Horizon Robotics' First-Half 2025 Financial Report: Prioritizing Growth and Scale for Future Prospects

![]() 08/28 2025

08/28 2025

![]() 1010

1010

Produced by ZhiNeng ZhiXin

In the first half of 2025, Horizon Robotics presented a financial report that underscores a strategic focus on growth over short-term profitability.

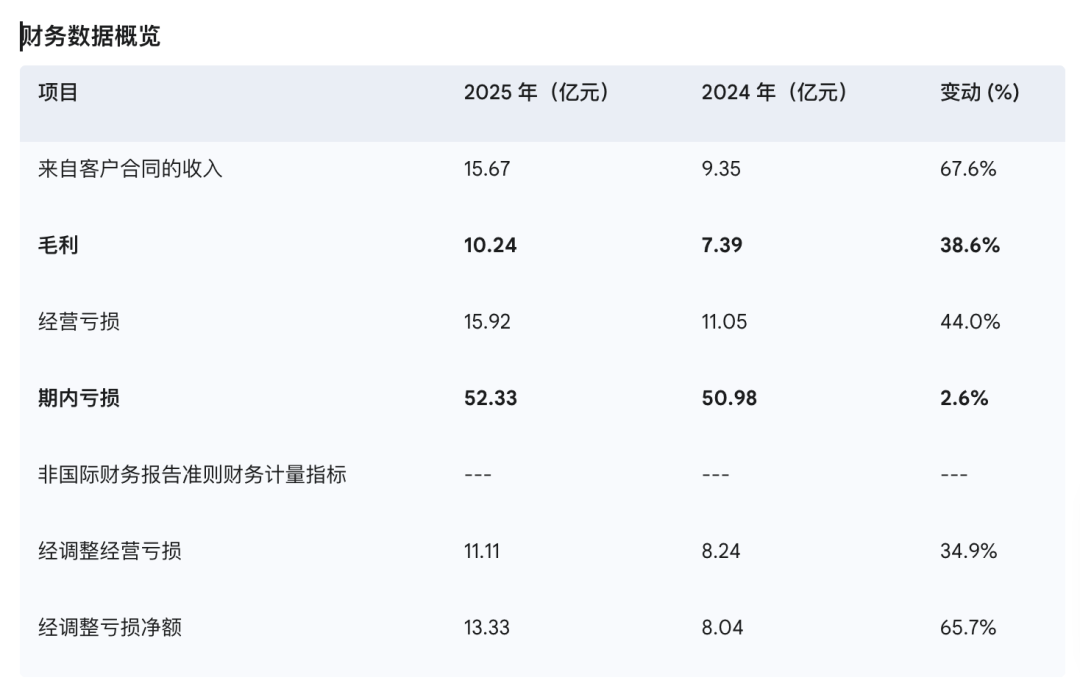

◎ Revenues soared to 1.567 billion yuan, marking a 67.6% year-on-year increase.

◎ Gross margins reached an impressive 65.4%, a rarity in the hardware-centric automotive intelligence sector.

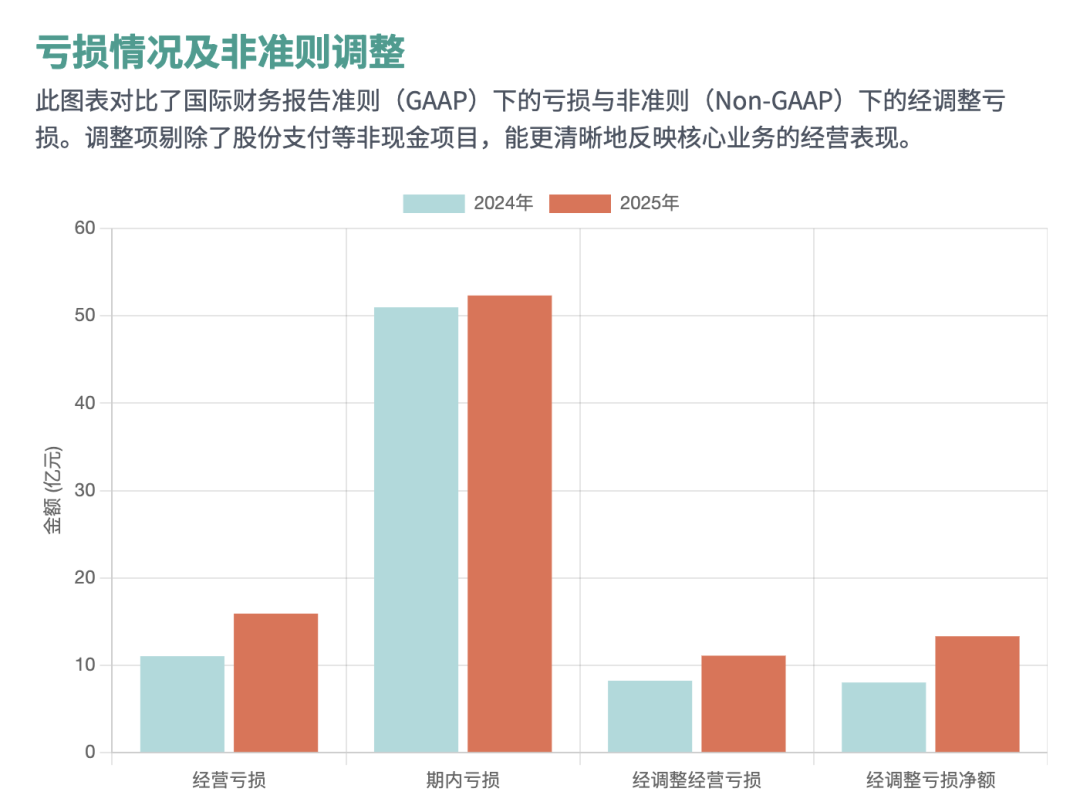

◎ Concurrently, operating and net losses expanded, totaling 1.592 billion yuan and 1.333 billion yuan, respectively.

This juxtaposition of rapid growth and sustained losses serves as a testament to Horizon Robotics' strategic priorities.

The company is in an accelerated phase of industrialization:

◎ Hardware shipments surpassed 1.98 million units, with cumulative deliveries of the Journey series exceeding 10 million, cementing its position as a leading player in domestic intelligent driving chips.

◎ The software licensing business provides stable cash flow and customer loyalty, necessitating substantial investments in R&D and market expansion, thereby limiting immediate profitability.

In essence, Horizon Robotics is sacrificing short-term profits for long-term growth and market scale.

Part 1: Overall Performance and Business Structure Evolution

Horizon Robotics achieved revenues of 1.567 billion yuan in the first half of 2025, a significant 67.6% increase from 935 million yuan in the same period last year. This growth is remarkable amidst current industry pressures.

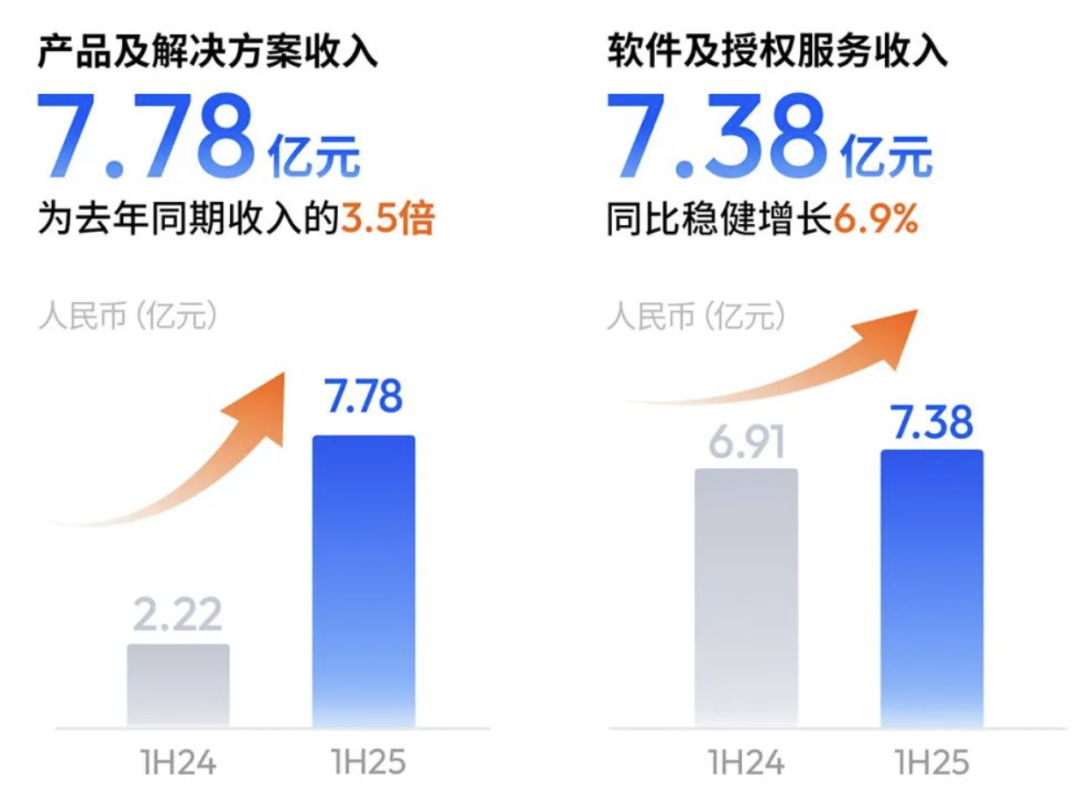

Revenue growth was primarily driven by products and solutions, which generated 778 million yuan, a 250% year-on-year surge, accounting for 49.7% of total revenues.

This growth was fueled by both increased shipments and higher value per vehicle. Total shipments reached 1.98 million units, doubling year-on-year, with mid-to-high-end products accounting for nearly half of shipments and contributing over 80% of business revenues. This structural shift indicates a move away from reliance on low-end products and towards revenue generation through advanced, value-added solutions.

The Journey 6 series emerged as a key growth driver, with shipments of mid-to-high-end solutions increasing sixfold year-on-year, directly boosting average selling prices and overall revenues.

With cumulative shipments of the Journey family exceeding 10 million units, Horizon Robotics became the first Chinese intelligent driving technology enterprise to reach this milestone, affirming its industry benchmark status.

Market share wise, the company's hold in China's self-owned brand assisted driving computing solutions increased to 32.4%, and in the ADAS front-view all-in-one market, it further rose to 45.8%, signifying enhanced dominance in niche markets.

In addition to hardware and solutions expansion, software and licensing services remain a cornerstone of Horizon Robotics' stability.

In the first half of the year, this business segment generated 738 million yuan in revenues, a 6.9% year-on-year increase, accounting for nearly half of total revenues. While growth was moderate compared to the product business, its stability and sustainability provided a buffer for cash flow and profit margins.

This underscores Horizon Robotics' "dual-wheel drive" business model:

◎ Rapid market penetration through hardware products, enhancing scale effects.

◎ Long-term customer binding and continuous revenue generation through algorithm and software licensing.

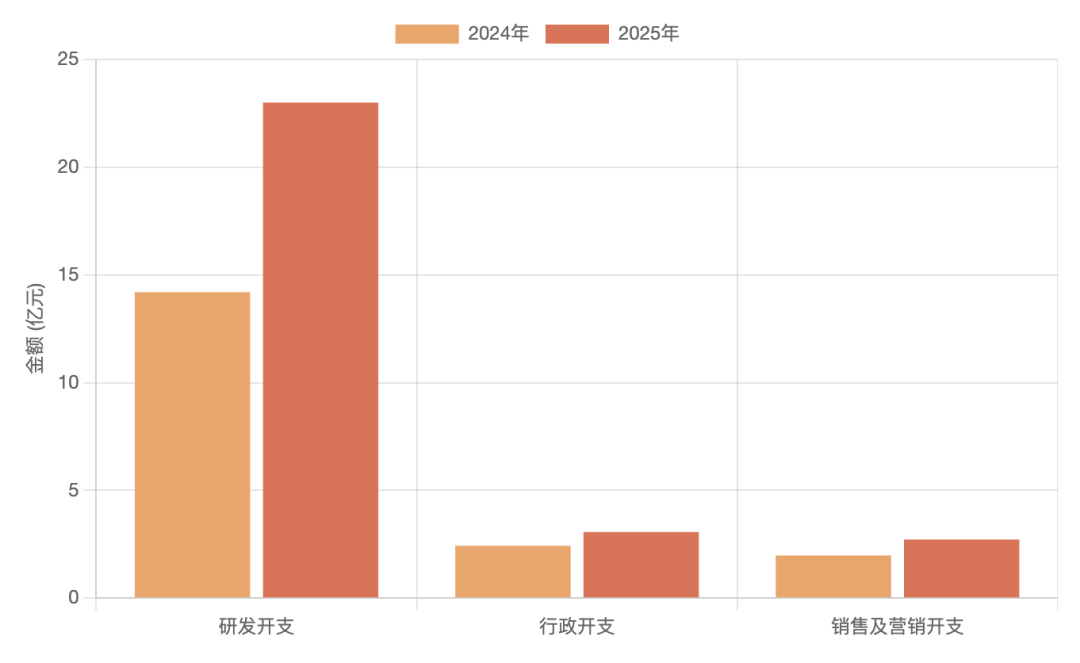

Behind this rapid expansion lie escalating operating costs.

R&D investment reached 2.3 billion yuan in the first half of the year, a 62% year-on-year increase, significantly outpacing revenue growth. This investment focused on urban assisted driving systems and cloud services. While increasing R&D expenses widened short-term losses, it holds strategic importance for maintaining a leading position in intelligent driving technology.

Administrative and sales expenses increased by 26.3% and 37.1% year-on-year, respectively, due to expanded organizational and market development efforts.

Financial data reveals an operating loss of 1.592 billion yuan, a 44% year-on-year increase, and an adjusted net loss of 1.333 billion yuan, a 65.7% year-on-year rise. In summary, revenues and losses are expanding concurrently, with the company still in a heavy investment phase, prioritizing scale and market share.

Despite breakthroughs in revenue scale and product structure, profitability remains under pressure. For a company in a phase of rapid technological iteration and market capture, this is a short-term inevitability.

The key lies in gradually optimizing cost structure while sustaining high revenue growth, facilitating a transition from "scale-driven" to "quality-driven".

Part 2: Product Positioning and Market Prospects in the Era of Intelligence

Amidst the global automotive industry's shift towards electrification and intelligence, Horizon Robotics' growth trajectory is emblematic.

Intelligent driving is a pivotal link in the new energy vehicle value chain, with hardware-software integration determining the depth and breadth of in-car intelligence. Horizon Robotics, with its deep expertise in chips and algorithms, is becoming an indispensable partner in automakers' intelligent strategies.

From a product solutions perspective, the mass production of the Journey 6 series significantly enhanced Horizon Robotics' market influence.

Mid-to-high-end intelligent driving solutions not only deliver higher value per vehicle but also place the company at the core of automakers' intelligent iterations. In domestic self-owned brand electric vehicles, Horizon Robotics has almost become a standard feature.

Against the backdrop of overall new energy vehicle sales growth, this integration will ensure steady shipment increments.

Crucially, as electric vehicle intelligence demand rises, automakers are willing to invest more in intelligent driving solutions, further bolstering Horizon Robotics' pricing power.

The software and algorithm licensing business acts as a "multiplier" in the electrification and intelligence wave.

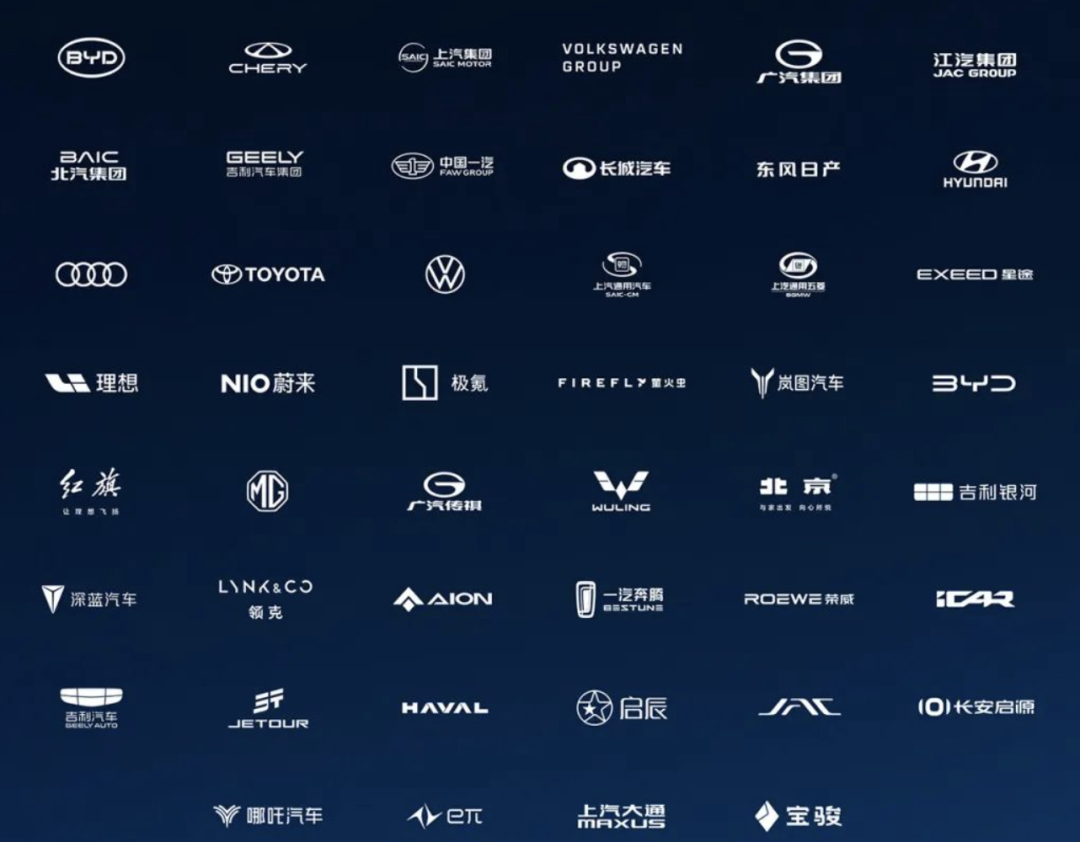

Unlike one-time hardware delivery revenues, software licensing generates ongoing service revenues and continuously extends the value chain through OTA updates. In the first half of the year, over 30 automakers, including domestic and joint venture brands, collaborated with Horizon Robotics.

This broad customer base not only stabilizes revenues but also amplifies Horizon Robotics' influence within the industry ecosystem.

Internationally, Horizon Robotics is gradually transcending "localization" constraints and actively expanding to foreign automakers.

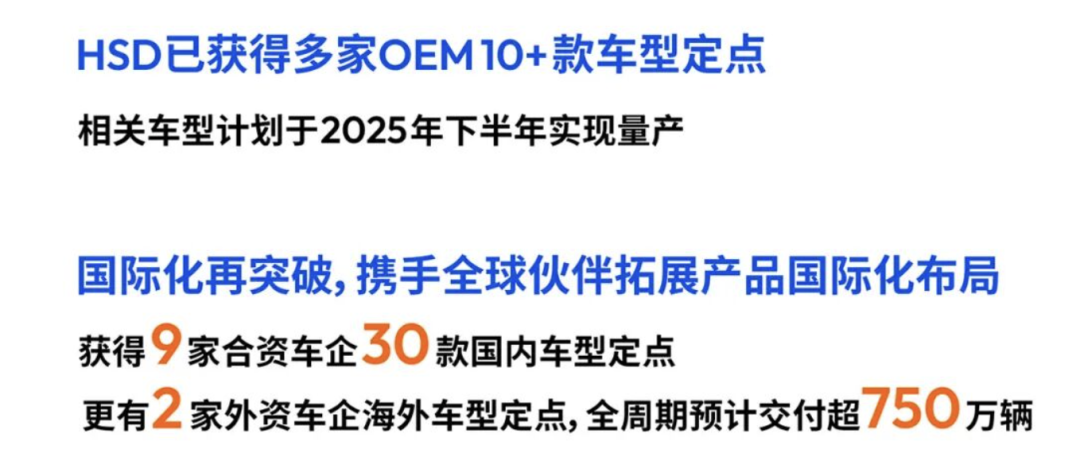

◎ In the domestic market, the company partnered with 9 joint venture automakers, including Volkswagen and Japan's largest automotive group, for 30 models.

◎ In overseas markets, solutions based on the Journey 6B were adopted by two foreign automakers, with an expected cumulative delivery volume of 7.5 million units over their lifecycles.

This not only expands the company's global presence but also demonstrates its internationally competitive technology. As electric vehicle penetration accelerates in European and American markets, Horizon Robotics' international orders are poised to become a new growth driver.

Intensified Industry Competition

◎ Both domestic players like Horizon Robotics, Black Sesame, and Xinchi, and international giants like Qualcomm and NVIDIA are vying for market share in intelligent driving chips and solutions. As technological barriers rise, maintaining high performance while ensuring cost competitiveness will be an ongoing challenge for Horizon Robotics.

◎ Profit model uncertainty persists, with automakers under immense cost control pressure. Future price negotiations may compress solution providers' profit margins.

◎ High R&D investment limits near-term profit improvement potential.

Horizon Robotics' strategy amidst the electrification and intelligence trend is clear: link electric vehicle shipments with high-performance product solutions, secure long-term revenues through software and algorithm services, and explore new incremental markets via international expansion.

This path ensures short-term growth and establishes long-term ecological barriers. However, sustainable commercialization hinges on balancing rapid expansion with profit quality in the coming years.

Summary

In the first half of 2025, Horizon Robotics witnessed rapid scale and market share expansion but faced ongoing profitability pressures.

The surge in hardware solutions, steady software licensing progress, and accelerated internationalization position it at the heart of the intelligent driving industry chain. However, the expansion of R&D, sales, and administrative expenses underscores the complexity of commercializing this sector.

Horizon Robotics must address two questions: First, how to gradually improve cost structure and narrow loss gaps while maintaining high growth? Second, can it successfully capitalize on overseas market growth as global automakers accelerate electrification and intelligence?