NVIDIA Q2 Earnings Report: Revenue Hits $46.7 Billion, Can the $50 Billion China Market Gamble Pay Off?

![]() 08/28 2025

08/28 2025

![]() 430

430

As the global AI industry continues to bask in the glow of computational prowess, NVIDIA's earnings report has once again stirred up the market. The company, often dubbed the "AI arms dealer," has once again exceeded expectations with its stellar performance. However, beneath the glossy surface lie hidden concerns such as slowing growth and geopolitical restrictions. After the market close on Wednesday, Eastern Time, the world's most valuable chip giant released its Q2 (ending July 2025) earnings report for fiscal year 2026. The report highlights a "double explosion in revenue and profit," yet also signals "growth slowing down," leaving investors to ponder Huang Renxun's expectations and frustrations regarding the Chinese market.

01 Revenue Hits $46.7 Billion, But Growth Rate Shows "Slowest in Nine Quarters"

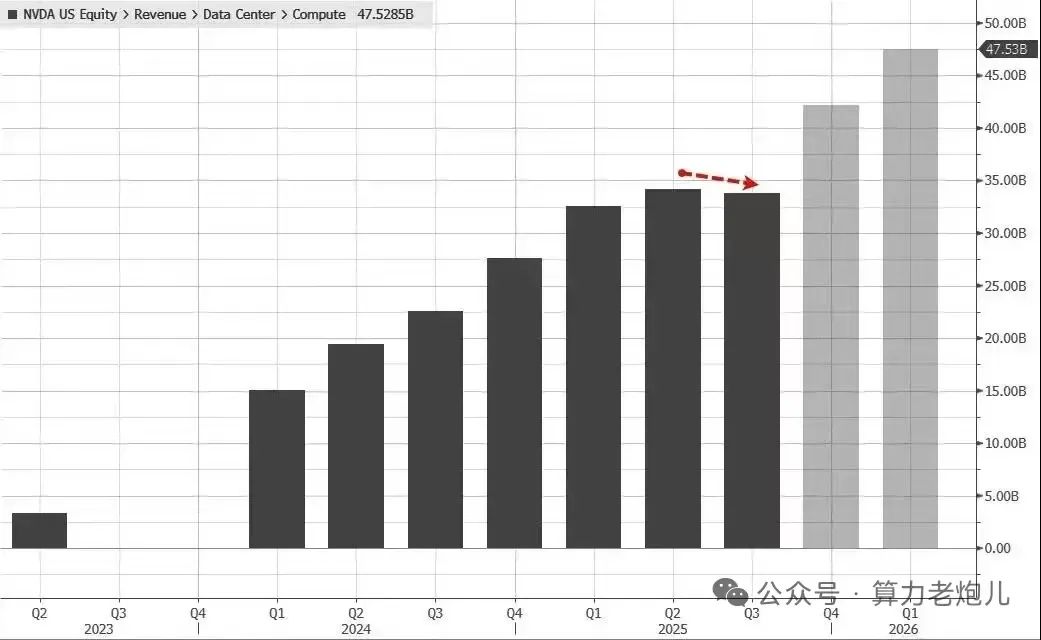

NVIDIA's Q2 earnings report kicked off with a script of "crushing expectations," as usual. The report revealed revenue for the period reached $46.74 billion, marking a 56% year-on-year increase and surpassing market expectations of $46.06 billion. Net profit stood at $26.42 billion, up 59% year-on-year, equivalent to earnings per share of $1.05, also exceeding expectations of $1.01. In absolute terms, this performance towers over most technology companies – revenue from the data center business alone ($41.1 billion) surpasses the total revenue of many established tech firms.

However, beneath these impressive numbers lies a detail that has piqued market interest: Since the generative AI boom commenced in mid-2023, NVIDIA has witnessed year-on-year revenue growth exceeding 50% for nine consecutive quarters. This quarter's growth rate of 56% is the slowest during this period, akin to a high-speed train tapping the brakes slightly. The train continues to move forward, but the "deceleration signal" has investors wondering if AI market demand is nearing saturation or if geopolitics, competition, and other factors are beginning to drag down growth.

It's worth noting that in previous quarters, NVIDIA's data center business created a myth with "growth rates exceeding 150% for three consecutive quarters," and the single-business revenue scale of $29.53 billion once shocked the industry. Now that the growth rate has declined, albeit still maintaining high growth, the transition from "frenetic to steady" has slightly furrowed the brows of Wall Street.

02 Core Data Center Business Leads, but Chinese Market and H20 Become "Pain Points"

As NVIDIA's "anchor," the data center business (centered around GPUs and supporting products) remains the primary growth driver – Q2 revenue was $41.1 billion, up 56% year-on-year. However, this achievement also harbors two hidden concerns: firstly, it slightly missed market expectations of $41.34 billion, marking the second consecutive quarter the business has "just missed the mark"; secondly, restrictions in the Chinese market have directly impacted the sales of key products.

The earnings report revealed that NVIDIA did not sell H20 chips to China in Q2, resulting in a $4 billion reduction in sales of the product. During the same period, only $180 million in inventory was released to customers outside China. Chief Financial Officer Colette Kress candidly admitted that, given a favorable geopolitical environment, third-quarter revenue from H20 chip shipments could reach $2 billion to $5 billion – these words not only expose the current helplessness but also hint at the untapped potential of the Chinese market.

In fact, the impact of the Chinese market has long been evident. Previous earnings reports showed that China's share in NVIDIA's data center business has dropped from 20% to less than 10%, with a market worth $7 billion to $9 billion shrinking. Although NVIDIA has customized "shrunk" chips such as H20 and L20 for China, performance limitations make it challenging to meet the needs of local AI enterprises. Coupled with the accelerated substitution of domestic chips, Huang Renxun had to admit: "China is a crucial market, but current restrictions are causing us to miss opportunities."

Nonetheless, the global AI arms race continues to underpin the data center business. Giants like OpenAI, Microsoft, Google, and Meta continue to purchase large quantities of NVIDIA chips for training large models. Sales of the latest generation of Blackwell series GPUs (dubbed by Huang Renxun as "the most powerful chip yet") increased by 17% quarter-on-quarter, and the addition of new customers such as Disney, Hitachi, and Hyundai Motor confirms the "exceptionally strong" demand. Huang Renxun emphasized in his statement: "The AI race has begun, and Blackwell is the core platform."

03 Gaming Business Recovers, Software Ecosystem Becomes "Invisible Moat"

Under the AI halo, the gaming segment, once NVIDIA's "flagship business," has finally witnessed a significant recovery. Q2 revenue from the gaming and AI PC business reached $4.3 billion, up 49% year-on-year, not only surpassing analysts' expectations of $3.82 billion but also improving upon the 42% growth rate from the previous quarter.

Behind this growth lies not only the increasing penetration of AI technology in the gaming industry (such as AI-generated scenes and intelligent NPCs) but also the robust supply of Blackwell chips. NVIDIA's AI tools for game developers not only enhance the smoothness and interactivity of game graphics but also propel the popularization of "AI PCs" – more and more players are willing to invest in graphics cards that support AI functions, driving the gaming business from "trough" to recovery.

More crucially, NVIDIA is no longer content with merely "selling hardware." Huang Renxun repeatedly emphasized during the earnings call: "We are transforming from a hardware company to a platform company." Currently, software, services, and ecosystems have emerged as new growth engines: The CUDA platform has garnered over 5 million developers and built a software library that is nearly impossible to replicate; the AI Enterprise suite and DGX Cloud services have diversified the revenue structure, reducing cyclical dependence on hardware sales.

As industry analysts have noted: "Hardware may be caught up by AMD and Intel, but the software ecosystem is NVIDIA's deepest moat." This transformation positions NVIDIA not just as a "gun seller" but also as a "rule-making player" in the AI wave.

04 Hidden Concerns: Competition, Valuation, and Geopolitics Form a "Triple Siege"

Despite the overall positive earnings report, NVIDIA's stock price fell by more than 4% in after-hours trading – the market is sending a clear signal: The AI party hasn't ended, but "risks are accumulating." Currently, NVIDIA faces three major challenges:

1. Intensifying Competition: Giants Are "Developing Their Own Chips"

NVIDIA's "throne of computational power" is under siege. AMD has launched the MI300 series of chips, aiming to capture the data center market; Intel is accelerating the development of AI chips. More dangerously, "big customers" such as Microsoft, Google, and Amazon have begun developing their own chips (such as Google's TPU and Amazon's Trainium) – they are unwilling to entrust the "AI lifeline" entirely to NVIDIA. This trend of "de-reliance" may erode NVIDIA's market share in the long run.

2. High Valuation: Market Patience is Limited

Currently, NVIDIA's price-to-earnings ratio stands at around 50 times (based on expected earnings for the next 12 months), significantly higher than the semiconductor industry average. Such a high valuation reflects expectations of "sustained high growth" – should future growth rates slow down further or performance fall short of "perfect expectations," the stock price may face significant adjustments. Wall Street analysts are beginning to question: "When will NVIDIA's growth peak arrive?"

3. Geopolitics: The Biggest "Uncontrollable Variable"

As mentioned earlier, restrictions in the Chinese market are already "obvious," and future geopolitical risks may escalate further. Huang Renxun has had to frequently shuttle between Washington and engage with policymakers, but in the context of the "China-US technology game," it's challenging for NVIDIA to completely规避 risks. More severely, if other countries follow suit with restrictive policies, the global market space will further shrink.

For the third quarter, NVIDIA has provided a revenue guidance of $54 billion, slightly higher than Wall Street consensus, and explicitly "excluding H20 sales" – this forecast conveys confidence in the future but also hints at caution in "keeping a hand in reserve."

Huang Renxun still holds out hope for the Chinese market. He revealed during the earnings call: "China may bring $50 billion in business opportunities this year, with an annual growth rate of about 50%. We hope to sell newer chips to China in the future." This statement underscores the importance of the Chinese market while hinting at expectations for an improvement in the geopolitical environment.

However, the AI wave won't rage forever. As technological iteration slows down, geopolitical frictions intensify, and market competition heats up, NVIDIA needs to prove not just "how many chips it can sell" but also "how much value these chips can create for customers." Judging from the earnings report, NVIDIA remains the biggest winner in the AI era, but the reefs hidden beneath the rapid growth are clearly visible. In this AI race, can Huang Renxun continue to lead? The answer may have to wait for next quarter's earnings report to be revealed.