"Robotaxi First Stock": How Close to Profitability?

![]() 08/27 2025

08/27 2025

![]() 493

493

In 2025, the Robotaxi sector continues to buzz with activity. Waymo has secured a self-driving test license in New York, General Motors has revived its autonomous driving initiative, Tesla plans to launch Robotaxi services to the public in September, and numerous domestic autonomous driving firms are expanding their Robotaxi fleets to accelerate commercialization. For a while, Robotaxi appears to have regained its vigor.

However, amidst this boom, a pivotal question lingers both within and outside the industry: how close is Robotaxi to achieving profitability?

Recently, two prominent Chinese autonomous driving companies, Pony.ai and WeRide, both unveiled their financial reports for the second quarter of 2025.

Both firms have been hailed as the "Robotaxi First Stock." By examining these two companies, we can gauge how close Robotaxi is to profitability.

01 Pony.ai: Tripling of Robotaxi Passenger Fare Revenue

One of Pony.ai's primary focuses this year has been to accelerate the commercialization and mass production of Robotaxi.

In terms of fleet size, Pony.ai's total number of Robotaxi vehicles has surpassed 500.

At the Shanghai Auto Show in April this year, Pony.ai unveiled its seventh-generation autonomous driving system. Simultaneously, Pony.ai has broadened its network in the autonomous vehicle field, collaborating with Toyota, GAC Aion, and BAIC ARCFOX to jointly propel the mass production process of autonomous vehicles.

Currently, multiple models of the seventh-generation Robotaxi have entered the mass production stage, including the Toyota BZ4X Robotaxi, GAC Aion Terator Robotaxi, and BAIC ARCFOX Alpha T5 Robotaxi, all of which have commenced open road testing.

As of August 11, 2025, Pony.ai has produced 213 seventh-generation Robotaxi vehicles, with a cumulative test distance exceeding 2 million kilometers on public roads in four major first-tier cities.

Pony.ai has repeatedly affirmed that it will complete the deployment of 1,000 Robotaxi vehicles this year. Currently, this goal appears achievable.

The expansion of the fleet size has driven Pony.ai's overall revenue to continue rising.

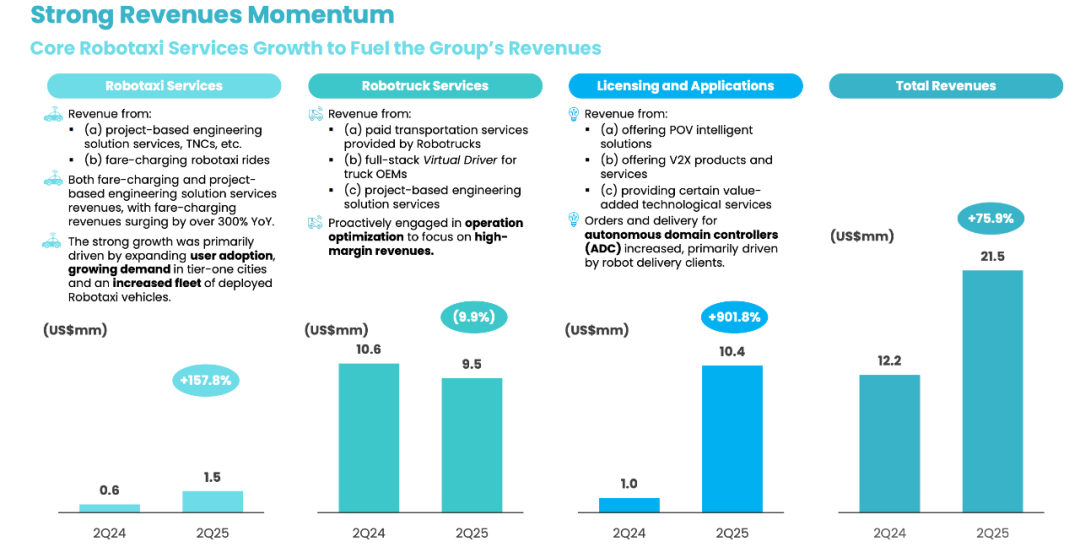

Pony.ai's total revenue for the second quarter reached 154 million yuan (21.5 million USD), marking a year-on-year increase of 75.9% and a quarter-on-quarter increase of 53.5%.

Among this, Robotaxi business revenue amounted to 10.9 million yuan (1.5 million USD), with a year-on-year increase of 157.8%, and Robotaxi passenger fare revenue surged more than threefold year-on-year.

This growth stems from several aspects:

1. Expanded user coverage. Currently, Pony.ai is the sole company in China offering fully driverless Robotaxi fee-based operation services in Beijing, Shanghai, Guangzhou, and Shenzhen, with a total operation area exceeding 2,000 square kilometers in first-tier cities.

2. Increased user numbers. Pony.ai has optimized pricing and operation strategies for different customer groups. The number of registered Robotaxi users in the second quarter increased by 136% year-on-year.

3. Increased fleet size. With over 500 vehicles in operation, Pony.ai conducts 7x24-hour autonomous driving tests in Beijing, Guangzhou, Shenzhen, and Seoul, South Korea, and launches 24-hour Robotaxi ride-hailing services in Guangzhou and Shenzhen to cater to diverse user needs.

Pony.ai's revenue is divided into three main components: Robotaxi, truck, licensing, and application revenue. The second-quarter revenues were 1.5 million USD (10.9 million yuan), 9.5 million USD (68.2 million yuan), and 10.4 million USD (74.6 million yuan), respectively.

Although the proportion of the Robotaxi business in overall revenue is currently not high, accounting for only 7.11%, Pony.ai is deeply validating its business model through large-scale operations. From Pony.ai's current operations, we can already observe revenue inflow and continuous growth, which is scalable and bodes well.

Concurrently, Pony.ai is also accelerating its overseas market expansion this year, albeit relatively slower than WeRide.

In the Middle East, Pony.ai has established a strategic partnership with Dubai's Road and Transport Authority. The first Robotaxi road test will be conducted in 2025, with plans to achieve fully driverless commercial operation in 2026.

In Europe, Pony.ai pioneered tests in Lenningen, Luxembourg, in June and plans to expand to more regions.

In Asia, Pony.ai has obtained a national-level autonomous driving test license issued by South Korea. Since April, the test in Gangnam District, Seoul, has been extended to 7x24 hours, capable of adeptly handling the busiest and most complex urban road conditions in South Korea.

Of course, overall, Pony.ai is still incurring losses, with a loss of 382 million yuan in the second quarter and a total loss of 650 million yuan in the first half of the year.

However, as of the end of the second quarter, Pony.ai still had 5.36 billion yuan in cash reserves, indicating sufficient short-term ammunition.

02 WeRide: Robotaxi Revenue Soars 836.7%, Loss Widens

WeRide's second-quarter financial report showcased impressive performance, with revenue of 127 million yuan, a year-on-year increase of 60.8%.

Among this, Robotaxi business revenue was 45.9 million yuan, with a significant year-on-year increase of 836.7%, setting a new quarterly record since the company's inception. Furthermore, the proportion of Robotaxi business in second-quarter revenue increased markedly to 36.1%, hitting a new high for a single quarter since 2021. The second-quarter gross profit surged 40.6% year-on-year to 35.7 million yuan (5 million USD), with a profit margin of 28.1%.

Let's delve into WeRide's revenue composition.

WeRide's revenue primarily consists of two parts: product revenue and service revenue.

In terms of products, WeRide has formed a five-product matrix encompassing autonomous taxis, autonomous minibuses, autonomous delivery vehicles, autonomous sanitation vehicles, and advanced intelligent driving systems.

In terms of services, it mainly provides autonomous driving-related operation and technical support services, intelligent data services, customized R&D services, and ADAS R&D services.

In terms of composition, product revenue was 59.8 million yuan (8.3 million USD) and service revenue was 67.4 million yuan (9.4 million USD).

As just mentioned, Robotaxi revenue was 45.9 million yuan (approximately 6.4 million USD), making a significant contribution to overall revenue.

However, upon reviewing the financial report, another substantial revenue stream was noted, namely intelligent data services. This service revenue amounted to 35.8 million yuan in 2025Q2, second only to the Robotaxi business.

Regarding intelligent data services, according to multiple sources such as prospectuses and annual reports, WeRide has not provided a clear explanation.

For this intelligent data service, WeRide serves as an agent, with Yuji (Guangzhou Yuji Technology Co., Ltd.) as the supplier.

Founded in 2021, Yuji's legal representative is Han Ming. In the prospectus updated in August 2024, WeRide stated that Han Ming is the brother of Han Xu, the chairman and CEO of WeRide. Neither Han Xu nor WeRide holds significant economic or voting rights in Guangzhou Yuji Technology Co., Ltd.

Since 2021, Yuji has also become a supplier of WeRide, offering services such as high-precision maps and data annotation. WeRide also mentioned in its prospectus that from 2021 to June 30, 2024, Yuji provided surveying and mapping services to WeRide for amounts of 30 million yuan, 111.5 million yuan, 38.9 million yuan, and 65.6 million yuan, respectively.

Some media reports have claimed that Yuji undertakes various data annotation tasks from external companies and signs contracts in the name of WeRide, with Yuji actually being the executor, thereby inflating WeRide's revenue. However, WeRide officially denied these claims.

This aspect may require WeRide to provide a clear explanation to the public.

In terms of overseas expansion, WeRide is one of the earliest explorers and has the widest range of product categories. Let's be precise and add "one of."

Starting with the business, initially, WeRide focused on autonomous taxis, but now it has evolved into a five-product matrix encompassing autonomous taxis, autonomous minibuses, autonomous delivery vehicles, autonomous sanitation vehicles, and advanced intelligent driving systems.

Essentially, WeRide is willing to try any business related to commercialization and self-sufficiency.

WeRide is the only technology company in the world whose products hold autonomous driving licenses in six countries, including Saudi Arabia, China, the United Arab Emirates, Singapore, France, and the United States. It has conducted autonomous driving research and development, testing, and operations in 30 cities across 10 countries globally.

Apart from direct participation, WeRide is also collaborating with the global car rental platform Uber, planning to deploy autonomous Robotaxi services in 15 new international cities over the next five years, encompassing international markets in Europe, the Middle East, and other regions.

Oh yes, on August 15, WeRide also received tens of millions of dollars in investment from Grab, an application platform in Southeast Asia. The two parties will cooperate to deploy Robotaxi on a large scale in Southeast Asia.

Thus, taking Robotaxi overseas also has its benefits, potentially attracting new investment opportunities and enhancing survival prospects.

WeRide's net loss in the first quarter of this year reached 385 million yuan, and the net loss in the second quarter was 406 million yuan. The cumulative net loss in the first half of 2025 amounted to 791 million yuan. Currently, WeRide has 5.82 billion yuan in cash reserves, indicating sufficient short-term ammunition.

In summary, the continuous surge in Robotaxi revenue actually signifies that WeRide's driverless technology is performing well and has surpassed the "technology verification" stage, entering a phase of promoting large-scale commercialization.

03 Commercial Breakthrough, Awaiting the Inflection Point

For the current Robotaxi industry, it is still in the nascent stage of "market cultivation - profitability." However, this commercialization path has proven feasible. The upcoming challenges for autonomous driving companies are crucial and multidimensional: capital reserves, technical prowess, cost control, operational efficiency, user trust...

Nonetheless, the profitability horizon is gradually becoming clearer. Whoever can pioneer through numerous obstacles is expected to seize the initiative in this travel revolution and open a new chapter in Robotaxi profitability.

End.