Small and Medium-sized Online Car-hailing Services: No New Stories

![]() 11/05 2025

11/05 2025

![]() 629

629

With Shangdao Travel joining the online car-hailing IPO race, along with already listed Dida Travel, Ruqi Travel, and Cao Cao Travel, as well as Huoli Group and Vsheng Times, which submitted applications earlier, the IPO surge of small and medium-sized online car-hailing companies has arrived.

At present, the online car-hailing market is contracting, and competition is intensifying. Only through differentiated operations can there be a possibility of enhancing business value. Cao Cao Travel focuses on customized online car-hailing services, while Shangdao Travel emphasizes segmented scenarios such as students and business travelers.

In the future, almost all online car-hailing giants, including Didi, Gaode, Cao Cao, Shangdao, T3, and Ruqi, will focus on autonomous driving online car-hailing services, Robotaxi. The current rush to go public is to secure a ticket for the future era of online car-hailing.

However, in the current debate over the route of Robotaxi, who will be the mainstream: automotive giants (Tesla), tech companies (Baidu), or online car-hailing companies?

Rise and IPO Surge

A decade ago, there were no online car-hailing services, only taxis.

Until the wind of mobile internet transforming the real economy blew here, addressing the pain points of the taxi market with several potent solutions.

In 2010, Yongdao Travel was founded, one of the earliest online car-hailing platforms globally, almost in sync with Uber in the US market.

Over the next two years, local online car-hailing brands such as Didi and Kuaidi were established, and Uber entered the Chinese market. With the support of various capitals, the "Thousand-Team Battle" in the online car-hailing market began.

After Didi merged with Kuaidi and acquired Uber China, it officially became the leader in the Chinese online car-hailing market and has remained so ever since.

A few years later, the online car-hailing market welcomed a new batch of players, including Shenzhou Private Car, Cao Cao Travel, Shouqi Car Hailing, Shangdao Travel, Ruqi Travel, and T3 Travel.

Behind them stood the big brothers of automotive OEMs. Shenzhou Private Car was backed by the former Shenzhou Group; Cao Cao Travel was controlled by Geely; Shouqi Car Hailing is a brand under the Shouqi Group; Shangdao Travel was invested in by SAIC; GAC founded Ruqi Travel; and behind T3 Travel stood Dongfeng, FAW, and Changan.

Automotive giants found that the long-term operational business value was greater than one-time sales, and online car-hailing could serve as a stable sales channel for their new energy vehicles. Additionally, online car-hailing could become an excellent window for them to connect with consumers—every online car-hailing service could bring the automotive brand closer to users.

Supported by automotive giants, Cao Cao Travel and others became a solid second tier in the online car-hailing market. Didi finally welcomed its most powerful competitor after several years.

However, this relatively balanced market state was soon disrupted again by new industry trends.

In 2017, driven by the need to monetize traffic, Gaode relied on its strong position in the LBS field to enter the online car-hailing market with an aggregation model.

It did not directly participate in online car-hailing services but instead resold received orders to other online car-hailing brands. True to its Alibaba roots, this business model was sufficiently "e-commerce-like."

Subsequently, Baidu, Tencent, Meituan, Huawei, and even Didi joined the aggregation model for online car-hailing.

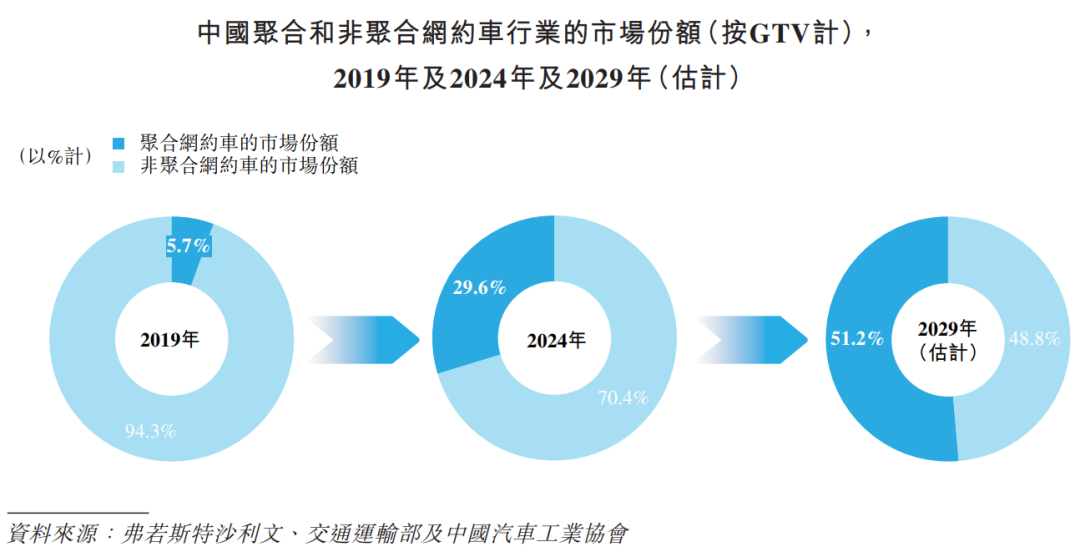

In 2019, the aggregation model accounted for only 5.7% of the online car-hailing market; by 2024, it had risen to 29.6%; the market predicts that by 2029, aggregated online car-hailing will account for 51.2%, becoming the mainstream.

Around the aggregation model of online car-hailing, a batch of online car-hailing brands that were previously on the market's fringes came back to life; it also directly spawned a batch of small online car-hailing companies that survive through Gaode's aggregation model. For example, Flight Manager launched Huoli Travel in 2015, and Vsheng Times launched 365 Online Car-hailing in 2018.

Since 2024, the online car-hailing market has seen a capital boom, with Dida Travel, Ruqi Travel, and Cao Cao Travel going public; at the end of last year, Huoli Group (Huoli Travel) and Vsheng Times (365 Online Car-hailing), which have online car-hailing concepts, aimed to list on the Hong Kong Stock Exchange's main board. Recently, Shangdao Travel submitted its IPO prospectus, officially embarking on its journey to go public.

Intense Competition in Online Car-hailing

Originally, the online car-hailing market had formed a generational lead over the taxi market. By gradually increasing penetration, it could form a stable profit model while improving overall service quality.

The aggregation model of online car-hailing disrupted the relative balance, plunging the entire market back into intense competition.

The service prices of online car-hailing were already lower than those of taxis of the same grade. Under intense competition, the service prices of the entire online car-hailing market continued to decline. Aggregation platforms with traffic advantages also took away a significant portion of the revenue from orders.

This means that a single business did not earn much, and the big brother took the lion's share, leaving the little brothers doing the work with less and less to take home.

As a result, drivers dependent on online car-hailing earned less and less, inevitably leading to a decline in service quality. In the long run, this is not conducive to the ecological balance of the online car-hailing market.

This chaotic state has plunged the online car-hailing industry into a fierce competition arena. Previously, a significant portion of the penalties imposed by regulatory authorities were for violating industry price fairness rules—to secure orders on aggregation platforms, online car-hailing companies secretly lowered their unit prices by a few cents.

This is very unfavorable for online car-hailing companies caught in the middle. From their performance, it can be seen that Shangdao Travel, Huoli Group, and Vsheng Times, which are in the IPO stage, are all incurring losses, all due to their online car-hailing businesses.

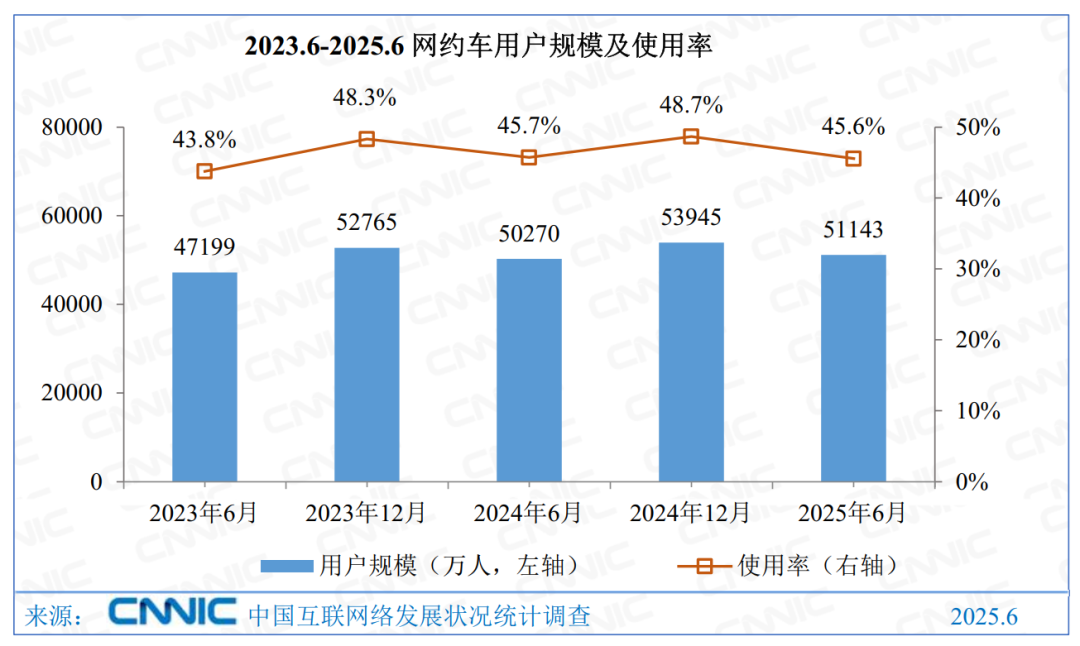

More critically, amid the pressure on the overall consumer market, even with price reductions, online car-hailing has not been able to attract more users and increase usage rates.

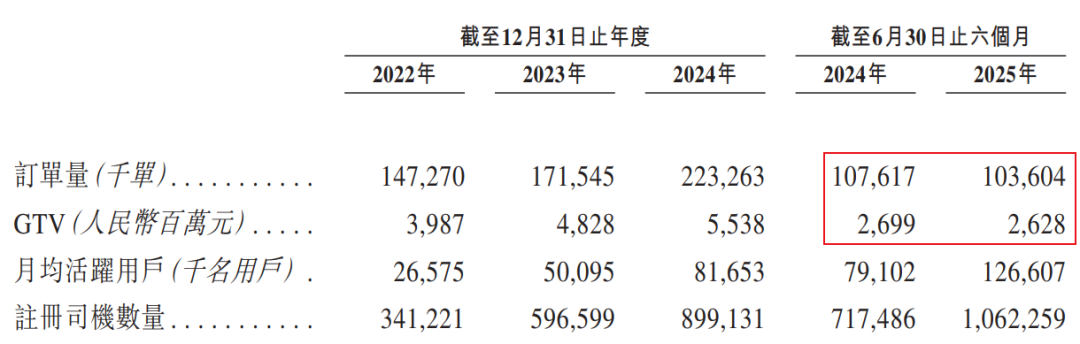

Taking Shangdao Travel, which recently disclosed operational data, as an example, in the first half of 2025, its online car-hailing orders were 104 million, down 3.7% year-on-year, with a GTV of RMB 2.628 billion, down 2.6% year-on-year.

Fortunately, everyone has realized that aimlessly participating in industry competition has limited value in improving business quality. At present, only through differentiated operations can some directions for business improvement be found.

Cao Cao Travel, leveraging the advantages of the Geely system, focuses on customized online car-hailing services to optimize online car-hailing. In addition to the commonly seen Cao Cao 60 and Maple Leaf 80V, Cao Cao Travel also introduced LEVC TX5 to launch a more high-end Limousine Service.

In fact, except for a few national online car-hailing giants like Didi, Gaode, and Cao Cao, most second and third-tier online car-hailing brands operate regionally.

Ruqi Travel deep cultivation (focuses on) the Greater Bay Area market, Shouqi Car Hailing mainly operates in the Beijing market, and Shangdao Travel has the second-highest market share in Shanghai after Didi.

In response to the special needs of the Shanghai online car-hailing market, Shangdao Travel has taken refined operations to the extreme. In 2024, it launched Shangxue Small Special Car, providing one-stop multi-day pickup and drop-off services for parents who need help picking up and dropping off their schoolchildren.

For the business car rental market, Shangdao Travel launched the Star Enjoy Pickup and Drop-off Service, customized for major transportation hubs such as airports. As of the end of June this year, this service covers 56 airports and over 237 train stations in China. In the first half of this year, the GTV generated by the Star Enjoy Pickup and Drop-off Service reached RMB 128 million, ranking second in the domestic corporate travel service industry.

Looking at Robotaxi as the Future

The existing online car-hailing business can be seen as the internetization of the taxi business, basically just a transitional stage. Online car-hailing giants have placed their hopes for the future on autonomous driving online car-hailing services, Robotaxi.

Whether from a technical or social perspective, Robotaxi currently faces significant challenges, but the trend towards driverless online car-hailing is undeniable. Morgan Stanley's latest forecast predicts that by 2035, the global market for Robotaxi and fully autonomous driving will reach USD 300 billion.

Autonomous driving has now reached a stage where, whether in terms of training volume accumulation or the efficiency of future application scenarios, online car-hailing will be one of the best scenarios.

After Baidu launched Luobo Kuaipao in cities like Wuhan, it officially brought the competition in the Chinese online car-hailing market into the Robotaxi stage. The latest data shows that Luobo Kuaipao operates in 22 cities, with over 250,000 weekly orders.

Tesla's autonomous driving taxi project, Cybercab (formerly known as Tesla Robotaxi), will adopt fully autonomous driving technology, eliminating the steering wheel and pedals. The latest news indicates that the model will enter mass production in 2026 and will be operated independently through a dedicated fleet.

Additionally, leading online car-hailing companies such as Didi, Cao Cao, T3, Ruqi, and Shangdao are all making Robotaxi their future main focus. Gaode will also personally enter the field, collaborating with automotive giants to venture into Robotaxi.

Shangdao Travel, which recently impact (aimed for) IPO, has become an excellent observation sample in this track (sector).

Founded in 2018, Shangdao Travel completed its external financing in 2020. Industrial capitals such as Alibaba, CATL, and Momenta have invested a total of RMB 2.63 billion to support Shangdao's battle in Robotaxi.

Alibaba later transferred its equity to Gaode. CATL is the world's leading power battery manufacturer, and Momenta is China's leading autonomous driving solution provider. Coupled with Shangdao's major shareholder, SAIC Group, they form a dream team for Robotaxi.

Shangdao Travel launched its Robotaxi demonstration application in 2021 and was selected for the country's first batch of autonomous driving L3/L4 level access and road operation pilot list in 2024. This year, it launched a trial operation in Shanghai's Pudong New Area and plans to achieve large-scale commercial operation of Shangdao Robotaxi in multiple cities across China by 2027.

Most online car-hailing companies adopt this approach, leveraging the industrial advantages of automotive OEMs and strategic partners behind them to try to seize the initiative in the future market of Robotaxi.

Currently, the Robotaxi market is in its infancy, and the market has not yet solidified, meaning that everyone still has opportunities.

However, from the perspective of the industrial foundation, investment scale, and future commercialization of autonomous driving online car-hailing, Robotaxi will ultimately only be a game for giants.

The essence of the technological gap is that as the thresholds for new technologies in terms of industrial foundation and R&D investment increase, advanced players will quickly secure their industry positions and block latecomers, forming technological monopolies. Ultimately, market concentration will significantly increase compared to the previous generation.

Nevertheless, there is no need to worry about the future of small online car-hailing companies. What they are planning is often "building a bridge over the river while secretly crossing another." Online car-hailing is precisely the bridge that can help them quickly scale their business and secure a ticket to the capital market. What they are truly after is the direction of their original core business. That is where their lush pastures lie. For example, Flight Manager of Huoli Group.

It is precisely the medium-sized online car-hailing companies that truly need to feel market pressure. Everyone has Robotaxi, but there are often only one or two seats at the peak. Those who fall halfway up the mountain have invested heavily but may end up with nothing.