The Evolution of Domestic Games' Overseas User Acquisition: Harnessing AI and Trending Topics for Global Dominance

![]() 08/28 2025

08/28 2025

![]() 518

518

How Long Can the Glory Last?

Original by Youshu's Digital Economy Studio

Author | Youshu

If you consistently track the overseas revenue rankings of Chinese mobile games, you'll observe an intriguing phenomenon: not only do the rankings shift rapidly, but many top-performing games are virtually unknown in China.

One notable dark horse is Tap4Fun's Kingshot. Launched in late February this year, the game surged into the top three of the "China Mobile Game Overseas Revenue Growth Ranking" in April (and has maintained that position since), and debuted at 14th in the "China Mobile Game Overseas Revenue Ranking." By May, its revenue ranking skyrocketed nine positions, joining forces with its sibling game, Whiteout Survival, in the top five.

According to Sensor Tower's latest report released in early August, Tap4Fun achieved an 81% year-on-year revenue increase in the first half of 2025 with these two hit products, simultaneously securing the top spot in both the overseas mobile game publisher revenue ranking and growth ranking. As of the end of July, Kingshot, which has been online for just five months, surpassed $200 million in global cumulative revenue, creating a "rapid success miracle" in overseas markets.

Sensor Tower pointed out that behind this success lies "Tap4Fun's profound R&D and operational strength in the strategy genre, as well as a highly mature new product cold start system." This "cash-sucking ability" has also stunned the international scene, with many bloggers incorporating it into "folk business school textbooks" and summarizing its daily traffic secret: over 2,000 YouTube AI ads.

Moreover, similar successful strategies aren't isolated among domestic manufacturers. Earlier, Bingchuan Network's The Legendary World became a phenomenal case in user acquisition with its textbook-level ability to follow hot topics and "side gameplay" marketing. Last year, Bilibili's Romance of the Three Kingdoms: Strategic Ambition and Tanwan Games' Beast Lord: New World also disrupted the traditional landscape through a series of innovative materials. Another company, 37 Interactive, which surpassed RMB 5.7 billion in overseas revenue last year, also disclosed that AI deeply participates in the generation of 70% of its video materials in advertising videos. This indicates that the competition among overseas manufacturers has long evolved from a simple "burn rate war" to a game of efficiency and tools.

For overseas markets, the "tricks" China is already familiar with have instead formed a kind of dimensionality reduction attack. Since 2022, with intensified domestic competition and tightened game license approvals, a large number of manufacturers have had to bet their growth on overseas markets. The "advertising material factory" model has almost become an industry consensus: using massive, low-cost, hot topic-focused creativity to pry open the doors of unfamiliar markets. As a result, one after another name that is virtually unknown in China has become a dark horse overseas.

When "loud advertising" becomes the fastest overseas path for non-top game companies, the "cheap + brainwashing" material approach becomes the key to breaking the cold start.

The next question is: How exactly do domestic game manufacturers stir up a storm globally with these user acquisition materials? And can this approach be sustained?

From Web Games to PC Games: The Origin of User Acquisition for Domestic Mobile Games

The term "user acquisition" refers to directly obtaining users through advertising to supplement or replace natural traffic. In the commercialization process of the domestic game industry, user acquisition has always played a pivotal role, and the forms and innovations of user acquisition materials in the game industry often lead the entire advertising industry.

Game user acquisition can be traced back to the era of web games. According to previous Dumou reports, starting from 2007, SLG games like The World Conquest and Blood of Three Kingdoms, casual games like Cat Journey, and role-playing games like Mortal Cultivation and Sword of Pride emerged one after another. Web games, with their short development cycle and low threshold, quickly gained popularity in China.

Source: Dumou

The evolution of material forms is closely tied to the development of internet infrastructure and internet terminals. At that time, China was in the era of vigorous PC internet growth, and user acquisition materials were primarily banners, static illustrations, and animated GIFs. Common advertising slogans included straightforward copywriting like "brothers, come quickly" and "log in to receive divine equipment," focusing on low thresholds and strong stimulation.

Since then, the development of mobile internet has directly fueled the mobile game market's takeoff. In 2012, China's mobile game market reached RMB 3.24 billion, and mobile phones surpassed PCs for the first time to become the largest internet terminal, with a user scale growth rate of 73.7%. In the following years, video ads focusing on gameplay demonstrations and content showcases also entered a period of rapid growth.

However, about a decade ago, as the domestic mobile game user base peaked and channel placement costs continued to rise, user acquisition quickly transformed from an "auxiliary means" to the "main battlefield." When the demographic dividend of the internet and terminal revolution faded, the only way for manufacturers to acquire new users was to fiercely compete in advertising creativity.

Around 2018, global mobile game advertising creativity and placement entered an acceleration phase. Taking the most representative category in China at that time—legendary games—as an example, according to DataEye, the proportion of their user acquisition video materials surged from less than 1% in 2017 to 20.21% in 2018, reaching 60.95% in 2019 and exceeding 74.09% in the first quarter of 2020.

After 2018, manufacturers generally established a "material factory"-style operating model: user acquisition departments often have dozens to hundreds of people, producing advertising materials in batches through assembly lines; hot topics can be transformed into ads within 24 hours, forming high turnover; the pace of ad iteration is fast, and "updating every three days" has become a consensus.

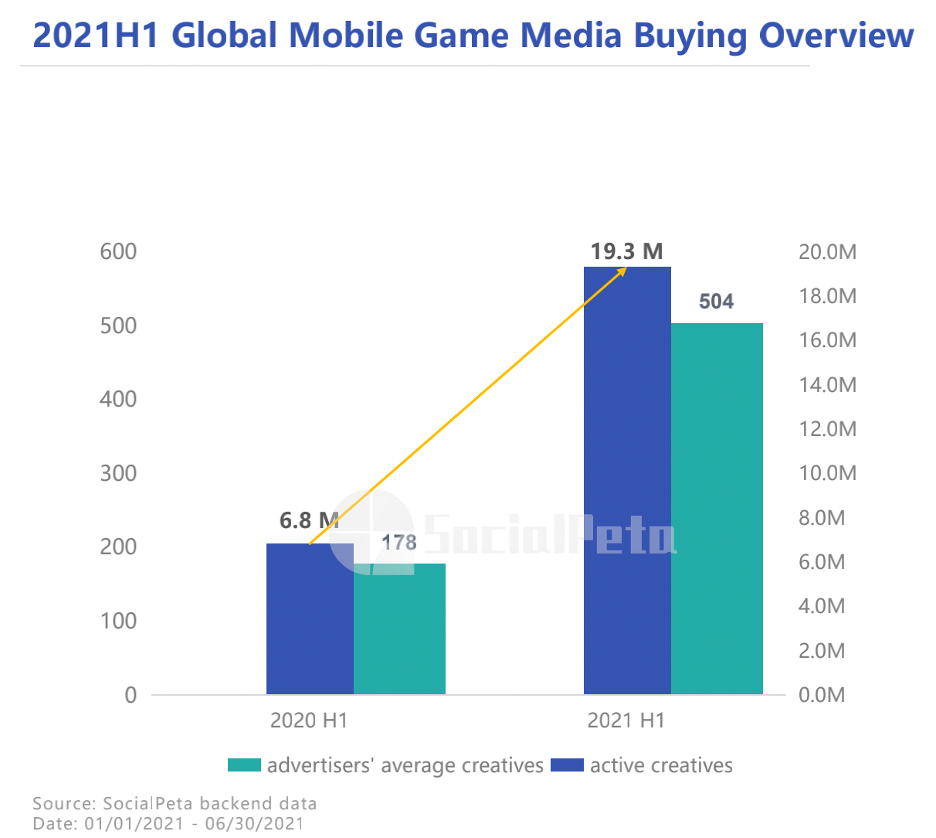

According to SocialPeta data, by the first half of 2021, the average number of creatives per advertiser had reached 504, a year-on-year surge of 183%, with a total of over 19 million active creatives. This indicates that the industry has entered a user acquisition logic of "high-density testing - rapid elimination."

From Hot Topics to AI: The Ultimate Evolution in the Post-Pandemic Era

If the "material factory" model after 2018 streamlined user acquisition, then the global traffic competition post-pandemic has given birth to the ultimate evolution of user acquisition materials: faster hot topic leveraging, harsher gameplay mismatches, and deeper AI involvement.

In the summer of 2022, a "dog head" became the traffic password for Chinese mobile game ads globally. Domestic manufacturer Wonder Game's Save the Doge began overseas distribution in July and topped the dual charts of multiple Southeast Asian countries within just a few weeks. According to SocialPeta, by August, its cumulative downloads on both ends had surpassed 12 million. With viral spreading on social media platforms like TikTok and YouTube, the "draw lines to save the dog" ad material became a phenomenonal meme.

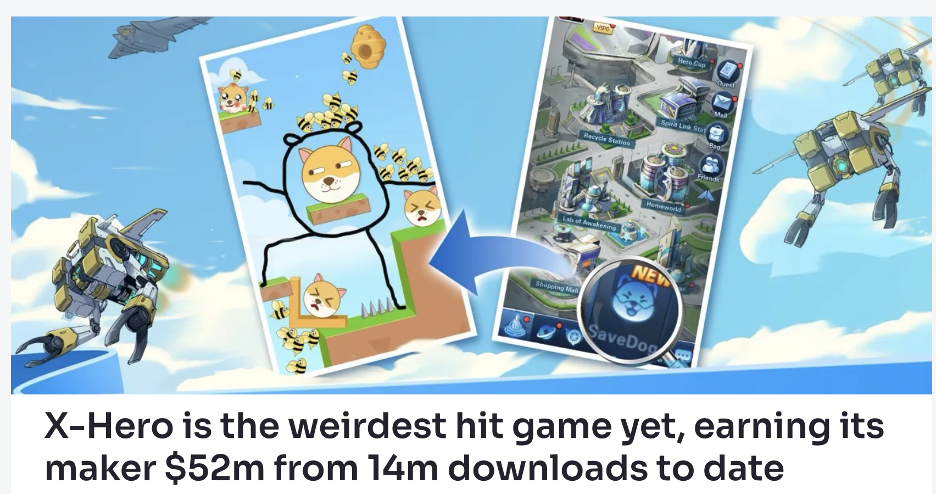

The success of the dog head quickly attracted followers. Bingchuan Network's X-Hero, a card RPG game that had been online for two years, directly incorporated dog head elements in its update, stacking the top-flow image of stick figures. By simply changing the game icon and updating some gameplay materials, X-Hero topped the US App Store free chart at the end of August 2022 and surged to the top spot in 25 countries worldwide. Microdot Interactive almost simultaneously launched its own version of Save the Dog, and the previous horror game Backrooms Buff Doge, due to its contrasting setting of "muscle dachshund" and live streaming adaptability, received millions of views on YouTube.

Source: mobilegamer.biz

Hot topic materials are like matches that ignite the market, instantly crossing language and cultural barriers, turning an originally unknown game into a "global hit."

Compared to following hot topics, Bingchuan Network demonstrated another path in its new game The Legendary World released the same year: "side gameplay" marketing. It locked in the casual gameplay that had been verified in the top ten of the iOS free chart earlier that year (such as Clash of Souls, Doge Wars, Draw Lines to Save Stickman, My Parking Lot, and Used Car Parking Lot), directly implanting the already market-verified "side gameplay" into the game and transforming it into user acquisition materials to attract players.

In October 2022, The Legendary World's daily material placement volume exceeded 12,000 groups, corresponding to occupying the top two spots of the iOS free chart for 11 consecutive days, verifying the effectiveness of this approach.

The ingenuity of this approach lies in gameplay mismatches. Players download because of "side gameplay," but they are retained by the core loop of placement + card collection upon entering the game. By grafting hot gameplay onto heavy products, Bingchuan upgraded user acquisition from simply chasing hot topics to an industrialized approach of "side gameplay strategy library" + "rapid implantation."

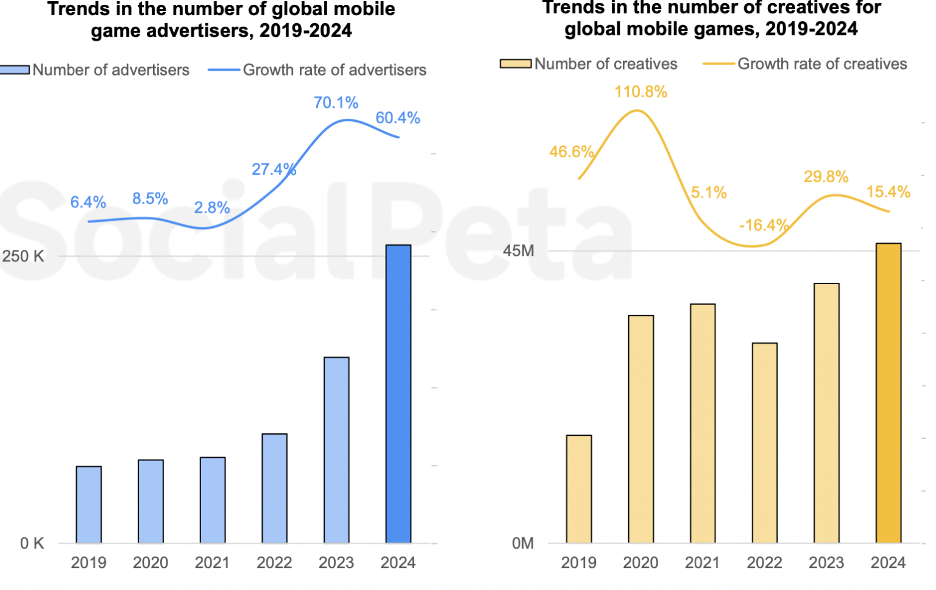

However, the victory of user acquisition has also brought severe intra-industry competition. Udonis data shows that the total number of global mobile game advertising creatives reached 46.2 million in 2024, a year-on-year increase of 15.4%, and the number of advertisers increased by 60% year-on-year. With more and more materials, channel competition has become more intense, and the advertising environment has become crowded.

Even more crucial is that the customer acquisition cost in the game industry has reached a state of "out of control." In July 2022, Charles Nicholls, Founding Director and Chief Strategy Officer of SimplicityDX, stated that the average customer acquisition cost (CAC) for acquiring each new user had risen to $29. This figure has soared by an astonishing 222% in the past eight years; in 2013, the cost was only $9.

In such a competitive environment, the past model of winning by "stacking quantity" is gradually failing, and the industry is beginning to search for new breakthroughs.

On the one hand, AI batch generation of advertising materials has become a trend. 37 Interactive disclosed that 70% of the video materials in its overseas product advertising have been generated by AI, far surpassing manual work in terms of efficiency, cost, and multi-language adaptability.

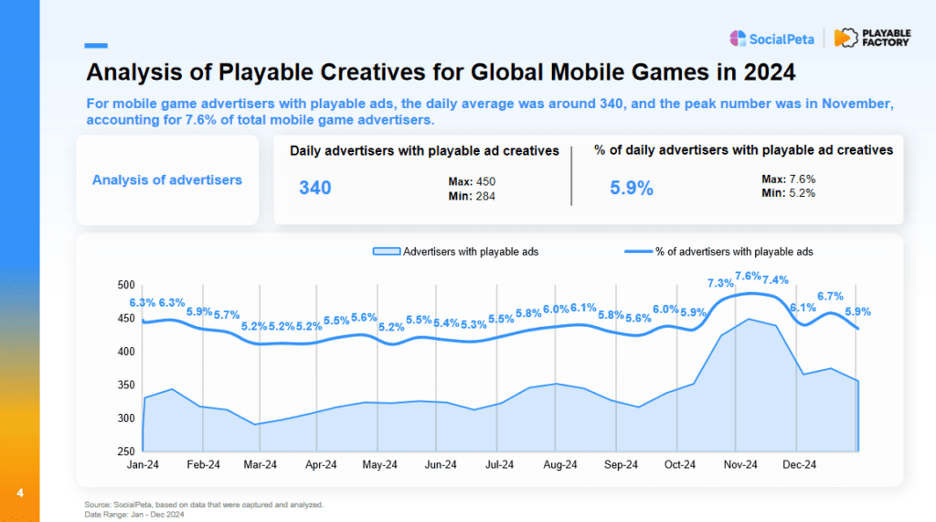

On the other hand, playable ads are becoming the new core of global mobile game user acquisition. According to the "2025 Global Mobile App Playable Ad Marketing Insight Report" jointly written and published by SocialPeta and Playable Factory, more than half of the top 100 mobile game publishers worldwide have incorporated playable ads into their core strategies. By 2024, an average of 340 mobile game advertisers globally placed playable ads every day, with the peak period seeing a share of 7.6%, meaning that one out of every 13 user acquisition teams included playable ads as part of their regular mix.

Gameplay innovation drives user acquisition materials into a new era. Hot topic materials are matches, side gameplay is tactical upgrades, and AI and playable ads may become new engines, pushing user acquisition towards the future of ultimate efficiency and interactive experience.

Geographical Differences: Why Can "Old Wine in New Bottles" Pierce Through Overseas Markets?

On the surface, domestic game manufacturers' user acquisition materials are often criticized as "rough and low-brow," but these straightforward and even slightly "rustic" ads have repeatedly proven effective overseas. Tap4Fun's latest two games—Whiteout Survival and Kingshot—are typical examples: despite their seemingly simple strategies, they have simultaneously stirred up storms in Southeast Asia and Europe and the United States.

Udonis once wrote an article titled "2,000 AI Ad Materials Daily, Kingshot Dominates the US, Japan, and South Korea in June," analyzing why this new "cash cow" could replicate the success path of its predecessor Whiteout Survival. According to SocialPeta data, the game had already begun placing ads in August 2024. As of early June this year, the cumulative number of iOS and Android advertising materials reached approximately 10,000, with a daily peak placement volume exceeding 2,000, demonstrating its fierce market competition.

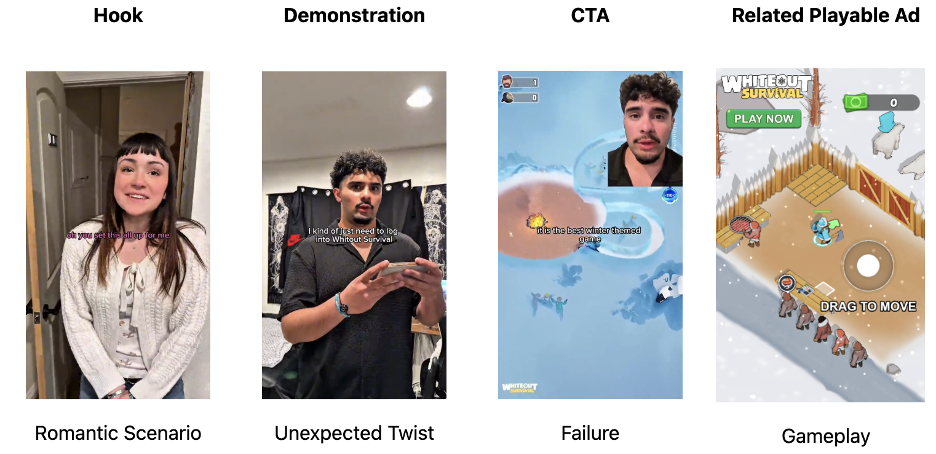

Contrary to the widespread "puzzle-solving + numerical growth" formula in the market, the advertising creativity of "Kingshot" stands out with two distinct features: Firstly, it harnesses large-scale AI generation, tailoring styles to regional preferences through diverse prompts and models. Secondly, it blends live-action performances with game footage to create lifelike scenarios. Oil painting-style AI videos evoke an epic medieval ambiance, while anime PVs entertain with whimsical plots like time travel, bread stealing, and Hatsune Miku. For Asian audiences, dramatic narratives of "husbands off to war, wives waiting at home" are added, and even geishas in kimonos are juxtaposed with Western knights, amplifying an exotic charm through unique mash-ups. Additionally, there are cross-border experiments combining ASMR, clay crafting, and game footage, expanding the horizons of advertising formats.

In Southeast Asia, this type of content has found the most fertile ground for its initial growth. The vast user base and low traffic costs make short, concise, and impactful ads a "fast track to popularity." "Kingshot" swiftly topped the charts in markets like the Philippines and Thailand through high-frequency advertising. Low-threshold content coupled with extremely high ad frequency forms a classic "quantity suppression" strategy, enabling new games to swiftly overcome the initial growth hurdle and acquire millions of users.

In Europe and the Americas, the rise of TikTok and YouTube Shorts unexpectedly opened a new avenue. Previously, long-term brand building was essential, but now direct pain point expressions can quickly "break the mold." Extreme scenarios such as "saving a girl," "fighting zombies," and "surviving a blizzard" strike a chord with users through vivid imagery, transcending language and cultural barriers. "Whiteout Survival" resonates with its "apocalyptic survival + extreme weather" theme, while "Kingshot" builds dramatic tension through AI and live-action combinations, attracting numerous casual players who might not otherwise be drawn to SLG.

Whether in Southeast Asia or Europe and the Americas, these cases underscore one point: in mobile advertising, the completeness of the narrative is not paramount. What truly drives click-through rates are powerful situations and immediate conflicts—this is the essence of "new wine in old bottles" and the reason Chinese advertising materials consistently penetrate overseas markets.

Is this model sustainable?

The user acquisition model is reaching a turning point. The current scenario is that global traffic prices continue to escalate. For manufacturers, the same advertising budget yields fewer and fewer new users.

Currently, Chinese manufacturers' strategies for overseas user acquisition may face three underlying concerns:

1. Burnout effect: Chinese manufacturers' overseas success stories hinge on high-frequency advertising to rapidly increase volume. However, this approach essentially involves "trading money for time"; once the advertising intensity wanes, revenue declines. Most manufacturers cannot sustain such high acquisition costs in the long run.

2. Aesthetic fatigue: Whether it's "saving a girl," "knocking down a wall to save a dog," or AI + live-action montages, overuse of these materials quickly diminishes users' attention spans. DianDian Interactive has consistently employed this model with "Whiteout Survival" and "Kingshot," but avoiding future material homogenization is a daunting challenge.

3. Rising conversion costs: Most users acquired through side games and trending materials are "casual users." They might be tempted to download by ads, but their willingness to stay and continue paying is limited. As casual users dwindle, the acquisition cost for the next wave of users only increases. Especially in European and American markets, user lifecycle management is more crucial than initial growth.

The Chinese user acquisition approach has undeniably proven its "hit effectiveness": one formula can simultaneously penetrate Southeast Asia, Europe, and the Americas. However, it is often a "tactical surprise attack" that is challenging to solidify into a lasting brand barrier. A one-trick pony can succeed everywhere, but only temporarily.

The key to the future lies in exploring deeper content innovation and community operations while maintaining user acquisition efficiency, transforming the "instant traffic" generated by advertising into "long-term user assets." After all, a hit achieved through budget stacking is merely a fleeting victory.

As the popularity of side games in mini-games tends to become homogeneous, the content and operational advantages of heavy games are being re-emphasized. The market may be reverting to normalcy—manufacturers must contemplate: for the next growth phase, will they rely on "traffic dividends" or stem from the genuine rebuilding of long-term product value and player relationships?

THE END

Producer: Xiaodong

Operation: Feng Qingyanzhong

This article is an original contribution of "You Diandian" and cannot be reproduced in any form without permission.