Horizon's Ambition: 10 Million HSD Systems Deployed in Vehicles

![]() 09/01 2025

09/01 2025

![]() 575

575

Edited by | Qiu Kaijun

"In 3-5 years, we hope to deploy 10 million HSD systems in vehicles for mass production."

On August 29, at the Chengdu International Auto Show, Horizon held a press conference for the 10 millionth shipment of Journey chips. The founder and CEO, Yu Kai, announced the company's goal of making intelligent driving accessible to every ordinary Chinese car owner.

Horizon aims to create China's version of FSD, but at an affordable price.

01

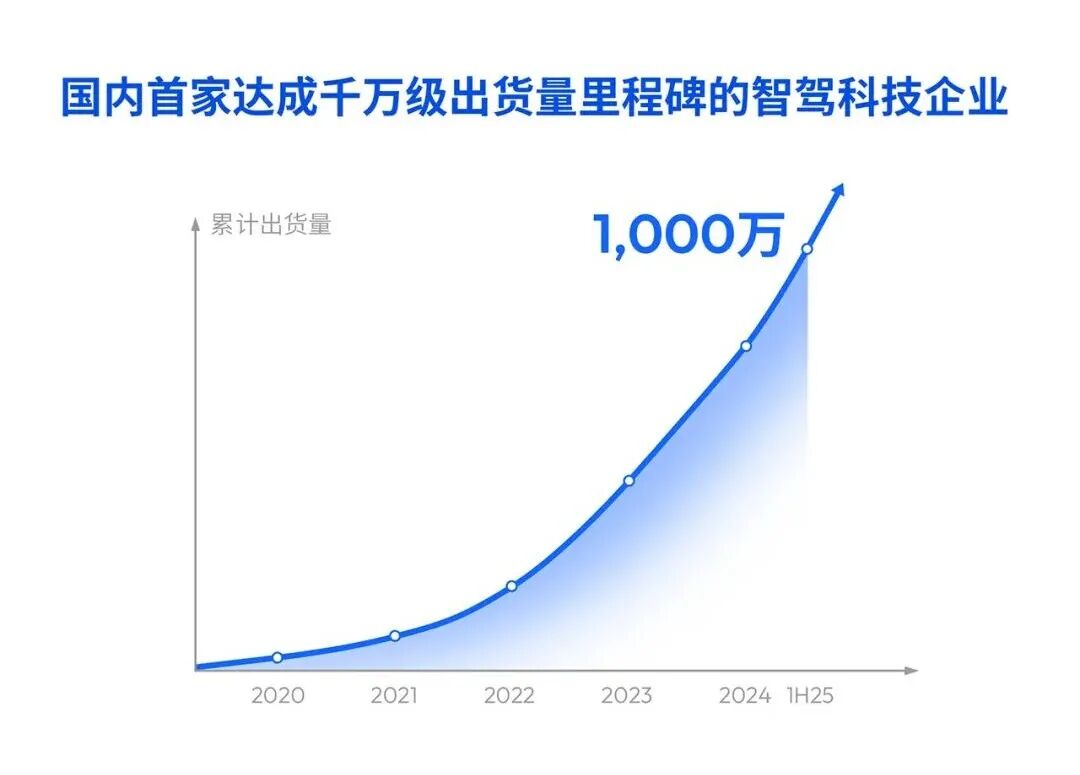

Achieving the First Domestic Milestone of 10 Million Shipments

Before discussing long-term goals, let's look at the present.

At the Shanghai Auto Show in April, Horizon had shipped 8 million Journey chips for pre-installation mass production. In less than half a year, this number has been updated to 10 million, marking the first time a domestic intelligent driving chip has achieved 10 million shipments.

Actually, this milestone achievement was disclosed by Horizon in its semi-annual report a few days ago.

We can see that Horizon has entered an expansion phase.

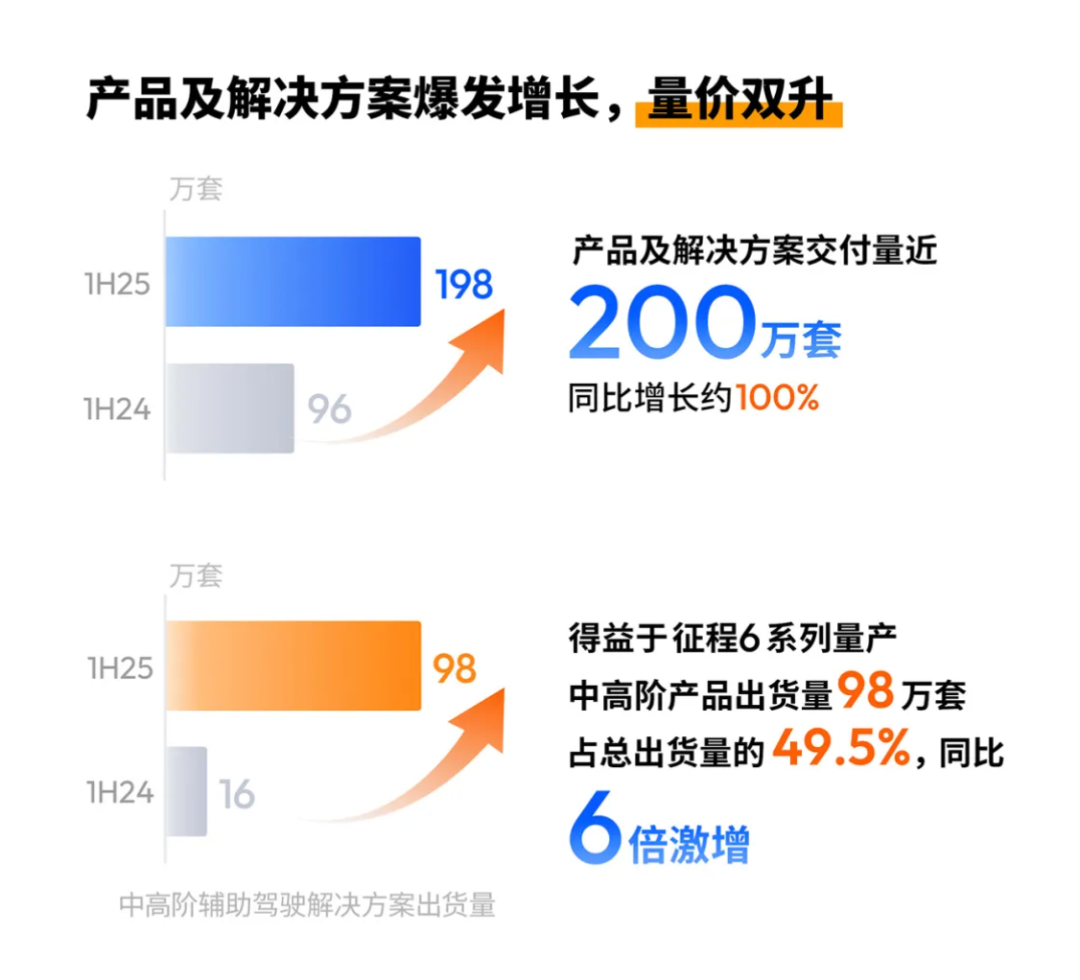

According to the semi-annual report, Horizon's total shipments of products and solutions in the first half of the year reached 1.98 million units, double the 960,000 units in 2024. Among them, the shipments of mid-to-high-end solutions supporting high-speed NOA and urban NOA were 980,000 units, six times that of the same period last year, accounting for nearly 50% of the total shipments.

The surge in shipments is essentially due to the continuous expansion of customer and model cooperation.

According to data provided by Horizon, they have currently established cooperation with over 40 automakers and brands, with 400 mass production models confirmed, up from 310 in April.

This is specifically reflected in the operating data:

In the first half of the year, Horizon's product solution revenue was 778 million yuan; total revenue was 1.567 billion yuan, an increase of 67.6% from 935 million yuan in the same period last year. Gross profit was 1.024 billion yuan, with a comprehensive gross margin of 65.4%; cash and cash equivalents reserves amounted to 16.1 billion yuan, maintaining sufficient liquidity.

After the semi-annual report, the capital market also gave positive feedback, with Hong Kong stocks rising by over 14%.

2025 marks the 10th anniversary of Horizon's establishment.

Yu Kai also reviewed the company's development history at the press conference, saying, "In 2015, we wanted to create brain chips for robots and become the 'Wintel of the robot era.' This goal has remained unchanged."

From a certain perspective, smart cars are also a form of robot.

After ten years of accumulation, Horizon achieved mass production of Journey 2 in 2020, with the first model being the Changan UNI-T, marking a "zero breakthrough" for domestic automotive intelligent chips. Journey 3 and Journey 5 were then respectively equipped in the Li ONE and Li L8 Pro, making more car owners remember Horizon's name.

The Journey 6 series covers computing power from 10TOPS to 560TOPS, demonstrating strong competitiveness in different market segments. BYD Qin LEV (first mass production model of Journey 6M) and AION Rex (first mass production model of Journey 6E) have already been launched. Journey 6B, which focuses on entry-level safety assistance driving, is also deeply cooperating with Bosch. Bosch's new generation of multi-function camera platform based on Journey 6B is scheduled for mass production in mid-2026 and has secured orders from multiple global automakers.

From entry-level safety assistance driving to high-level urban assistance driving, Horizon offers computing solutions that balance performance and cost for vehicles of different price ranges.

02

The Key to the Next 10 Million

At this year's Chengdu Auto Show, the EXEED ET5 equipped with Journey 6P+HSD (Horizon SuperDrive Intelligent Driving System) made its debut – this is the first time the "full version" of the Journey 6P chip combined with the HSD software system has been installed in a vehicle. The new car will be officially launched and delivered in November.

With the support of Journey 6P, HSD adopts a one-stage end-to-end architecture combined with a reinforcement learning mechanism, enabling navigation assistance driving functions on urban and high-speed roads. It can handle complex road environments and complete high-difficulty tasks such as recognizing straight-through waiting areas and defensive driving in blind spots.

The emergence of this car is a crucial step for Horizon to implement its vision of "affordable FSD in China" and will also reveal the core logic behind its realization of "universal access to intelligent driving": hardware-software integration.

This has always been the route Horizon has adhered to.

One of the current core pain points of high-level assistance driving is the contradiction between "computing power demand and cost control." Simply stacking high-computing power chips can reduce development difficulty but significantly increase hardware costs, which will ultimately be passed on to consumers.

One of the best ways to optimize computing efficiency is through hardware-software integration. Tesla's self-developed HW3.0 chip, launched in 2019, demonstrated the powerful effectiveness of collaborative hardware-software design.

Yu Kai believes, "The current computing performance of smart cars has not yet met user needs, and the in-vehicle operating system needs to deeply collaborate with the chip in hardware and software."

The Journey 6P chip boasts a computing power of 560TOPS, integrated with a 4-core BPU, an 18-core CPU with 410K DMIPS, and an image processing bandwidth of 5.3Gpixel/s, meeting the real-time inference requirements of large intelligent driving models. Moreover, its computing efficiency surpasses that of NVIDIA's Thor-U, achieving better computing performance with less computing power, thereby reducing the overall system cost.

Universal access does not mean compromising quality, especially in the field of intelligent driving. Safety incidents caused by aggressive technology can incur "trust costs" far exceeding hardware costs. Horizon's strategy is to provide universal access within a safety framework, adhering to the essence of assistance driving.

03

Driving Force Behind "Universal Access to Intelligent Driving"

In recent years, the intelligent driving market has witnessed explosive growth. Consumers are increasingly concerned about intelligence when purchasing cars, and the weight of intelligent configuration in purchase decisions continues to rise.

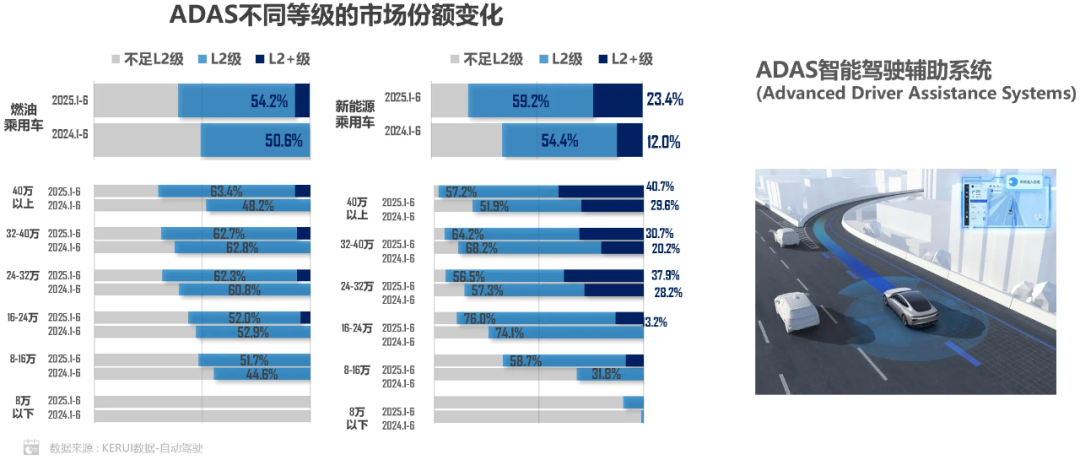

In previous years, due to the high cost of assistance driving hardware, high-level assistance driving was mainly available in mid-to-high-end models priced at 300,000 to 400,000 yuan. However, with increasing scale, high-level assistance driving will become more affordable.

The Xiaopeng G9 Max model, equipped with high-level urban navigation assistance driving, starts at 129,800 yuan. During this year's Chengdu Auto Show, Hongmeng Zhixing's Shangjie H5 began pre-sales, equipped with Huawei's Kunlun Intelligent Driving ADS4, with a pre-sale price starting at 169,800 yuan.

"Equal access to intelligent driving" and "universal access to intelligent driving" are becoming key industry terms, indicating that high-level assistance driving technology is being extended from high-end models to more affordable price ranges.

According to data from the China Passenger Car Association, from January to June 2025, the installation rate of L2 and above assistance driving functions in new energy passenger vehicles reached 82.6%. Among models priced above 400,000 yuan, the installation rate of L2 and above assistance driving is 40.7%, while for models priced between 160,000 and 240,000 yuan, it is 13.2%. However, compared to 2024, the growth rate is significant. This gap not only indicates that "affordable and effective intelligent driving systems" remain a market gap but also validates the potential of Horizon's "universal access to intelligent driving" approach.

The ultimate path to cost control lies in scaling, and Horizon's core strategy is to partner with high-volume models, spreading costs through tens of millions of shipments and accelerating popularization.

Horizon has always focused on mainstream market sales. BYD Qin L EV is the sales leader among 100,000-150,000 yuan models, AION Rex is a high-volume SUV targeting family users, and EXEED ET5 is also positioned in the mainstream household market. These models generally achieve annual sales of tens of thousands or even hundreds of thousands of units, enabling more ordinary people to enjoy high-level assistance driving capabilities and accelerating the scale and speed of HSD deployment in vehicles.

In this regard, Horizon's goal of creating "affordable FSD in China" is not an empty boast. With the foundation of tens of millions of Journey chip shipments, the Journey 6 series covering various market segments, and the balance of cost and performance brought by hardware-software integration, Horizon is paving the way for this goal. It allows vehicles priced in the hundreds of thousands of yuan to obtain intelligent driving technology sourced from high-end models at a lower cost, truly realizing "effective and affordable."

-END-