SAIC-GM Shuts Down Factory; Private Enterprise Powerhouse Geely Steps In to Boost Galaxy's Production Capacity

![]() 11/05 2025

11/05 2025

![]() 519

519

Recently, it has been reported that Geely Auto has officially taken over the former SAIC-GM Beisheng plant, which is now undergoing upgrades and renovations. This move is aimed at bolstering Geely Galaxy's production capacity.

In early 2025, SAIC-GM, facing overcapacity issues, shuttered its once-pivotal Shenyang plant. The capacity utilization rate of the Shenyang Beisheng plant plummeted from a peak of 95% to below 40% in 2023. This left a substantial amount of production equipment idle, while operational costs remained high, ultimately leading to the plant's closure.

The factory, which the state-owned enterprise SAIC withdrew from the market, was subsequently acquired by the private enterprise Geely Auto. This shift in ownership reflects the significant transformation that has taken place in China's automotive market landscape over time.

Currently, the challenges faced by SAIC Group are not unique; they are shared, to varying degrees, by all state-owned automotive enterprises. Once synonymous with stability, these enterprises have been pushed to a critical juncture by the intense market competition in recent years.

Previously, there were rumors of a potential merger between Changan and Dongfeng, as well as discussions about restructuring between China FAW Group and GAC Group. However, these plans were ultimately shelved due to a complex web of regional relationships.

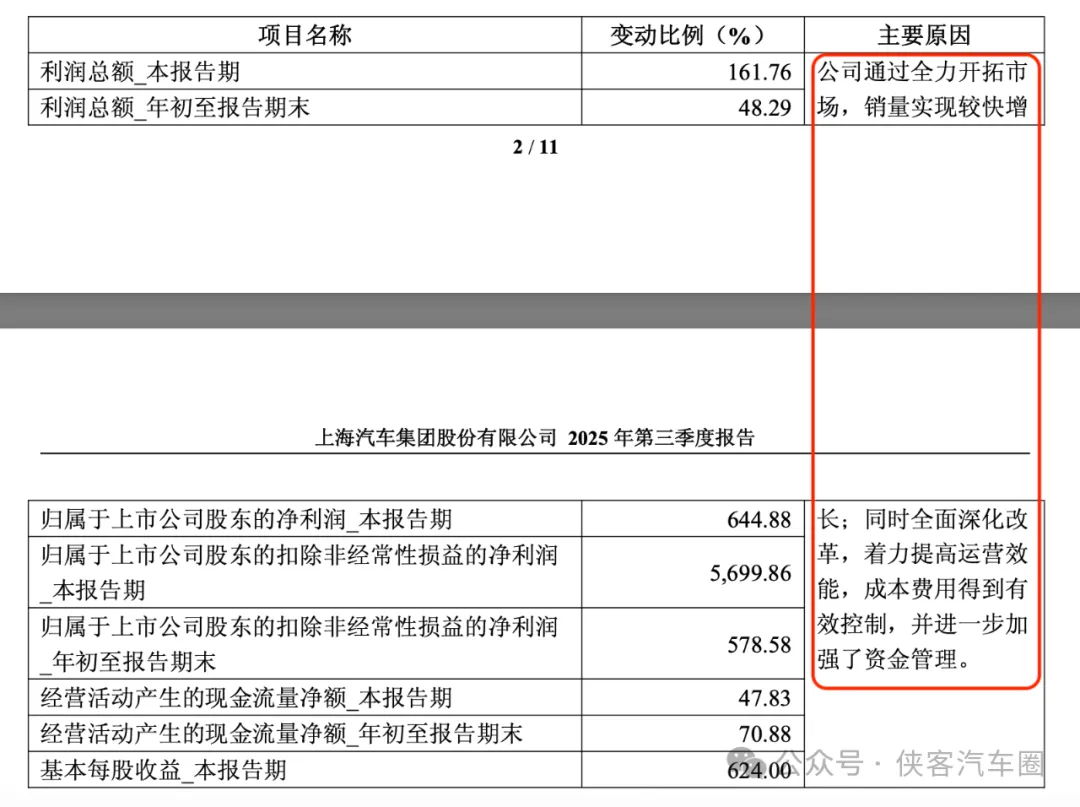

Unlike other state-owned enterprises that considered mergers and restructuring as solutions, SAIC opted to shut down factories and streamline its operations. After implementing a series of production capacity reductions and asset impairments, SAIC Group's performance finally stopped its downward trajectory and rebounded in the first three quarters of 2025.

In the third quarter, revenue soared to 169.403 billion yuan, marking a 16.19% year-on-year increase. Meanwhile, net profit attributable to the parent company reached 2.083 billion yuan, a staggering 644.88% surge from the previous year. However, as previously noted, despite the increase in net profit, SAIC Group's current performance still lags significantly behind its previous levels and is even the second-lowest in 16 years.

Turning our attention to Geely Auto, as the second-largest private enterprise in the sector, it has been making steady strides. Following the 'Taizhou Declaration,' it streamlined its brand portfolio. However, Galaxy's sales have skyrocketed. From the sales data for the first 10 months, Galaxy's sales exceeded 1 million units, representing a 187% year-on-year increase. Sales in October also doubled, reaching 63,500 units. This sales figure is second only to that of the new-force automaker Leapmotor.

Consequently, Galaxy's production capacity is in urgent need of expansion. By taking over the production capacity of the former SAIC Beisheng plant, Geely Auto is already in the process of recruiting employees and anticipates commencing production by the end of December.

This shift in ownership and production capacity also highlights, from the October sales data, that private enterprises continue to ascend, while state-owned enterprises proceed with caution.

Let's delve into the sales data first.

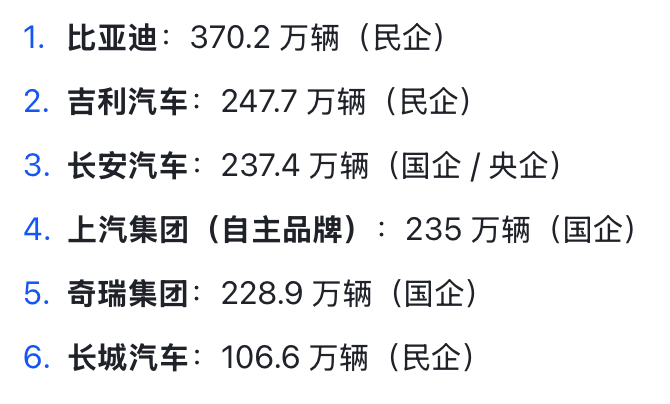

BYD: Cumulative sales of 3.702 million units in the first 10 months, marking a 13.9% year-on-year increase and achieving 80.5% of the annual target.

Geely Auto: Cumulative sales of 2.477 million units in the first 10 months, up 44% year-on-year, with a target achievement rate of 82.6% and new energy vehicles accounting for 58%.

SAIC Group: Cumulative sales of 2.35 million units for its self-owned brands in the first 10 months, up 28.3% year-on-year, with cumulative new energy vehicle sales of 1.29 million units, up 42.5% year-on-year.

Changan Automobile: Cumulative sales of 2.374 million units in the first 10 months, up 10.1% year-on-year, with new energy vehicle sales of 869,000 units, up 60.6% year-on-year.

Chery Group: Cumulative sales of 2.289 million units in the first 10 months, with new energy and export sales up 54.7% and 13% year-on-year, respectively.

Great Wall Motors: Cumulative sales of 1.066 million units in the first 10 months, up 9.9% year-on-year, focusing on brand elevation and increasing the proportion of high-end models.

From the data for the first three quarters, it is evident that private enterprises are leading the way in terms of growth momentum. Geely's sales growth in the first 10 months (44%) is more than four times that of Changan (10.1%), while BYD, despite its large base, still maintains a 13.9% growth rate. In the new energy sector, Geely's new energy vehicle sales are up 64% year-on-year, far outpacing SAIC's self-owned brand growth rate of 28.3%.

In contrast, state-owned enterprises, except for the new energy sector, rely heavily on their scale base for overall growth. Chery, as a mixed-ownership enterprise, only achieved an overall growth rate of 3.3% in October, significantly lower than the average of private enterprises and purely state-owned enterprises.

Currently, private enterprises have established differentiated competitive advantages. BYD has constructed a comprehensive product matrix spanning from 100,000 to 1 million yuan. Geely has achieved balanced development in both the fuel and new energy sectors. Great Wall Motors' average vehicle price has surpassed 180,000 yuan.

State-owned enterprises, however, continue to grapple with the issue of being 'large but not strong.' Although SAIC's self-owned brands account for 64.4% of its sales, its high-end brand Zhiji is still in the pre-sale stage. Changan's new energy penetration rate is less than 40%, significantly lower than Geely's 58%, and its overseas market contribution pales in comparison to that of Chery and BYD.