehensively covering the three major segments of devices, infrastructure, and services. This marks Lenovo's attempt to transform comprehensively from a hardware manufacturer to an AI-driven solution provider.

In terms of applications, in personal intelligence scenarios, the Tianxi ecosystem has accessed over 1700 AI applications, spanning various professional fields such as healthcare, law, and education. In smart city scenarios, Lenovo Group has strategically partnered with Fujian Wuyishan, Hubei Yichang, Shanghai Hongkou, and Hohhot, Inner Mongolia, to infuse AI technology into smart city construction.

As a result, Lenovo's AI strategy is starting to bear fruit. For instance, it launched the first AI foldable phone equipped with Moto AI, personal and enterprise-level AI super assistants. Within Lenovo Group, the Intelligent Devices Group (IDG) achieved a 13% year-on-year revenue increase last year, expanding its global PC market share to 23.7%. The Infrastructure Solutions Group (ISG) saw a 63% year-on-year revenue surge, and the Solutions and Services Group (SSG) recorded a 13% year-on-year revenue increase.

A detailed breakdown reveals that the term "Agent" is frequently mentioned in Lenovo's AI strategy. Does this imply that Lenovo will place greater emphasis on this area?

| Will Agent Be a New Breakthrough? |

After the 2025 Innovation Technology Conference, Yang Yuanqing stated in an interview, "Today, many may view Lenovo as a device seller, be it PCs, mobile phones, or servers. In the future, we may become a company with Agent business at its core."

Objectively, even though AI Agents are still evolving, their role in propelling the entire AI industry cannot be overlooked, particularly in driving demand for edge computing devices, further pushing AI terminal deployment from the cloud to the local level.

This viewpoint is reasonable. The past few years have been the inaugural years of Agent commercialization. Survey data from Deloitte shows that 25% of enterprises using generative AI will deploy AI Agents in 2025, rising to 50% by 2027. IDC also predicts that by 2028, at least 15% of daily work decisions will be autonomously made by Agentic AI, and 33% of enterprise software applications will incorporate Agentic AI.

Against this backdrop, numerous technology giants, including NVIDIA, Baidu, OpenAI, ByteDance, and Honor, have launched various application bodies leveraging their own technologies. For example, Zhao Ming, the former CEO of Honor, announced at the launch of the Honor Magic7 series that they had created the world's first operating system equipped with an Agent, deriving the YOYO Agent, which even ordered 2000 cups of coffee for the audience on-site.

This signifies that Agents have immense potential and growth room, and Lenovo's Agents need to further demonstrate that users will demand higher-level AI Agents. It requires products like computers to transcend generative AI dialogue and responses, being able to mobilize end-to-end resources to fully comprehend human information in various forms such as images, speech, and text, thereby making autonomous decisions in complex situations. Under the Agent collaboration framework, it can also collaborate with other Agents (multi-modal Agents).

Currently, Lenovo has achieved results in Agent implementation and application, but this field is still fraught with concerns.

Yang Xu, CEO of Lenovo Lenzu, once published a signed article titled "Building a Fertile Soil for AI Ecosystem: Releasing Data Value in the Smart Era through Open Collaboration," discussing that under the AI wave, the industry faces two major bottlenecks: insufficient data governance efficiency and high barriers to ecosystem collaboration.

Interestingly, this viewpoint posits that, "High barriers to ecosystem collaboration—technology silos lead to inefficient collaboration of computing power, storage capacity, and network resources."

Taking PCs as an example, many brands, including Huawei and Lenovo, are currently trying to solve the problem of edge ecosystem collaboration to achieve software and hardware collaboration and multi-functional office work. However, users have an extreme pursuit of experience, which is actually testing the effectiveness of AI Agents of many vendors, including Lenovo, in terms of product technology.

Further, in May of this year, Lenovo launched a new personal Agent, Tianxi, although Lenovo's AIPC previously came equipped with Lenovo Xiaotian, launched in April 2024.

Additionally, Lenovo has introduced new software suites such as Creator Zone. However, objectively speaking, some suite functions are not differentiated from mainstream market products. Applications for generating content in the form of images, text, and videos, making PPTs, summarizing documents, and generating meeting minutes are also relatively commonplace.

Conversely, these functions are ubiquitous in the industry or on the market. For some users choosing PCs, they may consider more factors related to the PC brand itself. As for how significant a role AI Agents play in purchase decisions, it remains unclear. Obviously, an AIPC enterprise does not equate to an AI enterprise, nor can it fully demonstrate the absolute success of AI Agents.

Based on Lenovo Group's financial report, AI PCs account for 16% of total notebook sales in the Chinese market. The market anticipates Lenovo's first-mover advantage in the AI PC field to quickly translate into profit growth, but the actual penetration rate of 16% has yet to form a significant scale effect, indicating a long road ahead.

The reason is that the PC business still constitutes a significant portion of Lenovo's revenue, but against the backdrop of an AI function activation rate exceeding 30% for high-end models, AI PC products across the industry do not yet possess disruptive innovations.

Correspondingly, an Intel survey also shows that 78% of users believe the usage efficiency of AI PCs is lower than that of traditional PCs. Furthermore, NVIDIA founder and CEO Jen-Hsun Huang believes that the main dilemma of AI PCs lies in the incomplete AI ecosystem on PC terminals, and users' willingness to pay for them is still insufficient.

Regarding business innovation, the public often pays more attention to underlying logic and core technologies. Especially for many Chinese companies, most netizens have generally become accustomed to comparing such "overnight" technologies with previous or foreign enterprises. If not careful, the first team to dive in will either face public criticism or be highly praised. Obviously, just like smartphones, the current implementation of AI Agents in various application scenarios has yet to produce phenomenal disruptive technological innovations.

The challenges do not end there; external competition is also fierce.

With the advent of HarmonyOS in the PC field, achieving industrial boundary innovations in hardware form, operating systems, and other aspects, the rapid growth of Huawei's China business will put pressure on Lenovo.

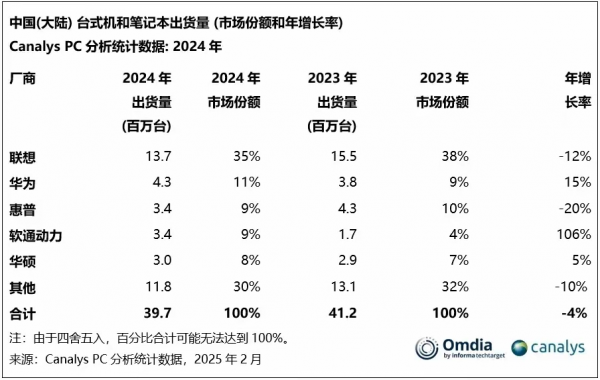

Last year, Huawei's desktop and notebook shipments in the domestic market grew by over 15%, while Lenovo saw a negative growth of 12%. With the emergence of a new operating system in the PC field this year, the future process of the AI PC industry transitioning from technology exploration to terminal application landing will see even fiercer competition. Just like new energy vehicles, the pressure on leading brands often stems from the entry of new forces, as consumers will have more choices.

Apart from the aforementioned C-end field, in the B-end field, the challenge faced by Lenovo's Agents is how to generate larger-scale commercial returns?

Public information indicates that currently, Agents have achieved initial results in implementation and application. Lenovo's entire smart product matrix covers personal, enterprise, and urban scenarios and has accessed thousands of applications. However, the current issue that needs to be addressed is how to secure more orders. According to public data compiled by Smart Hyperparameters, in terms of the bidding amount for large models last year, the mainstream share was still dominated by a few top players.

Previously, Lu Yuan, General Manager of Lenovo China's Government and Enterprise Business Group AI Workstation, explicitly highlighted three primary challenges associated with launching a comprehensive Agent solution: the expense of cross-software and hardware evaluation, the protracted productization cycle of large models, and sluggish order conversion rates.

The rationale behind these observations stems from the fact that technologies like AI Agents pose significant challenges to vendors' adaptation efficiency. With the relentless iteration and advancement of reinforcement learning and edge model technology routes, independent software developers and enterprises are forced to incur higher costs for learning, experimentation, and training. This, in turn, places considerable pressure on enterprises to facilitate the localized deployment of large models.

Delving deeper into the industry's pain points, the core challenge behind enterprises' investment in the prosperity of Agents lies in the limited computing power of local devices. These devices often cannot support intelligent agent tasks that demand high concurrency and significant computing power, particularly those that require extensive GPU computations, which standard office computers simply cannot handle. Additionally, when Agents perform tasks, they frequently occupy local computing resources and operational permissions, severely impacting user experience.

It is undeniable that some practitioners or project stakeholders may harbor concerns about potential risks posed by Agents, such as AI illusions, wrong decisions, and data leakage. This is because, during scheduling or content generation, AI Agents cannot entirely rule out factual errors or misunderstandings of instructions, which could trigger a series of project risks.

Thus, these issues necessitate collaborative efforts from the entire industry chain, including Lenovo, to address them effectively.

AI-centric enterprises are all accelerating their pace, fearing being left behind, and Lenovo is no exception. As a leading hardware manufacturer, the path Lenovo will take by betting on AI is not only a question for Lenovo insiders but also for the market to observe and evaluate.

(Note: Replace "official_image_url" with the actual image URL)